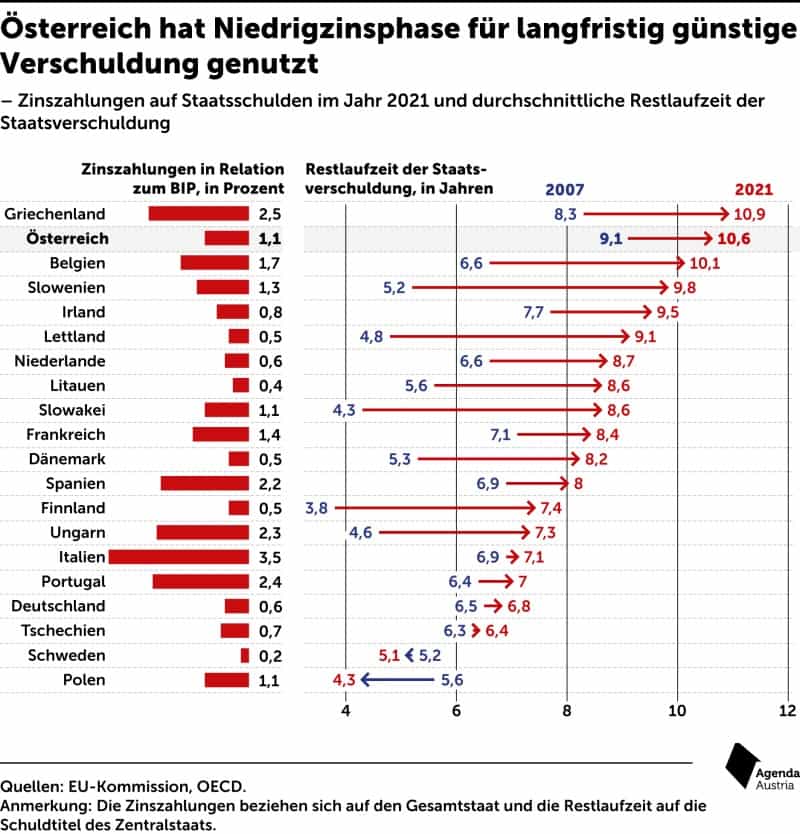

Steigende Zinsen würden Staaten überfordern

Sollten die Zinsen steigen, würden die Staatsschulden teurer:

Quelle: Agenda Austria

Man beachte, wie falsch es wieder in Deutschland gemacht wurde.

The Economist diskutiert Szenarien:

- “For a given cost of borrowing, three main factors determine the cost of servicing legacy debts. Two are straightforward: the level of debt, and the proportion of it whose value is pegged to inflation or prevailing interest rates. (…) The third factor is more complex: the maturity of the debt.” – bto: letztlich keine Rocket Science.

- “The more long-dated debt, the longer it takes for budgets to take a hit when rates rise. The most common measure of this protection, the weighted average maturity (wam) of debt, can be a source of comfort. Britain, in particular, has a lot of long-dated bonds: the wam of its bonds and treasury bills is about 15 years.“ – bto: Auch das leuchtet ein und ist nicht sonderlich kompliziert.

- “Suppose you line up every pound (or dollar) a government has borrowed by the date on which the debt matures. Halfway along you would find the median maturity—the date by which half the government’s borrowing would need to be refinanced at higher rates. Call it the interest-rate half-life.” – bto: Andere Maßstäbe wie die gewichtete Laufzeit sind nicht so gute Indikatoren.

- “Central banks in the rich world have implemented huge quantitative-easing programmes, under which they have bought trillions of dollars worth of government bonds. To do so they have minted fresh electronic money, known as central-bank reserves. These reserves carry a floating rate of interest, the adjustment of which is the main tool of monetary policy. When rates rise, the cost to central banks of paying interest on the ocean of reserves created under qe rises immediately. Raising interest rates thus reduces central-bank profits. And because those profits typically flow straight into government coffers, taxpayers suffer.” – bto: Das ist ein Punkt, den man nicht unbedingt auf dem Radarschirm hat.

- “QE has been particularly lucrative for central banks in euro-zone countries whose long-term debt is risky and therefore carries a high yield. National central banks such as the Bank of Italy carry out most of the ECB`s QE locally, bearing the default risk and earning the yield on the bonds of their respective home states, while also paying their share of the ecb’s interest costs. Earning the yield on Italian government debt while paying out much less in interest on reserves helped the Bank of Italy to remit profits worth 0.4% of GDP to the government in 2020.” – bto: eine wundersame Reichtumsmaschinerie.

- “A full accounting of interest-rate sensitivity must thus adjust for the holdings of central banks, treating the associated debt as carrying a floating rate of interest. (…) Most striking are the results for Japan and Italy, which have the highest debts. Because the Bank of Japan has replaced nearly half the Japanese bond market with its reserves, the interest-rate half-life is vanishingly short. Thankfully inflation in Japan is only 2.5% and expected to fall. There is little pressure to raise interest rates. The same cannot be said for the euro zone, where the ECB is projected to raise rates rapidly so as to tame inflation. It is often noted that Italy’s huge debts of over 150% of GDP at least carry a wheigthed average Maturity of over seven years. But Italy will in fact inherit higher funding costs quickly because its interest-rate half-life is little more than two years. Were the ECB`s policy rates to reach 3%, the Bank of Italy’s share of the interest costs would immediately rise by an annual 1.2% of GDP. Every one percentage point increase in the financing costs on the €462bn of debt (net of central banks’ estimated holdings) coming due by July 2024 would cost the government another 0.3% of GDP annually.” – bto: Das ist eine Überraschung für mich.

- “Is there any way for indebted countries to avoid higher interest costs? It might seem tempting to unwind QE faster, by selling bonds (rather than waiting for them to mature, as several central banks are currently doing). But selling bonds would cause central banks to book capital losses, because rising yields have eroded the value of their bondholdings. At the end of March the Fed’s unaudited financial statements showed an unrealised capital mark-down of $458bn on its QE portfolio since the start of the year (…).” – bto: Es ist schon witzig, wie wir uns in eine Welt bewegt haben, wo Geld nichts kosten darf.

- “Another option is to find a way for central banks to pay less interest on reserves. (…) The ECB and the Bank of Japan already have such a ‘tiered’ system. (…) Using tiering to avoid paying banks interest while their funding costs went up would be a tax in disguise. Banks, considered together, have no choice but to hold the reserves QE has force-fed into the system. Compelling them to do it for nothing would be a form of financial repression which may impair banks’ ability to lend.” – bto: Wobei man auch sagen kann, dass die Reserven eigentlich irrelevant für die Banken sind. Sie brauchen sie ohnehin nicht. Geld sollten sie im eigentlichen Geschäft verdienen.

- “A third option is to tolerate high inflation rather than raise rates. Despite rising interest costs, many countries’ debt-to-GDP ratios will fall this year as inflation eats into the real value of their debts. (…) But because making the switch would deliver a one-time fiscal windfall at the expense of long-term bondholders, and because inflation can be painful to get down, it could eventually appeal to indebted governments.” – bto: zweifellos, gerade in der Eurozone.

“Whether it is banks, taxpayers or bondholders, somebody has to pay the bills that are now falling due.” – bto: Und es sollten nicht die deutschen Steuerzahler für alle sein.

→ economist.com: „How higher interest rates will squeeze government budgets“, 12. Juli 2022