Vergessen wir die Zombies nicht

- „Ever since the GFC, unprecedented fiscal and monetary support for private and public firms, both in the US and around the world, has saved many companies from failing. With that, a bank of zombie firms has built up. These are firms which are barely surviving, living effectively on ‘monetary life support’, i.e. cheap money.” – bto: Und damit ist nicht Amazon gemeint, wie Marcel Fratzscher in einem seiner weniger hellen Momente mal geschrieben hat.

- “Zombie companies are essentially companies which are unable to generate enough profit to cover debt-servicing costs and, therefore, need to borrow to stay alive. Those concerns have come back to the fore since the Covid-19 pandemic and its associated economic damage and extreme levels of monetary support (i.e., cheap/plentiful liquidity).” – bto: Lerne: Solange es billiges Geld gibt, geht es den Zombies gut.

- “As central banks now enter a period of tightening monetary policy and liquidity, there’s concern that the inevitably higher rates that firms will have to pay to service their debt will be the tipping point that pushes many companies over the edge and into bankruptcy (and, with that, increase the risk of recession).” – bto: Das ist spannend. Denn zumindest in Europa dürfte das Thema der Zinserhöhungen vom Tisch sein. Was die Frage aufwirft, wie das Szenario einer inflationären Rezession auf die Zombies wirkt. Vermutlich nicht so gut.

