Potemkinsche Wirtschaft – ein Blick in die USA

Es lohnt sich, einen Blick auf die Treiber der US-Wirtschaft zu werfen. Keine überraschende, aber erschütternde Erkenntnis: Ohne die massiven Staatsdefizite wäre schon lange kein Wachstum mehr möglich gewesen:

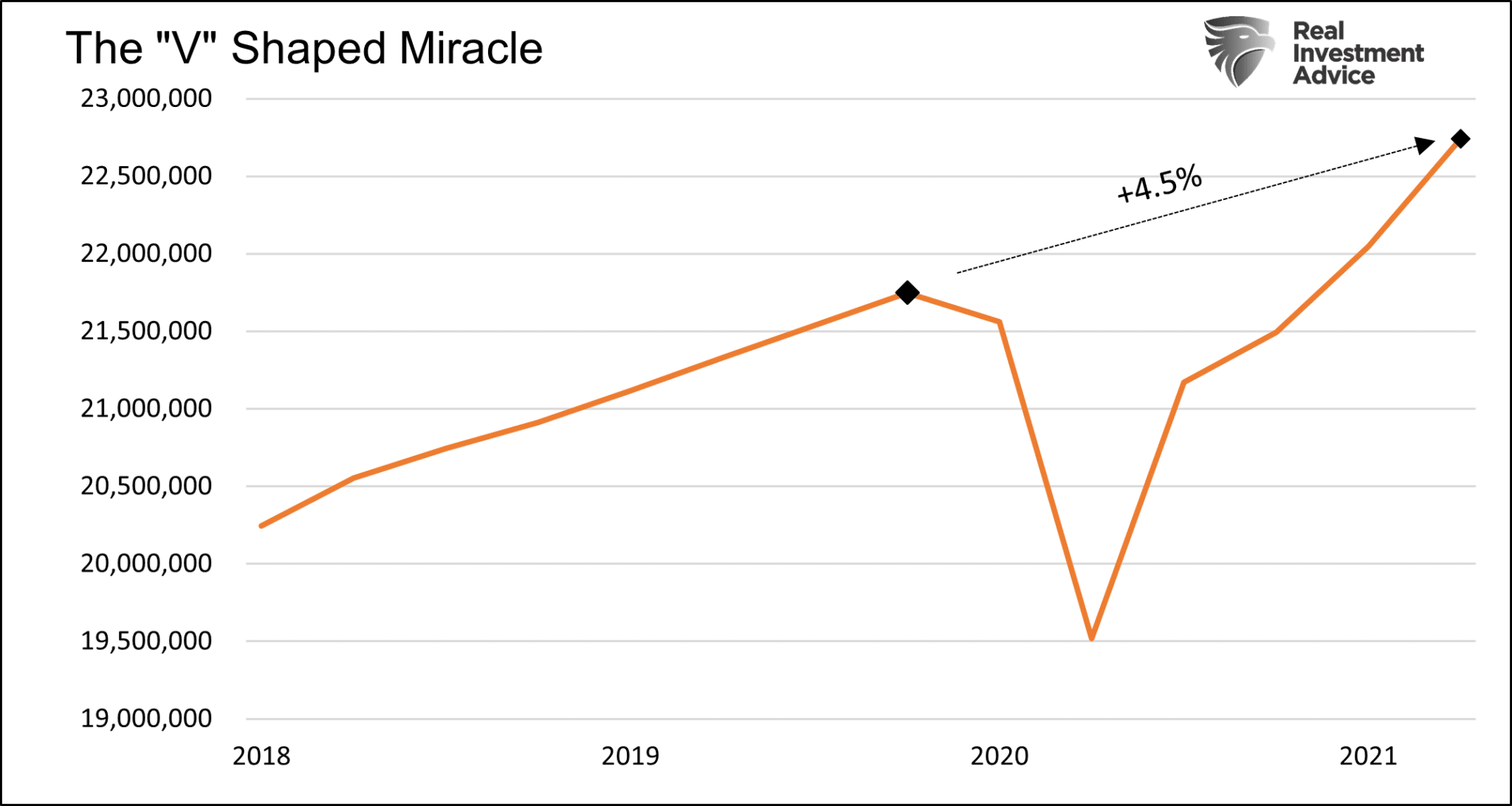

- “Narratives of a booming economic recovery can only mislead the public and investors for so long. Toss in robust economic data, and the façade seems awfully real. Consider the following: Nominal GDP is now 4.5% above the high-water mark set pre-pandemic. Historically, economic recoveries do not get more ‘V-shaped!’” – bto: in der Tat ein beeindruckender Aufschwung:

Quelle: Real Investment Advice

- “Many other measures of economic activity are fully recovered or will be shortly. The only major economic data point under some pressure is employment. Even that, however, is improving sharply from the Pandemic lows. (…) Supporting our belief is the fact there are more job openings than unemployed people.” – bto: Und die Menschen werden auch wieder in den Arbeitsmarkt zurückkehren.

