Wo sollen die Rohstoffe für die Energiewende herkommen?

Die FINANCIAL TIMES (FT) wirft einen Blick auf den Rohstoffbedarf der Energiewende:

- “(…) copper, with its high conductivity, efficient heat transfer and ductility, is critical for motors, transformers, wiring, and, in a warming world, air-conditioner piping. And as North America, Europe and Australia accelerate the transition, their own domestic production is in long-term decline. According to CRU, a commodities consultancy, copper demand from renewables will be about 801,000 tonnes in 2022 out of total global consumption of about 25m tonnes. Over the next four years, the company says, EVs and renewables will account for 72 per cent of the total growth in refined copper demand.” – bto: nicht so überraschend, wenn alles elektrifiziert wird.

- “If North Americans and Europeans are serious about any energy transition, they might consider a ‘Circular 5’ for transition metals. Or they can buy their cars from the Chinese, perhaps with Tesla badges.” – bto: Jetzt fragt man sich, was bedeutet das?

- Es geht um eine feste Kaufzusage für seltene Rohstoffe, um deren Verfügbarkeit sicherzustellen. Die USA haben das im und nach dem Zweiten Weltkrieg gemacht: “(…) in April 1948, the AEC began issuing a series of public ‘circulars’ that offered a minimum guaranteed price for uranium and a 10-year purchase contract, along with bonus payments for significant uranium finds in the US. The most fondly remembered was ‘Circular 5’, which established premium prices for higher grade ore, and which was in effect from February 1949 to March 1962.” – bto: Das sollte vor allem die deutsche Regierung machen, sind wir doch “Vorreiter”…

Wie groß die Herausforderung ist, zeigen Berechnungen des IWF:

- “Replacing fossil fuels with low-carbon technologies would require an eightfold increase in renewable energy investments and cause a strong increase in demand for metals. However, developing mines is a process that takes a very long time—often a decade or more—and presents various challenges, at both the company and country level.” – bto: Angesichts der Pläne zum Klimaschutz müssten die Investitionen doch boomen. Oder gibt es Zweifel in den Zentralen der Minenkonzerne?

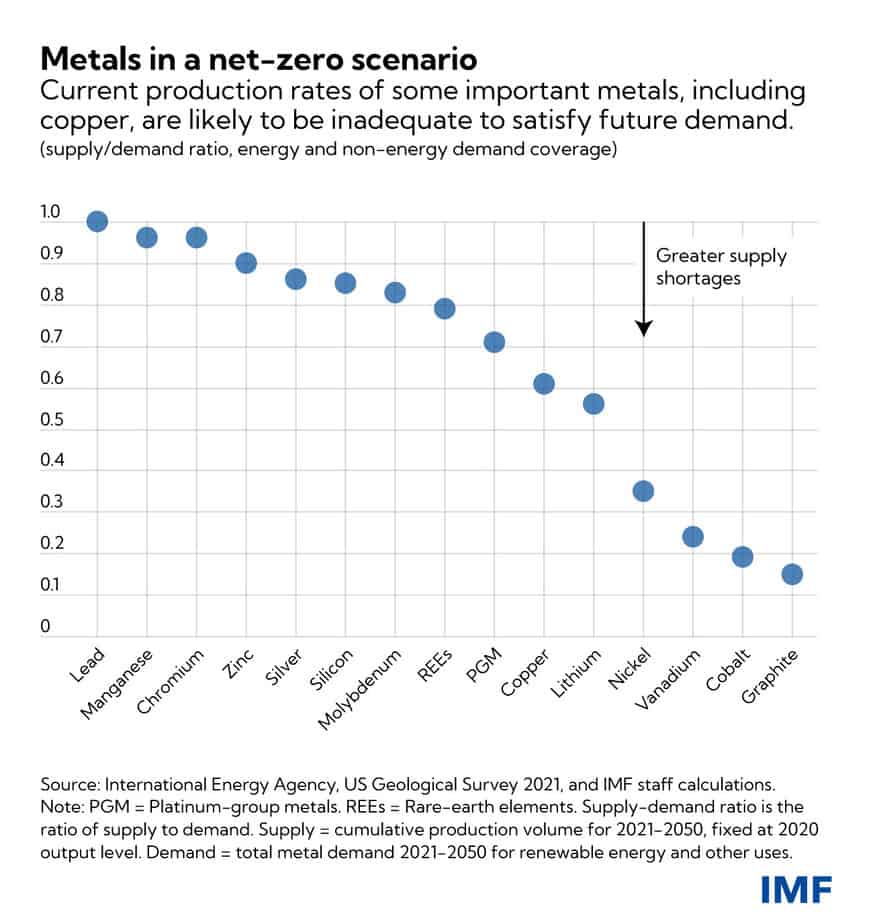

- “The first question is how far current metals production is stretched and whether existing reserves can provide for the energy transition. Given the projected increase in metals consumption through 2050 under a net zero scenario, current production rates of graphite, cobalt, vanadium, and nickel appear inadequate, showing a more than two-thirds gap versus the demand. Current copper, lithium and platinum supplies also are inadequate to satisfy future needs, with a 30 percent to 40 percent gap versus demand.” – bto: So wird es nicht funktionieren mit der Energiewende und vor allem wird es unheimlich teuer.

