We All Know How This Ends, So Why Are We So Slow To Price It In?

Eigentlich eine sehr gute Frage: wir wissen doch alle, dass die Party die wir gerade feiern auf einem sehr ungesunden Fundament beruht. Warum machen wir dennoch völlig unbesorgt weiter? Die Analysten der Citigroup suchen einen Erklärungsansatz, während die Kollegen von Zero Hedge ihre Kommentare hinzufügen und ich wie immer die Highlights kommentiere:

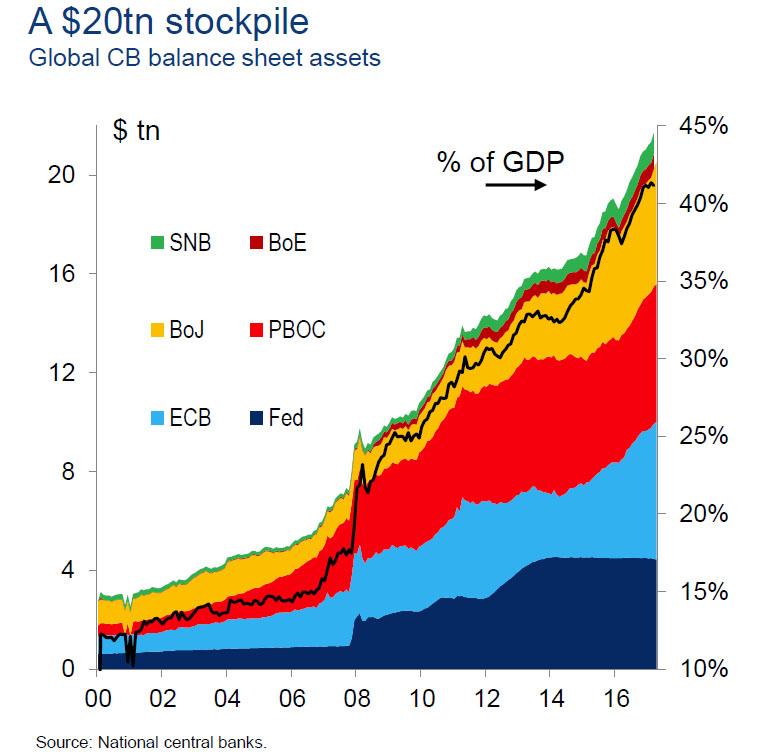

- “….central bank balance sheet account for over 40% of global GDP, amounting to no less than $21 trillion. That in itself, should explain why the “most hated bull market” of all time is not a bull market at all, but the world’s biggest experiment in central planning.” – bto: genau so muss man das sehen.

Quelle: Zero Hegde

- “Yet the time of this unprecedented monetary experiment is coming to an end as we are finally nearing the point where due to a growing shortage of eligible collateral, the central bank support wheels will soon come off, resulting in gravity finally regaining control over the market’s surreal trendline.” – bto: die Märkte wären also wieder auf Fundamentaldaten angewiesen.

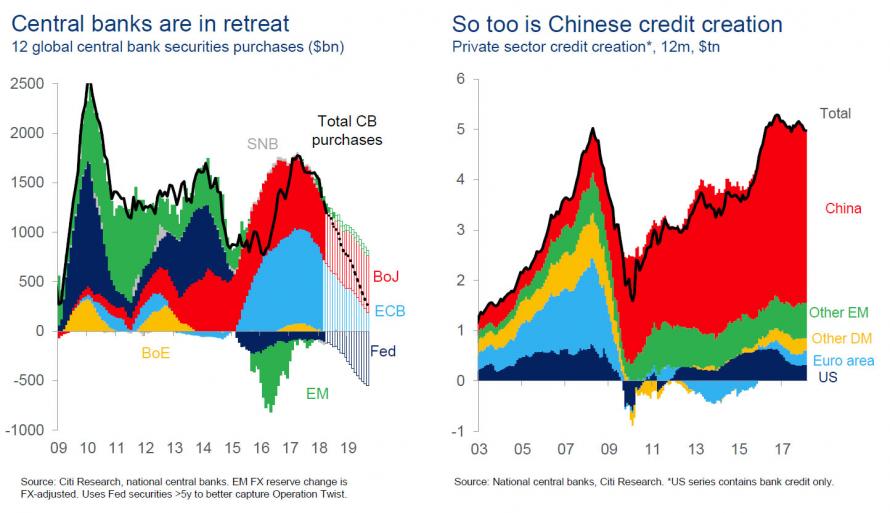

- „this central bank handoff is also the topic of the latest presentation by Matt King, in which the Citi credit strategist once again repeats that “it’s the flow, not the stock that matters“, a point we’ve made since 2012, and underscores it by warning – yet again – that “both the world’s leading marginal buyers are in retreat.” He is referring to central banks and China, the world’s two biggest market manipulators and sources of capital misallocations.” – bto: womit wir – so wir denn glauben, dass die Käufe der Notenbanken etwas bewirkt haben und zugleich, dass wirklich ein Ende bevorsteht – in der Tat in einen möglichen Abgrund blicken.

