Platzt eine der größten Blasen?

Die US-Börse schwächelt seit einigen Wochen. Pause oder Auftakt zur großen Korrektur? Ich weiß es nicht. Aber es gibt ernstzunehmende Stimmen die Warnen. So – erneut – GMO, die ich schon mehrfach hier zitiert habe:

Immer wieder lesenswert:

→ Was steckt hinter den hohen Margen der US-Unternehmen?

→ Die kommende Blase bleibt ein Thema

Nun also die Warnung vor dem großen Einbruch:

- “(….) bearish advice in bubbles always comes from old fogeys who “just don’t get it,” because I received that old fogey advice back then and just didn’t listen. I doubt speculators in the current bubble will listen to me now; but giving this advice is my job and possibly the right thing to do. So, once more unto the breach, dear friends.” – bto: Klar, es gibt eine große “This time it`s different”-Fraktion.

- “This time last year it looked like we might have a standard bubble with resulting standard pain for the economy. But during the year, the bubble advanced to the category of superbubble, one of only three in modern times in U.S. equities, and the potential pain has increased accordingly. Even more dangerously for all of us, the equity bubble, which last year was already accompanied by extreme low interest rates and high bond prices, has now been joined by a bubble in housing and an incipient bubble in commodities.” – bto: und natürlich auch in den alternativen Assets wie Private Equity and Ventures.

- “What nobody seems to discuss is that higher-priced assets are simply worse than lower-priced ones. When farms or commercial forests, for example, double in price so that yields fall from 6% to 3% (as they actually have) you feel richer. But your wealth compounds much more slowly at bubble pricing, and your income also falls behind. Some deal! And if you’re young, waiting to buy your first house or your first portfolio, it is too expensive to get even started. You can only envy your parents and feel badly treated, which you have been.” – bto: Das ist der Effekt der Duration, den man sehr ernst nehmen muss.

- “And then there is the terrible increase in inequality that goes with higher prices of assets, which many simply do not own, and “many” applies these days up to the median family or beyond.” – bto: was zu Unzufriedenheit führt, wie man jeden Tag lesen und sehen kann.

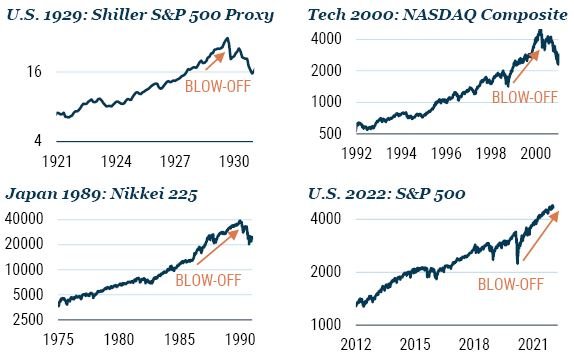

- “All 2-sigma equity bubbles in developed countries have broken back to trend. But before they did, a handful went on to become superbubbles of 3-sigma or greater: in the U.S. in 1929 and 2000 and in Japan in 1989. There were also superbubbles in housing in the U.S. in 2006 and Japan in 1989. All five of these superbubbles corrected all the way back to trend with much greater and longer pain than average.” – bto: Wir wissen, dass es zu sehr schweren Krisen kam oder aber zu langen Phasen geringen Wachstums.

“Today in the U.S. we are in the fourth superbubble of the last hundred years.”

- “Previous equity superbubbles had a series of distinct features that individually are rare and collectively are unique to these events. In each case, these shared characteristics have already occurred in this cycle. The penultimate feature of these superbubbles was an acceleration in the rate of price advance to two or three times the average speed of the full bull market. In this cycle, the acceleration occurred in 2020 and ended in February 2021, during which time the NASDAQ rose 58% measured from the end of 2019 (and an astonishing 105% from the Covid-19 low!).” – bto: also eine Beschleunigung des Aufschwungs an den Märkten.

