Stephanie Kelton reagiert auf Kritik an MMT

Stephanie Kelton, die Protagonistin der Modern Monetary Theory (MMT), bei bto ausführlich zitiert, reagiert in einem Gastbeitrag bei Bloomberg auf die Kritik an ihren Überlegungen. Konkret antwortet sie auf Paul Krugman, immerhin Nobelpreisträger und nicht gerade als neo-liberal bekannt. Schauen wir uns das mal genauer an:

- “There is a doctrine among mainstream economists holding that: (1) government deficits push interest rates higher and (2) rising interest rates crowd out private investment. The government can take more of the economy’s financial resources, but only at the expense of lost private investment. This means that running budget deficits has at least some downside.”– bto: In der Tat sehe ich das nicht so. Die Defizite werden ja mit zusätzlichem Geld finanziert. Insofern steigt die Geldmenge und es gibt kein direktes Crowding out. Was es allerdings gibt, ist natürlich eine Konkurrenz um Güter, die preissteigernd wirken kann, wenn Kapazitäten ausgelastet sind.

- “Paul Krugman is a believer in this doctrine. (und hat zu geschrieben): Are MMTers claiming, as Kelton seems to, that there is only one deficit level consistent with full employment, that there is no ability to substitute monetary for fiscal policy? Are they claiming that expansionary fiscal policy actually reduces interest rates?” – bto: Wenn man die Regierung als Geld-Produzenten ansieht, ist das wohl so.

Dazu die kurze und dann die ausführliche Antwort von Stephanie Kelton:

- “Is there only one right deficit level? Answer: No. The right deficit depends on private behavior, which changes. MMT would set public spending always to the level required to achieve full employment, and then accept whatever deficit may result.” – bto: Das setzt eine Feinsteuerung voraus, die ich mir nur schwerlich vorstellen kann. Bisher war das mit der staatlichen Steuerung so eine Sache.

- “Is there no ability to substitute monetary for fiscal policy? Answer: Little to none. In a slump, cutting interest rates is weak tea against depressed expectations of profits. In a boom, raising interest rates does little to quell new activity, and higher rates could even support the expansion via the interest income channel.” – bto: Ja, da stimme ich zu. Allerdings glaube ich, dass die Fiskalpolitik immer zu spät kommt.

- “Does expansionary fiscal policy reduce interest rates? Answer: Yes. Pumping money into the economy increases bank reserves and reduces banks’ bids for federal funds. Any banker will tell you this.” – bto: und mittleerweile auch jeder Leser hier, würde ich denken.

Also nun zur ausführlichen Antwort:

- “Is there only one right deficit level? No, because for one thing, MMT would establish a public option in the labor market — a federally funded job guarantee— thereby ensuring full employment across the business cycle. The deficit, then, would rise and fall with the cycle, as the job guarantee becomes a new stabilizer, automatically moving toward the ‘right size’ in response to changes in the level of aggregate spending.” – bto: Das ist schon recht radikal. Erinnert Skeptiker irgendwie an die DDR. Auch da gab es keine Arbeitslosigkeit, weil jeder immer irgendwo angestellt war. Ich selber finde zwar, dass es gut wäre, wenn die Empfänger von staatlichen Leistungen jeden Tag zum Dienst erscheinen müssten, damit sie nicht abhängen bzw. weniger Zeit haben schwarz dazu zu verdienen. Aber die Frage ist natürlich, was das für die Produktivität einer Wirtschaft macht, wenn der Druck fehlt.

- “In the absence of a job guarantee, things get trickier. (…) If the private sector wants to spend less and save more, the public sector will need to accommodate that desire by running a bigger deficit or the economy will be pushed away from full employment.” – bto: Außer man exportiert einfach mehr, so wie wir das machen.

- “Is there no ability to substitute monetary for fiscal policy? Not much. (…) It is true that the Fed can pursue any rate policy it desires. It does not follow, however, that cutting interest rates will work to induce enough spending to maintain full employment. (…) The evidence suggests that interest rates don’t matter much at all when it comes to private investment (…).” – bto: Das stimmt natürlich. Aber die Unzulänglichkeit der Geldpolitik kann doch nicht zu dem Argument führen, dass nur der direkte Zugriff auf die Notenpresse wirkt.

- “Does expansionary fiscal policy reduce interest rates? Yes, unequivocally. (…) Imagine the government is running a trillion-dollar deficit, sending out checks for military weapons, contracting to do massive infrastructure projects, and so on. All of those checks get deposited into financial institutions across the country. And each time a check is deposited, the bank gets a credit to its reserve account at the Fed. When you pay your taxes, your bank loses reserves, but with a trillion-dollar deficit, there is a huge net infusion of reserves into the banking system. If the central bank takes no action to prevent it from happening, the overnight lending rate — the federal funds rate — will fall to a zero bid.” – bto: Dem folge ich auch. Ich erinnere an die Diskussion der Staatsschulden von James Montier, die ich bei bto früher gebracht habe. Bringe sie heute Nachmittag als Wiederholung.

