Wie Negativzinsen die Krise verstärken

Nun, wo “Investoren” Österreich und Nordrhein-Westfalen Geld für weniger als ein Prozent (vor Steuern und Inflation) auf 100 Jahre leihen, ist es an der Zeit, sich die Folgen des geldpolitischen Endkampfes (“Endspiel” geht einfach nicht mehr) vor Augen zu führen. Zero Hedge greift dazu auf einen früheren Beitrag von JP Morgan zurück und fasst zusammen, wie fatal die Politik wirkt und damit eigentlich die Probleme verschärft, statt sie zu lösen.

- “(…) it was back in February 2016 that we presented a JPMorgan analysis from Panigirtzoglou, in which he argued that there are several unintended consequences from very negative policy rates, with little evidence of a positive impact (…) So now that there is a new record amount of negative-yielding debt, it is time revisit these unintended consequences below.” – bto: Und das machen wir jetzt einfach.

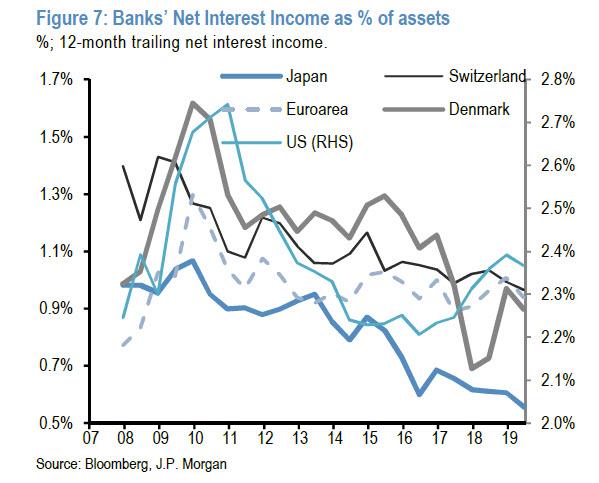

1. Lower bank profitability

- “(…) even if the portion of reserves subjected to deeply negative rates is limited, banks are not immune to a reduction in net interest income, especially if interest rates move deeper into negative territory. This is because banks seem unable or unwilling to pass negative deposit rates to their retail customers, leaving them with few options to offset costs. These costs not only include the negative interest on their reserves with the central bank (which can be limited by a tiered scheme) but also include reduced income from security holdings as government bond yields turn negative and a potential loss in income from reduced credit creation and money market activity.” – bto: Ich habe gerade einen Brief von der Bank bekommen, wonach ab einem bestimmten Betrag Negativzinsen fällig werden. Da ich den nicht habe, bin ich fein raus. Vorerst.

- “Indeed deeply negative policy rates have taken their toll on Danish, Swiss and Japanese banks’ net interest income.” – bto: was dieses Chart zeigt. Ich denke, der Euro-STOXX Banken 600 zeigt das auch. Ich habe jedenfalls seit 2007 keine Banken mehr im Portfolio.

Quelle: JP Morgan, Zero Hedge

- “(…) the contrast between banks in countries where central banks have experimented with negative deposit rates, where net interest margins have at best remained stable as in the case of the Euro area, and the US, is striking. In the latter, banks saw an improvement in net interest margins from a trough in 2016 against a background of rising central bank policy rates and despite credit creation if anything slowing modestly since early 2016, as well as a flattening in the US yield curve.” – bto: Klar, die EZB killt die Banken – und dann dürfen sie die deutschen Steuerzahler retten. Wie? Na ja, Sie wissen schon …

2. Reduced rather than increased credit creation to the real economy

- “(…) there was little evidence that very negative policy rates helped credit creation further. Denmark and Switzerland introduced very negative policy rates in 2015. (…) the evidence from Denmark and Switzerland is that the introduction of deeply negative interest rates was initially accompanied by a deterioration rather than improvement in credit creation. (…) net credit creation in the Euro area declined sharply during the Euro area crisis and remained weak even as the ECB pushed deposit rates to -20bp in 2014. It subsequently recovered, though to fairly muted growth rates by historical standards. (…) So the initial experience of policy rates being pushed into very negative territory was that it was associated at best with little clear impact on credit creation and in some cases in outright contraction in loan creation, and the subsequent recovery seems subdued by historical standards.” – bto: Warum ist das denn so? Klar, entscheidend für die Bereitschaft zur Kreditaufnahme (außerhalb des Finanzsektors) sind die Ertragsaussichten. Sind die schlecht und hat man schon viele Schulden, macht man es eben nicht. Da kann einem das Geld hinterhergeworfen werden!