Quelle: Longview

Quelle: Longview

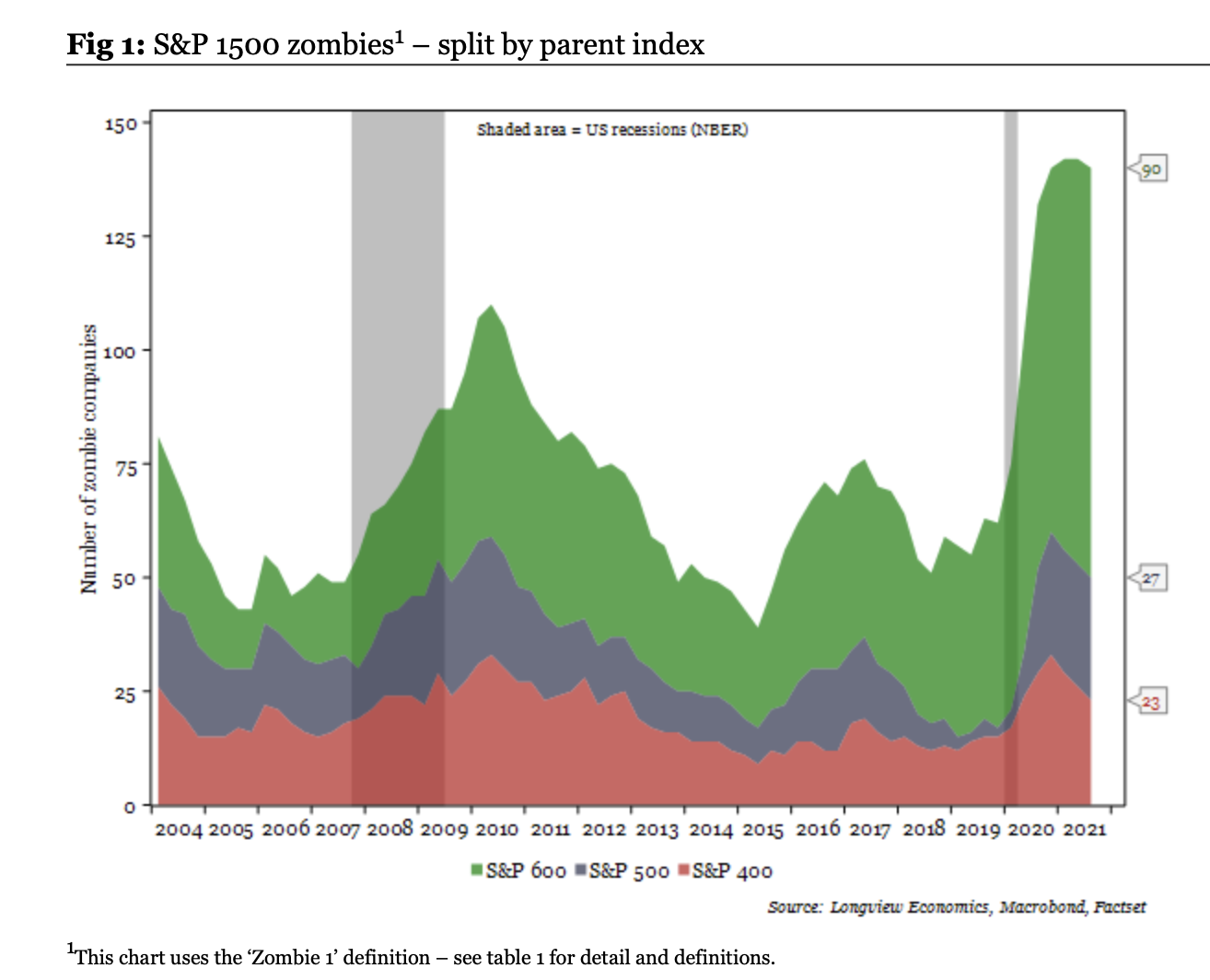

- „Analysing the S&P 1500, we show that 10.5% of companies (with available data) have been unable to cover interest payments with EBIT over the past two years.“ – bto: Ich bezweifle, dass es in Europa besser aussieht.

- „(…) a large proportion of those companies, that meet the zombie definition, are part of the S&P 600 small-cap index (i.e.)they are at the smaller end of the spectrum). Equally, as our estimates of private sector SME indebtedness show, the debt build-up has also been significant for the small ‘private company’ segmentof the corporate base.“ – bto: Das überrascht nicht. Dennoch dürfte es nicht wenig Unternehmen geben, die größer sind und ebenfalls zombielike.

- „(…) not surprisingly, many of those most affected by the pandemic. Broadly speaking, these companies are more affected by the declining EBIT than increasing interest payments. Airlines, cruise ships, energy companies and car manufacturers, for example, are some of the worst affected sectors. As the pandemic becomes endemic, and much of the global economy reopens and returns to normality, the sales of those sectors should recover. With debt increasing in those sectors though, and inevitably higher rates over the coming quarters, it will be critical to watch if those most-affected areas of the economy can return to long-term profitability.” – bto: Für die Energieerzeuger muss das nicht unwahrscheinlich sein, sind es in den USA doch vor allem die Frackingunternehmen, die naturgemäß von hohen Ölpreisen profitieren.

