4000 Milliarden US-Dollar vor dem Transfer in die USA?

In der letzten Woche habe ich die Möglichkeit einer Rallye des US-Dollars diskutiert. Dabei bin ich vor allem auf die fundamentalen Probleme Europas und die Stimmung der Marktteilnehmer eingegangen. Dabei habe ich einen eventuell weitaus stärkeren Einflussfaktor für den US-Dollar übersehen: die Folgen einer Veränderung der US-Unternehmenssteuern mit der Folge, dass die Unternehmen ihre im Ausland gebunkerten Reserven in die USA zurückholen:

- “(…) American companies have stashed trillions of dollars overseas in what amounts to the greatest cash reserve in the world. Apple has $257bn parked abroad beyond the reach of the Internal Revenue Service. Alphabet (Google) has $126bn, Microsoft $84bn, Cisco $68bn, and Oracle $59bn. The US Bureau of Economic Analysis estimates that total retained earnings outside the country have mushroomed to $4 trillion.” – bto: Das sind in der Tat erhebliche Größenordnungen.

- “(…) the White House is preparing ‘mandatory’ action as part of his tax reform unlike the previous voluntary attempts to lure back money through tax holidays (…) these repatriated capital flows will have a volcanic impact on the US dollar, Wall Street, and the global financial system, with big winners and big losers.” – bto: Das leuchtet ein.

- “(…) Bank of America says a big chunk of this cash is in other currencies. The funds would have to be converted on the exchange markets. When this happened following the ‘tax holiday’ in 2005 it caused the dollar index (DXY) to rocket by 15pc over twelve months (…) This time the sums are much larger, the tidal force that much greater. (…) Whispers of a trillion dollar conversion are doing the rounds.” – bto: wobei die Unternehmen sich sicherlich schon gehedged haben, weshalb der Effekt kleiner sein dürfte.

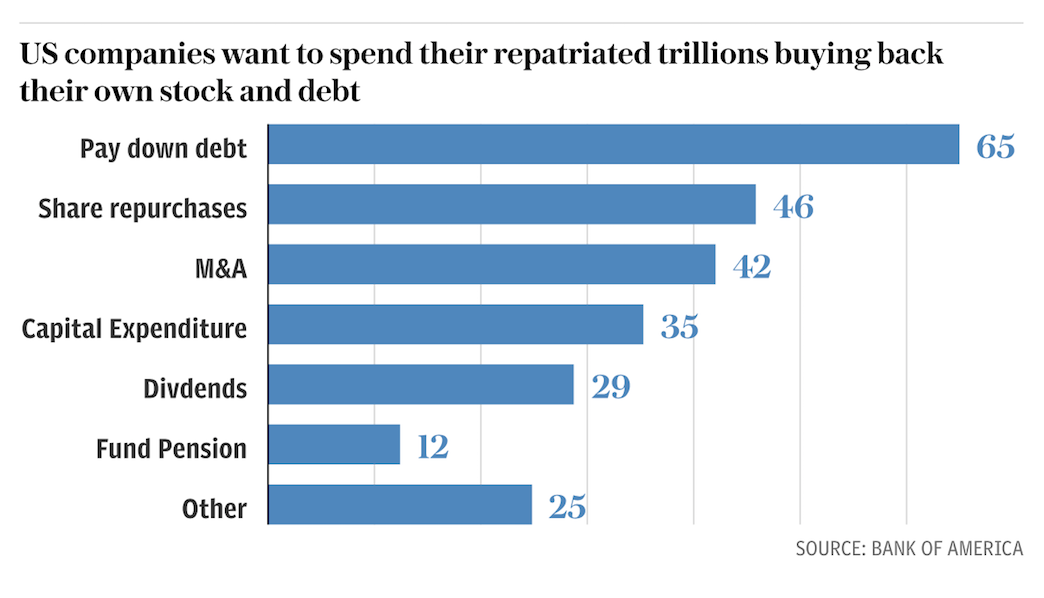

- “(…) most companies have no plans to invest repatriated funds in the real economy (…) but rather for ‚paying down debt‘ (65pc), ‘share repurchases‘ (46pc), or ‘M&A‘ (42pc). This is (…) would cause US corporate debt issuance to dry up and would – ceteris paribus – send Wall Street equities into a parabolic rally akin to the dortcom blow-off in 1999” – bto: eine in der Tat beeindruckende Überlegung. Dass die Unternehmen nicht investieren wollen, zeigt, wie groß die Schieflage in der globalen Wirtschaft mittlerweile ist. Hier die Abbildung dazu:

- “Shifting it to the US for other purposes would drain dollar liquidity from offshore markets, tightening the supply of oxygen for corporate credit in Asia, Latin America, and the emerging world. The bigger the volume, the greater the risk of repeating the 2013 ‘taper tantrum’ that shook the emerging market.” – bto: womit wir wieder bei dem Szenario wären, welches schon im Frühjahr diskutiert wurde.

- “We have the potential for a perfect dollar storm ripping through a global financial system that has never been more leveraged to the US dollar. Yet currency analysts and hedge funds are mostly positioned for the exact opposite.” – bto: Nur wegen dieser Positionierung der Spekulanten kann es zum Sturm kommen.

- “I regard the Trump episode as a brief anomaly – like the Jackson presidency of the 1830s – with no bearing on US long-term prospects. America remains the scientific superpower. There is no challenger: Europe is in demographic decline; China has failed to grasp the nettle of reform under Xi Jinping and may slow to 2pc growth rates by the early 2020s.” – bto: Trotz aller meiner Kritik an den USA sehe ich das genauso.

- “Failure to repeal Obamacare is no template for the battle over tax reform in any case. The issue has different contours. It is easier to cut taxes than it is to solve the Rubix Cube of US health care. (…) in the 2018 mid-term elections if they prove incapable of converting a monopoly of power into legislation. The Republicans need an ‚easy win‘.” – bto: Das leuchtet mir ein und spricht in der Tat für eine Reform.

→ The Telegraph: “Write off Donald Trump and the dollar at your peril”, 6. September 2017