Quelle: Citibank, Zero Hedge

- “we know what central banks are doing, so why are we so slow to price it in – especially since the marginal buyer – central banks – sets the price, and the marginal buyer will be gone by this time next year? (…) which suggest that both the global stock and bond markets are headed for a major crash as a result of the slowdown in central bank purchases.” – bto: was man zumindest denken kann, wenn man an eine Fortsetzung der Korrelation glaubt:

Quelle: Citibank, Zero Hedge

- “… not only have markets lost their ability to discount future news, but that central banks – unable to grasp this – believe that in a perverse case of reflexivity, the market is actually giving the “all clear” to their actions, when it is their actions themselves that have broken the market, which effectively encourages central banks to break it even more.” – bto: ich denke der neue Fed-Präsident ist sich der Risiken sehr wohl bewusst.

- „Unfortunately they seem to have neglected the textbook footnote that states that markets function this way only when they are deep and liquid. That might have been a reasonable description of pre-crisis markets; it seems a deeply unreasonable assumption for post-crisis markets in which leverage is constrained and one set of buyers have come along and absorbed virtually all of the world’s net new issuance.” – bto: diese Wirkung der Liquidität und vor allem der pro-zyklische Charakter war schon mehrfach Thema bei bto. Die Liquidität ist weg, wenn man sie braucht.

- “According to King there are 5 key lessons investors appear to have forgotten, so here is a reminder.

- “”Mind the flow, not the stock”, which of course refers to the ongoing slowdown in central bank purchases as shown in the charts above.” – bto: es ist ist der Tat die Veränderung, die auf die Märkte wirkt. Das gilt auch bei der Verschuldung. Das Delta des Delta macht den Unterschied für die Konjunktur.

- “”Announced ≠ already discounted“, or why just because markets have had time to “price something in”, never means that they have priced it in.” – bto: was ich wiederum erstaunlich finde. Man sagt doch immer, die Märkte würden alles vorwegnehmen.

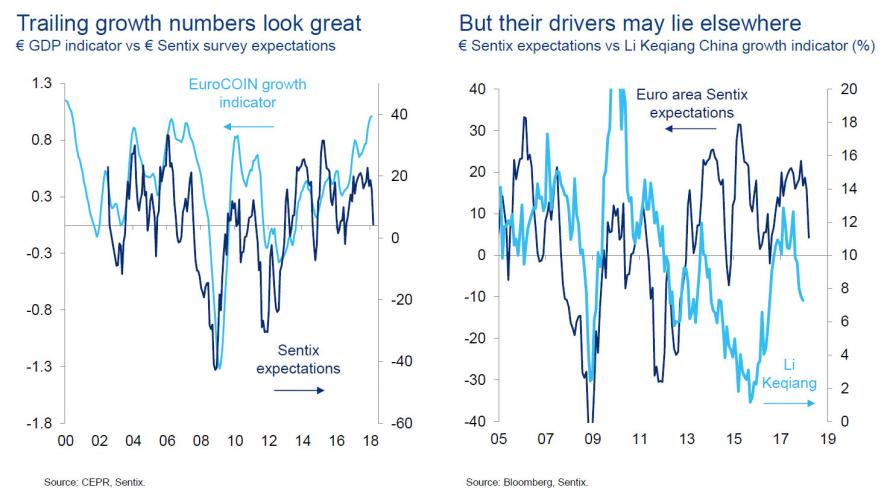

- “”Think global not local.” – when it comes to the global economy, it’s all about China, and specifically its credit impulse. Here King notes that whereas trailing growth numbers look great, their drivers likely lie elsewhere..” – bto: nämlich im Kreditwachstum, was gerade auch in China die entscheidende Voraussetzung für Wachstum ist.

Quelle: Citibank, Zero Hedge

- “The latest decline in German manufacturing sentiment follows 6 months after the Li Keqiang (LKQ) index, which tracks Chinese growth, peaked last summer. Likewise, the previous surge in German industrial confidence began in spring 2016, 6 months after the LKQ troughed.” – bto: was in der Tat die nachfolgende Abbildung schön verdeutlicht:

Quelle: Citibank, Zero Hedge

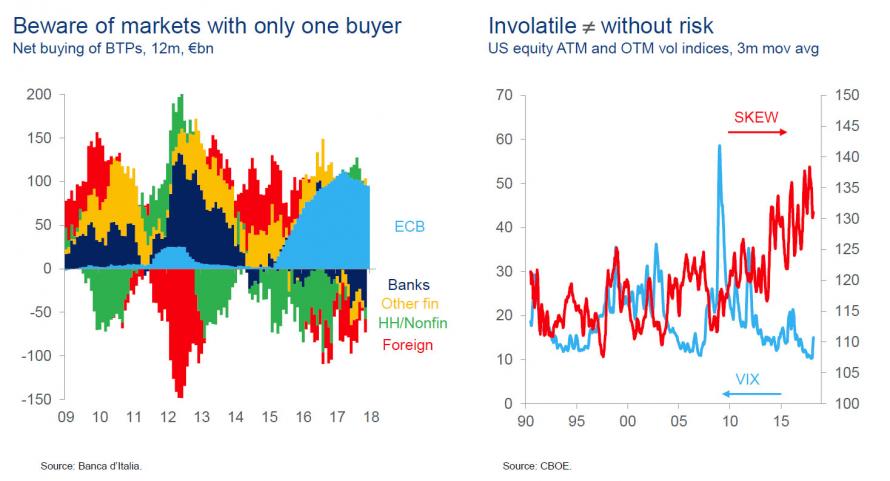

- “King’s 4th lesson is that “a diverse market is a resilient market“, pointing to the Italian BTP market specifically, where he urges investors to “beware markets with only one buyer“, in this case the ECB.” – bto: was wir schon an anderer Stelle gesehen haben.

Quelle: Citibank, Zero Hedge

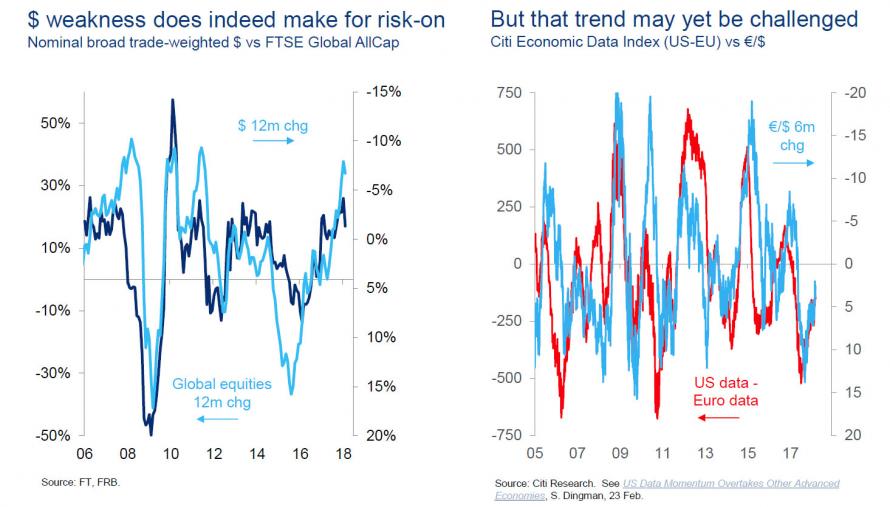

- “”beware of circular logic”, in this case as referring to the US Dollar, because while $ weakness does make for a risk on environment, that trend is about to be challenged. Or said otherwise, enjoy the recent move while you can, because “self-reinforcing processes can run in both directions.“” – bto: ich denke auch, dass es zu einer unerwarteten US-Dollar-Rallye kommen könnte.

Quelle: Citibank, Zero Hedge

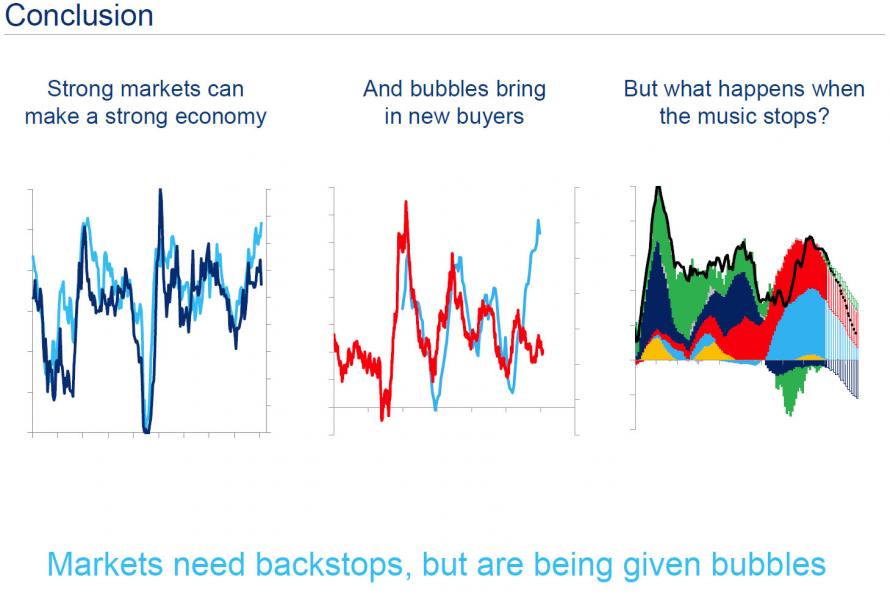

- “This brings us to Matt King’s conclusion, which comes in three very simple parts: strong markets can make a strong economy…and bubbles bring in new buyers…what happens when the music stops?”

Quelle: Citibank, Zero Hedge