Wie QE die US-Börse treibt

Eine Frage, die immer wieder im Raum steht, ist die nach der Wirkung der Geldpolitik auf die Vermögenspreise. Während es immer noch Vertreter gibt, die behaupten, die Geldpolitik hätte keine Auswirkungen auf die Vermögenspreise, spricht doch viel für das, was man intuitiv annehmen sollte. Billiges Geld führt zu tieferen Abzinsungssätzen und damit überproportional steigenden Vermögenspreisen, je länger und sicherer die Cashflows umso mehr …

Die Analysten von Société Générale haben mal nachgerechnet, wie QE in den USA gewirkt hat. “SocGen strategists Sophie Huynh and Charles de Boissezon calculate that nearly half of the U.S. benchmark’s current level is due to quantitative easing, while claiming that the impact of QE on the Nasdaq was even higher at 57%, with small cap less affected.” So berichtet Zero Hedge:

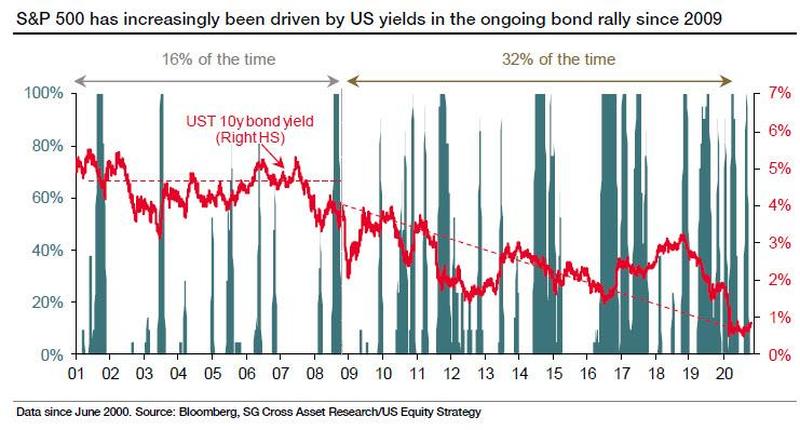

- “(…) before QE, US equities were more often the driver of US bonds, as investors would add either more or fewer bonds to their portfolios in response to the risk-on/off signals provided by the equity complex. However, this causality has totally changed since QE: US equities have been increasingly driven by US bond yields.” – bto: wie diese Abbildung unterstreicht:

Quelle: SocGen via Zero Hedge

- “SocGen find that for all US equity indices – from large, mid and small caps to the more tech-focused Nasdaq 100 – the US bond yield has played an increasing role in equity returns. Since 2009 until today, bonds have driven the S&P 500 32% of the time (on daily data), S&P 400 Midcaps 38% of the time, the Russell 2000 36% of the time and the Nasdaq 100 25% of the time. ‘All in all, the causality relationship of bonds driving equities was approximately two times more frequent than in the pre-2009 period’, according to SocGen.” – bto: Und das ist sehr einleuchtend. Man kauft vor allem stabile Werte, die überproportional von einem geringeren Diskontierungsfaktor profitieren.

