Schulden schaffen kein echtes Wachstum

Wir wissen es schon lange. Neue Schulden haben einen abnehmenden Grenznutzen. Der realwirtschaftliche Impuls nimmt ab. Dennoch kurz zur Auffrischung eine Zusammenfassung über Real Investment Advice:

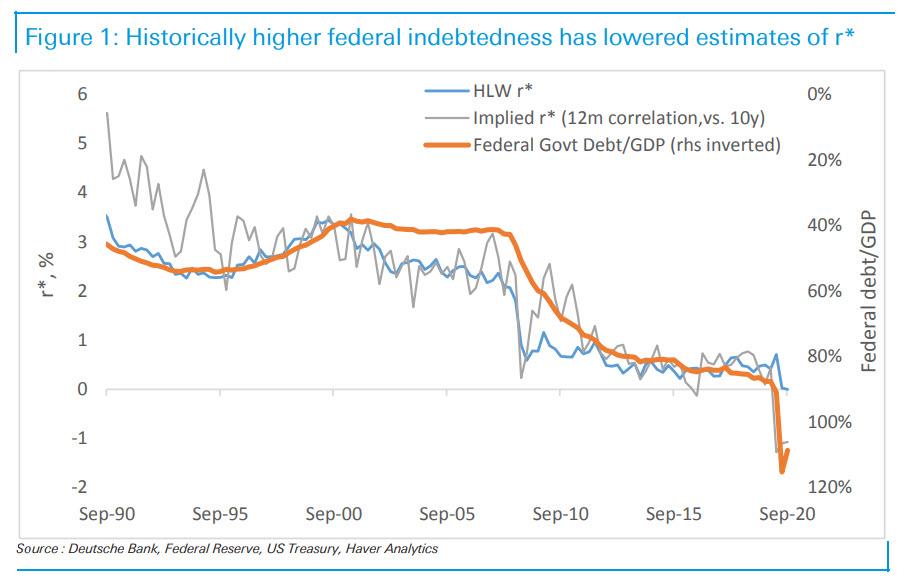

- “(…) even Deutsche Bank credit strategist, Stuart Sparks, got the memo.“History teaches us that although investments in productive capacity can in principle raise potential growth and r* in such a way that the debt incurred to finance fiscal stimulus is paid down over time (r-g<0), it turns out that there is little evidence that it has ever been achieved in the past. The chart below illustrates that a rising federal debt as a percentage of GDP has historically been associated with declines in estimates of r* – the need to save to service debt depresses potential growth. The broad point is that aggressive spending is necessary, but not sufficient. Spending must be designed to raise productive capacity, potential growth, and r*. Absent true investment, public spending can lower r*, passively tightening for a fixed monetary stance.” – bto: Es geht also nicht um die Schulden allein, sondern um die Verwendung der Mittel!

Quelle: Deutsche Bank, RIA

- “Economists estimate the latest stimulus bill could add nearly $1 trillion to nominal growth (before inflation) during 2021. While such a surge in growth would be welcome, it represents just $0.50 of growth for each dollar of new debt.” – bto: Das dürfte zunächst daran liegen, dass das Geld nur in den Konsum fließt.

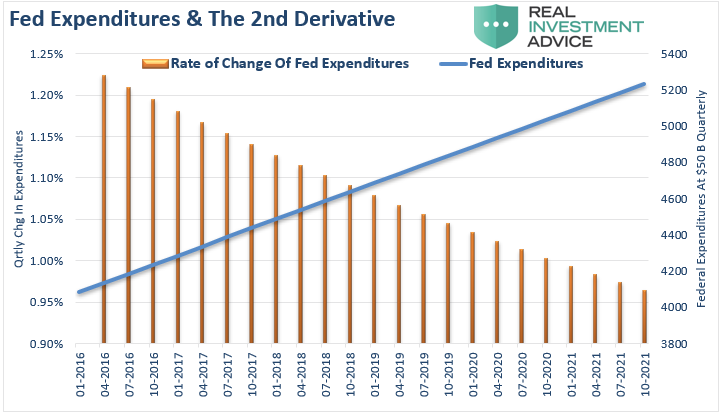

- “(…) the ‘second derivative’ measures how the change rate of a quantity is itself changing. As Government spending grows sequentially larger, each additional round of expenditures will have less and less impact on the total. Going back to 2016 (…) the Government increased spending by roughly $50 billion each quarter on average. If we run a hypothetical model of Government expenditures at $50 billion per quarter, you can see the issue of the ‘second derivative.’” – bto: Man sieht halt, dass die neuen Ausgaben ein immer geringeres “Delta” darstellen. Man müsste den Betrag jedes Mal erhöhen, wollte man denselben Grenzeffekt erreichen.