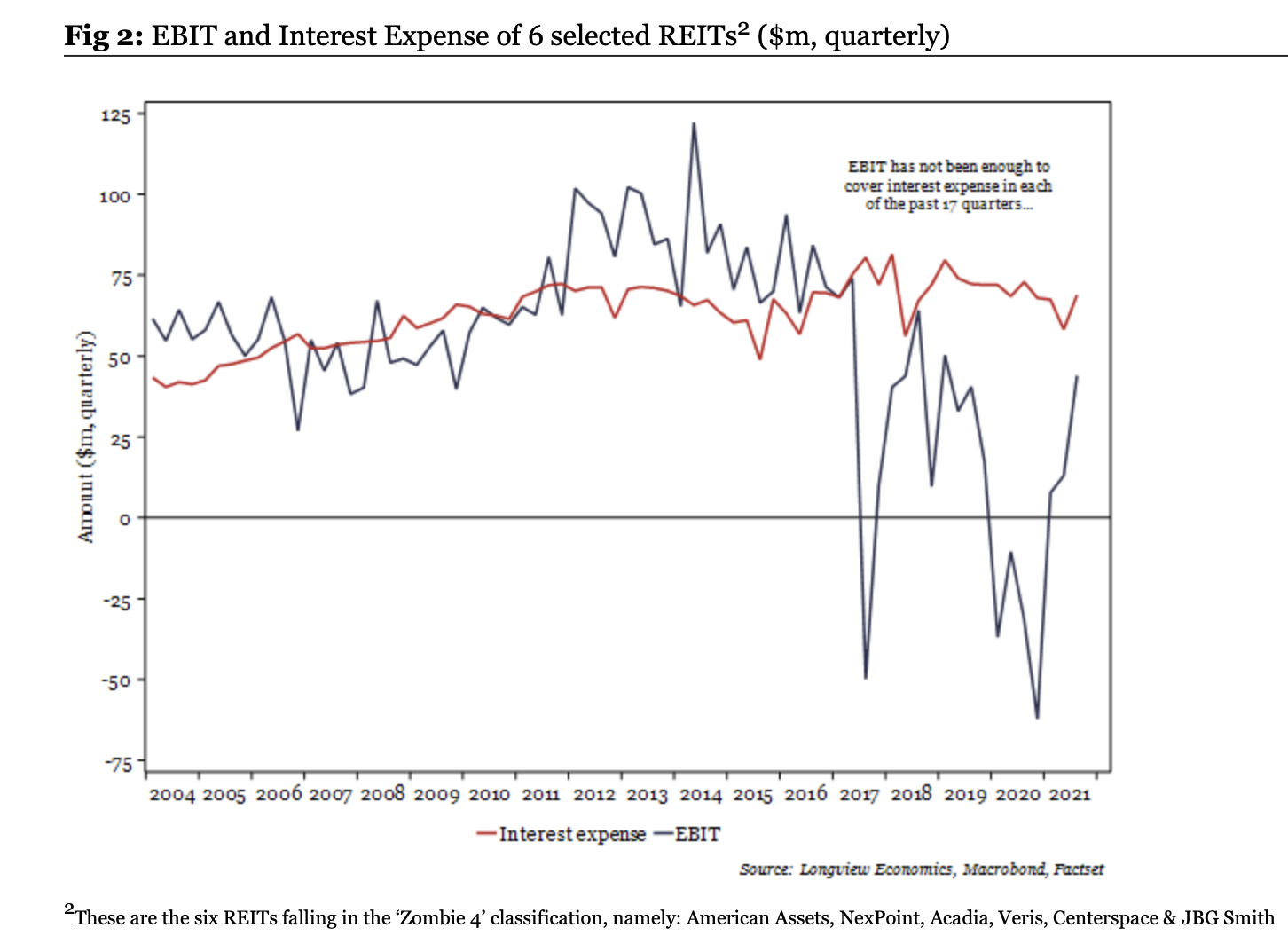

Was mich dann überrascht hat, ist die hohe Zombifizierung bei REITs:

Quelle: Longview

- „One key sector of note, though, is the ‘Real Estate’ sector. We calculate that 23% of the companies in the sector are zombies, on our loosest ‘Zombie 1’ definition, and 6.5% using the strongest ‘Zombie 4’ definition. Indeed, aggregating the income statements of those zombie REITs, we show that these firms have not made enough earnings to cover interest payments in any of the past 17 quarters.“ – bto: Das ist ein erhebliches Problem. Aber warum dieser Sektor? Naturgemäß arbeitet man viel mit Schulden, aber bereits 2017, also vor dem Rückgang der Einzelhandelsmieten?