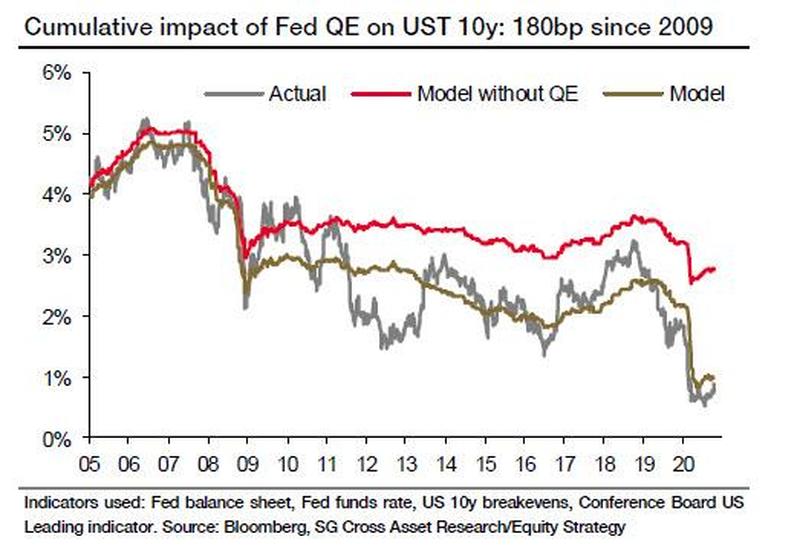

- Zunächst geht es um die Wirkung von QE auf die Zinsen der zehnjährigen US-Staatsanleihe: “Since 2009, the cumulative impact of the different waves of QE on UST 10y bond yield was approximately 180bp. In other words, without QE, 10Y Yields would have been around 2.8%, a number which many would claim is unthinkable in the current environment.” – bto: Das ist ein deutlicher Unterschied und der muss eine Auswirkung auf die anderen Assets haben.

Quelle: SocGen via Zero Hedge

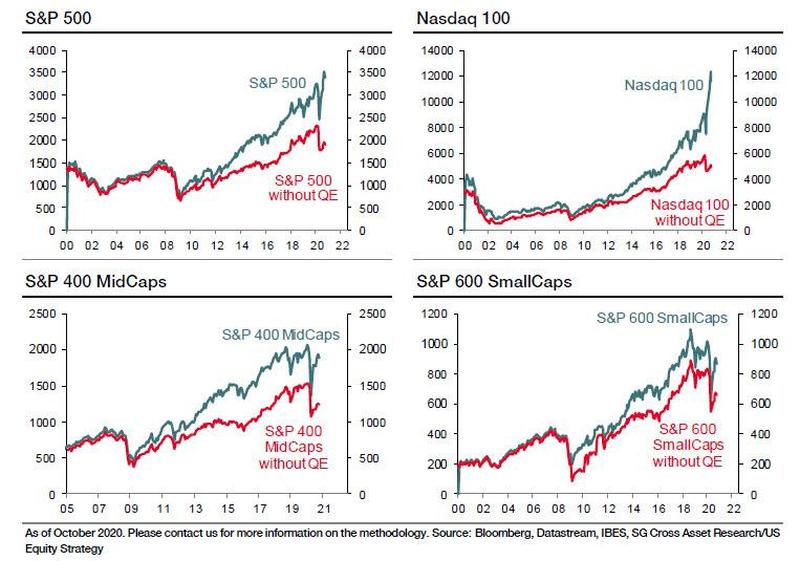

- Dann geht es um die Wirkung auf die Aktien: “Using the bank’s equity risk premium framework and work on the impact of QE on UST 10y allows it to understand how the different US equity indices have been impacted since 2009: there is a huge dispersion among the equity indices under review: the Nasdaq 100 has been the most impacted – and even more so this year – versus the S&P 600 Small Caps, which has been the least impacted. As of Oct-2020, the Nasdaq 100 price level was 57% explained by QE.”