Quelle: RIA

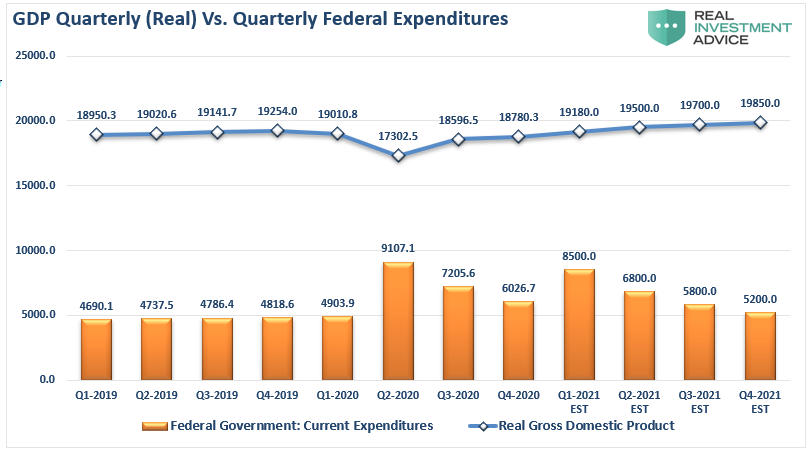

- “The following chart shows how the ‘second derivative’ is already undermining both fiscal and monetary stimulus. Using actual data going back to Q1-2019, Federal Expenditures remained relatively stable through Q1-2020, along with real economic growth. However, in Q2-2020, with our estimates through 2021, Federal Expenditures will double. However, economic growth rates will slow quickly after the stimulus expires.” – bto: weil die Last der Schulden auf der Wirtschaft lastet.

