Studie: Die EZB-Politik führt zur Vermehrung von Zombies

Zombies. Heute erneut das Thema bei bto. Schon vor einigen Wochen habe ich eine Studie besprochen, die zeigt, dass die zunehmende Zombifizierung von der Politik der EZB gefördert wurde und wiederum zu einem deflationären Druck führt, also genau dem Gegenteil dessen, was die EZB eigentlich erreichen will.

→ Wie Politik und EZB Deflation und Stagnation fördern

Heute nun ein anderes Papier, erschienen an der New York University:

- “At the peak of the European debt crisis in 2010, the European Central Bank (ECB) began to introduce unconventional monetary policy measures to stabilize the Eurozone and restore trust in the periphery of Europe. Ultimately, these unconventional monetary policy measures were aimed at breaking the vicious circle between poor bank health and sovereign indebtedness, which had led to a sharp decline in economic activity in the countries in the periphery of the Eurozone. Especially important in restoring trust in the viability of the Eurozone was the ECB’s Outright Monetary Transactions (OMT) program, which the ECB’s president Mario Draghi announced in his famous speech in July of 2012, saying that […] the ECB is ready to do whatever it takes to preserve the euro. And believe me, it will be enough.” – bto: Kann man mit billigem Geld und dem Aufkaufen von Anleihen die Probleme lösen oder verschärft man sie gar?

- “There is clear empirical evidence that the announcement of the OMT program has been successful in terms of lowering spreads of sovereign bonds issued by distressed European countries. Moreover, we show that the resulting value increase of these bonds resulted in a backdoor (indirect) bank recapitalization as banks with significant holdings of these bonds experienced substantial windfall gains, which helped to restore the stability of the European banking system.” – bto: Beides wäre doch ein unstrittiger Erfolg.

- “There are a lot of unvital signs that Europe’s weak economic recovery is a repeat of Japan’s ‘zombie lending’ experience in the 1990s, when banks in distress failed to foreclose on unprofitable and highly indebted firms. For example in 2013 in Portugal Spain and Italy, 50%, 40% and 30% of debt, respectively, was owed by firms which were not able to cover their interest expenses out of their pre-tax earnings.“ – bto: Aus gutem Grunde. Sie können die Verluste nicht tragen und halten deshalb an den Zombies fest.

- “To the best of our knowledge, our paper is the first to provide systematic evidence that, indeed, the slow economic growth in Europe can at least partially be explained by zombie lending motives of banks that still remained undercapitalized after the OMT announcement.” – bto: also ein weiterer Beweis für etwas, was man schon durch einfache Überlegung erwarten kann.

- “By continuing to lend to their impaired borrowers, distressed banks can avoid realizing losses on outstanding loans, which would further deter the banks’ situation due to increasing regulatory scrutiny and intensified pressure from market forces. Instead, by ‘evergreening’ loans to their impaired borrowers, banks in distress can gamble for resurrection in the hope that their borrowers regain solvency, or, at least, they can delay taking a balance sheet hit. This behavior leads to an inefficient allocation of bank loans, since loan supply is shifted away from creditworthy productive firms towards distressed less productive borrowers, which distorts market competition and causes detrimental effects on employment, investment, and growth in general.” – bto: und die Inflationsrate, wie wir in der anderen Studie gesehen haben!

- “Our results show that banks from stressed European countries (the GIIPS countries, i.e., Greece, Ireland, Italy, Portugal, and Spain) realized the highest windfall gains after the OMT announcement due to their substantial amount of sovereign debt holdings from these countries. Moreover, we document that this increase in bank health led to an increase in available loans to firms. (…) banks with higher windfall gains on their sovereign debt holdings increased loan supply to the corporate sector relatively more than banks with lower windfall gains, but only to existing borrowers.” – bto: Also hat es funktioniert! Die Kreditvergabe wurde angekurbelt – allerdings nur für “bestehende Kunden”.

- “(…) we document that high-quality non-zombie firms indeed suffered from the pres-ence of zombie firms in their industry: both their investment and employment growth rates were significantly lower if the fraction of zombie firms in their industry increased compared to high-quality non-zombie firms active in industries without a high prevalence of zombie firms. This finding highlights that the distorted market competition, induced by the misallocation of loan supply due to zombie lending, hampered real economic growth and thus significantly weakened the potentially positive impact of the OMT program’s indirect bank recapitalization effect.”– bto: Da die Studie schon älter ist, stellt sich die Frage, weshalb sie von der EZB nicht zur Kenntnis genommen wird.

- “Overall, the announcement of the OMT program probably averted an even fiercer economic downturn or even a break-up of the Eurozone. Our results suggest, however, that combining the OMT program with a targeted bank recapitalization program would presumably have led to superior outcomes in terms of economic growth.” – bto: Auch das leuchtet ein!

