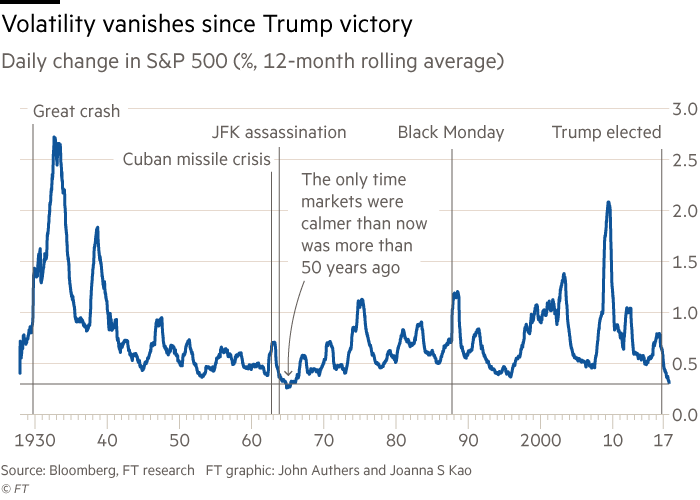

“Trump era brings lowest stock market volatility since early 1960s”

Heute Morgen habe ich die vermutlichen Folgen jahrelanger Volatilitätsunterdrückung diskutiert: zunehmende Risiken und Verschuldung, die unweigerlich in die nächste Krise führen. Ergänzend dazu die Analyse der FT, mit einem sehr langfristigen Vergleich. Die Volatilität lag seit den 1960er-Jahren nicht so tief!

- “The year after Donald Trump’s surprise victory in the US presidential election have been the quietest months for the US stock market in more than half a century. Since election day, the daily change in the S&P 500, the most widely followed index of US stocks, has been only 0.31 per cent as the blue-chip index has set new record highs. This is the lowest daily change in more than 50 years.” – bto: Nun würde Trump es vermutlich als sein Verdienst sehen. Ich bin da eher bei dem Beitrag von heute Morgen. Es ist billiges Geld und Herdenverhalten.

- Und mit Blick auf den Kontrast (geo)politischer Risiken und tiefer Volatilität: “(…) there is historical precedent for a sharp contrast between the strong performance of stocks and a turbulent political backdrop. (…) The quietest 12 months on record also followed a political shock, starting a week after the assassination of John F. Kennedy in 1963. The period saw an average daily movement of only 0.25 per cent.” – bto: was nur zeigt, es kann solche Perioden geben, aber die Risiken für eine Trendumkehr sind immer vorhanden.

- “Over the last half century, the index has moved by an average of 0.72 per cent each day, more than double the volatility seen this year. In addition to the low level of realised volatility in the S&P 500, investors have also hedged against future volatility in a way that shows they are not too concerned it will pick up.” – bto: Und das halte ich für ein Alarmsignal aller erster Güte!

- “The strategy of ‚selling vol‘, or betting on a fall in the Vix in the futures market, has been dramatically successful under Mr Trump. Over the past 12 months, the exchange-traded fund offered by BlackRock that mimics the result of selling the Vix has gained about 200 per cent.” – bto: Das dürfte aber im Falle einer Trendwende massiv verstärkend wirken und auf den Aktienmarkt durchschlagen.

- “The longer a low volatility environment persists, the greater the average equity market drawdown when it ends. The combination of low volatility with very strong returns has spurred exceptional risk-adjusted returns, which are usually measured by the ‚Sharpe ratio‘, which divides annual returns by annual volatility.” – bto: Man steht als Investor also sehr gut da.

- “Sharpe ratios were higher a couple of times in the 50s and in the 90s, but the current Sharpe ratio would put this rally in the 0.3 percentile of the best times in history (…) Let that sink in: this stock market is better than 99.7 per cent of the times since 1900.” – bto: Ist er das wirklich oder wollen wir das nur glauben???!

Und hier das unglaubliche Chart der FT dazu:

Quelle: FINANCIAL TIMES