Wie die Zentralbanken die Inflation auslösten

Am 16. Oktober 2022 geht es im Podcast um die diesjährigen Gewinner des Wirtschaftspreises der schwedischen Riksbank zu Ehren von Alfred Nobel und im Schwerpunkt um die Rolle der Notenbanken. Ein Paper von THE NEW ZEALAND INITIATIVE hat in mehreren Zeitungen Aufmerksamkeit gefunden und ich spreche dazu auch mit einem der Autoren.

Im Vorwort schreibt William White, ehemaliger Chefvolkswirt der BIZ, unter anderem:

„As I read this insightful essay, I became ever more convinced that the root of the central banking problem is what a philosopher would call an ontological error. Central bankers have fundamentally misread the nature of the system they are trying to control. They wrongly assume that the economy is simple and static, and therefore as understandable and controllable as a machine. In contrast, it is as complex and adaptive as a forest, a system where policy can have different effects over different time horizons, many unintended consequences and where there is no “equilibrium”. Humility rather than hubris should have conditioned monetary policy right from the start.” – bto: Und niemand dürfte bestreiten, dass es genau daran noch fehlt. Bis heute!

Und weiter über die Fehler der Notenbanken:

- “First, during the period of ‘The Great Moderation’, leading up to the Great Financial Crisis that started around 2008, central banks attributed low and stable inflation (and high and stable growth) to their own wise policies of demand management. In reality, the underlying cause was a series of positive supply side shocks that included both globalisation and positive demographic trends. The Great Financial Crisis then was triggered, and caused to persist, largely by the unwinding of excesses in the real and financial sectors that were directly due to the stance of monetary policy prior to the crisis.” – bto: Die Notenbanken haben die Krise erst bewirkt, weil sie nicht verstanden haben, was passiert.

- “Second, during the initial phase of the covid pandemic, central banks failed to appreciate how much supply potential had been reduced by illness and lockdowns. As a result, they failed to see how easily inflation might be triggered by still more monetary expansion, particularly as an adjunct to unprecedented fiscal expansion. More technically, the authors note that the central banks assumed Philips’ curves were flat and that inflationary expectations were well anchored. Both assumptions have been proven ‘wildly incorrect’.” – bto: weil sie eben nicht mehr auf die Inflation geachtet haben.

- “Third and subsequently, central banks asserted that the original negative, supply side shocks would prove ‘transitory’ – another error.” – bto: Das wird aber immer noch von einigen angenommen. Das kann sein, aber eben nur, weil die Wirtschaft einbricht.

- “And fourth, central banks today also seem largely unaware of the further negative supply shocks that are fast approaching. In effect, the favourable supply side shocks we saw prior to the Great Moderation are now going into reverse, and in addition, we now also have climate change and massive resource misallocations to contend with. Wheeler and Wilkinson rightly imply that this “stagflationary environment” will pose huge challenges for central banks going forward.” – bto: Davon können wir getrost ausgehen.

Soweit einer der klügsten Köpfe.

Nun zu den Kernaussagen der Studie:

- Zunächst der Hinweis, dass es eben nicht am Krieg liegt: “Several countries have annual inflation rates in the 2%-4% range including China, Japan, Switzerland, Saudi Arabia, and many Asian countries. Between May 2020 and May 2022 core inflation in the US was 10 percent and accounted for 70% of the headline inflation of 14 percent. Core inflation was 8 percent in the U.K. and accounted for 70% of the 11.5 percent of headline inflation. Core inflation accounted for 60% of headline inflation in France and 50% in Germany during this period.” – bto: Es ist die Folge der Politik der Notenbanken.

