“Worries over debt costs gnaw at corners of US stock markets”

Gestern beschäftigte ich mich schon mit der hohen Verschuldung der US-Unternehmen. Hier ein Nachtrag aus der FT:

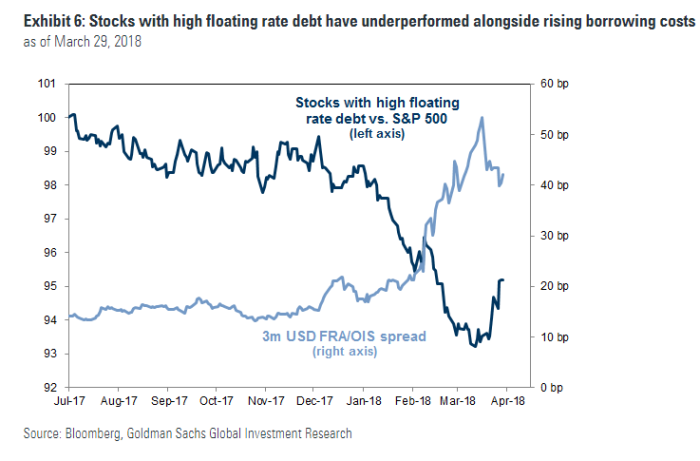

- “Equities bears are sharpening their focus on debt, judging from the latest analysis by Goldman Sachs. In a new note, the investment bank points out that US companies with the highest debt loads sensitive to rising borrowing costs have been taking a bigger hit than their peers in the latest markets shake-out. The drag is a reminder that macroeconomic and monetary policy-related strains still matter (…).” – bto: natürlich, kommt doch das Ausfallrisiko zurück!

Quelle: FT

- “(…) a basket of 50 US equities with floating rate bond debt in excess of 5 per cent of total borrowing has performed roughly 3.2 percentage points worse than the benchmark S&P 500 index, Goldman Sachs calculates. The move has come as a key reference rate for trillions of dollars worth of debt has risen to levels not seen since the global financial crisis in 2008.” – bto: Das habe ich hier schon diskutiert. Die Gründe sind vielfältig, ich denke aber, es zeigt nur, dass die Märkte anfangen, wieder ein bisschen zu funktionieren.

- “More worryingly, the average company in the US index is highly levered. Despite the preponderance of technology groups with large cash mountains, the median ratio of net debt to earnings before interest, tax, depreciation and amortisation is 1.7 — the highest since 1980.” – bto: was man auch aus dieser Darstellung entnehmen kann:

Quelle: FT

- “Interest payments on leveraged loans tend to react more directly to increases in near-term rates. Researchers at Goldman Sachs point to media group Viacom and construction materials group Vulcan as examples — both have net debt of roughly three times earnings before interest, depreciation and taxes. And both have significant portions of variable-rate bonds among their total stock of debt. Shares in companies like these have underperformed the S&P 500 index by roughly 5 per cent since July. That suggests a level of discernment that credit analysts think is beyond the equity market.” – bto: noch nicht ausreichend, denke ich. Da ist noch mehr erforderlich und wird sich entsprechend spürbar machen.

- Goldmans Empfehlung: “Over a longer horizon, though, ‚the backdrop of elevated corporate leverage and tightening financial conditions drives our continued recommendation to own stocks with strong balance sheets.‘” – bto: Dem kann ich mich nur anschließen!

→ ft.com (Anmeldung erforderlich): “Libor/equities: smarter than thought”, 4. April 2018