Quelle: RIA

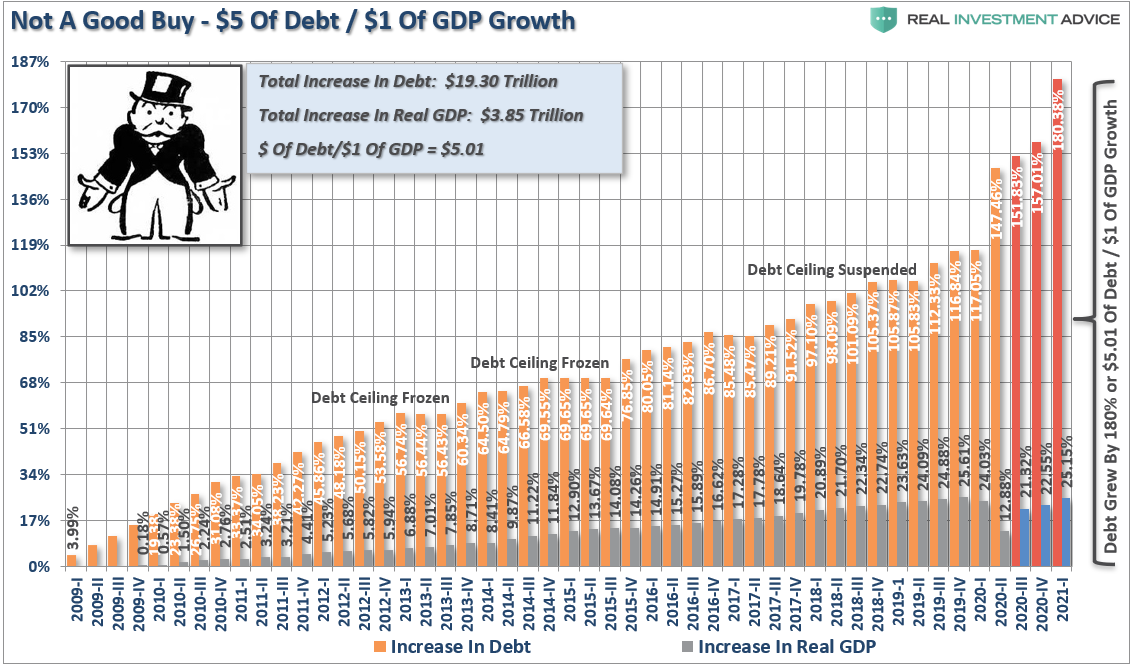

- “To understand this better, we can view it from how many dollars it requires to generate $1 of economic growth. Following the economic shutdown, when economic activity went to zero, each dollar of input had a more considerable impact as the economy restarted. However, going into 2021, economic activity has already recovered and started to stabilize at a slightly lower level than seen previously. Given that stabilization of activity, it will require more dollars to generate economic growth in the future. As shown, it will need nearly $5.50 of debt-supported expenditures to create $1 of economic growth.” – bto: Wie sollen die Schulden dann bedient werden?

- “That is NOT a new thing (…) the economy requires $5.01 of debt to create $1 of growth. While not a great return on investment, it will worsen as debt continues to retard economic growth.” – bto: Und das sieht – wie wir wissen – in anderen Ländern genauso aus. Wir haben das schon bei Hoisington gesehen: → Zur abnehmenden Wirkung von Schulden

Quelle: RIA

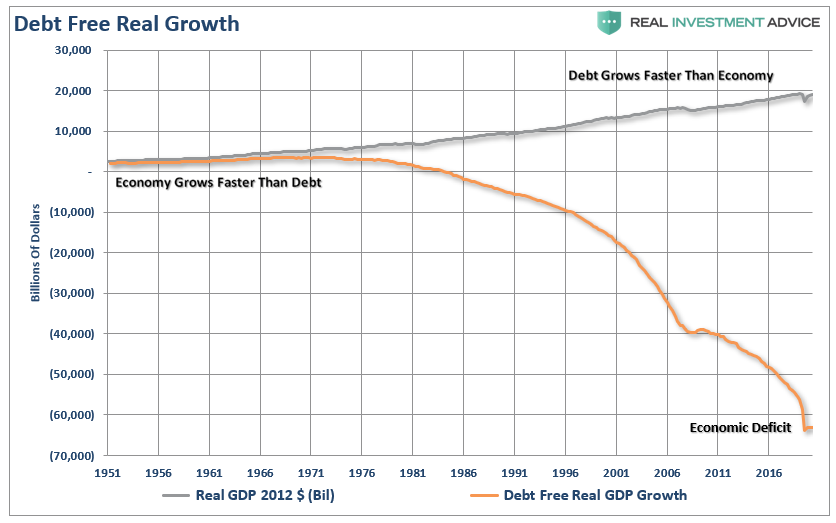

- “(…) more debt doesn’t lead to more robust economic growth rates or prosperity. Since 1980, the overall increase in debt has surged to levels that currently usurp the entirety of economic growth. With economic growth rates now at the lowest levels on record, the change in debt continues to divert more tax dollars away from productive investments into the service of debt and social welfare.” – bto: wie auch in Europa und leider seit Jahren auch in Deutschland. Das führt zu solchen Darstellungen:

Quelle: RIA

- “The hope over the last decade was the economy would eventually ‘catch fire’ grow organically. (…) However, such has never occurred. Each time Central Banks reduce monetary supports, the economy stalls or worse. (…) The ability to pull-forward future consumption through monetary interventions has been reached. Despite ongoing hopes of ‘higher growth rates’ in the future, such will likely not be the case until the debt overhang gets cleared. (…) Due to the debt, demographics, and monetary and fiscal policy failures, the long-term economic growth rate will run well below long-term trends. Such will only continue to widen the wealth gap, increase welfare dependency, and socialism continuing to usurp the ‘golden goose’ of capitalism.” – bto: Das Coole ist, dass es immer wieder gelingt, die Schuld für die schlechte Entwicklung dem Kapitalismus anzulasten und so die Begründung zu haben für noch mehr Interventionen und Schulden.

→ realinvestmentadvice.com: “#MacroView: Debt Fueled Spending Won’t Create Growth”, 9. April 2021