Und dann die entscheidenden Abbildungen:

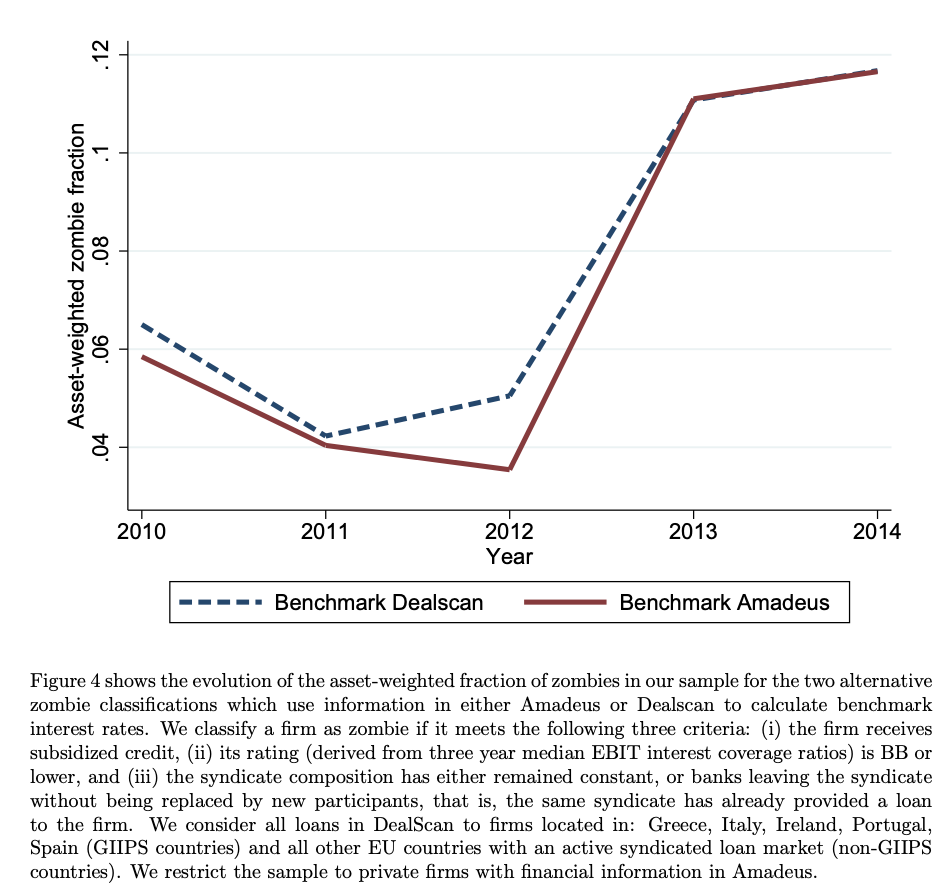

Zunächst der Anstieg der Zombies gleich nach “whatever it takes”:

