Referendum vorbei – Krise bleibt

Nun haben die Italiener abgestimmt. Kurz- und mittelfristig dürften sich die Konsequenzen in Grenzen halten, egal wie die Finanzmärkte heute auch reagieren. Bekanntlich denke ich, das dürfte das Leiden verlängern, weil nun die Regeln gelockert werden und Europa alles tun wird, um die Stimmung in Italien zu bessern.

Nüchtern bleiben jedoch die Fakten, die deutlich zeigen, dass Italien eben nicht dauerhaft im Euro überleben kann. Nur zur Auffrischung: die Argumente von Ambroise Evans-Pritchard im Telegraph:

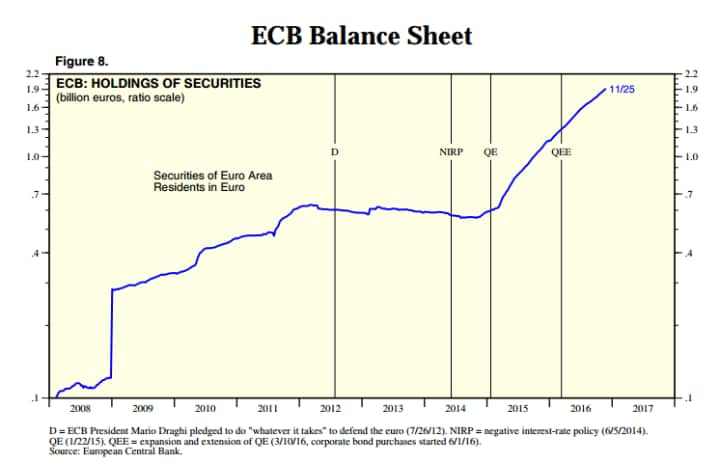

- “The moment of real danger for Italy will come as soon as the European Central Bank starts to taper bond purchases, or even hints at a change in course.” – bto: weil dann nämlich die Zinsen steigen (könnten!).

- “Italy’s problems never went away. They were disguised by quantitative easing and the artificial suppression of borrowing costs. The ECB’s €80bn purchases each month jammed the signalling system for sovereign credit risk.” – bto: natürlich nicht. Solange jedoch die Pleite des Landes ausgeschlossen wird, wären die Zinsen auch ohne EZB recht tief im heutigen Umfeld.

- “But even this has not been enough to stop the risk spread on Italian 10-year yields rising for several months as the banking crisis deepens, hitting a two-year high of 192 basis points earlier this week.” – bto: was aber mit einer allgemeinen Marktreaktion zu tun hat.

Quelle: IL SOLE, The Telegraph

- “The global reflation shock since the election of Donald Trump is bringing matters to a head faster than anybody could have imagined weeks ago. Italian borrowing costs have risen in lockstep with US Treasury yields, even though Italy is not reflating at all and is certainly not about to enjoy a fiscal shot in the arm.” – bto: Das stimmt. Es sind simpel nur höhere Zinsen für einen bankrotten Schuldner. Unangenehm.

- “Its banks own €400bn of Italian government bonds and these are suddenly worth less. (…) It is our old friend the ‘doom loop’. The banking crisis is driving up sovereign bond yields, and higher yields are in turn driving the banks into deeper trouble.” – bto: ein wirklicher Teufelskreislauf. Beide stützen sich gegenseitig oder ziehen sich in den Abgrund, je wie man es sehen will.

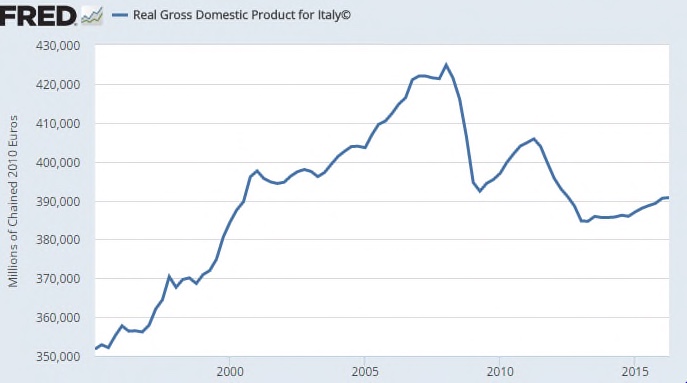

- “The country is stuck in a depressionary debt trap. Trend growth is below zero. GDP is still 9pc below its pre-Lehman peak. Industrial output is back to levels reached thirty-five years ago. (…) No large developed country in modern times has ever suffered such a fate.” – bto: was beweist, wie mächtig das Konstrukt des Euro ist.

- “(…) a vicious cycle of labour hysteresis as economic stagnation and weak productivity reinforce each other. Its exchange rate is overvalued by 20-30pc against Germany.” – bto: eine Lücke, die Italien nicht wird schließen können. Wie auch?

Quelle: ST LOUIS FED, The Telegraph

- “Italy cannot now deflate its way back to viability since this shrinks the underlying base of nominal GDP and automatically steepens the debt trajectory. It is impossible task for a country with a public debt ratio of 133pc of GDP, and is self-defeating in mechanical terms.(…) There is no plausible way out for Italy within the current contractionary structure of monetary union. Only ECB bond purchases forever can keep the lid on this pressure cooker.” – bto: was aber nur die Symptome bereinigt, nicht eine Heilung bewirkt.

- “Yet it is patently obvious that QE is nearing political, legal, and technical limits. The ECB already faces a lapidary attack by Otmar Issing, (…) ‚The no bailout clause is violated every day‘, he said.” – bto: was ja auch stimmt. Aber ohne die EZB wäre der Euro schon längst Geschichte.

- “The ECB has so far bought €1.4 trillion of bonds. Its balance sheet will reach 35pc of eurozone GDP by the end of the year at the current torrid pace, much higher than it ever reached in the US.” – bto: ohne Wirkung auf die Realwirtschaft übrigens.

Quelle: YARDENI, The Telegraph

- “It invites the perennial question whether Italy, Portugal, and perhaps others, can fund themselves at all in the capital markets, given that the eurozone has done almost nothing since the debt crisis of 2011-2012 to put monetary union on workable foundations.” – bto: Tja, solange die Märkte denken, irgendwer haut sie raus, wenn es hart auf hart kommt, ja.

- “There is still no fiscal union, no shared debt issuance, no banking union worth the name, and no expansionary New Deal to lift the economy off the reefs once and for all. All it has done is to tighten surveillance, hoping somehow that it can muddle through by riding on world demand.” – bto: eine Politik, an der die Gläubiger einen erheblichen Anteil haben.

- “The ECB’s Mario Draghi knows the dangers but he is caught in a Kulturkampf with the dominant power of Europe. Germans regard the experiment of QE and negative rates as a violation of the ‘Ordoliberal’ orthodoxies that anchor the nation’s post-War political and economic thinking.” – bto: Ich sehe die Risiken aus Deutschland nicht so. Im Wahljahr macht die Regierung alles, um die Illusion der Eurorettung aufrecht zu erhalten.

- “If Mario Draghi keeps pushing for more QE in this context, it will become almost impossible to silence criticism that his real objective is to hold down Italian yields and stave off the insolvency of his own country. Perhaps it is already impossible.” – bto: Auf jeden Fall liefert er populistischen Strömungen gute Argumente.