Was steht hinter Inflation?

- “Today inflation is very much a political, economic and social choice. Through much of history there was little opportunity to create it given the predominance of metal-based currency systems. Inflation did occur when shocks or wars led to these systems being suspended, when there were new discoveries of precious metals, or when rulers decided to debase the coinage to increase the supply of money.” – bto: So wird es auch in Zukunft sein, wo wir besonders auf hohe Inflation angewiesen sind.

Quelle: Deutsche Bank

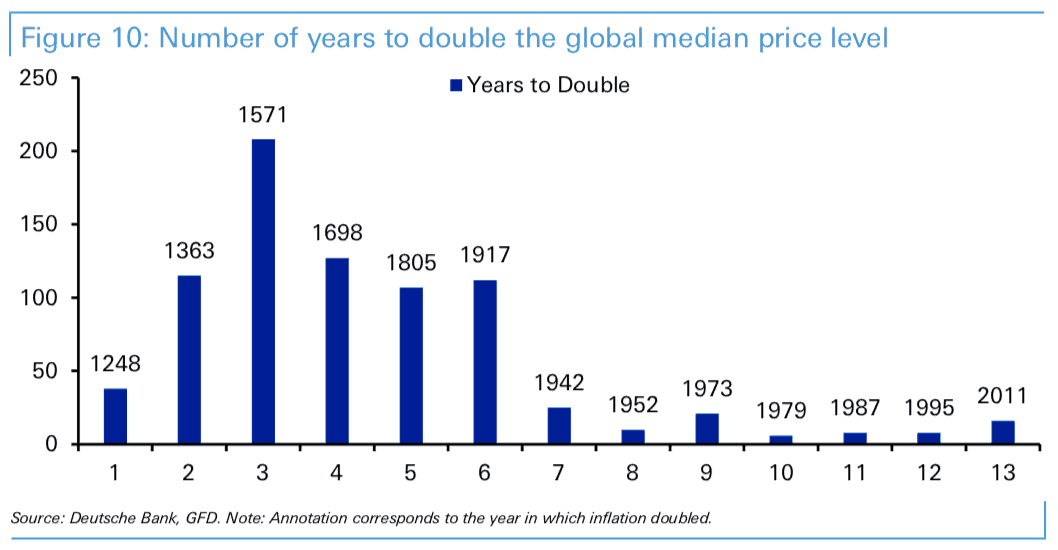

- “Another way of looking at this is to show (…) how many years it took for the global price level to double (based originally on the UK with Sweden (1291), France (1432), Netherlands (1451) and Belgium (1463) adding to this in the early years). After a relatively quick (38 years) doubling of inflation between 1210 and 1248, which may have been due to a trade-related influx of silverin the UK, the next 5 doublings of the overall price level up until 1917 each took over 100 years with the longest being the 208 years between 1363 and 1571 which included the period of the Black Death which decimated population sizes in many countries.” – bto: Inflation ist also in Wirklichkeit seltener, als wir gemeinhin denken.

