Verlieren die Notenbanken die Kontrolle?

Kevin Duffy verdient sein Geld mit Wetten auf fallende Kurse (“short seller”). Im Interview mit the market spricht der Chef des Hedgefonds Bearing Asset Management über die Blase an den Anleihemärkten. Ein wichtiges Thema, wie ich finde – auch bei bto:

→ Bonds die größte Blase aller Zeiten?

Schauen wir uns die Argumentation an:

- “What’s behind the recent weakness in the bond market? – I think it’s exhaustion. This year, we’ve had this big sea change in terms of the central banks going back to easing and being more accommodative. Yet, the bond market is basically saying: no more! Easy monetary policy is not having the same stimulative effect as it had in the past.” – bto: Mag sein. Ich erwarte eher sinkende Staatsanleihenzinsen und steigende Zinsen auf Unternehmensanleihen.

- “The big mistake of our times is the great monetary experiment which started in August 1971 when the US went off the gold standard. Every bubble has a belief system, a unifying narrative. This time it’s that the central bankers are all powerful.” – bto: Sie haben sich den Ruf der Alleskönner seit den 1980er-Jahren auch redlich erarbeitetet … Immer wieder haben sie die Welt gerettet. Das ist doch was!

- “It’s this idea that there is a free lunch when it comes to printing money. That’s what Modern Monetary Theory is all about: We can have our cake and eat it, too. We don’t have to feel the pain of a recession or the pain of a severe bear market. Anytime we get close to a downturn, central banks can just print money. Of course, we know that’s sheer nonsense. There is no free lunch. Polices like negative interest rates and Quantitative Easing are doing damage to the underlying economic engine. They misallocate capital, discourage thrift and promote fast money over slowly building wealth.” – bto: Und vor allem züchten sie Zombies, die wiederum das Wachstum dämpfen und noch mehr Liquidität erforderlich machen.

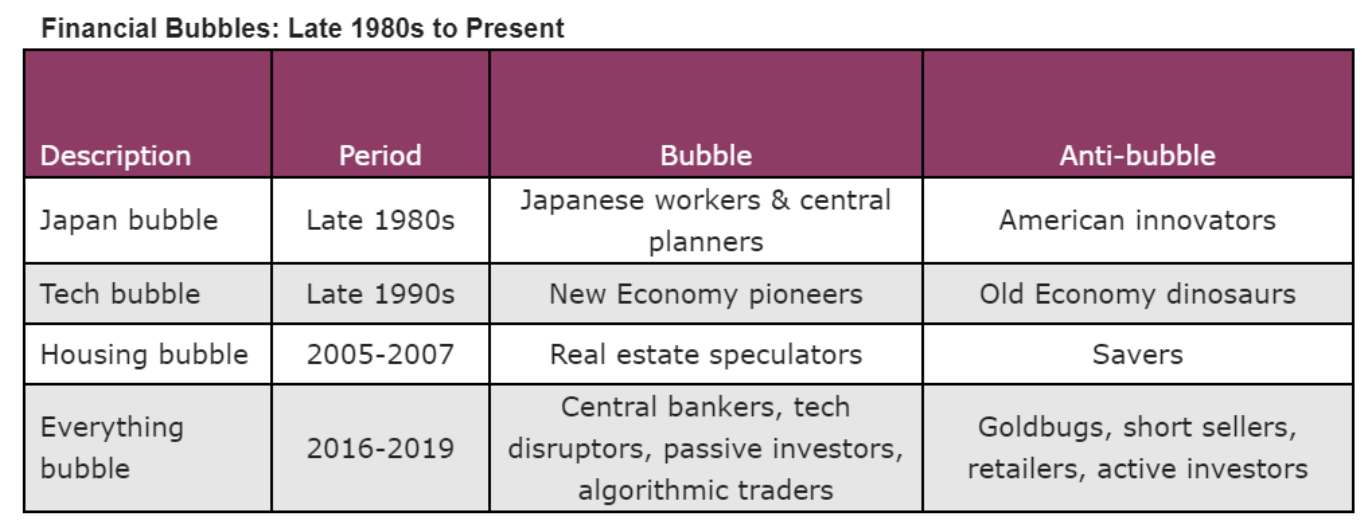

- “We know that the seeds of these bubbles are artificially low interest rates. The last two bubbles were sector specific: You had the tech bubble and then the housing and credit bubble. (…) This time, the center of the bubble is the bond market. You can even say at its core is the sovereign debt bubble. Then, you have all these other bubbles at the periphery: the high yield bubble, corporate bonds, auto finance, large cap technology, passive investing, private equity – bubbles everywhere. That’s what we’re looking at: Something on a much greater scale than anything we’ve seen before.” – bto: Die “Alles-Blase” stellt deshalb auch so eine große Gefahr dar.