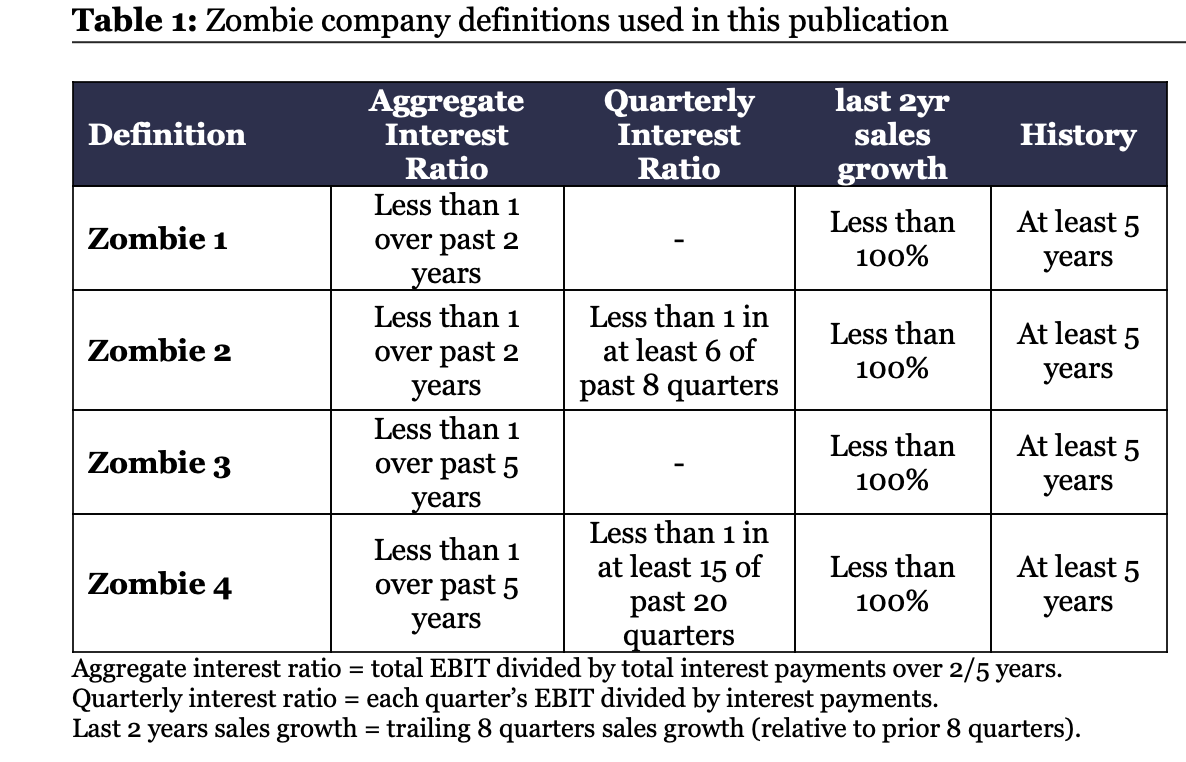

- “We are looking to find companies that have paid more interest than received in pre-tax earnings over the past 2 or 5 years. Two of the measures look at that metric in aggregate (i.e. over the whole time period), while the other two also require that interest payments aren’t covered by EBIT in at least 75% of the reporting quarters. We exclude new companies or those without sufficient data, and exclude those growing (in revenue terms) at a rapid rate.” – bto: Das ist richtig. Denn anders als Herr Fratzscher meint, sind Zombies keine Unternehmen, deren freier Cashflow negativ ist, weil sie stark wachsen.

