“The global bond rout has begun, leaving equities on borrowed time”

Heute Morgen habe ich gezeigt, wie die Zinsen auf Assets wirken, vor allem je länger die (implizite) Duration ist. Nun häufen sich die Zeichen für einen Zinsanstieg. Ambroise Evans-Pritchard diskutiert im Telegraph:

- “The current ‘ice age’ – to borrow from Albert Edwards at Societe Generale – began in 1981 when the US Federal Reserve delivered a crushing monetary shock and defeated the Great Inflation. Benchmark US yields have been falling in a staggered fashion ever since, drawn lower by the deflationary forces of the internet and a vast pool of cheap labour after China and Eastern Europe joined the global economy in the Nineties.” – bto: eine Entwicklung, die ich oftmals beschrieben haben.

- “(…) if the chartists are right the downtrend line has finally broken. US Treasury yields across the maturity spectrum are smashing through lines of resistance, with instant knock-on effects through the $49 trillion (£36 trillion) market for global bonds, and secondary effects through bank lending.” – bto: Gerade dieser Folgeeffekt sollte uns Sorgen bereiten.

- (…) the two-year US yield has been carving out a saucer-shaped bottom for almost a decade and is back to where it was in late 2008.(…) and is actually higher than the average stock dividend on the S&P 500 index. (…) The two-year Treasury is the canary in the coal mine. It is legitimate to say that the bond bull market of the last 36 years is over (…).”

Quelle: The Telegraph

- “(…) a rise in 10-year US yields to 3pc would clinch the argument. That is in sight as the anchor rate of the international system breaks out of its trading band and punches towards a three-year high of 2.6pc.” – bto: In der Tat scheinen die drei Prozent die magische Grenze zu sein.

- “What has changed the mood abruptly is news that even the Bank of Japan – the eternal QE recidivist – is reducing bond purchases. It is stepping back from the greatest monetary experiment in history. Even more astonishing is the spectacle of a Japanese economy in full-fledged boom.” – bto: Das ist eines der Szenarien, die ich auf bto am Montag diskutiert habe.

- “The peak flow of central bank liquidity is long past. The Fed has begun ‚quantitative tightening‘ and will ratchet up its bond sales to $50bn a month by year-end. The European Central Bank halved purchases to €30bn (£27bn) a month this January. It may be out of the game by September.” – bto: Da darf natürlich vorher nichts passieren, wie zum Beispiel ein Schock an den Märkten.

- “Markets will have to absorb an extra $1 trillion of debt supply in 2018. That is half story behind rising yields: the other half is that bond investors are becoming a little less insouciant about inflation, though they are still unwilling to capitulate on the bigger story of secular reflation.” – bto: Es ist eine spannende Schlacht zwischen Inflation und Deflation und auch ich weiß nicht, wie es ausgeht. Deshalb müssen wir uns auf beide Szenarien einstellen.

- “There are loose parallels with the wild year of 1987 when Wall Street soared to nosebleed levels despite warning signs from the bond markets. ‚The economy was going from strength to strength. The ISM (manufacturing) index was over 60, about the same as now, yet the market crashed,‘ said Albert Edwards. In a sense, equities buckled under their weight, even if it took the external catalyst of a rate rise by the Bundesbank.” – bto: was Gavekal so gut beschrieben hat.

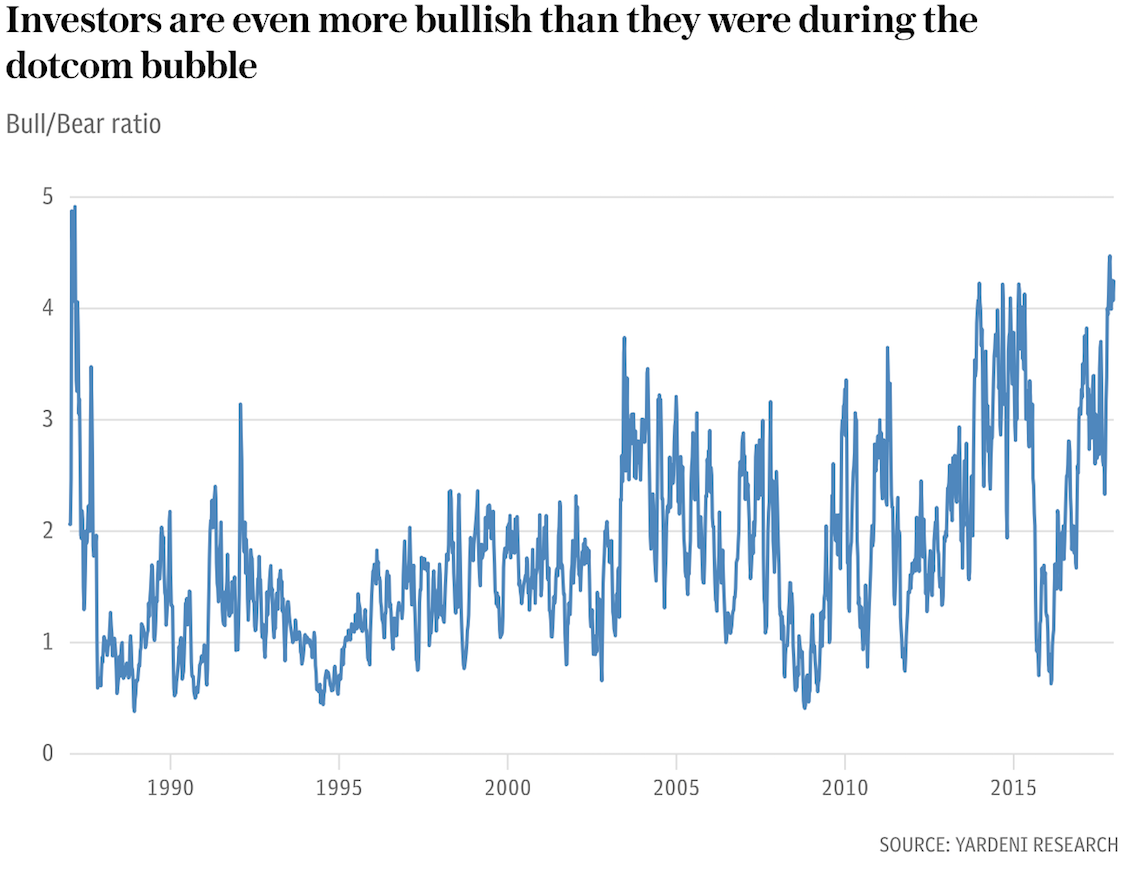

- “The ‚Bull Bear‘ indicator of professional advisors is currently at the same euphoric level reached in October 1987. It is higher than at the peak of the dotcom bubble, which is a frightening thought. Societe Generale’s equity guru, Andrew Lapthorne, says US corporations are running a cash deficit of $250bn a year and have exhausted the use of debt leverage to finance share buy-backs.” – bto: Das sind doch die wirklich gefährlichen Anzeichen!

Quelle: The Telegraph

- “(…) the International Monetary Fund (…) said a fifth of US firms risk bankruptcy when the rate cycle turns. The epicentre of trouble is in the lower half of the Russell 2000 index. These firms are already spending 30pc of earnings (EBIT) on debt costs. ‚That is where the next crisis might emerge,‘ said Mr Lapthorne.” – bto: was nun wirklich der Hammer ist!

- “Nobody knows where the pain threshold lies for a global financial system with a record debt ratio of 332pc of GDP – up 56 percentage points even since the Lehman bubble – and with an unprecedented sensitivity to US monetary policy through offshore dollar funding markets.” – bto: weshalb man rennt, bevor es passiert – und damit passiert es.