“The ticking time bomb that could blow up into a financial crisis”

Die Mahnungen nehmen zu, auch in den normalen Medien. So schreibt der Telegraph über die Zeitbombe, die in den Weltfinanzmärkten tickt. Konkret geht es um den explodierenden Markt der Leveraged Loans, also der hoch riskanten, unbesicherten Kredite, die an Unternehmen mit schwacher Bonität vergeben werden.

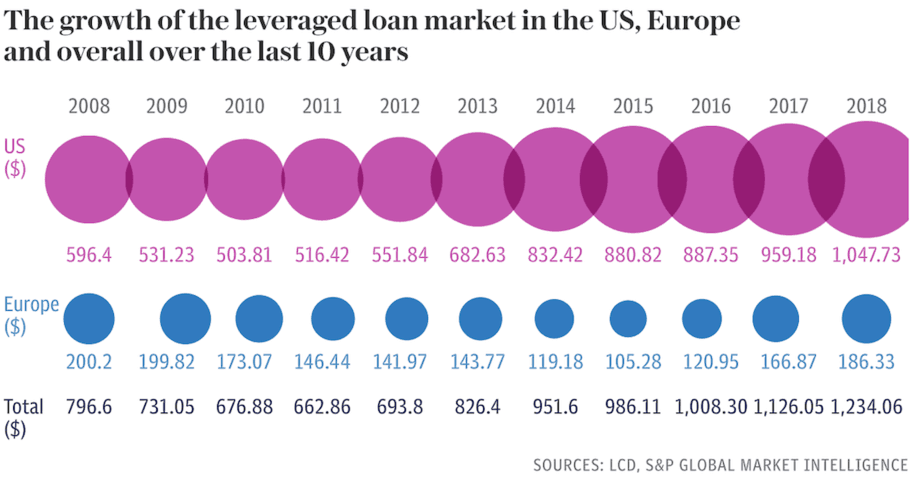

In der Tat ist der Markt explodiert:

Quelle: The Telegraph

- “With the 10-year anniversary of the Lehman Brothers collapse this month offering a ghostly reminder of past excess, some believe that the surge of covenant-lite loans in the leveraged loan market could be another ticking time bomb.” – bto: weil die Marktteilnehmer, getrieben vom billigen Geld, händeringend nach attraktiven Zinsen suchen. Sie haben ja auch 100-jährige Argentinier gekauft.

- “Amid fervent demand from lenders, these below investment grade loans have been stripped of their basic investor protections, like covenants, in recent years. Investors have piled into these risky but lucrative high-yield loans to obtain higher returns.” – bto: und weil es nicht ihr eigenes Geld ist!

- “Covenants require a borrower to pass financial tests, usually on a quarterly basis. These tests can stipulate how much debt a company can have or the earnings it needs to generate. But cov-lite loans now make up around 80pc of new issuance in the booming leveraged loan market, which surged past the $1 trillion milestone in the US earlier this year.” – bto: Es gibt also eine deutliche Verschlechterung der Kreditqualität.

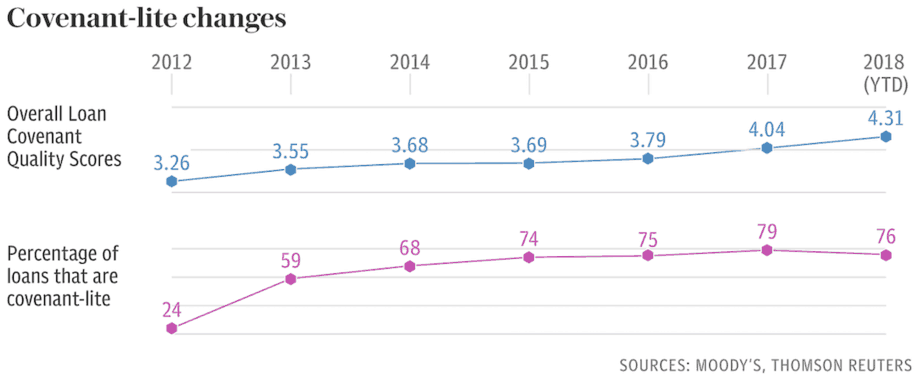

- “The credit ratings agencies, accused of being asleep at the wheel in the run-up to the crisis, are now among the first to sound the alarm. The quality of covenants has sunk to a record low, according to Moody’s. The ratings agency believes that leveraged loan investors ‚face significant future risks‘. Its Loan Covenant Quality Indicator in the first quarter of 2018 climbed to a record 4.12 on a scale of one to five, with a higher score indicating weaker protections for investors. It argued that there has been a ‚shift of power to borrowers‘ who have taken advantage of ‚favourable market conditions‘ and left investors with an ‚unprecedented‘ lack of protection.” – bto: was erfahrungsgemäß nicht gut ausgeht.

- “The International Monetary Fund also conjured up the ghosts of the last crisiswhen warning investors on leveraged loans. Lower-quality companies are enjoying ‚ample‘ access to credit and the market is ‚reminiscent of past episodes of investor excesses‘, the lender of last resort said in its global financial stability report in April.” – bto: wie hier immer wieder besprochen. Die US-Unternehmen könnten im Zentrum einer erneuten Krise stehen.

- “The two organisations agree that the widespread abandonment of these protections will likely lead to more defaults in the next downturn. Cov-lite loans being of a lower quality will ‚exacerbate the next default cycle‘ and a surge in defaults would send shock waves that would reach the real economy, the IMF predicted.” – bto: woraufhin die Helikopter wieder starten.

- “The intense demand in the leveraged loan market has fuelled the deterioration in the covenants. The balance of supply and demand leans heavily towards the latter. A borrowers’ market exists in which companies can issue loans without these basic red lines in the knowledge they will still be gobbled up by investors.” – bto: Die Investoren wollen gar keine Sicherheiten mehr haben.

Quelle: The Telegraph

- “Institutional investors and CLO managers are now the main lenders rather than banks, which typically demanded a more active role. (…) the loan market has become more like the bond market, which has few financial covenants and is also institutional investor-driven. (…) ‚The bigger problem is the overall erosion of documentation, which has become almost a joke. It has crept into the documentation that more and more cash from the company can be dividended out to the private equity firm when the lenders have not been repaid.‘” – bto: Tja, man muss sich auch ausnehmen lassen. Problem ist nur, dass die damit das System gesamthaft gefährden. Es gehört aber zu unserem Leverage-getriebenem System.

- “Cov-lite loans were once only given to the sturdiest companies that could be trusted to be handed more lax loan terms. Companies were lured by cov-lite loans in the aftermath of the crisis by their flexibility. (…) ‚It might have started innocently but as the market has evolved in the last 10 years we’ve seen it transition to a much more aggressive structure with fewer covenants and it has also led to a deterioration in debt structure‘ …” – bto: also eine einst gute Idee, die völlig aus dem Ruder gelaufen ist.

- “Moody’s has also warned investors to brace for far lower recoveries – the amount clawed back from defaulted loans. It forecasts that recoveries on first-lien loans – the first to be repaid in the event of a default – will be 60pc, well below the long-term average of 85pc. (…) ‚The default statistics and the recovery rates will be far worse than what CLO issuers have been touting.‘ Wall Street legend Sir John Templeton famously said ‚this time it’s different‘ are the four most dangerous words in investing. As investors ditch protections in a desperate hunt for stronger returns, they could have made the same mistakes all over again.” – bto: mit fremdem Geld und in der (sicheren) Erwartung, von den Notenbanken wieder gerettet zu werden.