3. Higher rather than lower bank lending rates

- “(…) the experience with deeply negative policy rates has been mixed. In Denmark, new loan rates to both NFCs and households declined by around 60bp from late 2016 to mid-2019. In Switzerland, bank lending rates for new investment loans to NFCs stabilized and were little changed in 2016-17, and declined by 5bp during 1H18 before stabilizing again. Lending rates for new 10y fixed-rate mortgages drifted 20bp higher from late 2016 to October 2018, before the bond market rally since then have seen fixed rate mortgages decline. And, despite a 50bp cut in the policy rate to -75bp in early 2015, rates on new variable interest rate mortgages linked to the policy rate declined around 10bp in total from early 2015 to late 2016 before stabilizing. In the Euro area, by contrast, loan rates on new business to NFCs and households have been relatively little changed since mid-2016. And in Sweden, new loan rates to households and NFCs have been largely stable since mid-2015. So the evidence from Switzerland, the Euro area and Sweden appears to be that deeply negative policy rates have overall seen little further decline of lending rates as banks (…).” – bto: Hier gilt es umgekehrt. Wenn der Kreditgeber pleite ist (die Bank) und der potenzielle Schuldner schwach, kann Geld noch so billig sein. Es wird nicht aufgenommen.

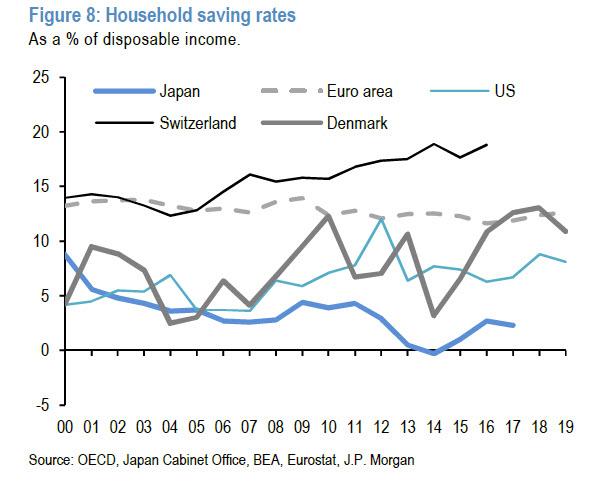

4. Higher rather than lower savings rates by households and non-financial corporates.

- “(…) when we look at household sector savings rates in the US, Euro area and Japan there is little evidence of lower savings rates in the Euro area and Japan, which had introduced negative policy rates in recent years, relative to the US.” – bto: Ist doch klar. Wenn ich für meine Rente mehr Geld brauche (weil es nichts verdient), muss ich heute mehr zur Seite legen.

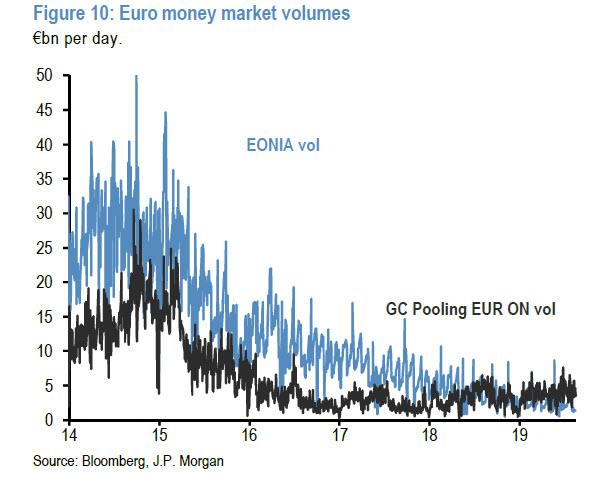

5. Impaired functioning of money markets

- “(…) negative rates coupled with QE had caused significant slowdown in money market activity: they quite literally are an ice age . Indeed, daily data show that both unsecured (EONIA volume) and secured (GC Pooling EUR overnight index volume) money market volumes have downshifted significantly since the ECB introduced negative rates in mid-2014 and accelerated once the ECB started its bond purchase program in early 2015, and pushed rates into more negative territory in late 2015/early 2016. (…) The collapse in money market volumes over the past years is concerning and shows that negative depo rates can make the functioning of money markets problematic even after QE is halted.” – bto: So ist es. Warum soll man etwas, was offensichtlich nichts wert ist, handeln?