Quelle: SocGen via Zero Hedge

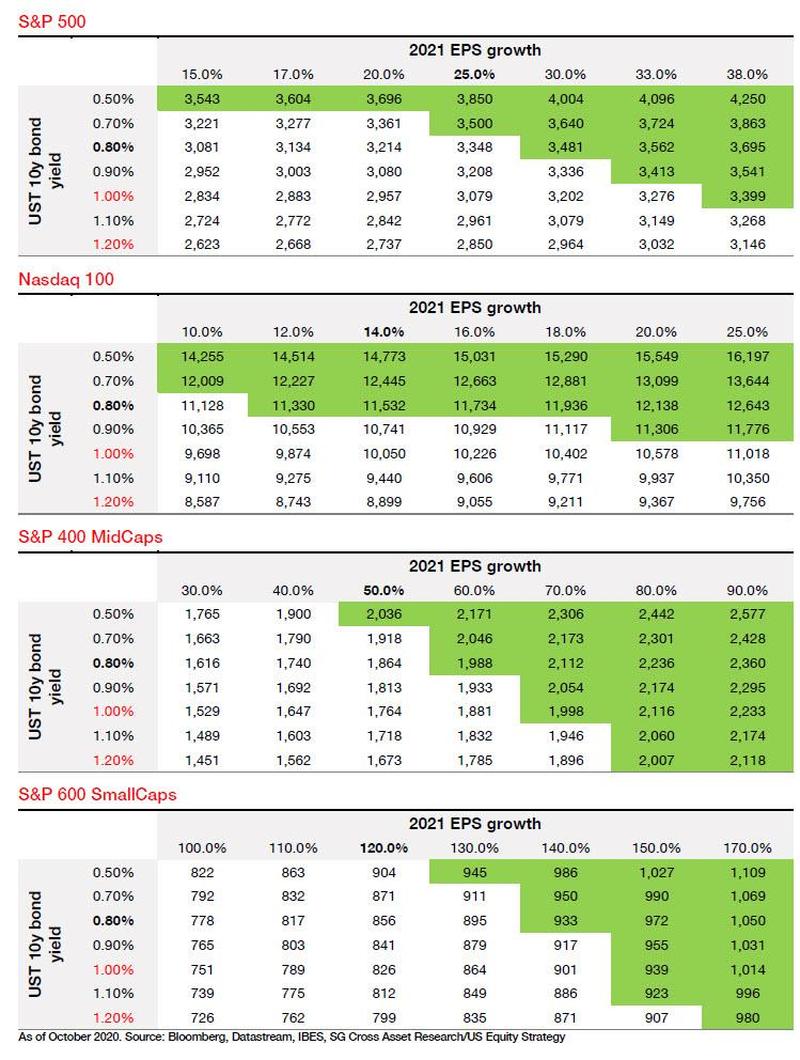

- “Having quantified the past, SocGen next looks at the future, and says that it expects 10-year Treasury yield to reach 1% by year-end and 1.2% by mid-2021 on less Fed intervention, increasing the need for earnings to deliver to justify valuations. For S&P 500 to ‘weather’ a 10-year yield of 1%, expected EPS growth in 2021 would need to be at least 38% vs current expectation of 24%; more ominously, for the Nasdaq 100, a doubling of the 2021 EPS growth would not be sufficient to absorb a UST 10y yield of 1%. In the case of mid and small caps, it would be considerably less. Needless to say, this suggests that if yields do indeed rise even modestly, there will be lots of pain for growth/tech/momentum names.” – bto: was aber voraussetzt, dass die Zinsen steigen. Vielleicht steigen sie ja nicht, sondern rutschen ins Negative?

Quelle: SocGen via Zero Hedge

- “Going forward, SocGen believes that currently causality order will hold and US Treasuries should continue to drive US equities, which is bad news for those who believe a continued rise in yields will not impact stocks: according to SocGen the impact will be very pronounced unless companies succeed in boosting their EPS well beyond current consensus estimates.” – bto: wobei man ein Szenario steigender Zinsen nur in einem Umfeld besserer Konjunktur und damit höherer Unternehmensgewinne sehen kann. Oder?

- “(…) aside from SocGen’s analysis which may be off by a few percentage points but is directionally accurate, the fact that Fed, through, QE now holds trillions in equity value hostage is also who Powell and his successors will never again dare to tighten financial conditions as the resulting asset price crash would have catastrophic consequences for both capital markets and US household net worth, which is roughly 70% in the form of stocks, bonds, financial assets, and other non-tangibles.” – bto: ein ewiger Fed-Put. Was soll schon schiefgehen?

→ zerohedge.com: „SocGen Calculates The S&P Would Be At 1,800 Lower Without QE“, 6. November 2020