- “The final feature of the great superbubbles has been a sustained narrowing of the market and unique underperformance of speculative stocks, many of which fall as the blue chip market rises. This occurred in 1929, in 2000, and it is occurring now. A plausible reason for this effect would be that experienced professionals who know that the market is dangerously overpriced yet feel for commercial reasons they must keep dancing prefer at least to dance off the cliff with safer stocks. This is why at the end of the great bubbles it seems as if the confidence termites attack the most speculative and vulnerable first and work their way up, sometimes quite slowly, to the blue chips.” – bto: In der Tat kann man das am US-Markt gut beobachten.

- “The most important and hardest to define quality of a late-stage bubble is in the touchy-feely characteristic of crazy investor behavior. But in the last two and a half years there can surely be no doubt that we have seen crazy investor behavior in spades – more even than in 2000 – especially in meme stocks and in EV-related stocks, in cryptocurrencies, and in NFTs.” – bto: Bei Krypto war mein Timing für den Podcast schon fast perfekt.

- “We have defined investment bubbles at GMO for over 20 years now by a statistical measure of extremes – a 2-sigma deviation from trend. For a random, normally distributed series, like the sum of tosses of a fair coin, a 2-sigma event should occur once every 44 trials in each direction. (…) In real life, though, humans are not efficient (in the economic sense) but are often quite irrational and can get carried away so that 2-sigma outliers occur more often than random – not every 44 years, but every 35 years. We studied the available data across all asset classes over financial history and found a total of more than 300 2-sigma moves. In developed equity markets, every single example of a 2-sigma equity bubble in the last 100 years has eventually fully deflated with the price moving all the way back to the trend that existed prior to the bubble forming.” – bto: Wenn das stimmt, wie erfolgt dann die Anpassung.

- “The key here is that two things are true: 1) the higher you go, the lower the expected future return; you can gorge on your cake now or enjoy it piece by piece into the distant future, but you can’t do both; and 2) the higher you go, the longer and greater the pain you will have to endure to get back to trend – in the current case to a trend value of about 2500 on the S&P 500, adjusted for the passage of time, from whatever high point the market might reach (currently at nearly 4700).” – bto: Das entspricht fast einer Halbierung.

- “(…) while it is dangerous to have a bubble in equities – for the loss of value can cause a shock through the wealth effect that can get out of control, which was a part of the problem in 1929 and the ensuing slump – it is much more dangerous to have a bubble in housing, and it is very much more dangerous to have both together. The economic consequences of the double bubble in Japan are arguably still playing out.” – bto: Und es wäre noch schlimmer gewesen, hätte Japan nicht von einer boomenden Weltwirtschaft profitiert.

Wo stehen wir heute?

- “First, we are indeed participating in the broadest and most extreme global real estate bubble in history. Today houses in the U.S. are at the highest multiple of family income ever, after a record 20% gain last year, ahead even of the disastrous housing bubble of 2006. But although the U.S. housing market is selling at a high multiple of family income, it is less, sometimes far less, than many other countries, e.g., Canada, Australia, the U.K., and especially China.” – bto: Ich erinnere an dieser Stelle an die Diskussionen vor einigen Wochen in Podcast und Blog.

- “Second, we have the most exuberant, ecstatic, even crazy investor behavior in the history of the U.S. stock market. The U.S. market today has, in my opinion, the greatest buy-in ever to the idea that stocks only go up, which is surely the real essence of a bubble.” – bto: was wir so sehen.

- “Third, as if this were not enough, we also have the highest-priced bond markets in the U.S. and most other countries around the world, and the lowest rates, of course, that go with them, that human history has ever seen.” – bto: Das ist doch die Begründung für die hohen Bewertungen und wie gestern gezeigt, werden Zinsen dauerhaft tief bleiben müssen. Also doch keine Blase?

- “And fourth, as gravy (as if we needed any) we have broadly overpriced, or above trend, commodities including oil and most of the important metals. In addition, the UN’s index of global food prices is around its all-time high (see Exhibit 2). These high prices are important as they push inflation and stress real incomes. The combination, which we saw in 2008, of still-rising commodity prices with a deflating asset price bubble is the ultimate pincer attack on the economy and is all but guaranteed to lead to major economic pain.” – bto: also realwirtschaftliche Probleme in Form steigender Kosten und gleichzeitig eine platzende Blase?

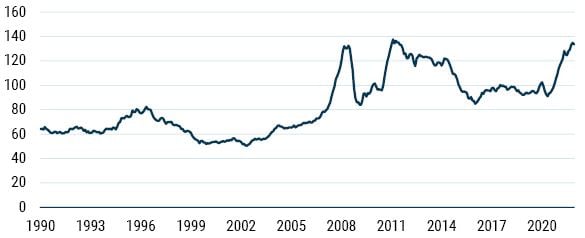

Abb.: UN FAO Food Price Index

Quelle: GMO

- “This time with world record stimulus from the housing bust days, followed up by ineffably massive stimulus for Covid. (Some of it of course necessary – just how much to be revealed at a later date.) But everything has consequences and the consequences this time may or may not include some intractable inflation. But it has already definitely included the most dangerous breadth of asset overpricing in financial history. At some future date, when pessimism rules again as it does from time to time, asset prices will decline. And if valuations across all of these asset classes return even two-thirds of the way back to historical norms, total wealth losses will be on the order of $35 trillion in the U.S. alone. If this negative wealth and income effect is compounded by inflationary pressures from energy, food, and other shortages, we will have serious economic problems.” – bto: Und nicht nur das, wir bekommen es auch mit massiven gesellschaftlichen Problemen zu tun.

- “The penultimate phase of major bubbles has been characterized by a ‘blow-off’ – an accelerating rate of stock price growth to two or three times the average of the preceding bull market. This pattern was shown as clearly as any of history’s other great superbubbles in 2020.” – bto: Die Abbildung unterstreicht das:

Abb.: Aktienblasen haben am Ende einen Blow-off:

Quelle: GMO

- “In the meantime, we are in what I think of as the vampire phase of the bull market, where you throw everything you have at it: you stab it with Covid, you shoot it with the end of QE and the promise of higher rates, and you poison it with unexpected inflation – which has always killed P/E ratios before, but quite uniquely, not this time yet – and still the creature flies. (Just as it staggered through the second half of 2007 as its mortgage and other financial wounds increased one by one.) Until, just as you’re beginning to think the thing is completely immortal, it finally, and perhaps a little anticlimactically, keels over and dies. The sooner the better for everyone.” – bto: Er ist also vorsichtig und sagt nicht, wann genau es so weit ist.

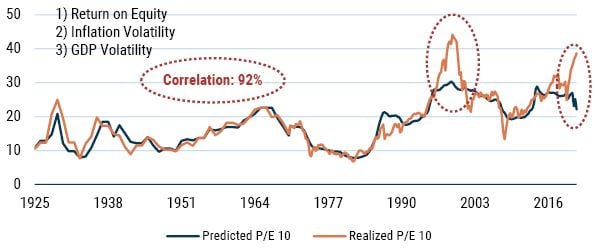

Hier die Bedeutung der Inflation für das P/E-Ratio und die Aussage, eigentlich müssten die Börsen schon korrigieren. Vielleicht tun sie es nicht, weil im Unterschied zu früher die Zinsen nicht steigen dürfen? Wobei auch das erhebliche negative Effekte hätte

Abb.: Die heutige Bewertung passt nicht zur Inflation

Quelle: GMO

Empfehlung für Investoren:

- “A summary might be to avoid U.S. equities and emphasize the value stocks of emerging markets and several cheaper developed countries, most notably Japan. Speaking personally, I also like some cash for flexibility, some resources for inflation protection, as well as a little gold and silver. (Cryptocurrencies leave me increasingly feeling like the boy watching the naked emperor passing in procession. So many significant people and institutions are admiring his incredible coat, which is so technically complicated and superior that normal people simply can’t comprehend it and must take it on trust. I would not. In such situations I have learned to prefer avoidance to trust.)” – bto: Das ist nachvollziehbar.