Quelle: JP Morgan, Zero Hedge

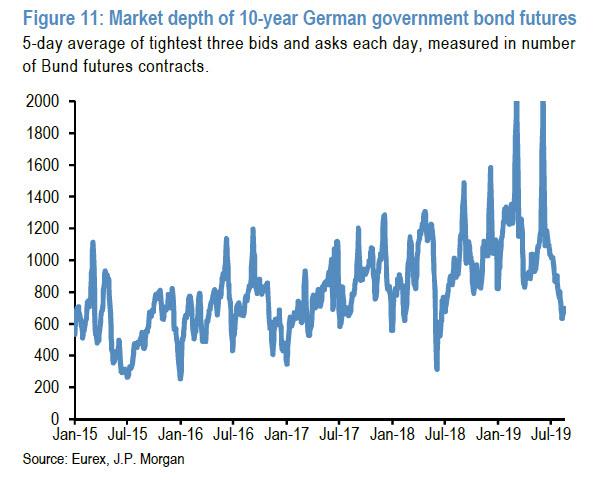

6. Reduced liquidity in bond markets

- “(…) according to JPM, liquidity in bond markets could also be affected by negative bond yields as real money investors are in principle less willing to trade bonds with negative yields. The next chart shows that the market depth of 10-year German government bond futures declined sharply this year as yields turned negative, reversing much of the improvement that occurred since mid-2016, when 10y Bund yields also turned negative. Previous sharp declines in market depth have also been associated with sharp sell-offs (…).” – bto: Das Thema bzw. erhebliche Risiko abnehmender Liquidität in den Märkten hatte ich immer wieder bei bto. Mir war neu, dass es auch mit dem Umstand zu tun hat, dass die Zinsen negativ sind. Aber klar: Wer keinen Zins bekommt, handelt weniger.