Quelle: IMF

- “We also examined whether production can be scaled up, by looking at current metal reserves. For some minerals, existing reserves would allow greater production through more investment in extraction, such as for graphite and vanadium. For other minerals, current reserves could be a constraint on future demand—especially lithium and lead, but also for zinc, silver, and silicon.” – bto: Das wäre ein weiterer Realitätscheck für unsere Klimaretter.

- “Importantly, however, metal reserves and production are not static. Firms can expand reserves through innovation in extraction technology and further exploration efforts may lead to increasing the future supply of metals to meet future demands. Moreover, metals recycling can also increase supplies. Reuse of scrap metals only occurs on a large scale for copper and nickel, but it’s now increasing for some scarcer materials like lithium and cobalt.” – bto: Natürlich wird die Menschheit neue Wege finden, das könnte aber auch teurer sein.

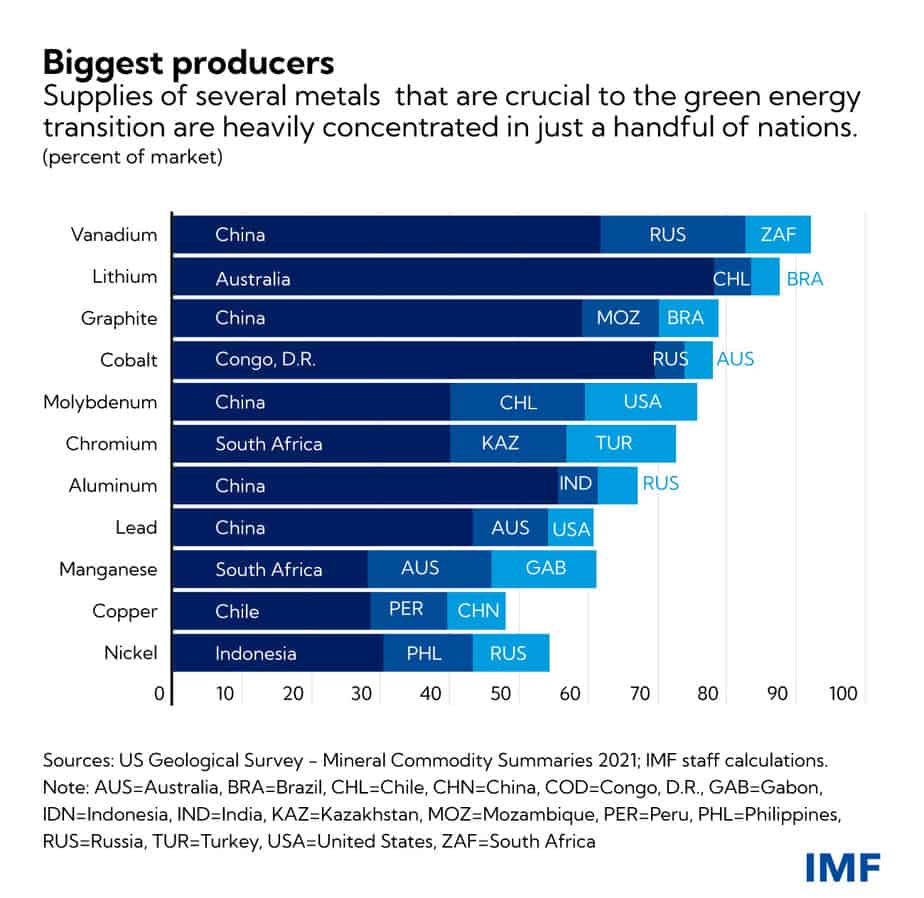

- “One complicating factor is that some important supplies are generally very concentrated. This implies that a few producers will benefit disproportionately from growing demand. Conversely, this lays bare energy transition risks from supply bottlenecks should investments in production capacity not meet demand, or in case of potential geopolitical risk inside or between producer nations.” – bto: Ich finde, man kann gut verstehen, warum China die Klimaschutzpolitik so unterstützt. China wird zum Weltlieferanten für die Technologie. China und Russland haben zusammen eine sehr starke Position, was sich auch geopolitisch niederschlagen dürfte.

Quelle: IMF

Und jetzt wird es witzig:

- “A related challenge is insufficient financing for metals and mining investment due to growing investor focus on environmental, social, and governance considerations, or ESG. Mining involves environmental impacts and fuels global warming, albeit just a fraction of coal and gas generation, as pointed out by a World Bank report on the mineral intensity of the energy transition. (…) An S&P Global analysis shows that the ESG average score of the S&P Global 1200, an index representing about 70 percent of global stock-market capitalization, stood at 62 out of 100, while the metals and mining sector’s score rose to 52 last year from 39 in 2018.” – bto: Das kann man sich nicht vorstellen. Die Unternehmen, die die Energiewende ermöglichen, bekommen schwerer Geld für Investitionen.

Fazit:

“While deposits are broadly sufficient, the needed ramp-up in mining investment and operations could be challenging for some metals and may be derailed by market- or country-specific risks.” – bto: nett formuliert.