Von der schädlichen Wirkung von Aktienrückkäufen

Ich halte wenig bis nichts von Aktienrückkäufen. Schon bei BCG konnten wir zeigen, dass diese letztlich auch nichts nachhaltig für den Aktienkurs tun. Dividenden sind da viel glaubwürdiger. Letztlich dienen sie nur dazu, den Gewinn pro Aktie zu schönen und damit die Boni des Managements. Getrieben ist dies durch weniger Aktien und den Leverage-Effekt, letzter gerade im Umfeld von Zinsen nahe null besonders wirksam.

Die FT hat Share Buybacks einem Urteil unterzogen. Es fällt wie erwartet negativ aus. Hier die Zusammenfassung.

Zunächst die Fakten:

- “S&P 500 companies have spent $1.1tn on share repurchase programmes over the past two years, as executives struggled to turn modest economic growth into higher earnings. Lacking opportunities to invest, or at least shareholder support to do so, companies have spent money buying their own stock, which provides a boost to the size of profits reported per share. Fresh records for buybacks are likely to be set, with changes to the US tax regime expected to trigger a repatriation of profits that have been held offshore for years.” – bto: Ich habe immer wieder den Wahnsinn der Rückkäufe kritisiert. Sie zeigen eine erhebliche Fehlallokation von Mitteln und vor allem tragen sie entscheidend zum Verschuldungsboom bei den Unternehmen bei, der einer der wesentlichen Brandbeschleuniger im nächsten Abschwung sein wird.

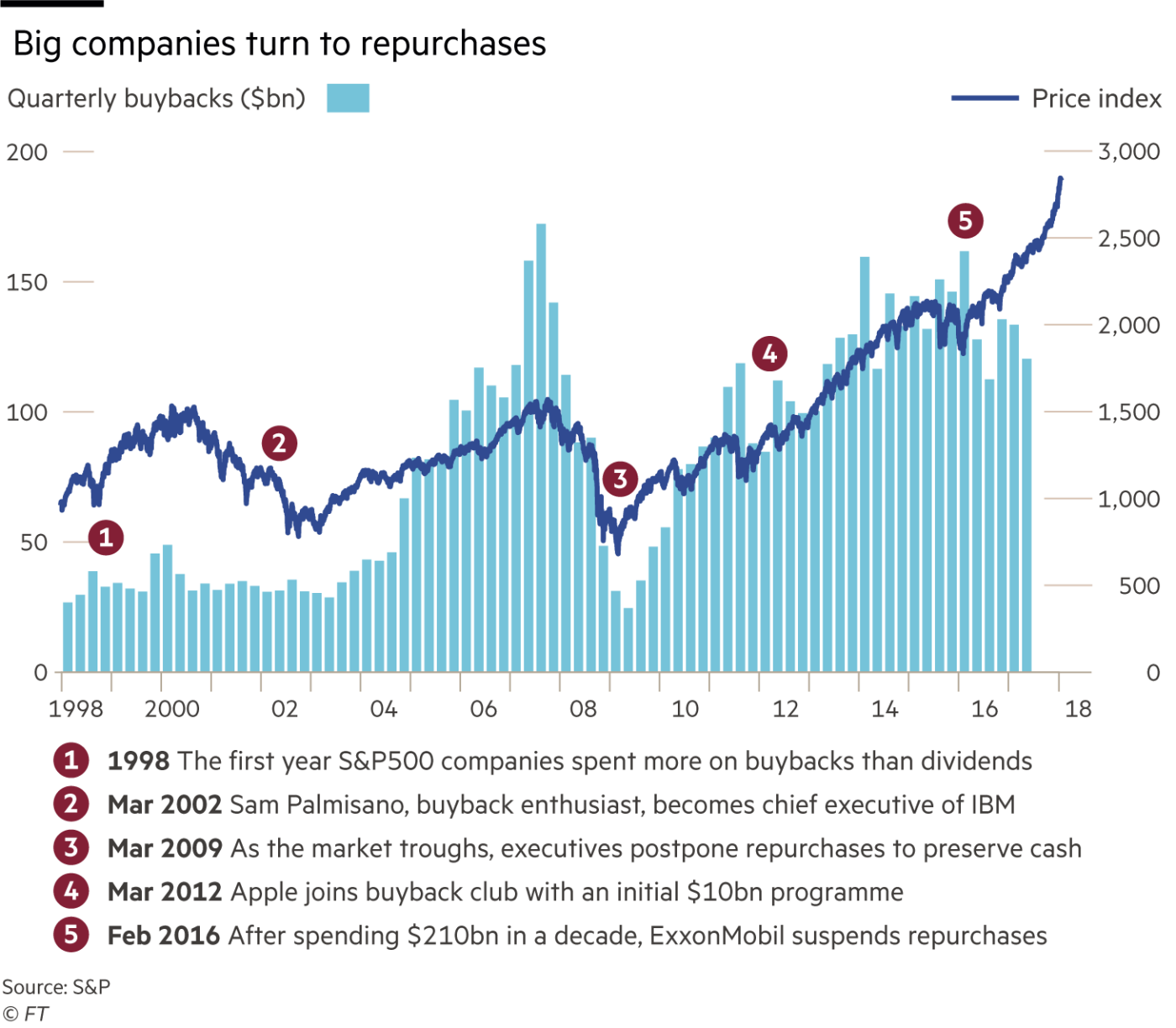

Die Zahlen sind wirklich beeindruckend:

Quelle: FINANCIAL TIMES

Entscheidend ist meines Erachtens der pro-zyklische Charakter der Rückkäufe. Unternehmen kaufen, wenn es teuer ist.

