Platzt die „größte Blase aller Zeiten“?

Nun, angesichts der aktuellen Turbulenzen hat John Authers von Bloomberg mit Grantham gesprochen und um eine Einschätzung gebeten:

- “Grantham noted continuing signs of speculative excess, and the fact that many American investors still had piles of unspent cash burning a hole in their pocket. But standing back to view the bigger picture after Wednesday’s big rally, he could see he was missing the context. ‘This was the biggest decline of the S&P in the first four months of trading since I was one year old, in 1939,’ he said. ‘There’s a huge gap between perception and reality. The reality is that this is about as rapidly as any market comes down. And there are no rallies as spectacular as bear market rallies.’” – bto: Das war mir nicht so bewusst.

- “Back in the summer of 2007, Grantham warned that the stock market was like a brontosaurus, whose brain and nervous system were so inefficient that it would take a long time to realize that it had been bitten in the tail. Sure enough, subprime lenders began to go bankrupt in early 2007, and the stock market didn’t collapse until the fall of 2008. This time around, sauropod stocks are still taking their time to adjust to rising interest rates and high inflation. But they’re getting there.” – bto: Ich denke an die vielen Beiträge, die betonen, dass Aktien der beste Inflationsschutz seien.

- “In this century, fear of deflation and malaise came to be seen as the great problem. Now, inflation is back, and sentiment is being driven by the slow and steady brontosaurus-like discovery that it really isn’t very nice. ‘They’re beginning to experience that inflation is a bad idea,’ Grantham said, ‘but it’s taken them six months to get there.’”– bto: Ich erinnere mich auch noch gut an 2007, wo ungeachtet der sehr deutlichen Warnzeichen die Börsen weiter nach oben gingen. Das Problem für die Skeptiker ist, dass sie lange durchhalten müssen.

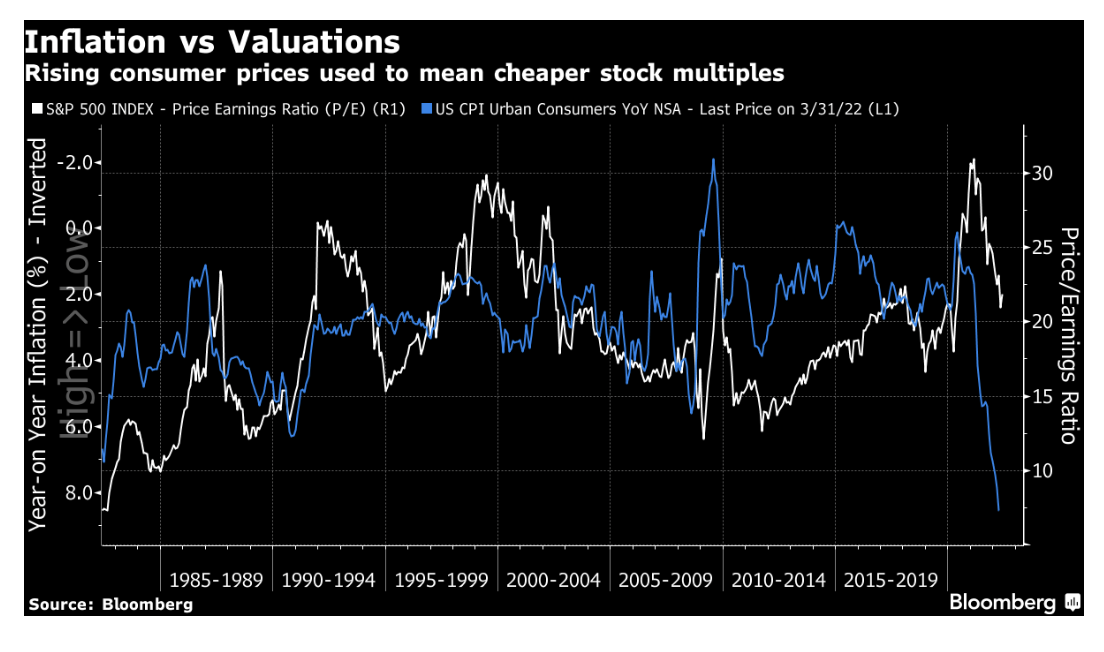

- “GMO’s models show that over history, inflation has a greater impact on stocks’ earnings multiples than anything else, and generally, it’s almost instant. This chart, showing the price/earnings ratio of the S&P 500 compared with the inverted inflation rate shows this crudely — when inflation rises, investors require a lower earnings multiple before they buy stocks. This time, p/es began to correct as inflation took off, although much of this was an attempt to unwind the excess caused by the pandemic. If inflation cannot be reeled in quickly, history suggests that multiples will have to fall much further.” – bto: Und wenn die Inflation nur durch eine deutliche Dämpfung der Konjunktur erzielt werden kann, sinken die Gewinne entsprechend.

