Zum Szenario steigender Zinsen

Der Ausblick für die Zinsen ist regelmäßig Gegenstand der Diskussionen bei bto. Ich erinnere an:

→ Warum sind die Zinsen so tief?

→ Säkulare Stagnation als Grund für tiefe Zinsen?

→ „Tiefe Zinsen, bis der Ketchup spritzt“

→ Niedrigzinsen: Die Badewannen-Theorie springt zu kurz

und natürlich:

→ Das Blutbad steigender Zinsen

Der Telegraph greift das Thema erneut auf und verbindet die Badewannen-Theorie (also Angebot und Nachfrage nach Geld) mit der demografischen Entwicklung:

- “The global savings glut is drying up. The long era of seductively abundant capital is drawing to a close, to be replaced by a sharp-elbowed scramble for scarce funding. This will be a painful surprise for those countries with public debt ratios smashing through 100pc of GDP and that rely on constant flows of imported capital to live beyond their means.” – bto: Simpel gefolgert, sie werden die Notenbanken heranziehen. Ich denke, dies ist das wahrscheinlichste Szenario.

- “(…) America’s opinion elites and both political parties have chosen this particular moment to embrace the beguiling notion that public debt does not matter after all, so long as you can print your own currency.” – bto: Mindestens wissen wir dann doch, wohin die Reise geht.

- “Even Warren Buffett has joined the chorus, confessing ‘hard money’ errors in the past and ridiculing ‘those who regularly preach doom because of government budget deficits’. (…) His endorsement is music to the ears of Democrats as they lurch leftwards (…) and discover the irresistible doctrine of Modern Monetary Finance, or just MMT to the initiated. Everything can be paid for on the never-never: a Green New Deal, Medicare for All, free university tuition, and higher pensions, backed by ample helicopter money from the US Federal Reserve when needed.” – bto: Und genau das brauchen wir, eine Politik des Geldes für alle, for free. Problem gelöst!

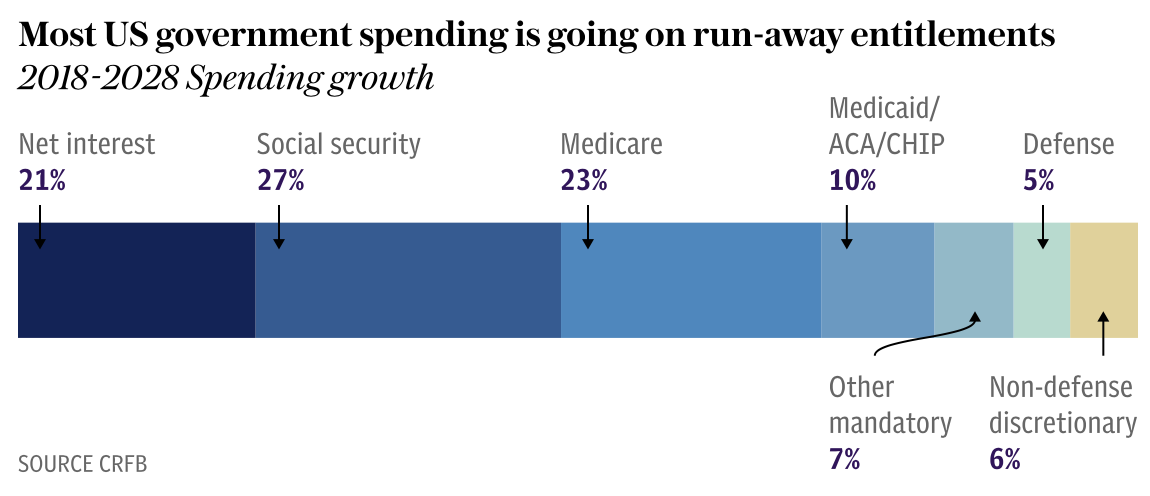

Und sie brauchen das “fresh Money”, wie man ganz leicht erkennen kann:

- “Fed chairman Jay Powell had a warning this week for the prophets of MMT and those tempted to believe that deficits don’t matter. ‘US debt is growing faster than GDP, really significantly faster. We are going to have to spend less or raise more revenue,’ he told Congress.” – bto: Er weiß, dass das nicht auf Dauer funktionieren kann.

