Wenn es um das eigene Geld geht, spielt ESG weniger eine Rolle

Morgen (26. März 2023) geht es im Podcast unter anderem um das Prinzip des ESG-Investing. Ziel dieses Ansatzes soll sein, die Welt über eine ethische Geldanlage besser zu machen. Doch wie steht es um die Praxis? Nun, die Anlagemanager scheinen sich mehr unter Marketinggesichtspunkten dafür zu interessieren.

Joachim Klement lohnt sich immer zu lesen. Sein Newsletter kann (noch) unentgeltlich bestellt werden. Vor einiger Zeit hat er eine Studie zu Geldverwaltern ausgegraben. Sie zeigt, was ich immer gedacht habe: Wenn es um das eigene Geld geht, wird es ernst.

- „(…) even with the fund managers committed to integrating ESG into their investment process I sometimes get the feeling that they do it mostly because their clients want them to do it and because it is easier to attract new assets if they do it.“ – bto: … denn es geht ja um die Assets under Management. Und wenn die Kunden das wollen, warum denn nicht?

- „(…) when it comes to my views about fund managers, a group of Swiss researchers have found that my views may not be too far off the mark. Vitaly Orlov and his colleagues looked at the ESG performance of some 22,000 fund portfolios in the US. The trick they used to identify if fund managers ‘care’ about ESG investing is to check if there are material differences in the ESG performance of funds where the fund manager has his or her own money invested vs. funds where the fund manager is not invested. Similarly, if the fund manager has more money invested in a fund, does the ESG performance of that fund change?“ – bto: Guess what! Die Manager wollen Geld verdienen und das beißt sich offensichtlich mit dem ESG-Anspruch.

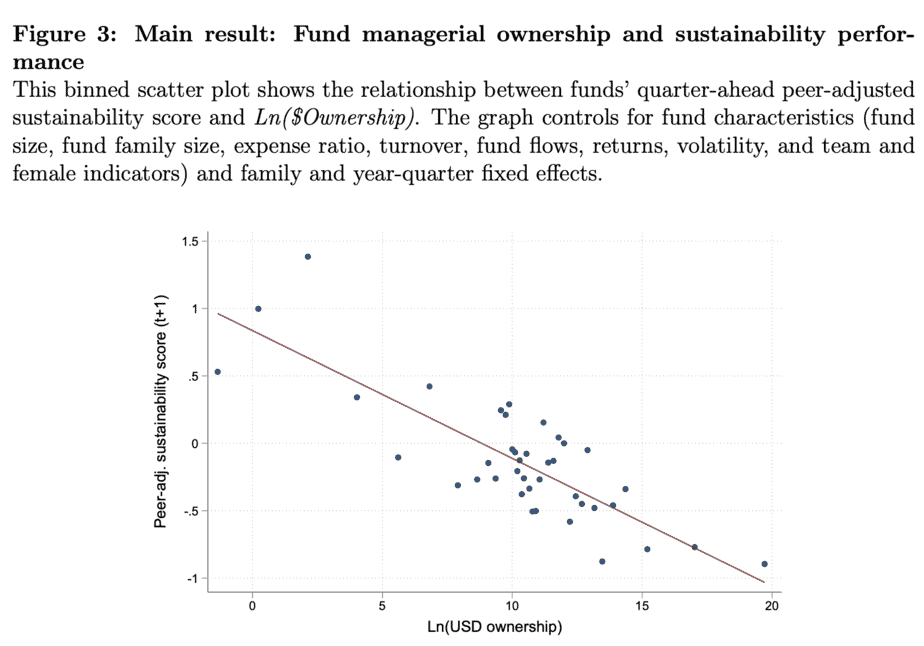

- „The results are straightforward and unfortunately not good. The more of his or her own money a fund manager has invested in a fund, the lower the ESG performance of the fund. Even more, if a fund manager invests more money in a fund and thus owns a larger share of the fund, the lower ESG performance of the fund gets over time.“ – bto: Offensichtlich denken oder wissen die Profis, dass das ESG-Investing nicht unbedingt eine gute Idee ist.

- „This strongly indicates that fund managers in the US on average implement ESG factors in their portfolios because their clients demand it or to attract additional assets.“ – bto: … weil es Gebühren bringt, nicht, weil sie die Ziele teilen.

Ich habe mir das Papier daraufhin angeschaut:

- „Overall, our analyses indicate that fund managers do not expect ESG strategies to deliver higher risk-adjusted performance. This suggests that the popularity of these strategies in the mutual fund industry is primarily driven by client demand, that is, by the possibility of fund managers attracting higher flows by tilting their portfolios in a higher ESG direction. “ – bto: Das ist die Aussage von oben. Man macht es, weil es Geld bringt, aber nicht wegen besserer Erträge.

- „We show that, on average, fund managerial ownership is associated with generally lower sustainability performance by over-weighting high-ESG firms. We interpret this result as evidence that fund managers do not consider ESG issues as material drivers of a portfolio’s financial performance, despite a widespread narrative in the asset management industry suggesting otherwise.“ – bto: Dann hätten also die ESG-Kritiker recht, wenn sie sagen, dass das zu einer geringeren Rendite führt.

- „Our key assumption is that fund managers with personal wealth tied to the funds they manage are more likely to choose portfolio holdings so to maximize financial performance. Thus, investigating the relationship between a manager’s investment choices and her co-investment in the fund – having or not ‚skin in the game‘ – can reveal how fund managers perceive sustainability performance.“ – bto: Okay, wir wiederholen uns jetzt. Es ist eindeutig.

- „Not only does managerial ownership appears significant per se in explaining ESG performance (…), but the higher the amount co-invested, the higher the reduction in a fund’s sustainability performance (…). In other words, the more ‚skin in the game‘ managers have in their funds, the less likely they seem to tilt their portfolios toward high-ESG-score firms.“ – bto: Auch das muss einleuchten.

- „We observe that episodes of increases in managerial ownership are followed by decreases in fund sustainability scores, whereas reductions in fund managers’ stake portend increases in sustainability scores in the next quarter. The effects on sustainability are especially pronounced following changes in ownership above $1 mln USD and following episodes of initial managerial co-investment or complete withdrawals of managerial stake in a fund.“ – bto: Es ist ein Trade-off. Was bringt mir mehr? Assets under Management oder die auf meinen Anteil entfallende Zusatzperformance.

- „Overall, the effects on the portfolio ESG performance of managers’ compensation structure, and its interactions with managerial ownership, support the interpretation that – based on their actions – fund managers expect portfolios tilted towards higher-ESG firms to deliver lower future expected returns.“ – bto: Und da helfen noch so viele Studien, die etwas anderes behaupten, nichts.

Das Ergebnis der Studie auf einen Blick: