Tiefzinsen als Folge zu hoher Verschuldung

Ich habe in der Vergangenheit bereits mehrfach aus den sehr interessanten Quartals-Kommentaren voin Hoisigton zitiert:

→ Zur abnehmenden Wirkung von Schulden

In der aktuellen Ausgabe gibt es eine interessante Zusammenfassung, wie wir dorthin kamen, wo wir heute sind – wirtschaftlich.

Zunächst die Zusammenfassung:

- “A very powerful secular downdraft has occurred in major measures of economic performance.

- The U.S. is caught in a debt trap, a term originated by the Bank for International Settlements. A condition where too much debt weakens growth, which elicits a policy response that creates more debt that results in even more disappointing business conditions.” – bto: was ein wichtiger Punkt ist. Die Verschuldung verschlechtert die wirtschaftlichen Rahmenbedingungen.

- “The secular decline in economic conditions and the debt trap preclude the textbook conditions for powerful monetary policy measures to stimulate economic activity. Further, debt financed fiscal programs only boost the economy in the veryshort-run, but ultimately reduce growth.”

- “The secular deterioration in economic growth has created a condition of excess resources and disinflation.” – bto: und auch die Zombifizierung.

- “The workings of the Fisher equation, which have brought Treasury bond yields lower, have been reinforced by a sharp decline in the marginal revenue product of debt.”

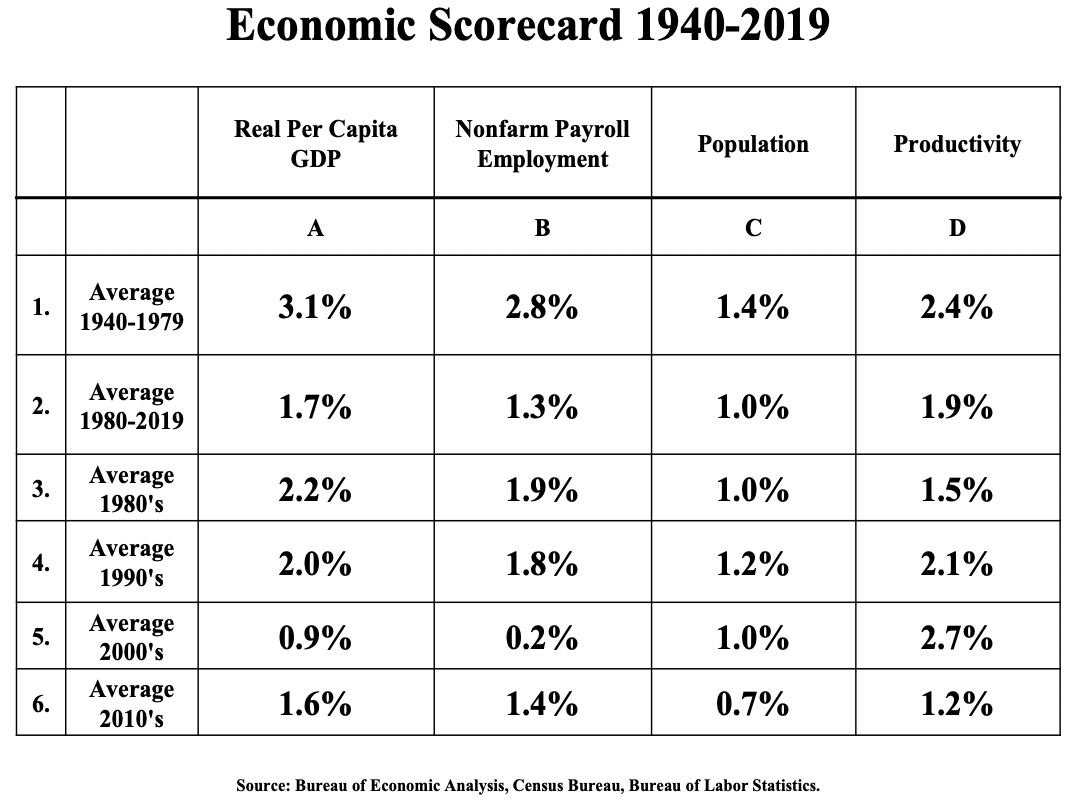

- “Real per capita GDP, employment, population and productivity have all exhibited pronounced secular deterioration. From 1980 through 2019, real GDP per capita grew 1.7% per annum, sharply lower than 3.1% in the prior forty years, 1940-1979 (Table 1).” – bto: Das haben wir natürlich nicht nur in den USA, sondern in der gesamten westlichen Welt, und das ist auch eine Ursache – nicht nur die Folge – der steigenden Verschuldung, weil man fehlenden Zuwachs mit Schulden kaschiert.

Quelle: Hoisington

- “Productivity growth slowed but held up better than economic output. Nonfarm productivity expanded 1.9% per annum in the past forty years, down from 2.4% in the prior period.” – bto: Dahinter steht bekanntlich auch die Zombifizierung.

- “The concept of the debt trap is consistent with scholarly research, from the 19th century to present, which indicates that high debt levels undermine economic growth. This causality is supported by the law of diminishing returns, derived from the universally applicable production function. Historical declines in economic growth rates have coincided with record levels of public and private debt. Total public and private debt jumped from 167.2% of GDP in 1980 to 364.0% in 2019, with an estimated record 405% at the end of this year. Gross government debt as a percent of GDP accelerated from 32.6% in 1980 to 106.9% in 2019 to an estimated 127% by the end of this calendar year.” – bto: Auch dies gilt gleichermaßen für andere Länder, namentlich auch in Europa.

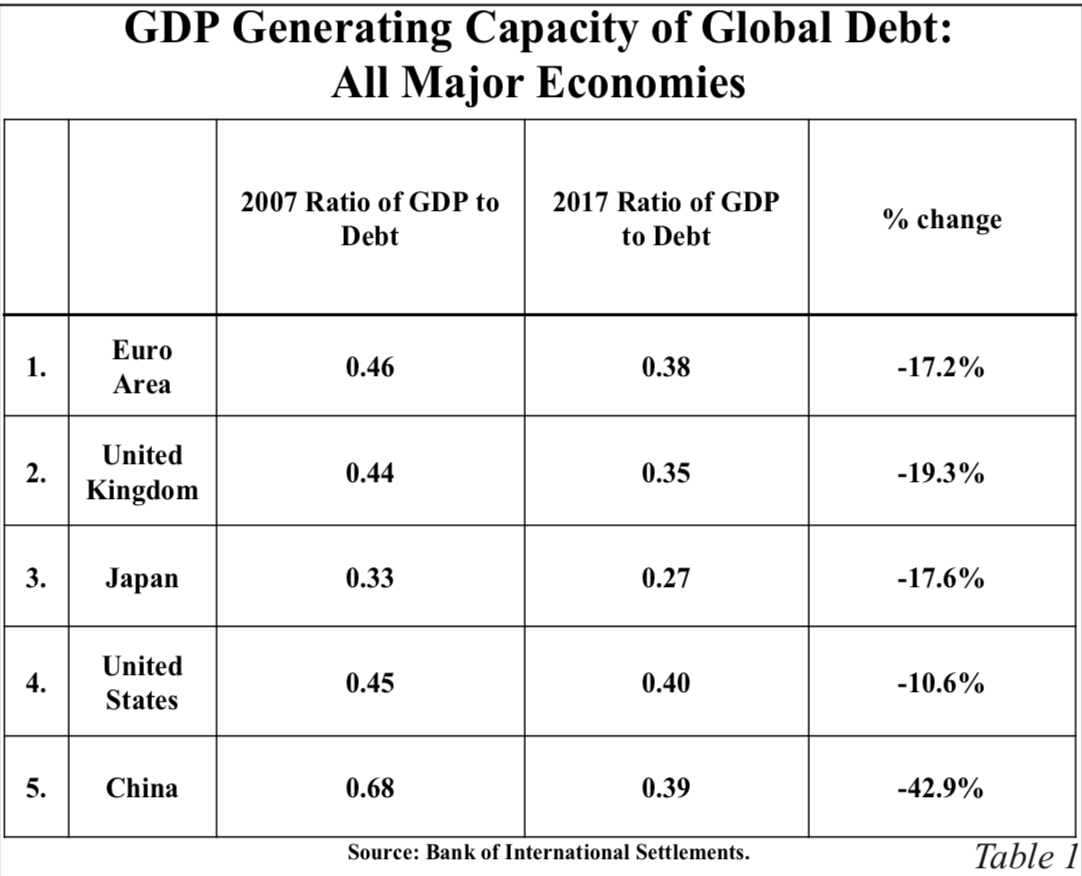

- As proof of this connection, each additional dollar of debt in 1980 generated a rise in GDP of 60 cents, up from 54 cents in 1940. The 1980’s was the last decade for the productivity of debt to rise. Since then this ratio has dropped sharply, from 42 cents in 1989 to 27 cents in 2019.

Dazu passt die Abbildung aus der oben verlinkten früheren Studie:

Quelle: Hoisington

- “(…) monetary policy is left with one-sided capabilities i.e., they can restrain economic activity by reducing reserves and raising rates, but they are not capable of stimulating economic activity to any significant degree. The Fed can stabilize distressed financial markets through their powerful lending abilities.” – bto: wie wir in diesem Jahr eindrücklich gesehen haben.

- “Debt financed fiscal policy can provide a short-term lift to the economy that lasts one to two quarters. This was the case with the debt financed stimulus packages of 2009, 2018 and 2019. However, the benefit of these actions in 2009, 2018 and 2019, even when the amount of the funds borrowed and spent were substantial, proved to be very fleeting and the deleterious effects of the higher debt remain. (…) multi-trillion dollars borrowed for pandemic relief in the second quarter encouraged the beginnings of a ‘V’ shaped recovery, but this additional debt will serve as a persistent restraint on growth going forward. When government debt as a percent of GDP rises above 65% economic growth is severely impacted and becomes very acute at 90%.” – bto: Diese Hürde von 90 Prozent ist ja umstritten. Dennoch müssen wir anerkennen, dass wir uns immer mehr in einer Sackgasse befinden.

- Und dann was Interessantes zur Inflation: “The key to determining inflation is not Fed policy statements but the general equilibrium conditions that simultaneously determine the aggregate price level, real GDP and nominal GDP. This occurs when the Aggregate Demand (AD) and Aggregate Supply (AS) curves intersect. The output gap is real GDP minus potential real GDP divided by real GDP. Potential GDP is designed to reflect the trend rate of growth in economic activity. When the output gap is negative, economic theory terms this condition a deflationary gap. When deflationary gaps persist, the AS curve tends to be highly elastic, remain elastic and tends to shift downward. When the AS curve shifts downward, this leads to lower aggregate prices and increased aggregate demand. In the past four decades of disinflation, the output gap was -1.60%, with a negative reading in 79% of the quarters. Even in the record long expansion from 2010-2019, the average was -2%, with 77.5% of the quarters negative.” – bto: Unausgelastete Kapazitäten werden durch Zombies vergrößert, beides muss deflationär wirken.