- “Keynes taught us the counter-intuitive insight that deficit funding in a slump pays for itself though higher growth and can lower the long-term debt ratio via the denominator effect, at least for fully sovereign nations. It is all matter of calibration and timing.” – bto: Das hat aber in der Praxis nicht geklappt, weil die Politiker es bei zu kleinen Krisen bereits probierten und dann meist zu spät waren.

- “The MMT view of the world is a stretched variant of ultra-Keynesian spending, or more accurately the theories of Abba Lerner in the early 1940s. Its theorists accept that there can be an inflation constraint on deficit spending, but neglect the risk that foreign funding can vanish in a world of open capital flows – and cause the real interest rate to spiral upwards.” – bto: Doch hier stellt sich die Frage, was passiert, wenn die Notenbank einfach den Zins garantiert, indem sie unbegrenzt kauft?

- “America is not there yet but it may soon be. China is no longer building up its $3 trillion foreign reserves and supplying America with capital in the process. Its current account surplus has dropped from a peak of $450bn a year to nearer zero. It has begun importing the global funds instead. ‘The world’s number one and number two economic powers are going to be competing for capital, and somebody has to fund the party,’ said Hans Redeker, currency chief at Morgan Stanley.” – bto: was auf die Notenbanken hinausläuft.

- “Japan’s vast life insurers and pension funds have long been salting away 40pc the country’s savings in foreign bonds and assets, and four-fifths of this has been going to the US. This must soon flow back the other way as Japan draws down its wealth to pay for old age care. A net 13m people are leaving the workforce over the next decade.” – bto: Das Gleiche steht uns auch bevor.

- “(…) the global savings rate (…) rose to a modern era high of 26.7pc in 2006. It has since slipped to 24.5pc. The savings rate for China has fallen from 52pc to 47pc over the last decade, according to World Bank data. It is certain to fall much further.” – bto: Und damit sollte es – so die Theorie – zu deutlich höheren Zinsen kommen.

- “A demographic ‘sweet spot‘ caused by falling birth rates and longer life spans from the 1970s onwards had led to a temporary abundance of workers. The entry of China and Eastern Europe into the globalised economy in the 1990s had boosted the labour pool by a further 820 million at a stroke. (…) This process going into reverse. (…) China’s workforce is shrinking by three million a year. A labour scarcity is bidding up global wages. The downtrodden salariat are about to get their belated revenge against the owners of capital.” – bto: Das sehe es genauso.

- “(…) the side-effect will be to lift real interest rates back to their historic norm of 2.75pc to 3pc. This will be painful. The global edifice of hyper-valued assets is built on the assumption that real rates will remain close to zero. A 3pc rate implies an ugly compression of equity, bond, and property prices.” – bto: So dürfte es sein.

- “The demographic supertanker has been turning for several years in Asia and Europe but the fall-out for the bond markets has been disguised by quantitative easing. Central banks have been soaking up a net $2 trillion worth of debt securities between them.” – bto: Und sie werden es weiterhin tun.

- “The Fed is actually selling $50bn a month, tightening the vice. That is a key reason why real US 10-year rates ratcheted up last year until they hit 1.15pc in October. It was enough to set off a 20pc crash on Wall Street and global bourses, a taste of things to come in a world where real rates are no longer suppressed.It does not take much to trigger tremors when the global debt ratio is 318pc of GDP (IIF data), some 49 percentage points higher than it was at the peak of the pre-Lehman credit bubble.” – bto: Deshalb wird MMT etc. kommen. Das Endspiel der gigantischen Manipulation des Geldes kommt in die finale Runde.