Stürzen uns die Notenbanken in die Rezession?

Am 8. Mai 2022 geht es – erneut – um die Geldpolitik in meinem Podcast. Zu Gast ist Professor Ottmar Issing, der erste Chefvolkswirt der EZB und ein wirklicher Kenner der Materie.

Zur Einstimmung einige Beiträge. So heute Ambroise Evans-Pritchard, der im Telegraph sehr schön erklärt, wieso die Notenbanken Gefahr laufen, ihren Fehler durch einen noch größeren Fehler zu korrigieren:

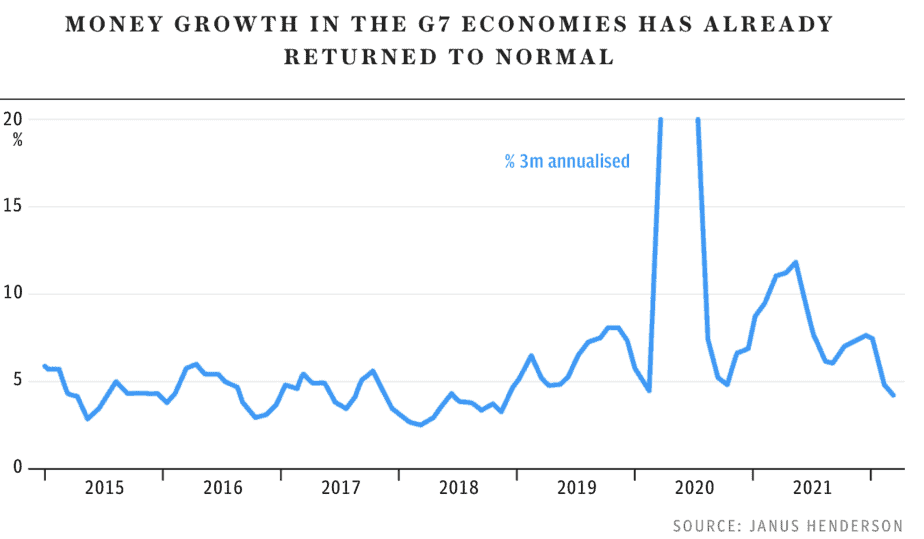

- „The cause of the current inflation spike is the one-off expansion of the money supply (40pc in US) during the course of the pandemic, used to finance unfunded budget deficits of New Deal proportions. This is feeding through with the typical time-lag of 18 months or so.“ – bto: Es war also ein einmaliger monetärer Schock und da der ohnehin abnimmt, besteht keine Notwendigkeit, etwas zu tun. Dies unterstreicht auch diese Abbildung:

Quelle: The Telegraph

Das entspricht genau dem, was Tim Congdon in meinem Podcast vor einigen Monaten erzählt hat:

→ Droht die Rückkehr der Inflation?

- Jetzt also nimmt das Geldmengenwachstum ab: „That monetary surge is already fading. Simon Ward from Janus Henderson says the growth rate of broad money in the G7 as a whole has fallen to 4pc over the last three months (annualised), down from an annual peak of 17.3pc in February 2021. Inflation may keep rising for a few more months as a legacy effect but the underlying problem is already solving itself.“ – bto: was dafürspräche, eben nichts zu tun gegen die Inflation.

- „Budget policy has turned contractionary across the West as pandemic support fades. The Fiscal Impact Measure at the Brookings Institution suggests that the fiscal squeeze by federal and state governments will be running at a pace of 3.5pc of GDP this quarter, and 3.2pc next quarter.“ – bto: “Fiscal squeeze” bedeutet weniger schnell mehr Schulden, aber weiterhin mehr Schulden.

- „Federal Reserve rate-setters have swung wildly from ultra-loose money to ultra-tight money after it is already clear that the cycle has turned. They are doing so as the IMF and World Bank slash their global growth forecasts, and as China’s ‘dynamic zero-Covid’ hits an economic brick wall. This has an uncanny echo of early 2008 when the Fed was spooked by surging oil prices. It talked up the futures curve by, yes, a full percentage point, misjudging how fast the US economy was already slowing.“ – bto: also das klare Risiko, dass hier in eine sich abzeichnende Rezession hinein gebremst wird. Man kann natürlich anders argumentieren und auf die Gefahr steigender Inflationserwartungen verweisen. Dies wird aber ebenfalls nicht mehr so gesehen, verharrt doch die Inflationserwartung auf tiefem Niveau.

- „The combined effect of ending QE and raising rates amounts to 13 synthetic rate rises so far under the Atlanta Fed’s Wu Xia “shadow rate”. A market variant of the shadow rate implies at least 25 rate rises by the end of the year, from cycle trough to peak.“ – bto: Angesichts der Verschuldung und der Vermögensblasen halte ich das für weitgehend ausgeschlossen.

- „The tightening so far has already pushed the US dollar index (DXY) to a 19-year high, an ordeal by fire for offshore borrowers with $12 trillion of US-denominated debt, much of it in emerging markets. It is dislocating large parts of the international financial system, still priced off three-month, one year, and five-year US dollar lending rates.“ – bto: Und es erhöht den inflationären Druck in der Eurozone, da der Euro so massiv schwächer wurde, während die Energierechnung in US-Dollar zu bezahlen ist.

- “Bill Dudley, the former head of the New York Fed, says his old colleagues have fallen so far behind the curve that they will have to keep raising rates until something breaks; or as he puts it, until the market ‘co-operates’ – presumably by means of an equity crash that does the job of cooling the economy. He said a recession was now unavoidable. My presumption is that this outlook – which I consider misguided – reflects broad thinking in Fed circles.”

- „This really is like 2008, when the ECB overreacted to a temporary oil shock and raised rates after Germany and Italy had already slipped into recession. As it happens, the Economic Cycle Research Institute has just issued a client note warning that Germany and Italy are today on the cusp of recession. Bank of America says its European Credit Macro Indicator is flashing a red alert.“ – bto: Wir können nicht ausschließen, dass wir es mit einer Stagflation zu tun bekommen.

- „In one sense, it is absurd that the eurozone still has rates of minus 0.5pc and is still doing QE at a time when inflation is 7.6pc in Germany, 9.8pc in Spain, and 11.8pc in Holland. But such is the absurd situation that the eurozone has got itself into under the structure of monetary union. The system may require negative rates in perpetuity.“ – bto: Japan oder Stagflation ist dann die Frage.

- „There will be a time for a post-mortem on the pandemic policies of the central banks. They should not be faulted for taking out an insurance policy against the tail risk of economic and financial meltdown at the onset of Covid. The error was to persist too long with extreme QE once the V-shaped rebound was underway.They got into trouble because they stopped paying attention to monetary data under their New Keynesian staff models. These staff models have not been revised and are now causing them to make the opposite mistake.“ – bto: Sie erkennen also nicht die dämpfende Wirkung ihrer Maßnahmen? Ich denke nicht, dass sie das nicht wissen. Sie überschätzen die Kraft des Aufschwungs.

- „(…) QE has worked exactly as you would expect under the quantity theory of money. (This) implies that the abrupt switch from QE to QT is going to lead to a drastic slowdown in the broad money supply. This will set off an asset crash this year followed by economic mayhem next year if central banks do not back off in time.“ – bto: Auch ich sehe diese Gefahr, ich sehe aber ebenfalls die strukturellen Risiken für eine nachhaltig höhere Inflation.