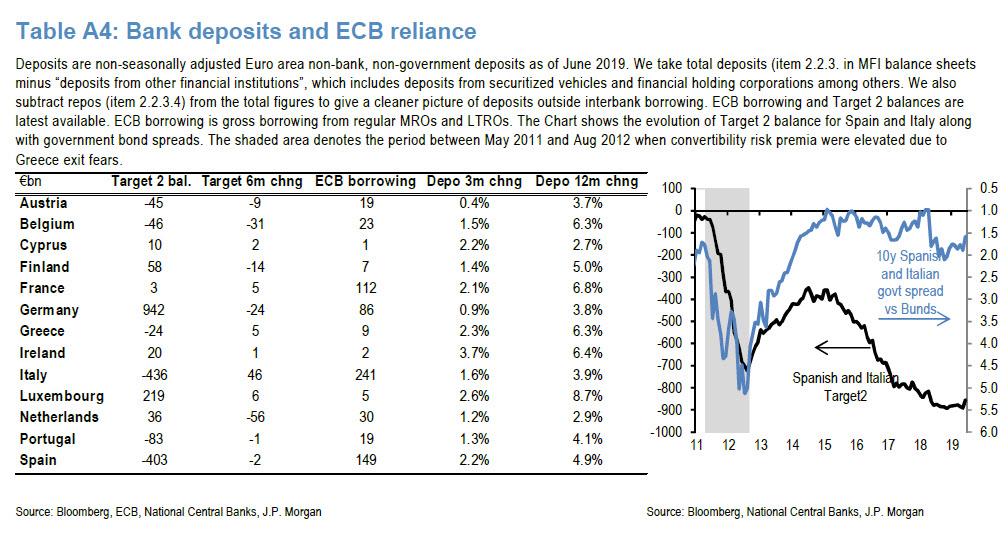

7. Increased rather than reduced fragmentation

- “(…) there has been no improvement in the ‘fragmentation’ of interbank markets since the first ECB depo rate cut in June 2014. (…) Since then, the latest ECB annual financial integration indicators, from July 2019, suggest the proportion of secured and unsecured money market transactions completed with domestic counterparties has increased from 25% in 2015 to 40% in 2019. The use of cross-border collateral in ECB monetary policy operations, which had recovered from a low of around 20% in late 2013 to close to 30% by early 2015 even as policy rates moved into modestly negative territory before stabilizing, has been declining steadily since mid-2016. (…) In addition, there has been deterioration in Target 2 balances since mid-2014, the broadest among quantitative measures of fragmentation. The sum of Spanish and Italian Target 2 balances has deteriorated by moving deeply into negative territory since the ECB first cut its depo rate to negative.” – bto: Natürlich, denn es war faktisch die Finanzierung der Kapitalflucht, was da stattfand. Bezahlt am Ende von der Bundesbank, also uns. Toll. Neu geschaffenes Geld wurde genutzt, um bei uns einzukaufen. Autos etc. und Assets. Und wir freuen uns über die digitalen Nullen (wir Deppen).

Quelle: JP Morgan, Zero Hedge

- “What is the channel via which negative policy rates could increase fragmentation? One potential channel is the risk appetite of banks. To the extent that negative policy rates hurt bank profitability, banks might become less willing to take risk and thus less willing to lend in interbank markets or to take credit risk in their bond portfolios. On the latter, there appears to be support from much of the academic literature that negative rates have depressed lending volumes for banks with high deposit shares. At the same time, work by the ECB (by Demiralp et al, May 2019) using Euro area bank level lending data suggests when controlled for both high retail deposit ratios and high negatively yielding excess liquidity ratios, as banks particularly exposed to negative rates, there has been a positive relationship with lending. As the ECB contemplates pushing deposit rates into even more negative territory, this is clearly a key issue – could more negative rates backfire by putting more pressure on bank profitability and curb risk-taking?” – bto: “could”? Natürlich ist es so.

8. Lower bond yields increase pension fund and insurance company deficits putting pressure on pension funds to match assets and liabilities.

Und jetzt kommen wir zur Wirkung auf die Altersversorgung. Kurz gesagt: ein Desaster. Aber auch das kümmert die Herrscher des “reichen Landes” herzlich wenig. Sie lösen das Problem ja dann, indem sie es “den Reichen” wegnehmen. Als würde das was an der Tatsache ändern, dass wir gesamthaft ärmer werden. Egal. Kommen wir zurück zu JP Morgan:

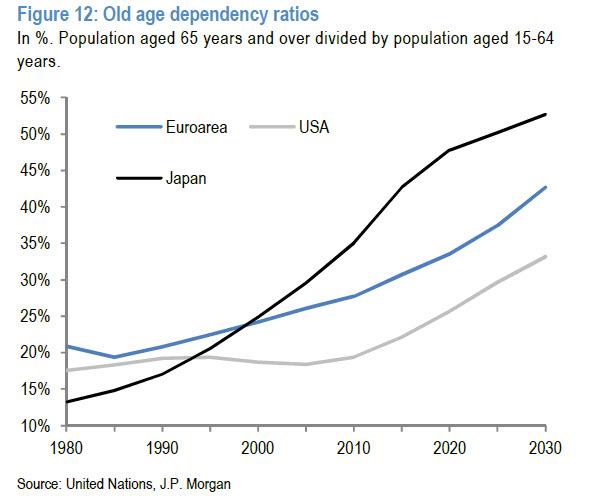

- “This pressure to move further away from equities and other high risk assets into fixed income is even stronger in countries like Japan where demographic pressures are more intense. For example, old age dependency ratios, i.e. the proportion of the population aged 65 years and over as a percentage of the population aged 15-64 years, have been rising steadily, with Japan aging more rapidly than the US or Europe.” – bto: Und wie schlecht wir darauf vorbereitet sind, habe ich immer wieder erläutert. Auch da gilt natürlich, dass das unsere Politiker überhaupt nicht interessiert. Lieber Klima retten.

