“‚Their Luck Is Running Out‘: Why Albert Edwards Expects A Chinese Hard-Landing”

Heute wenden wir uns China zu. Das Land steht für ein Großteil des Wachstums der Weltwirtschaft in den letzten Jahren und zunehmend im Wettbewerb im Bereich der Hochtechnologie. Donald Trump hat vermutlich auch aus strategischen Gründen den Handelskrieg mit China begonnen und es bleibt abzuwarten, ob es nun wirklich zu einer Entspannung kommt – oder es nur eine taktische Maßnahme vor den Wahlen war.

Zumindest kurzfristig scheint sich die Wirtschaft weiter abzuschwächen:

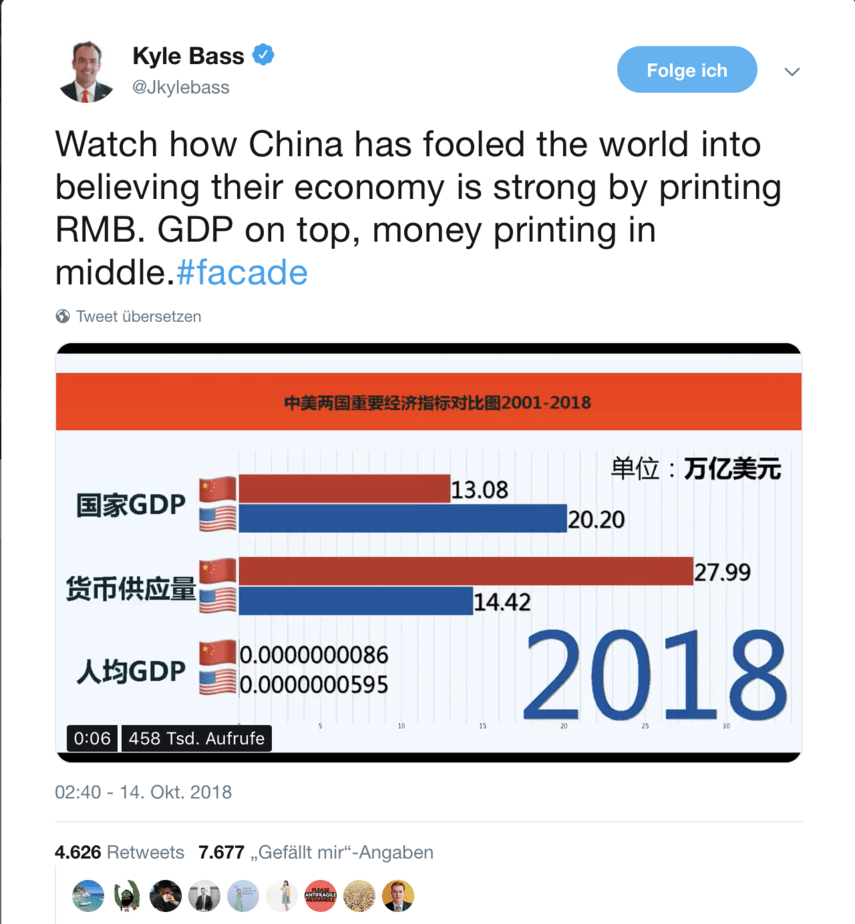

So oder so droht eine weitere Abschwächung in dem Land, das wie kein anderes auf Schulden gesetzt hat, um das Wachstum zu beleben. Das zeigt dieses Bild sehr schön:

Quelle: Twitter

Albert Edwards – Perma-Bär von SocGen – sieht das Land vor einer durchgreifenden Wende:

- Als es 1987 an der Wall Street crashte, “one key feature was investors’ surprise that the already frothy Japanese equity market and economy just sailed through the crisis more untouched than most. This was mistakenly attributed to sound policy and an unsinkable economy. As a result, confidence that Japanese policymakers could deftly manage and avert any potential crisis saw investors pour money into Japanese assets. Risk appetite inflated to previously unseen levels, and then (…) ›when policymakers have a ‘good’ crisis, investors then become over-complacent and fail to price risk correctly.‹” – bto: Japan galt damals als unschlagbar.

- “It wasn’t just Black Monday: as Edwards notes, in 2001, in the immediate aftermath of the Nasdaq crash and with the expected deep recession averted, investors made the mistake of anointing Alan Greenspan with semi-supernatural powers of policy management ‚whereas in fact he might have just been lucky.‘ (…) Alan Greenspan and the Fed were seen by investors to have had a good crisis, and together with Greenspans mythical equity market put, investors became overcomplacent. The bust, when it came, was worse, precisely because over-confidence in policymakers ability to control events led to excessive risk and debt being taken on.” – bto: Heute haben wir großes Vertrauen in die Notenbanken und in die chinesische Regierung, alles im Griff zu haben.

- “Fast forward to today when Edwards claims that with the world suddenly focused on the US, the real trouble continues to brew enearly half a world away: namely ‚China is currently another place where there is over-complacency.‘ Investors (…) are virtually certain that China’s economy will not hard-land, mainly because the policymakers have proved the naysayers wrong time and time again. But, as in the case of 1987 and 2001, ‚is luck now running out?‘ Edwards asks, this time for Beijing.” – bto: und damit für uns alle.

- “Edwards’ argument revolves around the claim with China’s policymakers having had a very good crisis in 2008 (which was papered over only thanks to trillions in new debt), ‚since then, naysayers, such as myself, have been consistently wrong in projecting that policymakers would lose control and that a grotesque credit bubble would burst and lay the economy low.‘” – bto: Das stimmt.

- “Edwards contends that as President Trump exerts mounting pressure on the Chinese economy via tariffs, ‚the worry is that a Chinese policy response will send the global markets into a tailspin, just as the August 2015 devaluation did.‘ Which, in turn, reminds the SocGen strategist that, as we China just unveiled its first ever current account deficit, marking a seachange in the direction of China’s capital flows, and making Chinas policymakers job even harder, once again bringing up the question: ‚Is luck running out?‘“

Quelle: SocGen, Zero Hedge

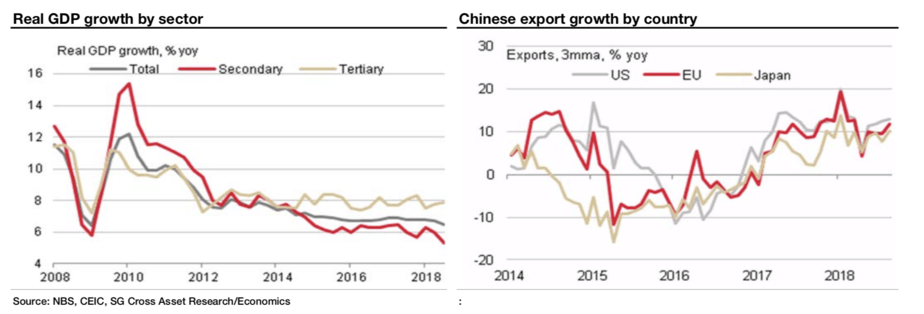

- “Of course, the current account is just a symptom of an greater malady affecting China: namely a rapid slowdown in Chinese growth. Referencing the recent work of SocGen China economist Wei Yao, Edwards notes that the swing into current account deficit shown above is likely to be permanent. The result will be increased fragility in the renminbi ‚at a time when economic growth is slowing sharply, led by the industrial (secondary) sector (see left-hand chart below). And with export growth to the US only temporarily buoyed to avoid tariff hikes, this slowdown is likely to intensify.‘” – bto: Und eine Abschwächung in China strahlt weltweit massiv aus.

Quelle: SocGen, Zero Hedge

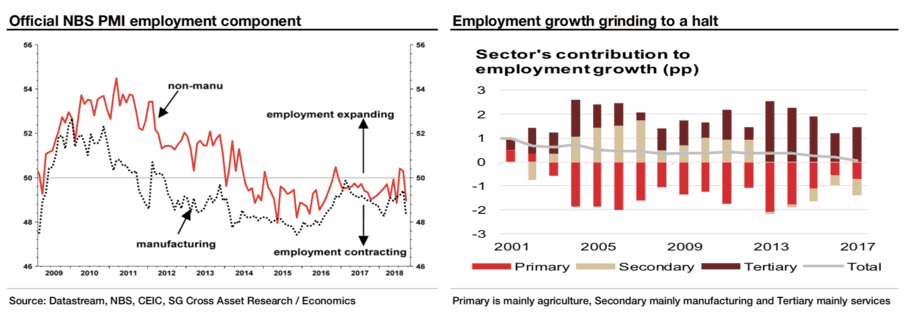

- “Even more troubling than China’s brand new current account deficit is that as Yao highlights, the Chinese economy has slowed to the point that employment has begun to fall, most visibly in the slump in the latest employment component of the PMIs (both official and Caixin). And while the decline in manufacturing jobs has been apparent for a few years now (ie sub 50), but it is also the services sector that is now also shedding labor, making China’s economic slowdown a ‚really serious‘ issue for policymakers.” – bto: und zwar sehr serious! Denn damit ist der soziale Konsens gefährdet.

Quelle: SocGen, Zero Hedge

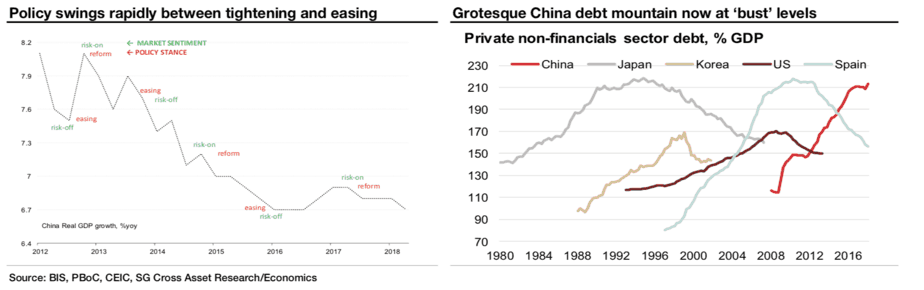

- “Meanwhile, the traditional response Beijing has activated in such situations – namely blowing a massive credit bubble, no longer appears to be an option as Chinese policy seems ‚to swing from feast to famine as policymakers grapple with the increasing instability of the credit bubble they have created.‘” – bto: Da ergeht es den Chinesen wie uns!

Quelle: SocGen, Zero Hedge

- “The main reason cited by the SocGen economists for the policymakers’ reluctance to blow yet another bubble is concerns about how it will affect China housing market, where the issue is that Beijing’s credit policy swings about so violently it destabilizes a housing market that is constantly prone to bubble tendencies (see chart below). This, Edwards believes, is due to few alternative investment opportunities – especially after the 2015 H2 equity market collapse.” – bto: Wie bei Goethes Zauberlehrling gibt es deutliche Probleme …

Quelle: SocGen, Zero Hedge

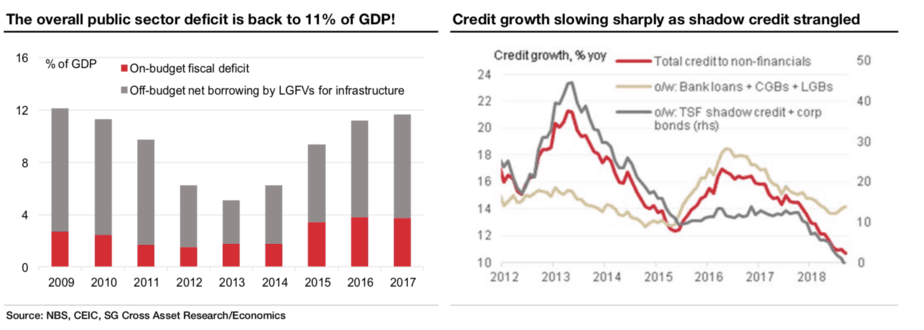

- “And here Edwards makes a bold assumption: ‚after the aggressively expansive monetary and fiscal policy of 2015/16, the authorities remain determined not to reignite the credit bubble.‘ (…) Still, one can argue that Edwards is correct, especially when one looks at the overall public sector deficit which is already at 2009 crisis levels of 11% of GDP, as creation of China’s shadow credit – the deus ex machina for the past decade – continues to be ‚strangled.‘” – bto: Ich würde immer erwarten, dass die Maschine wieder angeworfen wird, wenn es richtig problematisch wird.

Quelle: SocGen, Zero Hedge

“Edwards cautions that ‚no one expects a [Chinese] hard-landing‘ and asks ‚Why not?‘” – bto: So ist es !