- “Is there some reason the straightforward framework Krugman laid out is wrong? Yes, as even its creator went on to acknowledge. MMT rejects the IS-LM framework that Krugman uses to demonstrate the conclusion that widening budget deficits put upward pressure on interest rates and crowd out private investment.

- The model remains the workhorse for many mainstream Keynesians. MMT considers it fundamentally flawed. It is incompatible with much of Keynes’s ‘The General Theory of Employment, Interest and Money’. It was designed for a fixed-exchange rate regime, and it is not stock-flow consistent.

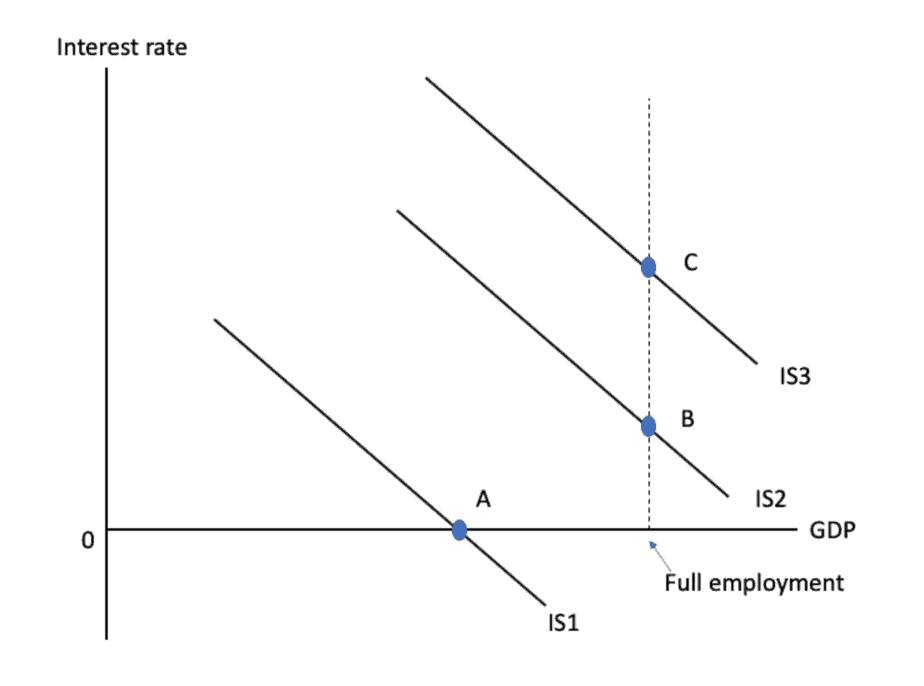

Here’s the framework Krugman presents as a challenge to MMT.

Each of the IS curves (1-3) represents a different fiscal stance. This framework shows that the government can expand its deficit and move the economy from a depressed condition at point A to full employment by shifting IS1 to IS2. The economy is now at full employment, but with higher interest rates and lower private investment.

Keep this in mind: Higher deficits give rise to higher interest rates, which give rise to lower investment. The last bit is referred to as ‘crowding out’. This is the inherent tradeoff that MMT denies and Krugman defends.

And it’s easy for him to defend it because his model assumes a fixed money supply, which paves the way for the crowding-out effect!” – bto: Da hat sie einen Punkt. Wenn Geld nicht knapp wird, kann man beliebig viel damit machen. Aber es gibt trotzdem einen Effekt: höhere Inflation oder weniger Deflation als ohne diese Maßnahme.

- “Keynes’s analysis was more nuanced. Investment decisions were forward-looking, heavily influenced by ‘animal spirits’, and overwhelmingly dependent on the state of profit expectations. When the profit outlook is sufficiently grim, no amount of rate cutting will entice businesses to borrow and invest in new plant and equipment (think Great Recession). Conversely, when the outlook is exuberant, businesses may borrow and invest even more, despite the central bank’s desire to slow an expansion by raising interest rates (think savings and loan crisis). The downward-sloping IS curve does not allow for either of these possibilities. Yet both outcomes can, and do, occur.” – bto: Das stimmt und wir wissen das schon lange. Nur ist diese Kritik am Blödsinn vorhandener ökonomischer Modelle Grundlage genug, um damit gleich MMT zu rechtfertigen?

- “Krugman says there is an inherent tradeoff between fiscal and monetary policy. I agree, but not with the tradeoff he describes. (…) The tradeoff that matters is the one that Hyman Minsky and James K. Galbraith have highlighted. Monetary policy ‘works’ by driving people into debt. Fiscal policy works by driving income into people’s pockets.” – bto: Das ist eine schöne Formulierung und man kann mit Blick auf die letzten 30 Jahre nur zustimmen!

- “That’s the tradeoff that interests me. Should we lean more heavily on (monetary) policy that works by leveraging the private sector’s balance sheet or on (fiscal) policy that works by strengthening it?” – bto: Wow, das hat schon fast politische Qualität. Die Antwort auf die so gestellte Frage ist klar. Doch ist das die Rechtfertigung für MMT? Könnte es nicht sein, dass beides falsch ist? Wäre es nicht besser, an den grundlegenden Faktoren zu arbeiten, die die Wirtschaft treiben? Investitionen, Bildung, etc.?