Klimapolitik: keine Kompetenz bei Notenbankern

Überall wird gefordert, dass die Notenbanken endlich die Politik gegen den Klimawandel unterstützen sollen. So auch in der FINANCIAL TIMES (FT):

- “We are facing a climate emergency that demands collective action and central banks must undergo another transformation, perhaps an uncomfortable one, to play their part in dealing with it. By reshaping their interventions in asset markets, they can accelerate reductions in carbon emissions and change the cost of capital to address hidden climate risks in the financial system.” – bto: Das schreibt kein Geringerer als der Chief Executive of Fidelity International.

- “Rather than waiting for governments to agree on legislation, investment programmes or carbon taxes, central banks can act now to reflect better the cost of climate change in the cost of capital and to change the behaviour of businesses, increasing it for emitters and lowering it for investment in carbon reduction.” – bto: Ich halte das für ausgemachten Blödsinn. → Die EZB und der Klimawandel

- “And separately, central banks could raid the macroprudential toolkit to impose additional capital requirements on activity that contributes to emissions. Central banks could consider expediting work on a ‘green’ Basel framework of bank capital measures as the next logical step, once they complete the foundational work of stress testing and developing a globally consistent taxonomy of green investments.” – bto: Allwissende Bürokraten agieren hier für einen guten Zweck. Ich kann es mir schon vorstellen.

Was für ein unrealistisches Ziel das ist, zeigt John Authers bei Bloomberg schön auf:

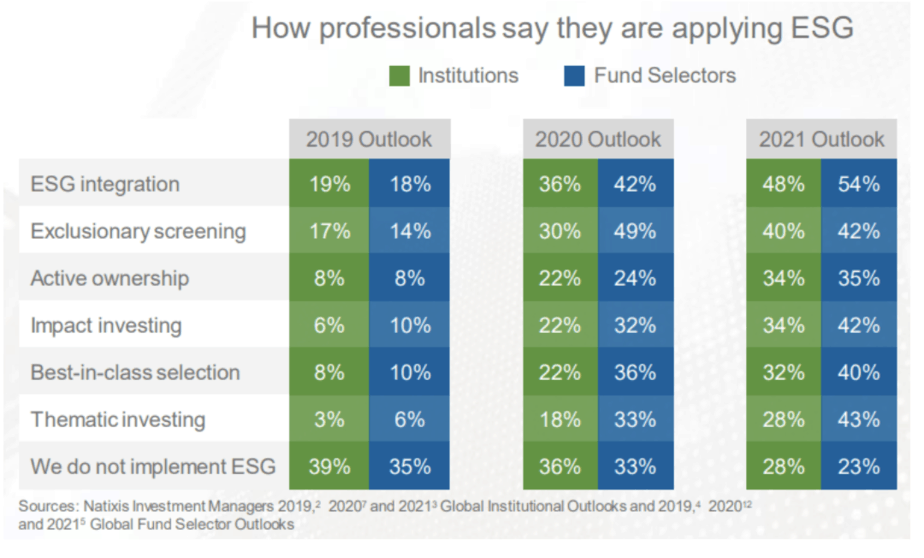

- “The money flowing into ESG ETFs has been impressive, while a survey of big institutions and fund selectors for Natixis SA shows a sharp increase in the numbers claiming to use ESG criteria when they allocate capital.” – bto: Das sagt erst mal nichts, nur, dass es ein gutes Geschäft ist.

