Wie die Eurozone die globale Verschuldung treibt. Politisch gewollt!

Welche Folgen eine einseitige Exportfixierung einer Volkswirtschaft hat, habe ich am Beispiel Deutschlands mehrfach diskutiert. Die Eichhörnchen-Strategie Deutschlands ist anerkanntermaßen eine Garantie für massive Vermögensvernichtung.

→ „Deutschland wirtschaftet wie die Eichhörnchen“

Bei uns über die falsche Anlage der Gelder (Target2!!). In den anderen Ländern über Kaufkraftentzug. Nun sind wir in der Eurozone drauf und dran, das deutsche System zum Modell für Europa zu machen. Die FT ist skeptisch:

- “The Asian financial crisis was so harrowing for those involved, and those who observed it from a close distance (…) determined never again to be at the mercy of foreign creditors (…). One consequence was a massive increase in ‚self-insurance‘ in the form of current account surpluses. It’s harder to have a currency crisis when you’re a net lender to the rest of the world.” – bto: In der Eurozone ist das Ziel ein anderes: Es geht um die Entschuldung der Krisenländer und die Rückkehr zu mehr Wachstum über den Export.

- “Big rich countries had weak growth and low interest rates in the early 1990s, and (…) this encouraged investors to put money into exciting ‚emerging‘ markets, (…) there was more foreign money available than worthwhile investments in need of funding, so local banks and non-financial companies ended up borrowing dollars and yen short-term to fund real estate bubbles and acquisitions.” – bto: Es ist immer problematisch, wenn man Geld für die falschen Zwecke einsetzt. Das war ja auch die Ursache der Eurokrise (wenn man von den anderen negativen Faktoren des Euro absieht).

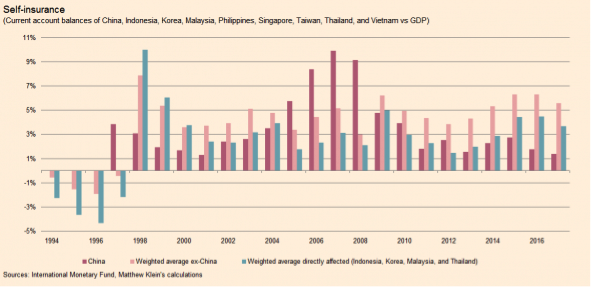

- “Deep recessions (…) led to political upheaval and humiliating interventions from self-righteous foreigners. Even countries that weren’t directly affected, such as China, Singapore, and Taiwan, took the lesson to heart. The chart below shows the aggregate current account balances of countries transformed by the crisis:” – bto: Die Länder sind von Defizit- zu Überschussländern geworden.

Quelle: FT

- “In 1994-1996, the countries directly affected by the crisis had a weighted-average current account deficit worth 3.4 per cent of their gross domestic product. Those countries reported an average current account surplus worth 3.1 per cent of GDP in 1999-2017. That’s a 6.5 percentage point swing! Even those that mostly missed the crisis — the Philippines, Singapore, Taiwan, and Vietnam — experienced a permanent shift in behaviour. (…) Despite going into the crisis well-prepared, they still increased their average surplus by 5 percentage points.” – bto: Es war natürlich im Unterschied zur Situation bei uns eine Änderung der Politik aus eigenem Antrieb, die auch möglich war, weil die Länder über eigene Währungen verfügen.

- “As national currencies were replaced by the single currency, investors came to believe that devaluation risk had been eliminated. (…) European banks engorged themselves and lent recklessly across the continent.” – bto: was die Eurokrise erst richtig befördert hat.

- “The net recipients of these flows often ended up with current account deficits about as large, if not larger than, countries such as Malaysia, Thailand, and Vietnam in the mid-1990s. By the peak in 2007-8, Cyprus, Estonia, Greece, Latvia, Lithuania, Portugal, and Spain all had current account deficits in the double digits. Ireland and Slovenia were also highly dependent on foreign financing to sustain their spending.” – bto: Das geht so: billiges Geld – Immobilienboom – Bauboom – steigende Gehälter – mehr Nachfrage – mehr Importe …

- “Latvians, the most extreme example, were spending about 30 per cent more than they earned before things painfully reversed. It took nearly ten years for nominal output there to return to its pre-crisis level.” – bto: Aber sie haben die Anpassung gemacht im großen Unterschied zu den südlichen Ländern.

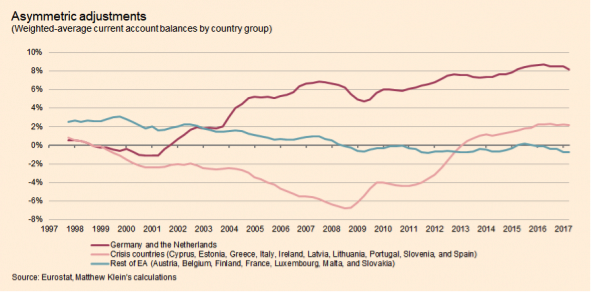

- “Just before the crisis, the countries that would be hardest hit — the Baltics, Slovenia, the so-called GIPSIs, and Cyprus — accounted for about 36 per cent of the gross domestic product of what is now the euro area. Germany and the Netherlands together were about 33 per cent. The rest of the EA — mostly Austria, Belgium, Finland, and France — accounted for the remaining 31 per cent. While they were roughly the same size, these three groups behaved in very different ways. (…) The chart below shows how all this played out:” – bto: Deutschland und Holland haben ihre Überschüsse vergrößert, die Krisenländer das Vorzeichen geändert.