Quelle: Bloomberg

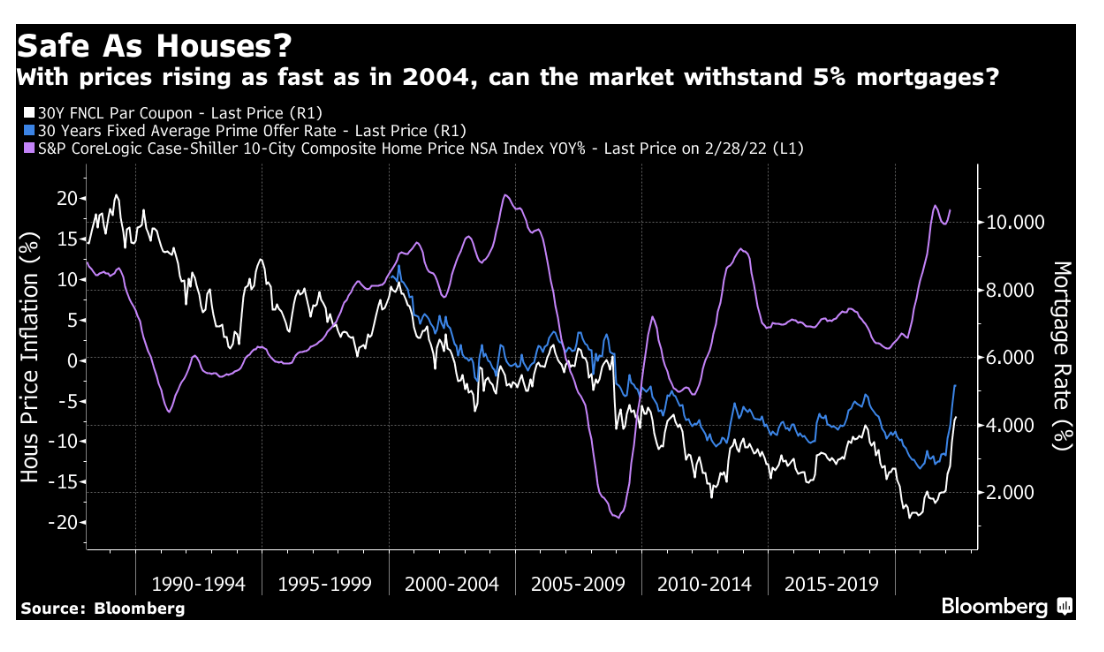

- “Where does this end? Grantham is convinced that this is the fifth great bubble of the modern era, following the U.S. in 1929, Japan in 1989, the dot.coms in 2000, and the Global Financial Crisis in 2008. With the exception of 2000, when the economy muddled through initially with only a relatively minor slowdown, all saw an immediate recession. The difference between 2000 and the others was that it was far more concentrated. U.S. tech stocks were absurdly overpriced but much of the economy was still reasonably valued. In the other bubbles, real estate prices were high, as they are now. Proportionate increases in mortgage rates on the scale we are currently witnessing therefore look very dangerous. ‘2000 showed you can just about skate through a stock market event,” said Grantham, “but Japan and 2008 showed you can’t skate through a housing crisis.’” – bto: Und wir wissen, dass es vor allem bei Immobilien die Preise in den letzten Jahrzehnten deutlich gestiegen sind.

Quelle: Bloomberg

- “The U.S. isn’t the only place with over-inflated housing prices. Cities like Vancouver, Toronto, Sydney and London all look similarly vulnerable to an increase in rates. On the face of it, the doubling of mortgage rates, and therefore mortgage interest payments for countries like the U.K., where variable-rate mortgages are still popular, makes a very dangerous combination with house prices that are inflating almost as fast as they did before the great U.S. housing bust that started in 2006.” – bto: Das wäre ein massiver deflationärer Impuls und damit – falls die These der “größten Blase” zutrifft – eine gefährliche Situation.