Quelle: Longview

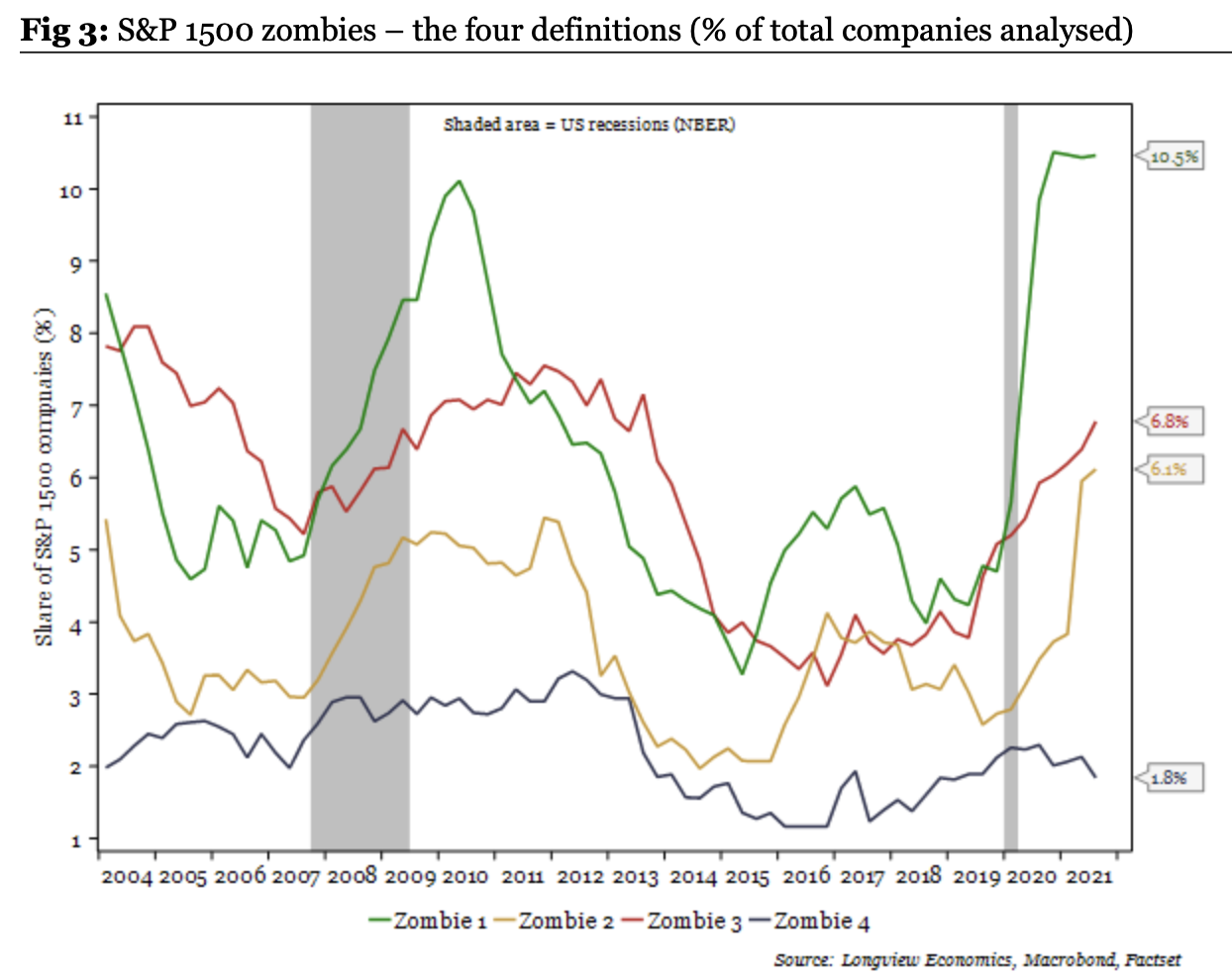

- “In fig 3, we show the number of companies that classify as zombies by the four definitions listed above in table 1. By the loosest ‘zombie 1’ and ‘zombie 2’ definitions, 10.5% and 6.1% of companies are currently classified as zombies (i.e. over the past eight quarters, interest payments have been higher than pre-tax earnings). That’s at all-time highs (at least since 2004).” – bto: Es unterstreicht, warum wir so wenig Wachstum haben. Nun wird es mit dem Krieg nicht einfacher.

- “Using the 5-year ‘zombie 3’ definition, though, (i.e. looking at the past five years), the number of zombie companies has been rising since 2017.” – bto: Das bedeutet, dass Corona das zwar beschleunigt hat, aber eben nicht die alleinige Ursache ist. Das zeigt die Folgen der Geldpolitik, auch wenn die EZB das natürlich leugnet.

- „It’s only when looking at the strictest ‘zombie 4’ measure (i.e. identifying companies with an interest ratio less than 1 in at least 15 of the past 20 quarters), that the proportion of zombie companies is not making new highs. It’s worth noting, though, that the number of companies classified as zombies by this definition has been trending higher since 2016.“ – bto: was wiederum unterstreicht, dass wir es mit einem chronischen Problem zu tun haben. Die negativen Wirkungen habe ich hier mehrfach diskutiert. Es lohnt keine Wiederholung, weil ich meine Leser nicht langweilen möchte. Einfach „Zombies“ in das bto-Suchfeld eingeben.

Quelle: Longview

- „Typically the companies, that have been categorised as zombies, are smaller. Of the 140 S&P 1500 ‘zombie 1’ companies, 90 of those (64%) belong to the S&P 600 small-cap index. That difference becomes more apparent with the tighter definitions. Indeed, of the 25 ‘zombie 4’ companies, 18 (75%) are from the small-caps, while the remaining 25% are from the mid-caps (i.e. none of the S&P 500 companies meet the definition). (…) The average turnover for a ‘zombie 4’ company is $2.3bn/quarter, while non-zombies are ~9 times larger, averaging $20.7bn/quarter in revenue. Despite being nine times larger, the average net debt is just 4.5 times larger and, reflecting the higher rates the smaller companies are likely having to pay, average interest payments are just three times larger.“ – bto: Dass die Unternehmen im Schnitt kleiner sind, bedeutet nicht, dass es für die Gesamtwirtschaft keine Rolle spielt.

- „In conclusion: While the build-up of ‘zombie 1’ companies is significant, the main cause is pandemic related. As the global economy continues to reopen, many of these companies should therefore return to profitability. There remains a number of, particularly smaller, companies that are in an extremely unhealthy position (i.e. the ‘zombie 4’ companies) that are highly exposed to the rising rate environment. Watching these closely over coming quarters will be critical for gauging the risk to the wider economy.“ – bto: Der Krieg trifft nun – mit Ausnahme des Energiesektors – die gleichen Unternehmen (Hotels, Flughäfen). Auch dürfte die Stagflation die Margen nochmals deutlich unter Druck setzen. Deshalb sind und bleiben die Zombies eine Belastung für die Wirtschaft – gerade in Europa, auch wenn die Zahlen hier nur die USA gezeigt haben.