Quelle: JP Morgan, Zero Hedge

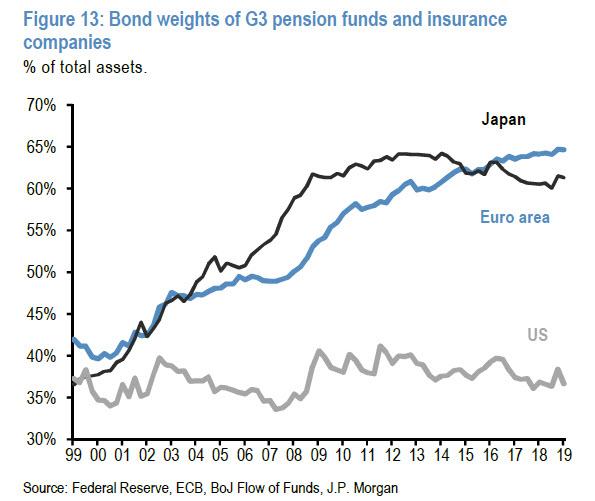

- “Generally, an aging population means that allocations are likely to shift towards relatively safer instruments as the ability to withstand larger drawdowns on capital diminishes as individuals age. And the effect of these demographic rends is likely a factor in the high share of total assets held in bonds by Japanese pension funds, especially relative to their US counterparts.” – bto: und Lebensversicherungen, die bekanntlich gezwungen werden, das Geld der Beitragszahler zu null bei den Regierungen anzulegen. Egal, trifft ja “die Reichen” – oder doch nicht?

Quelle: JP Morgan, Zero Hedge

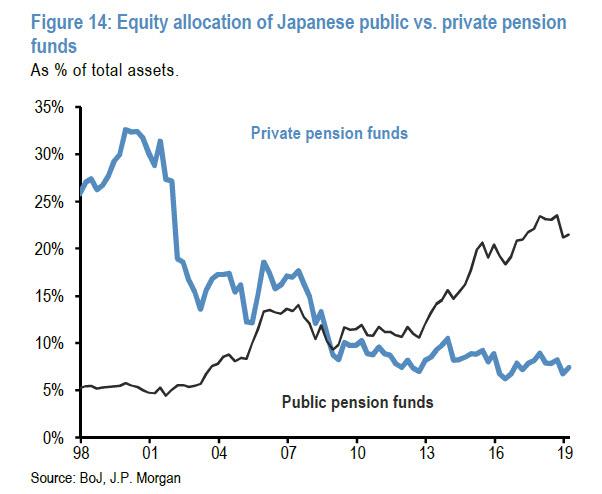

- “What is striking in Japan is that, in contrast to GPIF, which shifted towards equities post Abenomics most likely under political pressure, private Japanese pension funds have if anything reduced their equity allocations modestly.” – bto: Das wusste ich nicht. Das ist natürlich irre. Ich dachte immer, die Pensionsfonds dort kaufen fleißig Aktien in der ganzen Welt, weil sie wissen, wie das Spiel endet.

- “Pension funds and insurance companies which are facing a big increase in their liabilities have limited options such as taking a lot more fx and credit risk by shifting to foreign government or corporate bond markets, reducing benefits to new and sometimes to existing plan beneficiaries, or ask plan sponsors to increase their contributions. The overall impact is that lower yields can induce households, or companies that act as plan sponsors, to save even more for the future, an argument we have made since 2014, and one which not a single economist appears able to grasp.” – bto: BINGO! Deshalb spreche ich immer wieder von einem Ponzi-Schema. Nichts anderes erleben wir gerade. Das größte der Weltgeschichte. Blöd nur, dass wir am Ende mit dabei sind.

9. More income and wealth inequality as households and small businesses fail to benefit or are even hurt from negative rates.