Quelle: FT

- “In 2007-8, the crisis countries had an aggregate current account deficit worth 6.4 per cent of their GDP. Since mid-2015, they have earned an average current account surplus worth 2.1 per cent of their combined GDP — a swing of 8.5 percentage points!” – bto: allerdings überwiegend über einen Einbruch der Nachfrage, weniger über mehr Exporte.

- “Germany and the Netherlands had a surplus worth 6.1 per cent of their GDP on the eve of the crisis. Yet they too have increased their aggregate surplus in the decade since then. It currently stands at a whopping 8.4 per cent of output.” – bto: was auch am schwachen Euro liegt; wir profitieren von der Schwäche der anderen.

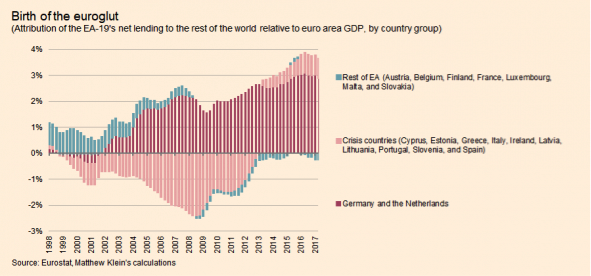

- “The chart below shows how these three groups of euro-area countries contributed to the aggregate current account balance of the bloc over time:” – bto: Das ist schon ein beeindruckendes Chart.

Quelle: FT

- “Since mid-2015, the bloc’s current account surplus has been about 3.6 per cent of GDP. On the surface, this can be attributed to Germany and the Netherlands, which account for 3 percentage points of that surplus. But the change in the 19-member group’s current account balance can be almost entirely attributed to the crisis countries.” – bto: was aber wie gesagt auf einen Rückgang der Binnennachfrage zurückgeführt werden kann.

- Jetzt kommt die FT zu ihrem Fazit: “This presents problems for the rest of the world.” – bto: eben weil es der Welt Kaufkraft entzieht und vor allem, weil es die globalen Ungleichgewichte verstärkt.

- “(…) if one group of people starts saving a lot more of their income than they used to, other people have to be saving less. (…) For example, Japanese companies spent more than they earned in the 1980s, but have been huge net savers ever since. That sector’s change in saving behaviour was offset by a collapse in the Japanese household savings rate and a big swing in the government’s fiscal position, so it didn’t affect the external position that much.” – bto: Bilanzrezession eben!

- “After 1998, the sustained change in East Asian current account balances went hand-in-hand with dis-saving elsewhere, most obviously in America. (…) This dis-saving might have been fine if there had been better growth opportunities in America compared to China, or in Spain compared to Germany. Current account deficits aren’t inherently bad, especially if they are produced by countries investing in their productive capacity.” – bto: Das passiert oft jedoch nicht. Siehe Bauboom in Spanien.

- “Unfortunately, things rarely work out this nicely. More often, you get (…) bubbles, unsustainable debts, and crises. Instead of being pulled to where they could do the most good, excess savers pushed themselves onto whomever they could. Ironically, the victims of one cycle can end up so traumatised by the experience they become the perpetrators the next time around.” – bto: So wie die Notenbanken eine Blase nach der anderen aufpumpen, führt auch dies zu einer Welle immer größeren Krisen.

- “You can tell the difference by looking at real interest rates. When real rates are falling it’s safe to conclude the dis-saving is the consequence of reckless investment from abroad, rather than reckless borrowing domestically.” – bto: Das ist eine sehr interessante Beobachtung!

- “All of this means that the euro area’s recent transformation into the world’s largest net lender, alongside the Greater East Asian supply chain, is going to be trouble for the rest of the world.” – bto: Davon ist auszugehen.

- “(…) European officials have been systematically shrinking the supply of euro-denominated safe assets. In 2007, the euro area had about €6 trillion in sovereign debt outstanding, all of which was considered equally good. Government debt has soared since then, but the amount of safe fixed income has collapsed, because default risk was reintroduced. Credit spreads currently imply a roughly 1-in-7 chance the Italian government will default at some point in the next decade. There are only three AAA-rated sovereigns left in the euro area: Germany, Luxembourg, and the Netherlands. Their combined debt is only about €2.5 trillion.” – bto: Damit haben wir einen starken Anreiz, nach anderen sicheren Geldanlagen zu suchen.

- “The problem here is that if defaults are a normal part of sovereign statehood in the euro area, you will, by definition, end up collapsing the supply of euro-denominated assets people can own without having to worry about defaults. (…) People who live in the euro area and want to buy ‚safe‘ assets will be forced to look abroad — which is exactly what’s been happening.” – bto: und was ich auch immer wieder rate. Es ist sehr vernünftig, das Geld außerhalb der Eurozone anzulegen.

Fazit FT: “(…) the euro area’s self-imposed safe asset shortage is going to force the rest of the world to dis-save on an unprecedented scale. Europe will have solved its problems at the expense of everyone else. The rest of us should be careful.” – bto: Und weiter geht es in der Spirale weltweiten Schuldenmachens. Dabei brauchen wir einen Reset.