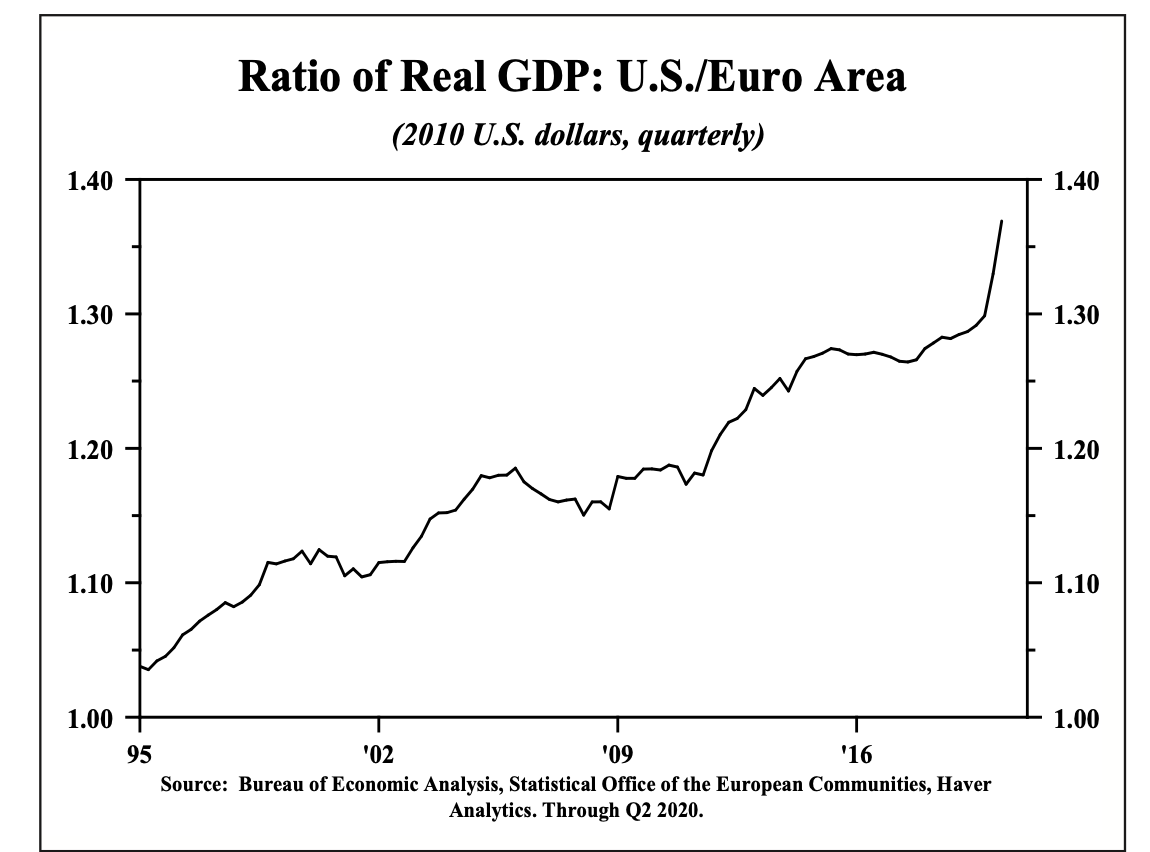

- “Another disinflationary force is that growth in the Euro Area and Japan has been even more disappointing than in the United States. In 1995, the first year of comparable data, real GDP was 4% percent greater in the U.S. than in the Euro Area. By the second quarter of 2020, the U.S. was 37% greater. (…) The underperformance of the Euro Area and Japan, which reflects their greater debt overhang, has contributed to strength in the dollar which has diminished inflationary pressures in the U.S. In addition, the weak growth in these two major areas has forced their businesses to send more goods to the U.S., thus detracting from U.S. output.” – bto: Die Performance Europas ist erschreckend.

Quelle: Hoisington

- “Falling real yields and inflationary expectations, via the Fisher equation, force government (risk-free) bond yields lower. But full application of the law of diminishing returns is also at work. Diminishing returns occur when a factor of production, such as debt capital is overused. This observation is confirmed by the decline in the marginal revenue product of debt. Economic theory demonstrates than when the MRP of a factor declines, the price received for that factor also declines. If, for example, labor is overused to the extent that its MRP declines, so do wages, the price of labor. Thus, the decrease in MRP of debt due to its overuse, indicates that interest rates, the price of debt, should fall. This is exactly what is happening in all the major economies of the world that are suffering from a debt overhang. Thus, considering decreasing interest rates as an inducement for governments to spend more borrowed funds will add to the severity of the debt spiral. If policy makers are incentivized to borrow more because interest rates are low, then the MRP of debt will fall, leading to even weaker growth. Moreover, interest rates are lowered indirectly by poorer growth and inflation, and by a further fall of the MRP of debt. Thus, the whole premise of Modern Monetary Theory is flawed at the core. The low interest rates are not a potential benefit for the economy, they are a result of the overuse of debt.” – bto: Man könnte sogar sagen, dass die vielen neuen Schulden ja zu einem Überangebot an Geld führen. Sind es doch zwei Seiten derselben Medaille.

- “General disappointment with trying to solve economic underperformance by more indebtedness may crystalize along with the realization that debt will not work any better in the U.S. than in Japan, the Euro Area and many other countries. As this dissatisfaction intensifies, either de jure or de facto, the Federal Reserve’s liabilities could be made legal tender, or a medium of exchange. Already, the Fed has taken actions that appear to exceed the limits of the Federal Reserve Act under the exigent circumstances clause, but so far, they are still lending and not directly funding the expenditures of the government in any meaningful way. But some advocate making the Fed’s liabilities spendable and a few central banks have already moved in this direction. If the Fed’s liabilities were made a medium of exchange, the inflation rate would rise and inflationary expectations would move ahead of actual inflation. In due course, Gresham’s law could be triggered as individuals move to hold commodities that can be consumed or traded for consumable items. This would result in a massive decline in productivity, thus real growth and the standard of living would fall as inflation escalates. Lower and moderate income households would be the most adversely effected. Velocity would rise dramatically.” – bto: Aber genau in diese Richtung bewegen wir uns doch – sowohl in den USA, vor allem aber hier.

→ hoisingtonmgt.com: „Quartelry Outlook“, Third Quarter 2020