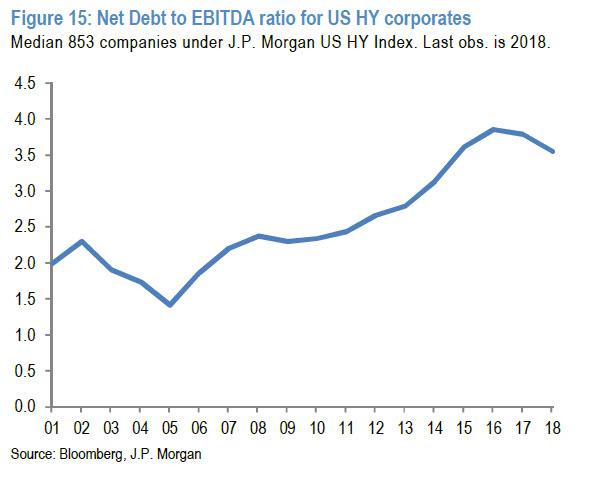

- “The main beneficiaries of negative rates have been large corporates which have seen a collapse to their interest expense as well as private equity companies that are able to lever by even more than in previous cycles to amplify their profits. Indeed, the median debt to EBITDA ratio for both HG and HY companies has risen in recent years to well above the peaks seen in previous cycles.” – bto: Und da vor allem die großen Unternehmen! Das ist eine enorme Benachteiligung des Mittelstandes und damit ein weiteres Wachstumshemmnis.

Quelle: JP Morgan, Zero Hedge

10. Central banks are trapped.

- “Negative rates coupled with QE raise questions about central banks’ exit potentially becoming more difficult in the future and raise the risk of a policy error as well as perceptions about debt monetization. It potentially creates bond bubbles by lowering bond yields below their equilibrium or fair value, creating fears that an eventual return to normality could be accompanied by sharp price declines. Perceptions about bond bubbles can increase long term uncertainty. In turn, higher uncertainty might prevent economic agents such as businesses from spending.” – bto: Und dass wir uns in einer Blase bei den Anleihen befinden, dürfte unstrittig sein. Dazu in diesen Tagen mehr bei bto.

11. The death of creative destruction and the zombification of corporations

- “By potentially allowing unproductive and inefficient companies to survive, helped by low debt servicing costs, negative rates could potentially hinder the creative destruction taking place during a normal economic cycle. In principle, similar to QE, negative rates could thus make economies less efficient or productive over time. The debate about so called ‘zombie’ companies has been particularly intense in Japan given the low business turnover rate. According to OECD, Japan’s business startup and closure rate is about 5%, roughly a third of that in other advanced economies with several commentators blaming the BoJ’s ultra-accommodative policies for this problem.” – bto: ja! Und das sagen neben bto auch deutlich andere Quellen wie die Bank für Internationalen Zahlungsausgleich. Einfach “Zombies” in die Suchmaske bei bto eingeben.

12. QE exacerbatea so called “currency wars”.

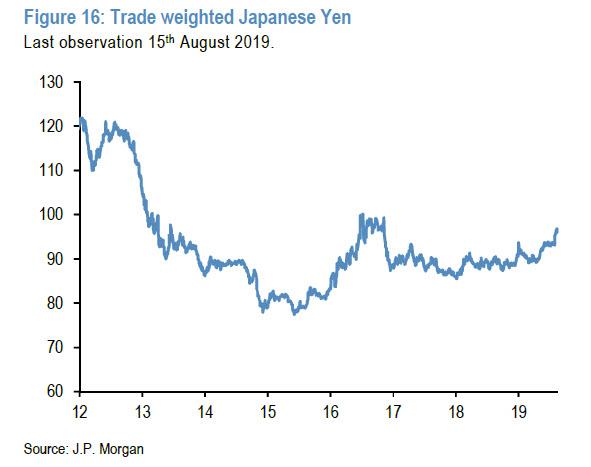

- “The value of the Japanese yen collapsed after Abenomics started in November 2012 and has stayed at historical lows since then helped by BoJ’s ultra-accommodative monetary policy. This is shown in the next chart by the real trade weighted index of the Japanese yen.” – bto: Schlimmer war es noch bei der EZB. Wir befinden uns mittendrin. Und es wird heißer werden in den kommenden Jahren.

Quelle: JP Morgan, Zero Hedge

- “Putting all of the above together, JPMorgan warns that moving to very negative policy rates (…) by central banks is not only not without risks or side effects, but could lead to worldwide devastation. Modestly negative policy rates perhaps had an overall positive impact initially, but keeping rates in very negative territory for prolonged periods or navigating to even deeper negative territory could unleash more unintended consequences than benefits. Just like QE, which from an emergency medicine to prevent the world from dying became a laxative to be used daily to prop up stock markets for the better part of the past decade.” – bto: Leider werden diese Stimmen nicht gehört. Im Gegenteil wie am Montag gesehen, werden sie immer lauter.

→ zerohedge.com: “12 Reasons Why Negative Rates Will Devastate The World”, 18. August 2019