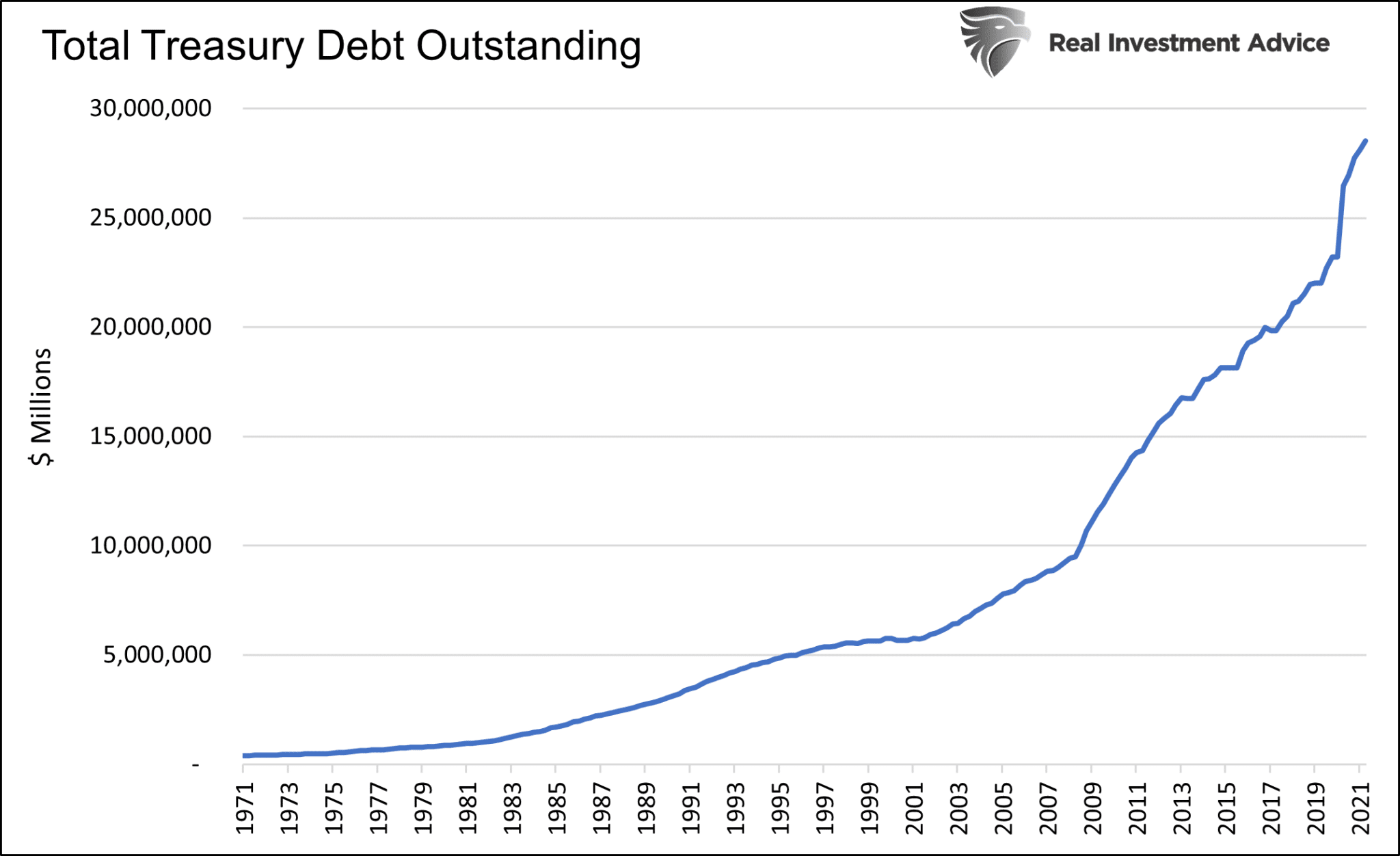

- “There is no doubting economic data is incredibly strong. However, what’s essential to understand is whether the economic activity is durable and sustainable or just a flimsy façade propped up by weak timbers that will erode in short order. (…) The pandemic recession was atypical. The global economy shut down in an unprecedented manner. To offset lost activity, the fiscal response from the government was massive. As shown below, Federal Debt outstanding rose by over $5 trillion in a little more than a year. As a comparison, debt increased by a little over $2 trillion during the 2008/09 financial crisis. Debt has grown at about six times the rate of the economy since the pandemic began. As a percentage of GDP, the current deficit is more significant than during the Civil War, WWI, Great Depression, and the Financial Crisis. Only the deficit funding WWII surpassed current levels. ” – bto: Nun wissen wir, dass es nötig war, zu intervenieren. Dennoch sind die Größenordnungen durchaus beeindruckend, vor allem, wenn sie in Relation zum BIP so sind.

Quelle: Real Investment Advice

- “Over the last year, the Fed bought more than half of the Federal debt issued. The graph below shows the Fed now holds 25% of all public Treasury debt outstanding. After the financial crisis, the percentage was less than 10 %.” – bto: Das kann Japaner und Europäer nicht wirklich beeindrucken.

- “The resulting rise in annual M2 money supply growth is the largest since at least the Civil War.” – bto: Dies dürfen wir halt nicht vergessen. Es muss zu mehr Geld führen.