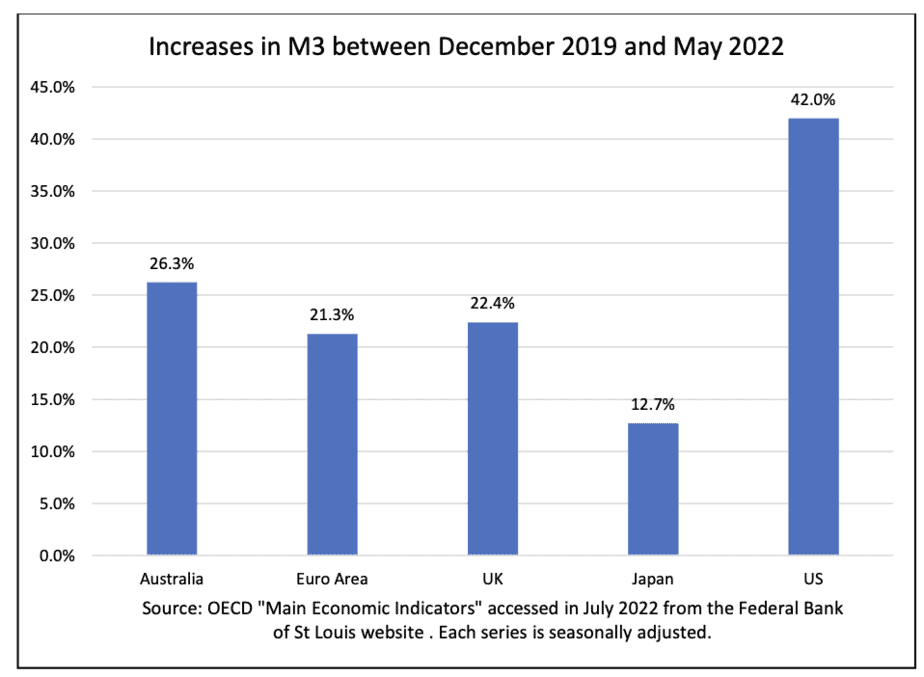

- “‘M3’ is a widely cited broad measure of the money supply. Figure 3 shows the increases in M3 between December 2019 (i.e., pre-Covid) and May 2022 for four major countries and the Euro area. The cross-country differences are marked, the outliers being the US and Japan. The surge in global inflation since early 2021 primarily results from the extraordinary degree of monetary and fiscal stimulus that central banks and governments undertook following the outbreak of the Covid pandemic. Excessive monetary stimulus pushed up commodity and equity prices, narrowed risk premia and led to rapid inflation in housing markets. These effects were predictable. Buoyant commodity prices are often linked to rapid increases in global liquidity, and the FAO Food Price Index increased by around 50% during the surge in quantitative easing and before the Russian invasion of Ukraine. Similarly, three weeks before Russia’s invasion of Ukraine, the price of brent crude oil was at its highest level since 2015.”

Quelle: THE NEW ZEALAND INITIATIVE

- “It was inevitable that the combination of extremely low and often unprecedented interest rates, readily available liquidity, and central bank pressuring of commercial banks to rapidly expand their lending would fuel house price inflation, especially as the size of the housing stock changes very slowly. Between the December quarter 2019 and December quarter 2021 real house prices in the OECD median country increased by 13% (…).” – bto: Deutschland liegt mit 15 Prozent im Mittelfeld.

Ursache dafür waren die Fehler der Notenbanker:

- “When inflation targeting became popular among many leading central banks in the 1990s, it was thought to solve many problems. (…) a public commitment to an inflation objective would provide a strong nominal anchor for stabilising inflation expectations and enable central banks to maintain underlying and headline inflation within target ranges. Central banks became complacent about their ability to maintain low inflation. They seemed to downplay the role played by positive supply shocks associated with globalisation, the global oversupply of manufactured goods, falling prices for information technology and capital goods, and the growing international competition for services such as education and health care in contributing to low inflation over the past two decades. They believed that when Covid restrictions were eased inflation expectations would remain anchored and that the growth in productivity would help restrain inflationary pressures.”

- “They also believed that they could ‘game’ inflation expectations by having policy interest rates close to zero (or negative) while also operating massive programs of quantitative easing. They believed that the credibility they had built through years of maintaining low and stable inflation would ensure that levels of core inflation and inflation expectations would remain well-anchored at levels consistent with price stability. This assumption proved to be wildly incorrect.” – bto: Dies ist berechtigte Kritik.

- Ebenso untauglich sind die Modelle: “They are inevitably simplified representations of a set of economic relationships that can provide useful insights into the impact of economic shocks and policy prescriptions. The parameters used in their operation – concepts such as potential GDP, output gaps, and the neutral interest rate -are all model based and not observable. No one knows the true values. Different estimation methods can lead to substantially different values.” – bto: Blindflug mit über-selbstbewussten Piloten …

- Zur Liquiditätsflut in Corona-Zeiten: “When the aggregate supply curve for an economy is steeply sloped as in the case of covid lockdowns, and households and firms are receiving extensive income support, adopting excessively easy monetary policy, and rapidly expanding the volume of broad money runs a major risk of fuelling price inflation in asset and product markets.” – bto: Genauso muss es sein.

Das lag auch daran, dass die Notenbanken durch andere Aufgaben abgelenkt waren:

- “Confident in their ability to maintain low inflation, central banks in recent years began diverting resources to other topics such as climate change and inequality. Such issues bear little if any relationship to the reasons why central banks exist — ensuring price stability and financial stability.” – bto: Das kann man gar nicht ausdrücklich genug betonen.

- “In undertaking quantitative easing some central banks began to operate like fiscal agencies and fund managers in making decisions about which sovereign bonds to buy or which corporate bonds and exchange traded equity funds to purchase. The European Central Bank’s decision to selectively purchase different member country sovereign bonds (e.g., those of Italy, Spain and Greece) in an attempt to narrow sovereign spreads within the Euro area has been very divisive among member governments.” – bto: So ist das, wenngleich unsere Regierung auch hier untätig zuschaut.

Fazit:

- “Central bankers need to reflect deeply on the management of monetary policy over the past two years and review their models and the assumptions and judgments they made. They must ensure that they have first rate financial market expertise on their monetary policy committees and Boards. (…) Central bankers need to learn from their misjudgements because the social, economic, and political consequences of major mistakes run deep and the trust and confidence that the public have in them can be readily depleted.”– bto: Und das ist nicht in Sicht!

→ THE NEW ZEALAND INITIATIVE: „How-Central-Bank-Mistakes-after-2019-led-to-inflation“, July 2022