Update zu Gold

Immer wieder habe ich mich (strategisch) positiv zu Gold geäußert. So hier:

→ Warum Gold ins Portfolio gehört

Nun kann man mir vorhalten, dass gerade in diesem Jahr die Entwicklung des Goldpreises gegen das Metall spricht. Haben wir nicht Krisen überall und das Gold sollte steigen? Doch es fällt? Und zwar wie!

Das hat interessanterweise besonders viel mit der Krise in den Schwellenländern zu tun bzw. hat eine gemeinsame Ursache. Der steigende US-Dollar führt zu Stress in den Schwellenländern und die steigenden US-Zinsen schlagen sich entsprechend negativ nieder, eben auch im Kurs von Gold. Es kann auch gut sein, dass die Schwellenländer Gold verkaufen – so habe ich das Gerücht aus der Türkei gehört –, um sich Liquidität zu beschaffen. Die FT dazu in zwei Kommentaren:

- “(…) we should be focusing on the strength of the dollar, rather than on events in Turkey, comes from gold. Demand for gold may ultimately lie in the eye of the perceiver, but the gold price is a great gauge of perceptions of risk, and of fears that paper currencies may suffer debasement. It remains an important link in the financial system.” – bto: weshalb es eigentlich komisch ist, dass er fällt.

- “And somehow the gold price has tumbled 12 per cent, when measured in dollars, since its recent peak 12 months ago, following a trajectory that looks remarkably like that of an emerging market currency in that time. It has given up all its gains since the election of Donald Trump in November 2016. As we are in a ‚risk-off‘ environment, when investors try to limit their risks, gold might normally be expected to be exactly the kind of place where they would seek shelter.” – bto: Das würde ich auch sagen, wir tun es nur scheinbar nicht!

- “(…) demand for gold tends to come from emerging markets, whether from individuals for jewellery or from central banks for their reserves, and so this is a sign that investors in emerging markets now feel it necessary to buy dollars rather than gold. And in part, gold tends to function as an indicator of alarm about the Federal Reserve. If investors think that the central bank will be too easy and allow inflation to take off they will buy gold. At present, the perceived risk is that the Fed will be too hawkish (and thus strengthen the dollar).” – bto: also Liquiditätsengpässe in den Schwellenländern und keine Inflationsängste?

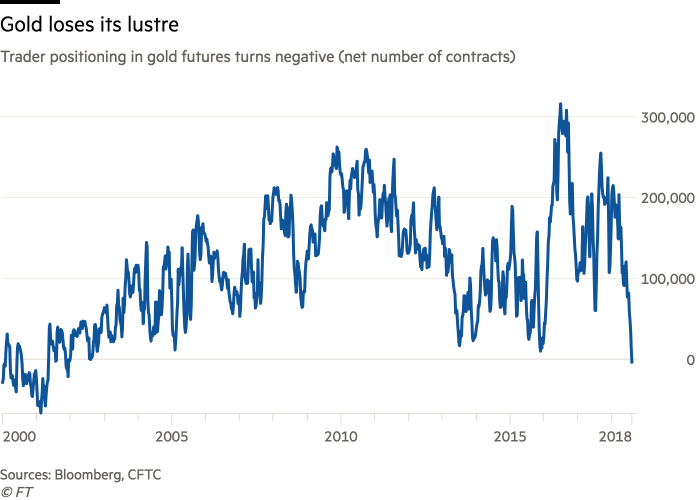

- Derweil nimmt die Spekulation gegen Gold zu: “Traders have increased their bets against gold, with speculative positions in futures on the precious metal the most bearish in 17 years, according to government data released on Friday.” – bto: Es wird so stark wie schon lange nicht gegen Gold spekuliert, nachdem: “The price of a troy ounce of gold has fallen another 3.3 per cent this month to a one-and-a-half year low of $1,182.90, extending this year’s tumble to more than 9 per cent.” Also geht es weiter runter? Denke ich nicht.

- “The net positioning of ‚non-commercial‘ players in the gold futures market — a CFTC classification that includes hedge funds, asset managers and trading groups — has fallen into negative territory for the first time since the end of 2001.” – bto: 2001 begann der Anstieg von Gold vom Tiefpunkt der Entwicklung seit den 1980er-Jahren bei 271 US-Dollar/Unze. Stehen wir also erneut vor einer derartigen Entwicklung?

Quelle: FT

- “‚When you see this extreme positioning on the short side it leads to a bottom in gold (…) It’s a great sign that a gold bottom is very near‘, said Mr Boockvar, a longstanding bull on gold.” – bto: Das könnte stimmen!

Das sieht auch PIMCO so:

“Gold is a real asset that not only serves as a store of value but also a medium of exchange, and that tends to outperform in risk-off episodes. As such, one would expect gold to outperform during the recent period of rising inflation expectations along with rising recession risk. Yet counterintuitively it has been underperforming relative to its historical average.” – bto: Gold ist also billig!

PIMCO weiter: “We believe this is because in the near term, gold’s properties as a metal and as a currency are causing it to drop amid trade tensions and the stronger U.S. dollar, dominating its properties as a long-term store of value. This leads, in our view, to an opportunity to add a risk-off hedge to portfolios at an attractive valuation.” – bto: eine Sicht, die ich teile.

→ zerohedge.com: “Traders increase bets that gold has further to fall”, 17. August 2018