“Turkey is the first big victim of Fed tightening, but it won’t be the last”

Immer wieder habe ich die Gefahr der Dollarverschuldung in den Schwellenländern thematisiert und mich über die Käufer der 100-jährigen Anleihe Argentiniens mokiert. Dass es nun in der Türkei losgeht, ist kein Zufall, ist es doch eine Kombination aus schuldenbasiertem Wachstum (falsch, wenn es unproduktiv ist) in Fremdwährung (immer hochgefährlich) und einer vorsichtig formuliert problematischen politischen Situation.

Viel ist dazu geschrieben worden. Wie immer ist Ambroise Evans-Pritchard derjenige, der es etwas in den breiteren Kontext setzt:

- “The famous Lex Dornbusch of financial crises is that they take longer to hit than you think, but then unfold much faster than you ever thought possible.” – bto: Das würde ich auch dem Kommentator von Dienstag entgegenhalten, der bto als übertrieben pessimistisch sieht.

- “Every hedge fund in Mayfair knew that Turkey was an accident waiting to happen. It was odds-on favourite to be the first of the big emerging market economies – along with Argentina – to face trouble as the US Federal Reserve raised interest rates and drained the pool of global dollar liquidity.” – bto: Aber eben nicht das Einzige und vor allem steigen die Zinsen schon länger und die Liquidität nimmt ab.

- “The foreign currency debt of Turkish companies, banks, and the state had reached 55pc of GDP, roughly the danger threshold in the Asian crisis of 1998. The country had become dangerously reliant on short-term dollar loans to cover a current account deficit of 6.5pc of GDP. This left Turkey at the mercy of shifts in global confidence.” – bto: klar, kurzfristig finanziert. Habe ich in meiner Aufzählung noch vergessen.

- “Dollar funding was irresistibly cheap in the halcyon days of zero rates, when the G4 economies were adding $2 trillion (£1.6 trillion) a year to the international system through quantitative easing. It was also a Faustian Pact.” – bto: Es zeigt nur, dass man Krisen, die aus zu vielen Schulden entstehen, nicht mit noch mehr Schulden bekämpfen kann.

- “The Institute of International Finance thinks events in Turkey are just the start of a long and painful hangover for those emerging markets that drank deepest from this cup, with South Africa, Indonesia and Colombia next in line as the spigot is gradually shut off.” – bto: Addieren wir dazu die Probleme, die von China ausgehen könnten, haben wir leicht eine Weltrezession und das Finanzsystem ist erneut nackt.

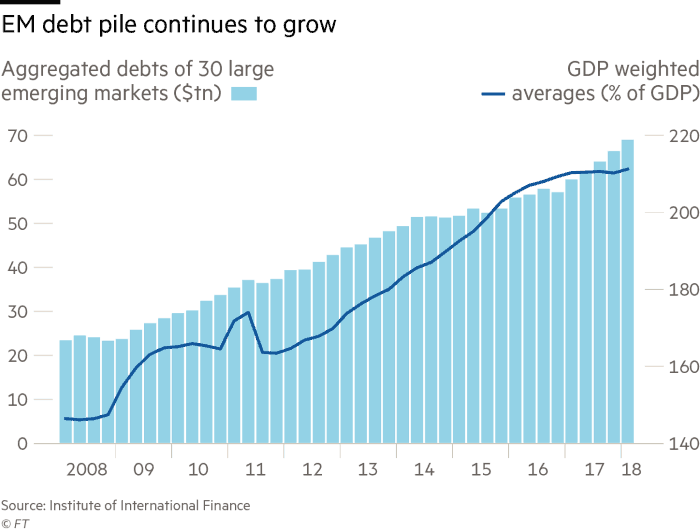

Hier passend dazu ein Chart der FT:

Quelle: FT

- “(…) the world has become hypersensitive as it grapples with a debt-to-GDP ratio of 318pc of GDP, some 40 percentage points higher than on the eve of the Lehman crisis.” – bto: Und deshalb bleibe ich auch so “negativ”. Die Notenbanken sind bald mit ihrem Latein am Ende.

