Protektionismus: Deutschland ist ein leichtes Ziel

Albert Ewards bringt es auf den Punkt: Deutschland ist (zu Recht) das eigentliche Ziel von Donald Trumps Handelspolitik. Für Edwards passt es in das “Ice Age”-Szenario. Klares Zeichen für das Endspiel:

- “Increasing trade tensions are an inevitable consequence of the side-effects of QE pursued by central banks – especially the ECB. In the near term, there are a couple of trade issues rankling the US Administration far more than steel and aluminium that could easily trigger a full-scale trade war. More immediate is the impending result of a US probe into China’s alleged theft of intellectual property. And boiling away in the background are Germany’s, and now too the eurozone’s, outsized trade surpluses.” – bto: Und im Unterschied zu dem, was unsere Führung immer wieder sagt, sind unsere Überschüsse wirklich ein enormes Problem. Für die Welt, aber auch für uns!

- “Edwards claims that President Trump ‚is a most unusual politician‘. Like him or loath him, he seems to be doing something politicians seldom ever do: namely, attempting to fulfill his election promises. This is most unusual!”

- “On the opposite end of the spectrum from Trump is Italy, which ‚easily wins the award of lying politicians‘ and which Edwards says is ‚perhaps the one reason electorate has turned its back on mainstream political parties‘ As a reminder, in the dramatic election outcome two weeks ago, euroskeptic, anti-establishment parties win a nominal majority, an unprecedented result for modern Europe. And, as Edwards correctly points out, ‚economic stagnation has coupled with political disappointment to turn a disillusioned and angry electorate away from the mainstream. To a greater or lesser extent, you can see this sort of electoral revolt in almost every single European country as well as in the US.‘” – bto: Das werden wir erst beim nächsten Abschwung erleben.

- “(…) since the inception of the euro at the start of 1999, Italian GDP has increased a paltry 8%. Contrast that with the UK and US, which have both grown around 45%, France and Germany at around 30%, and even Japan, which has grown around 20%! And Spain, despite seeing a gut-wrenching 10% decline in GDP between 2008 and 2013, has still enjoyed a massive 42% GDP rise since the euros inception. Italy’s economic performance is a disgrace for a G7 country and frankly intolerable. Against this backdrop, I’m amazed the vote for Italian radical parties wasn’t even higher!” – bto: Das kann man wohl sagen!!

- “The incredible yield suppression in the eurozone has seen capital flows haemorrhage out of the region in search of yield. This is why the ECB is largely responsible for placing the eurozone in the crosshairs of Trump’s newly aggressive protectionist measures.” – bto: So ist es. Die tiefen Zinsen fördern den Kapitalexport, damit den eigentlich schwachen Euro und natürlich auch die Handelsüberschüsse des Euroraumes.

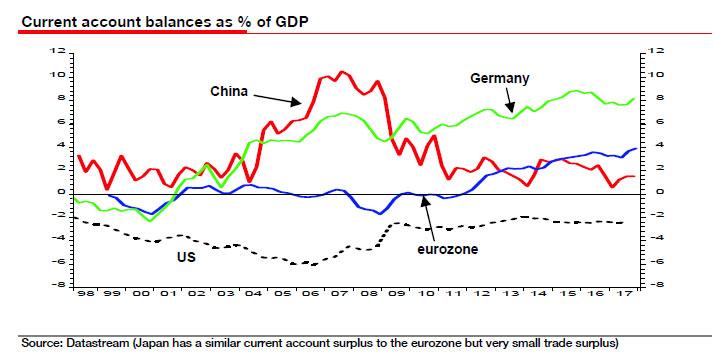

- “I believe Germany’s gargantuan trade and current account surplus will soon attract Trump’s full attention. The US has not been alone in criticising Germany’s outsized external surplus – so too have the European Commission, the IMF and the OECD. To be sure, other countries have a bigger surplus as a % of GDP, like Switzerland, Holland and Singapore, but these countries are relatively small. Germany’s surplus is now, in dollar terms, the biggest in the world. The eurozone surplus has also been rising in recent years to stand at 4% of GDP.” – bto: der Größte der Welt! Das müssen wir uns mal auf der Zunge zergehen lassen.

Quelle: SocGen

- “Making matters worse, everyone knows that it is Germany’s FX subsidy courtesy of the EUR – which replaced the far stronger Deutsche Mark – that makes Berlin one of the biggest currency riggers in the world. In fact, ‚a Chinese official commented a few years back that Germany, not China, was actually the world’s biggest currency manipulator – in tying its currency to far weaker economies, the real DM is massively undervalued.‘” – bto: Natürlich sagen unsere Politiker, dass wir nichts dafür können. Das stimmt aber nicht. Wir hätten zum Beispiel den Euro wirklich sanieren können.

“As a result, Edwards expects Trump to ‚soon turn his protectionist fire on both Germany and the EU. That will be messy.‘” – bto: Das kann man wohl sagen. Es würde nicht nur Deutschland in eine Rezession stürzen, sondern den Euro gleich ganz killen.