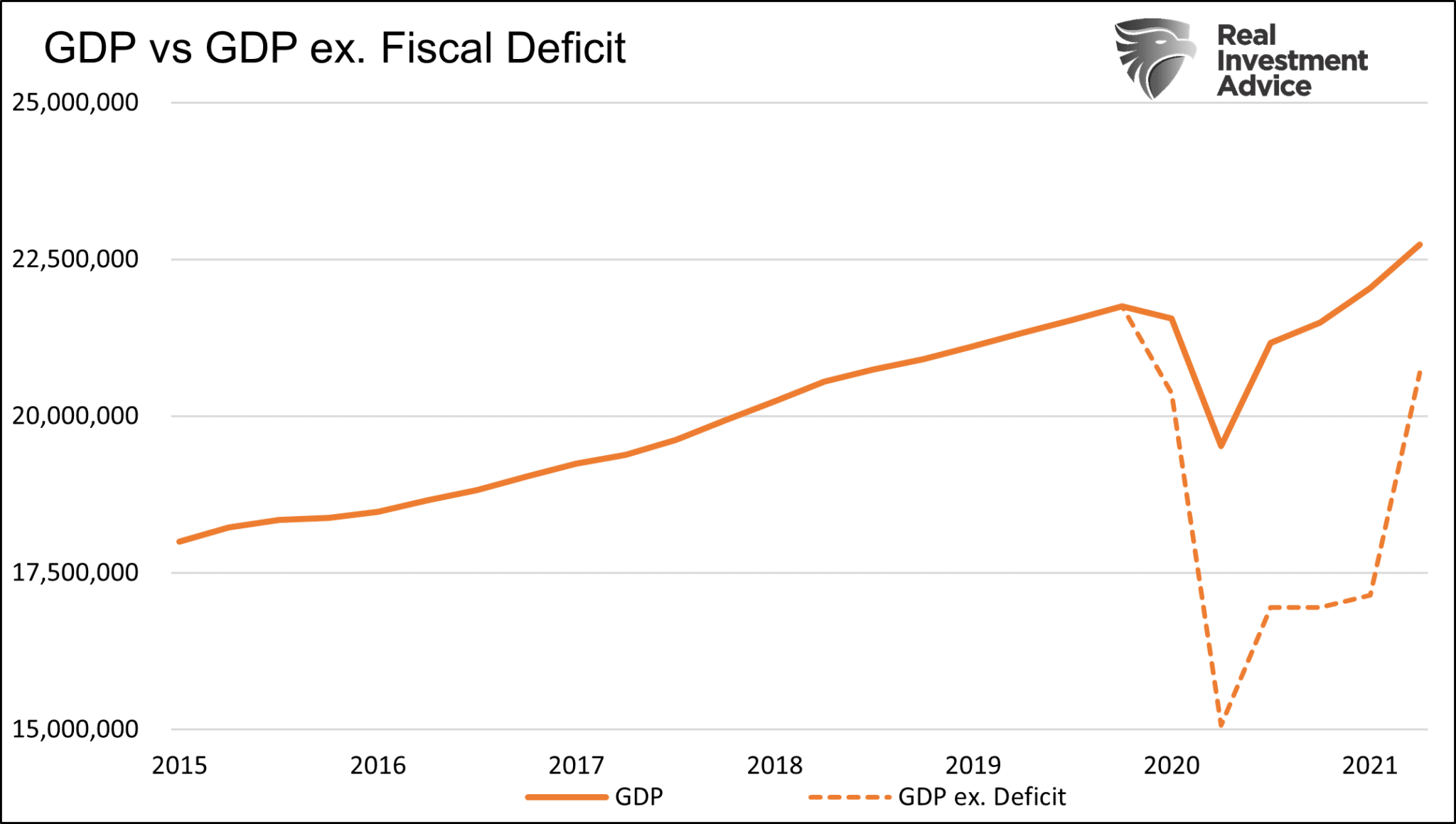

- “The graph below shows how government spending greatly boosted GDP The orange line shows GDP has fully recovered from the pandemic. The dotted-orange line, subtracting government spending from GDP, shows the organic economy is still 5 % below pre-pandemic levels. That is in stark contrast to GDP, which is running almost 5 % above pre-pandemic levels.” – bto: Auch hier kann man nur konstatieren, dass es nichts anderes ist als der erwünschte Effekt.

Quelle: Real Investment Advice

- “Politicians, economists, and even some Fed Presidents are increasingly concerned inflation may be persistent. (…) Persistent, not transitory, inflation poses significant problems for the Fed. To combat inflation, the Fed needs to raise rates and stop QE. If that doesn’t work, they would likely sell assets on their balance sheet. If the Fed tightens policy via the steps above, the Treasury’s job becomes much more complex and costly.Sustained inflation will weaken the foundation of the facade and blow our Potemkin economic recovery over.” – bto: Aber selbst ohne Inflation bliebe es doch bei der Erkenntnis, dass es dann zwar eine Zeit weiterginge, dennoch kann es nicht ewig so weitergehen.

- “As long as the foundation for the Potemkin economy can withstand economic and market pressures, our façade can last. However, there are limits to what the Fed can do. Inflation is one such limiter. If the Fed can thread the needle and taper QE but still adequately support post-crisis Treasury deficits, the façade may last longer than we think.” – bto: Und dann geht die Party an den Märkten weiter.

→ Real Investment Advice: „How Durable Is The Potemkin Economy?“, 17. November 2021