- “One of the signatures of this bubble is the price insensitive buyer, with central bankers at the top of the list. The idea is that if the markets are on autopilot you might as well get rich by front running the central bankers and the index investors who are just blindly buying the index.” – bto: Und damit sind sie in den letzten Jahren sehr gut gefahren.

- “My thesis is that when this bubble bursts, gold should rally, while bonds and stocks should crash. Against this backdrop, it’s remarkable that gold seems to have bottomed right around late April when Bloomberg BusinessWeek came out with its ‘Is Inflation Dead?’ cover. Yet, this signal from gold was widely ignored and we got this blow-off in the bond market.” – bto: weil alle davon ausgehen, dass wir in die Eiszeit marschieren mit noch tieferen Zinsen und Deflation.

- “As short sellers, we were thrilled by the prospect that WeWork would go public and we’d get an opportunity to short it. The cracks in the IPO market are telling us that there are limits to easy money. That’s the common theme: we’re getting exhaustion.” – bto: Ich denke auch, dass WeWork zeigt, dass die Stimmung am Markt dreht. Es dauert, aber es passiert.

- “This Everything Bubble is much more difficult to short than a «normal» bubble since it’s so broad-based and persistent. I’m sure that will change. But honestly, as somebody who’s been doing this for a while, there are times I wish I had never discovered short selling. That’s what a major top feels like.” – bto: Richtig, erst wenn alle aufgegeben haben, ist Schluss.

- “(…) where do you see the most promising short opportunities? – In auto finance, in the passive bubble and in money losing companies like Tesla or Carvana. These are a few of the themes we’re betting against. But we’re scaling back and trying to stay focused on our best ideas. It’s kind of a circle the wagons, bunker mentality at this point.” – bto: Und mit Tesla haben nicht wenige viel Geld verloren, die auf fallende Kurse setzten.

- “Where do you see attractive investments? – (…)One of the things we know from past bubbles is that you often get anti-bubbles. This was clearly the case in the year 2000 when you had the new economy bubble on one side, and the old economy anti-bubble on the other side. When tech stocks peaked in March of 2000, a lot of the «boring» value stocks bottomed at the same time. (…) One of the reigning narratives is that Amazon is going to put all retailers out of business. This may be true in a lot of cases, particularly in the mall space. But there will be survivors who benefit from their competitors going bust. Many of these names went through massive bear markets over the past three years. That’s why it may pay off to rummage through the junk pile in the retail sector.” – bto: Dazu muss man aber sehr genau hinschauen – nichts für den einfachen Investor.

Quelle: the market

- “Precious metals and mining stocks are another example of an anti-bubble: Faith in central banking is at the heart of this bubble and precious metals are the inverse of faith in central banks. So we like gold and gold stocks. Admittedly, gold mining is not a good business since it’s very capital intensive and whenever there is a boom there tends to be tremendous waste. But if gold goes up further, these companies are going to benefit.” – bto: Und deshalb gehören sie in das Portfolio.

Und jetzt noch der Bonus für all jene, die an “grüne Investments” und Nachhaltigkeit bei der Geldanlage glauben (ich gehöre bekanntlich nicht dazu). “There is also a socially responsible investing aspect – along the lines of environmental, social and governance factors – to this bubble as the Millennials start to take over investing functions. It’s a filter that you have to be aware of. Certainly, Tesla appeals to this ESG crowd. Another example is Beyond Meat, which went public in early May and shot up nearly tenfold in less than three months. At its peak, the company was valued at $15 billion with just $200 million in revenue and barely about to turn a profit. Large bureaucratic companies in general have become bastions of political correctness willing to cater to the ESG crowd. On the other side, if you’re a small entrepreneurial company, you’re not hiring based on diversity quotas. You’re hiring the most competent people you can find since you don’t have time to collect a bunch of worthless statistics. I feel this will be the gift that keeps on giving for contrarian investors: You want to look for stocks that don’t neatly fit into the ESG screens. The obvious example is the energy sector, especially natural gas exploration and production stocks, which are severely depressed. Fossil fuel investments are strictly verboten in the ESG playbook. That’s an opportunity.” – bto: Yep. Die Blase platzt und dann bekommen wir ganz andere Themen als das Verbieten von Fleisch. Selbst in Deutschland.

→ themarket.ch: “‘Central Bankers Are Starting To Lose Control’” 19. November 2019