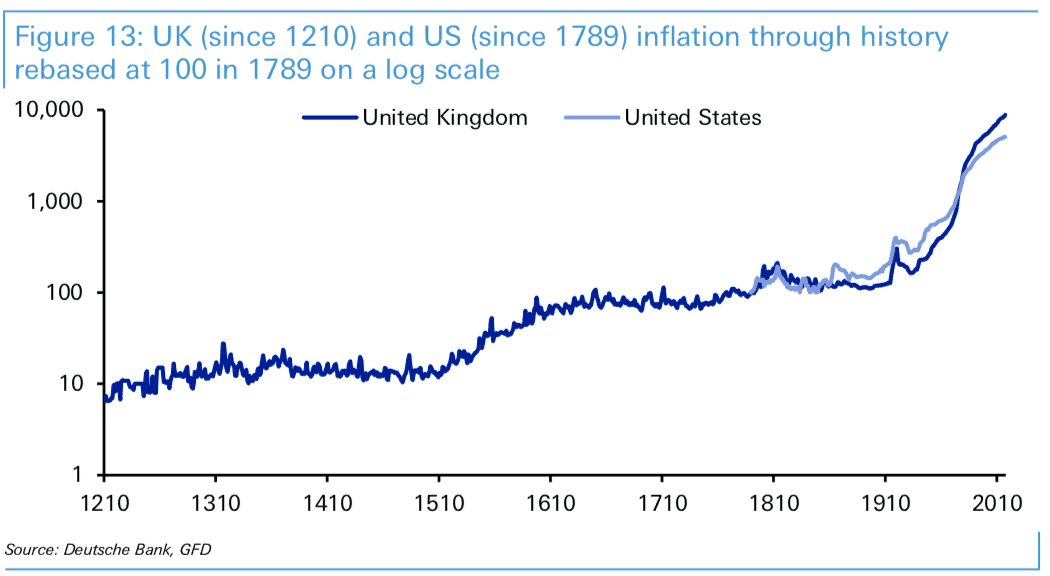

- “(…) although 21st century inflation has generally been becalmedrelative to the latter half of the twentieth century, the level of price rises remains elevatedrelative to long-term history. (…) in the UK the overall price level was more or less unchanged between 1800 and 1938 but has subsequently risen by a stunning multiple of 50 times(4885%) since this point. For the US we find that prices only rose 12% in the nineteenth century and only 52% from 1800 to the point the Fed was created in 1913. Inflation has since risen over 2000% (price level increased 24 times).” – bto: Wir brauchen also die Möglichkeit, beliebig viel Geld zu erzeugen, um hohe Inflationsraten zu erzielen.

Quelle: Deutsche Bank

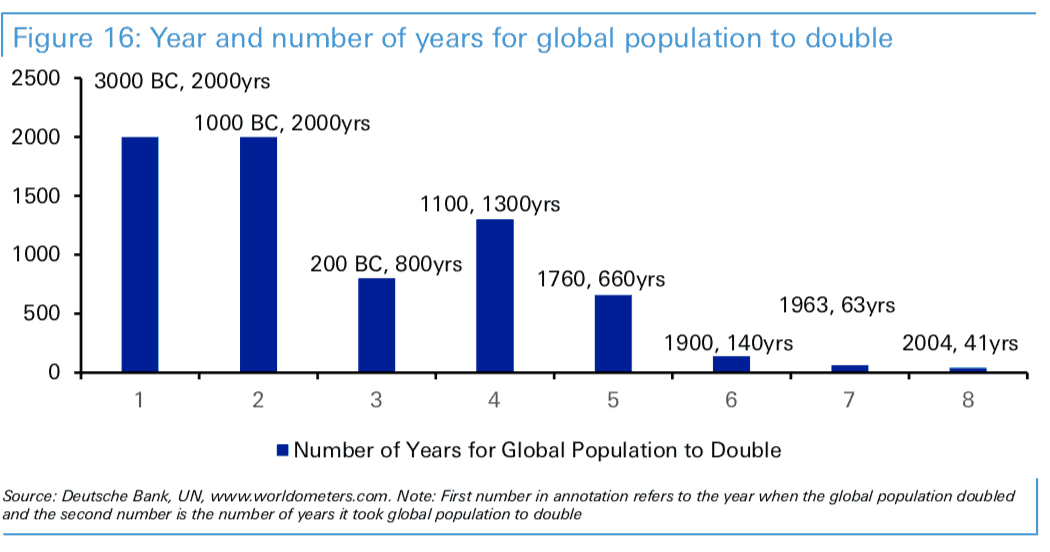

- “(…) there is pretty strong evidence to suggest that population growth has historically had a major impact on inflation.” – bto: Das unterstreicht die Abbildung sehr schön.

- “To look at global population growth in a wider context, (…) data starting in 5000BC and shows how many years the population took to double. The first two episodes of doubling took around 2000 years whereas the most recent one between 1963 and 2004 took only 41 years.” – bto: was dann auch zu erheblichen Migrationsproblemen und Konflikten in der Welt führt.

- “It wasn’t until post-1900 that population growth started to increase at rates not seen before and perhaps this started to put pressure not only on natural resources but also on the fixed currency monetary regime. If the population started to increase more rapidly than that seen through history but the monetary base was effectively capped by the finite supply of precious metals then it’s now easy to see how inflationary pressures were likely to have built up. So it is perhaps not a coincidence that the unique population increases in the twentieth century coincided with a century of repeated breakdowns in precious metal currency systems.” – bto. Das ist ein interessanter Gedanke, finde ich. Wir wären in einer so starken Deflation gefangen gewesen, dass die Antwort eine Öffnung hin zur Inflation sein musste. Es leuchtet als Argumentation zumindest ein.

- “The quantity theory of money is a mainstream economic theory based around the well known MV = PQ identity and is a good testing ground. (…) As a reminder M is the money supply; V is velocity — the number of times per year the average unit of money is spent; P is prices of goods and services; and Q is quantity of goods and services. The identity suggests in a precious metal currency era, if V is constant and M is only increasing very slowly with new discoveries of such metals, then PQ (i.e. nominal GDP) can only increase slowly.” – bto: nämlich im Umfang der Gold- und Silberfunde. Natürlich ein enges Gerüst und außerdem ein willkürliches. Nach der Eroberung Südamerikas ging es mit der Inflation erst mal so richtig nach oben.

- “(…) if M remains constant, all growth in Q (real output) would have to be deflationary. Real output (Q) can increase either through population or productivity growth. The population growth alone should have increased Q notably in the twentieth century which means that life under a continued gold standard would have become more and more deflationary. There is no theoretical reason why this couldn’t have happened but the reality is that for it to work, people would have had to accept annual nominal pay cuts and companies lower nominal profits to ensure the status quo. In real terms neither would have necessarily been worse off, however this would have been very difficult to politically sellto workers and businesses and would have therefore been largely impractical.” – bto: Das ist bekanntlich das Hauptargument für diese Politik. Man kann es nicht so leicht von der Hand weisen.