Quelle: Bloomberg

Quelle: Bloomberg

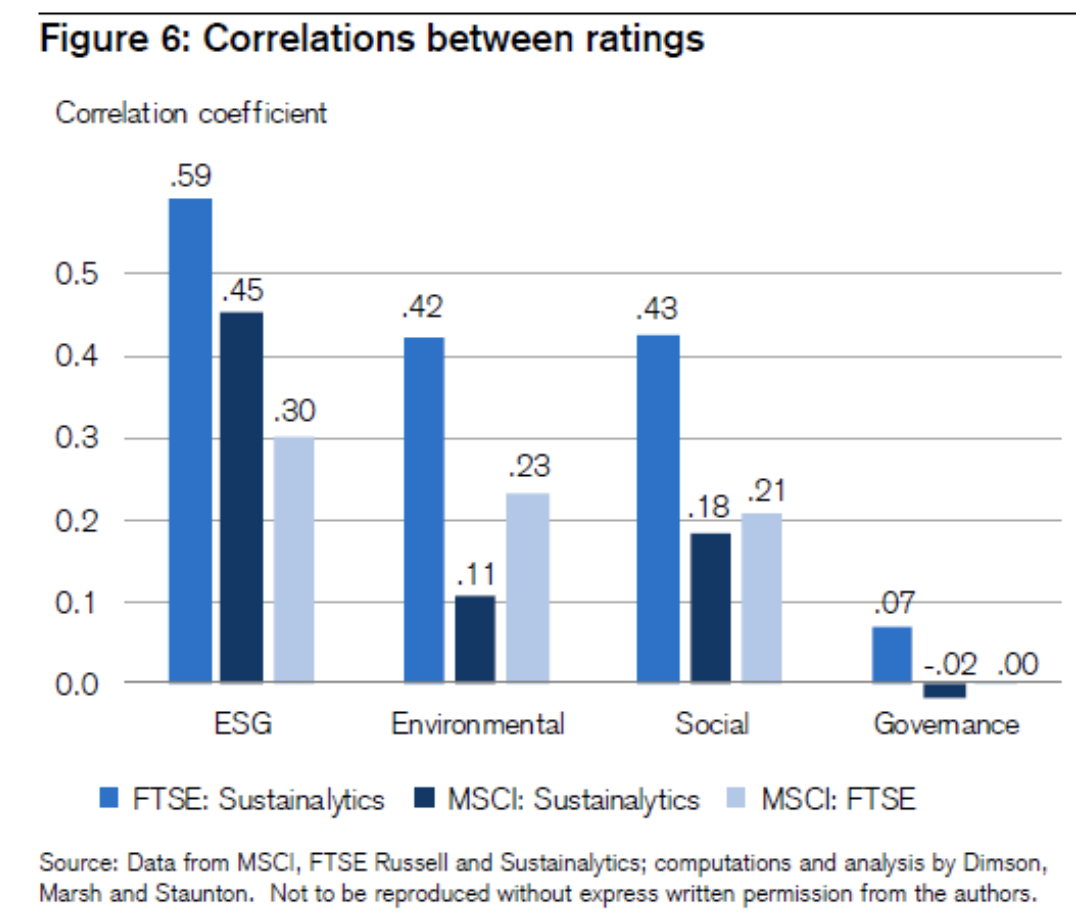

- “The ratings being used for ESG indexes are almost comically varied. In governance, in particular, there is almost no agreement between the main companies currently offering ESG ratings. The correlation between their choice of companies that score well on governance is almost zero, meaning that one rater’s opinion is of no guidance at all in guessing what another’s will be. (…) the following graphic, produced by the British academics Elroy Dimson, Paul Marsh and Mike Staunton for last year’s Credit Suisse Global Investment Returns Yearbook, in a Points of Return last year, and it remains relevant. It shows the degree of correlation between ratings from FTSE Russell, MSCI and Sustainalytics, all companies that offer ESG ratings for use in indexing.” – bto: Es ist schon witzig. Und darauf basierend sollen nun Notenbanken Vorteile gewähren? O. k., die EU will das mit der sogenannten Taxonomie ändern. Aber es wird immer ein Stückwerk bleiben.

Quelle: Bloomberg

- “All of this suggests that it is dangerous to attempt to use passive investing to encourage good behavior just yet. Companies are unclear as to exactly what they are being asked to do and how they are to be judged. Further, they will be tempted to “game” the evidently flawed metrics. Such issues also call into question how much government policy should incorporate climate risks. If the data are this unclear, for example, is there really a good case for monetary policy to include climate goals? As monetary policy is decided by people with expertise in monetary economics, and not necessarily climate science, they would be particularly vulnerable to relying on unreliable metrics.” – bto: So ist es. Wir haben dann marktferne Bürokraten, die einschneidende Entscheidungen treffen, die aber nicht unbedingt dem hehren Ziel dienen.