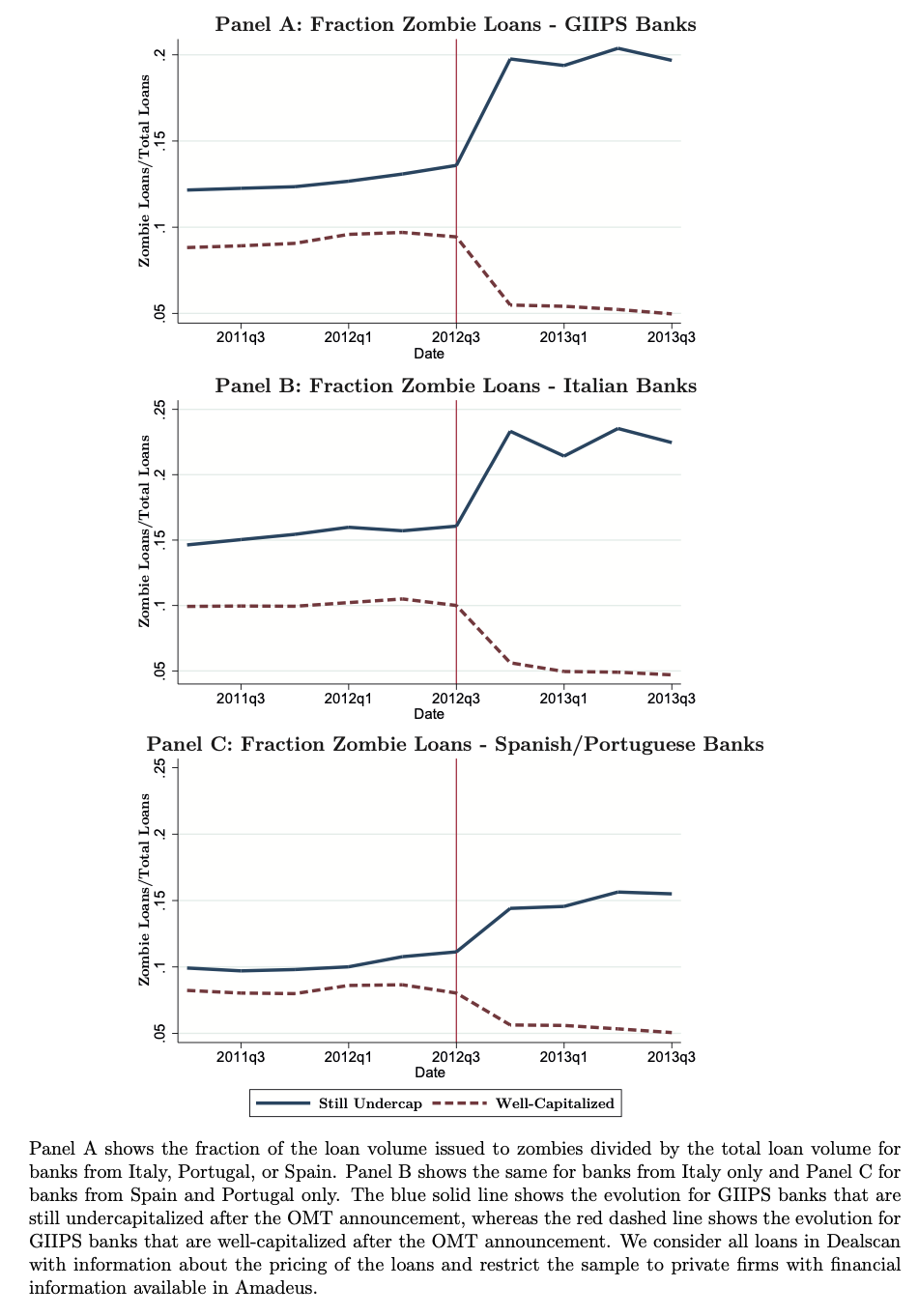

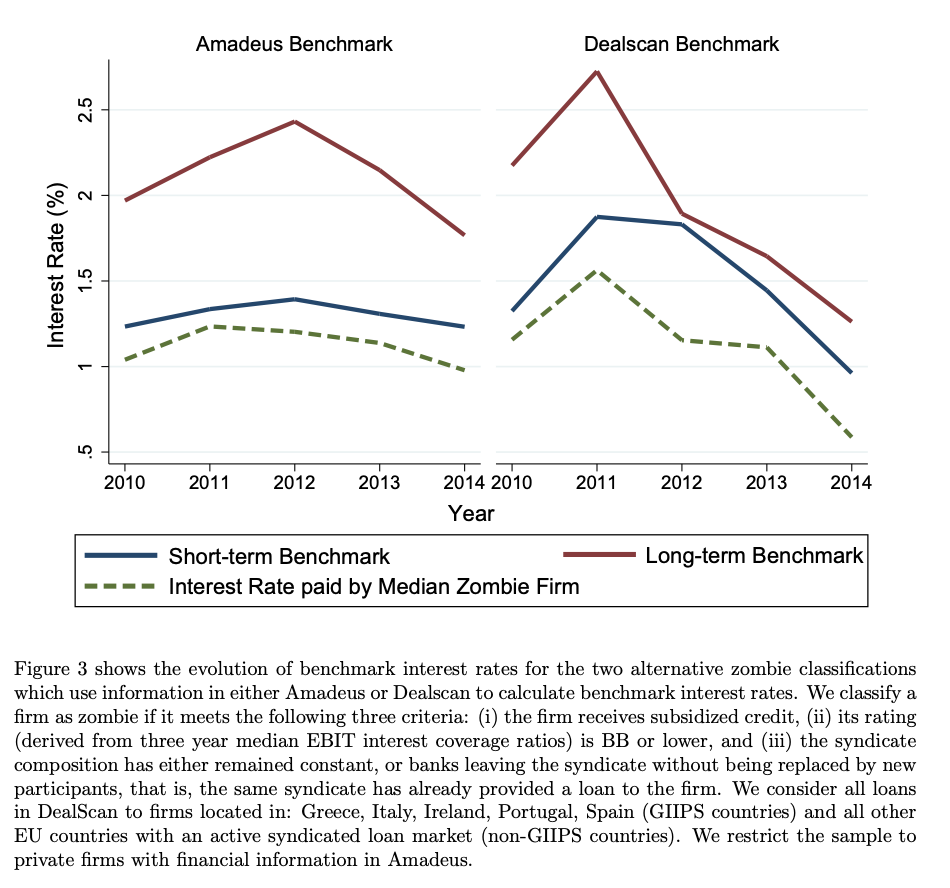

Während gleichzeitig der Anteil der Kredite, der an Zombies geht, nach oben schnellt (erste Grafik) und die Zombies dafür weniger Zinsen zahlen als die gesunden Unternehmen (zweite Grafik):

Nebenwirkungen: weniger Investitionen, weniger Innovation, weniger Produktivitätszuwachs, weniger Beschäftigung, weniger Inflation usw.

→ Stern University: “Whatever it takes: The Real Effects of Unconventional Monetary Policy”