- “Companies justify buybacks in terms of discipline and confidence. But, almost nine years into a stock market boom, executives are planning to buy shares when long-term valuations have rarely been higher. The latest surge comes as many companies have already piled up cheap debt simply to fund payouts to shareholders. Meanwhile, the proportion of sales spent on research and development at S&P 500 companies is still yet to recover to pre-2008 levels.” – bto: Damit sind wir beim Kern des Problems. Es fehlt an den Ausgaben für jene Bereiche, die zukünftiges Wachstum und vor allem Produktivität sichern. Es ist eine nachhaltig falsche Mittelallokation und man könnte alleine schon deshalb versucht sein, für eine höhere statt tiefere Unternehmenssteuer einzutreten.

Die FT fragt dann: “Do buybacks undermine the financial health of companies, juice bonuses and threaten the real economy?”

Vorwurf Nr. 1: Mitarbeiter profitieren von Buybacks mehr als Aktionäre

- “For many companies, particularly those in the technology sector, routine buybacks are a consequence of rising share prices. (…) Staff sell stock awards, forcing companies to buy to keep the share count stable. Apple has admitted that a primary purpose of its buybacks is to neutralise the impact of stock compensation. The company has spent $151bn on repurchasing stock in the past decade, about 17 per cent of its almost $900bn market valuation. The number of shares has dropped by about the same amount — 17 per cent. Yet when Apple started to buy in 2012, the shares could be bought for half today’s price. The difference has been handed to employees.” – bto: Urteil der FT: schuldig. Es dient vor allem den Mitarbeitern, nicht den Aktionären.

Vorwurf Nr. 2: Buybacks bieten die Möglichkeit zu manipulieren

- “Unlike a dividend paid at regular intervals, executives usually have authority to buy back stock at their own discretion. (…) Their popularity soared in the 1990s, as companies began rewarding executives with stock options. The value of such grants is tied to the share price, with dividend payments doing little or nothing for a chief executive’s remuneration. In 1998 the value of buybacks by S&P 500 members topped that of dividends for the first time. The pattern has been repeated in 13 of the past 14 years. Purchases can be used to shrink the number of shares in issue when earnings per share needs a boost, or to support the price when employees are exercising options to sell stock. Little disclosure about the precise timing of buybacks is required, and the area is not one where the SEC, which polices accounting issues, has typically taken action. (…) Equilar, which benchmarks corporate compensation, says that just over half of US listed companies use a total shareholder return metric, which adds dividends to share price gains, when setting executive pay. Only about a third of boards use EPS to determine pay awards. (…)When a company buys back shares at the same time it is using EPS as a performance metric, it will almost always have a way of adjusting for that effect.” – bto: Urteil der FT ist “nicht schuldig”. Ich bin nicht überzeugt, denke doch, dass es vor allem der Manipulation dient.

Vorwurf Nr. 3: Manager sind schlecht im Beurteilen des Wertes der Aktien

- “The only year in the past 14 when big US companies spent less on buybacks than dividends was 2009, when the S&P 500 index hit rock bottom. ‚The best time to do [a buyback] is in a recession, but that’s when everyone is scared stupid, says Andrew Lapthorne, a quantitative strategist for Société Générale.‘ If a company has more cash than it needs, and nothing better to invest in, it should consider whether buying its own stock is a good investment. Yet the time when companies have plenty of spare cash tends to be when business is good and shares are overvalued.” – bto: Die Unternehmen sind damit die heutigen Milchmädchen. Sie kaufen am Top und verkaufen am Bottom. So ist es natürlich nicht gedacht!

Vorwurf Nr. 4: Buybacks gehen zulasten von Investitionen

- “Some companies have managed to spend more on buybacks in recent years than the shares are worth today. Since 1995 IBM, the consulting and supercomputer group, has spent $162bn to repurchase more than half of its outstanding shares. What is left, for those who did not sell, is a company now valued at $154bn, suggesting the money was spent in the wrong place.” – bto: Die FT ist hier unentschlossen. Ich war schon eher bei der Vermutung, weil es eben Financial Engineering über echtes Engineering setzt. So verliert man an Wettbewerbsfähigkeit.

Vorwurf Nr. 5: Erhöhung der Krisenanfälligkeit

- “Three of the most dangerous words in the English language are ‚debt is cheap‘. Low interest rates have encouraged corporate borrowing to buy back stock and boost earnings per share. (…) The beauty of equity as a source of capital for business is that as it is perpetual, it does not need to be repaid. In a credit crunch or downturn, dividends can be cut to save cash, fresh equity sold. (…) Before the 2008 financial crisis, measures of indebtedness, or so-called leverage, fell. Overall debt levels were rising, but asset values were also much inflated. For non-financial companies in the S&P 1500, net debt as a proportion of assets dropped from 21 per cent in 2000, to below 9 per cent five years later. This time the metric has steadily risen along with the market, to exceed 19 per cent. Last April the International Monetary Fund calculated that $7.8tn had been added to the liabilities of US companies since 2010. Median net debt of S&P 500 companies was close to a record high of 1.5 times earnings. Contemplating Federal Reserve plans to raise interest rates, the IMF last year warned that businesses representing a fifth of corporate assets could struggle to meet higher interest costs.” – bto: Die FT meint, “voll schuldig” und ich stimme zu. Es ist der Ursprung für die baldige Fortsetzung unserer Krise.

Quelle: FINANCIAL TIMES

→ ft.com (Anmeldung erforderlich): “Lex in Depth: the case against share buybacks”, 30. Januar 2018