So ist das mit Prognosen!

So ist das mit Prognosen!

Albert Edwards heute Morgen dürfte zu den bekannten Kommentaren geführt haben. „Seit Jahren liegt er falsch …, so wie Sie Herr Stelter.“ ist dann noch einer der netteren.

Edwards selber greift die Kritik in seinem letzten Investorenbrief auf. Zu gut, um es nicht auch hier zu zitieren:

- “Its good to have a little humility in this business because its so darn humiliating when forecasts are proved wrong. And the bolder the forecast, the more humiliating it is! (…) One of the most leveling experiences at the end of an article or interview about my thoughts is to scroll down and read some of the readers comments.” – bto: Das verstehe ich gut!

- “Gordon Gould from Boulder, Colorado writes, ‚Barron’s notes that Société Générale’s Albert Edwards is a permabear. However, your readers would surely like to know how some of his previous calls have turned out. A quick Google search revealed that nearly five years ago, Edwards called for the Standard & Poor’s 500 index to hit 450 and gold to exceed $10,000. While even a broken clock is correct twice a day, perhaps in Edwards’ case, we’re talking about a broken calendar on Saturn, which takes about 29 years to orbit the sun.‘ Ouch!” – bto: ja, ouch. Das ist natürlich schon gemein. Denn Edwards hat recht, wenn er darauf hinweist, den Bullenmarkt bei Anleihen prognostiziert zu haben.

- “Where did it all go so wrong? In the Barrons interview, I explain why in my Ice Age thesis I still expect US equity prices to fall to new lows in the next recession. I always expected the equity markets day of reckoning to come in a recession with equity valuations falling to lower lows than in the two previous cyclical bear market bottoms in 2001 and 2009. If I am right, the next recession will see a lower level than the forward PE of 10.5x in March 2009. A forward PE of 7x and a 30% decline in forward earnings would take the market to new lows as part of a long-term secular valuation bear market (which began in 2001). Then the stratospheric rise in the market over the past few years will be seen as just a temporary aberration fuelled by QE.” – bto: Und hier geht es ihm wie mir und vielen anderen. Ich habe auch die Wirkung der Geldpolitik völlig unterschätzt und wie lange und massiv sie betrieben wird.

- “The moment of truth for my strategic Ice Ageview will come when we know how far the equity bear market will fall in the next recession, or conversely whether the bond bull market will continue with 10y US yields, for example, falling into negative territory.” – bto: In der Tat, das wäre dann die massive Intervention, um den erneuten Kollaps zu verhindern.

- “The lesson from Japan I told clients was that once their Great Moderation died in 1990, the economic cycle returned to normal amplitudeas private credit growth could no longer be induced to keep it going. Thus I expected that after the 2008 economic debacle the US economic cycle would return to normality and for recessions to become much more frequent events as they were in Japan after 1990. And as in Japan, I expected each rapidly arriving recession would take equity valuations down to new lower lows.” – bto: Aber Bernanke und Co. haben daraus gelernt und es eben viel aggressiver betrieben.

- “(…) increasingly, wiser heads than I, who did not leave the equity party early, are suggesting a top might be close. (…) Perhaps the greatest near-term threat to the stability of the equity markets is seen as the recent surge in bond yields, which are now testing the critical 3% technical level (…) which emphasizes the relevance of the 3.00%/3.05% support. Let me translate: 3% resistance is very strong but if broken, there is big trouble afoot!”

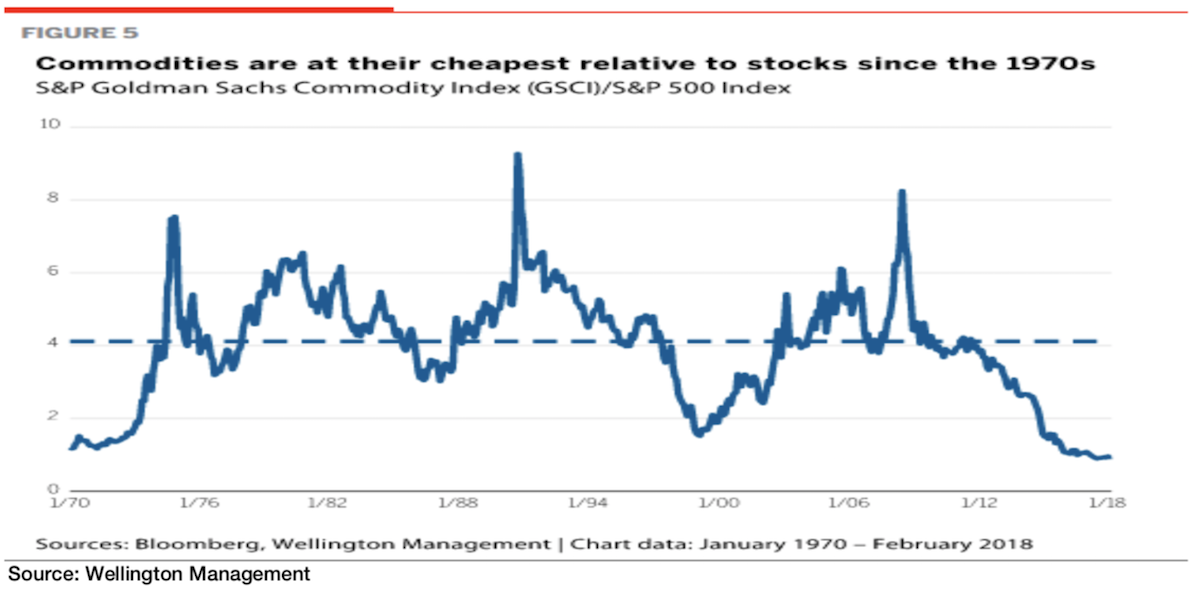

- “Many see the recent strength of industrial commodity prices as the start of a longer secular move. Hence I was intrigued by this chart form Wellington Managements Q2 Multi Asset Outlook. It shows commodities, which have been ripping upwards in recent weeks, at multi-decade lows relative to equity prices. If this implies a period of catch-up for commodities, then bond yields are indeed in real trouble. But perhaps the converse is true (…).” – bto: nämlich, dass die Börsen kollabieren …

Source: Wellington Management

- “Instead I think, like Mark Mobius, that equities are looking for an excuse to sell off and the current rally may abruptly end for any number of reasons. (…) But if I am wrong on bonds and we have seen the end of the bond bull market, after having been wrong on equities, maybe it is time to think hard on what the Barrons correspondent said and take a sabbatical maybe on Saturn.” – bto: Bei mir würde es schon eine kürzere Entfernung tun. Aber bekanntlich mache ich ja keine Prognosen, ich stelle sie nur zur Diskussion!