- “When one considers that the twentieth century also saw large productivity gainsrelative to history due to the rapid diffusion of labour-based technology improvements, it is easy to see how the MV = PQ identity would leave precious metal currency systems hugely deflationary and unsustainable in periods of strong real output and/or population growth.” – bto: Da wir in Zukunft weniger Bevölkerungswachstum haben und die Produktivitätszuwächse zumindest unsicher sind, wäre von dieser Seite kein großer Inflationsdruck zu erwarten.

- “It’s possible that the high global inflation of the 1970s and 1980s was partly (or perhaps significantly) a lagged response to the peak rate of population growth in the 1950s and 1960s. As we’ll see below there is some evidence from academia that children are inflationaryfrom birth (…) a slowing in the rate of population growth over the rest of the 21st century is possibly going to mean that the high inflation of the twentieth century is a statistical aberration, at least in terms of the population influence on it.” – bto: eine naheliegende Überlegung.

Dann geht es natürlich auch um die Frage der Erwerbsbevölkerung und der abhängigen Bevölkerung:

- “The graph that best represents our long-term structural thoughts on this is a stylized representation of the global labour supplyover the last few decades (…) in the More Developed World (MDW) plus China over the last 70 years and that expected over the next 30 years. (…) China then decided to integrate itself into the global economy and over the last 35-plus years has effectively dropped over a billion cheap workers onto the global economyat a time when baby boomers in the West were already helping to boost the labour market size. A combination of the two has meant that labour costs have been exogenously controlled by a surge in the global labour force since 1980.” – bto: Das ist ja irgendwie bekannt, dennoch eine gute Erinnerung, da es erheblichen Einfluss auf das Wirtschaftsgeschehen hatte.

- “(…) the “productivity ratio” (…) highlights that the most productive workers (35 to 54-year olds) in the main global economies were relatively scarce at their trough around 1980and in abundance over the last decades. This trend was most extreme in China.” – bto: Nur werden die Arbeitnehmer jetzt wieder knapp – vor den Folgen der Automatisierung.

- “The consequence of this is that labour will likely regain some pricing powerin the years ahead as the supply of it now plateaus and then starts to slowly fall. Any economic growth should therefore see upward pressures on labour costs, all other things being equal. (…) data seems to suggest an inflationary bias to ageinggiven the elderly’s relative spending needs at a society (state plus individual) level. When the proportion of the population able to work starts to shrink relative to those who are no longer productive, there will be more people competing to consume fewer goods and services. All things being equal, prices should rise.” – bto: Diese Argumentation kennen Leser von bto bereits aus früheren Beiträgen.

- “(…) the one big inflationary force that is more powerful than population is money printing. (…) The QE experiment was arguably an attempt to reflate the system but perhaps an incomplete oneas the money created was used to buy financial assets and was not spent on reflating the wider economy. That QE has caused asset price inflation in many areas is almost indisputable. So creating money does create inflation – all other things being equal – but the type of inflation depends on where the money ends up. Had governments used QE to directly increase government spending then we would likely have seen much higher inflation post the GFC. Instead we’ve seen high asset price inflation.” – bto: Das leuchtet ein.

- “The fact that global debt levels are generally at record highs also increases the risk of inflationary policies as at some point governments may choose to try to inflate their way out of their debt burdens. (…) with debt levels historically high and likely to continue to increase over the years ahead, the political pressure on the central bank regime of the last 30+ years is surely likely to be challenged as it will be politically tempting to try to monetise the debt accumulated in the era of unbridled credit growth. The fiat currency system provides the framework for this. So the path of inflation has not been preordained but the temptation to inflate away the debt in the global economy and see a ‘great reset’ will be there for years and decades to come.” – bto: So ist es. Die Frage ist, wann es passieren wird. Bisher waren die Notenbanker nicht aggressiv genug, wie wir gesehen haben.

Was zur Zusammenfassung führt:

- “So higher inflation is certainly our conclusion in the medium term. However beyond that such a move may provoke a backlash and prompt a return to some kind of global monetary system where the supply of money is fixed to something tangible. In a digital era, the offspring of crypto currencies may eventually provide the architecture for such a system. By then global population growth will likely be at levels it was when precious metal currency systems were much more stable (…). So inflation first as the pool of workers falland then as part of the ‘great reset’ in response to the debt accumulationof the last 40 plus years and then maybe a long period of very low inflation again as population growth grinds to a halt.” – bto: ein Szenario, dem ich einiges abgewinnen kann.

Leider kann ich die Studie hier nicht verlinken.