- “There is now synchronised global tightening. The Fed in particular is unlikely to back off soon given that its ‚underlying inflation gauge‘ has hit a 13-year high of 3.33pc. The Bank for International Settlements says dollar debt in emerging markets has soared to $7.2 trillion, when both cross-border loans and ‚functionally equivalent‘ derivatives are included. This is an unprecedented figure and has never been tested in a cycle of rising Fed rates.” – bto: Und wird die Fed diesmal auf das Ausland Rücksicht nehmen? Ich denke, wir können uns nicht darauf verlassen.

- “Investors fear that the Turkish state itself does not have enough dollars to cover even a tiny fraction of the country’s $240bn of external financing needs over next twelve months, should inflows dry up completely or turn into capital flight. (…) the Erdogan regime must take three drastic steps: a rate rise of up to 1,000 basis points, a budget squeeze enshrined in law with a Fiscal Rule, and the release of the US pastor Andrew Brunson held for alleged terrorism.” – bto: Letzteres zeichnet sich ja ab. Die Frage ist übrigens: Warum haben wir keine Sanktionen verhängt, als es um deutsche Staatsbürger ging? Ich kenn die Antwort natürlich, doch erinnert es etwas an die Münchner Konferenz, was wir da veranstalten.

- “The lira slide risks turning into a self-feeding downward spiral with systemic implications for Turkish banks. Phoenix Kalen from Societe Generale says each 10pc fall in the currency erodes 50 basis points of bank capital buffers. Any sustained move beyond 7.0 to the dollar leaves lenders high and dry, leading to a credit crunch.” – bto: ein Margin Call, wo man das Geld nicht beschaffen kann.

- “Standard & Poor’s said the true ratio of bad loans in the system has reached double digits. Firms in construction, real estate and energy have borrowed heavily in dollars but derive most of their revenues in lira. Few have currency hedges. Turkish banks are coming under mounting pressure to roll over loans in what amounts to stealth restructuring, drawing them into the morass.” – bto: Was China vielleicht kann, kann die Türkei noch lange nicht.

- “In the end, (the crisis of 1998) was contained when the Greenspan Fed slashed rates. The same happened again in early 2016 during the Chinese currency crisis when the Yellen Fed quietly suspended its tightening campaign and halted a nasty global sell-off.” – bto: Die Notenbanken sind gefangen in der Politik billigen Geldes, es muss immer billiger werden.

- “The Fed is unlikely to come to the rescue this time until there is blood on the floor. The Powell Fed is faced with inflationary late-cycle fiscal stimulus by the Trump administration, forcing it compensate with higher interest rates. This is pushing the dollar higher.” – bto: was die USA allerdings auch nicht wollen.

- “There is another unsettling thought to contemplate. The emerging market nexus was not big enough to take down the global economy in 1998. Today it makes up over 50pc of world output, and 80pc of incremental growth.” – bto: Dann ist auch hier bei uns die Party zu Ende.

Zu Asien zeigt sich die FT hingegen optimistischer:

- “In Asia in general, (…) economic fundamentals are stronger and central banks are very vigilant, a result of the profound and violent experience of the Asian financial crisis that erupted in 1997. Policymakers (…) willing to take difficult steps to keep inflation and exchange rates under control, even if that meant sacrificing growth by using high interest rates.” – bto: Ohnehin haben mehr asiatische Länder Überschüsse.

- “China remains vulnerable to the escalating trade war with the US, as shown in a 16 per cent drop in its stock markets this year, and other EM are vulnerable to a slowdown in China. But even this is a secondary consideration against a background of rising US rates and a stronger dollar.” – bto: Der Dollar bleibt auch hier das Problem, wobei ich schon denke, dass China aus sich heraus ein Problem darstellt.