Nichts hat sich wirklich gebessert seit Lehman

Am Montag haben wir die Zahlen von McKinsey an dieser Stelle diskutiert. Martin Wolf, sehr smarter Volkswirt bei der FT hat darauf basierend beschrieben, weshalb sich nichts oder wenig seit der Finanzkrise geändert hat. Klare Zusammenfassung kann man da nur sagen:

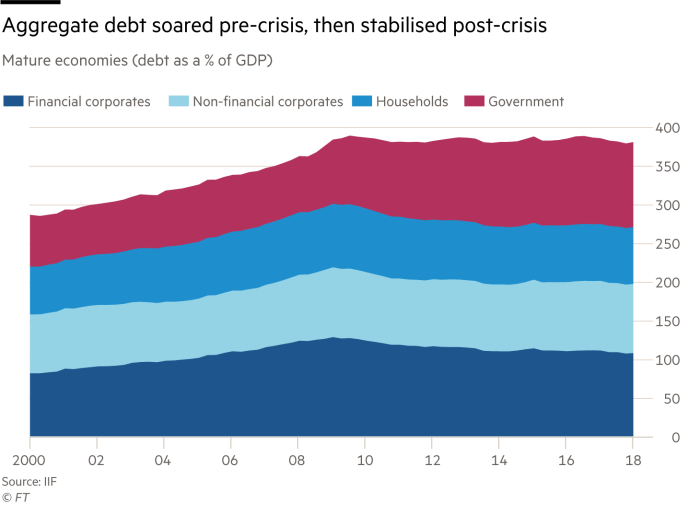

- “After the Great Depression and a second world war, people wanted change. They got it. France calls what followed les trentes glorieuses. (…) So what happened after the global financial crisis? Have politicians and policymakers tried to get us back to the past or go into a different future? The answer is clear: it is the former.” – bto: sie haben weiter gemacht, wie davor. Das sehen wir alleine schon an der gestiegenen Verschuldung:

- “After the crisis of 2008, they wanted to go back to a better version of the past in financial regulation. (…) The chief aim of post-crisis policymaking was rescue: stabilise the financial system and restore demand. This was delivered by putting sovereign balance sheets behind the collapsing financial system, cutting interest rates, allowing fiscal deficits to soar in the short run while limiting discretionary fiscal expansion, and introducing complex new financial regulations. This prevented economic collapse, unlike in the 1930s, and brought a (weak) recovery.” – bto: so gesehen war es richtig und erfolgreich.

- “Central banks acted as lenders of last resort, as they should. They also played the dominant role in macroeconomic stabilisation, as pre-crisis thought suggested. Their principal instrument remained interest rates, though they included long rates this time, because short rates reached zero. Shortly after the worst of the crisis had passed, fiscal policy turned towards austerity. The financial system is much as before, albeit with somewhat lower leverage, higher liquidity requirements and tighter regulation. Efforts to lower debt in the private sector were modest.” – bto: und schon diese geringen Bemühungen zum Deleveraging wirkten stark dämpfend auf die Wirtschaft.

- “Conventional wisdom still considers “structural reform” largely synonymous with lower taxes and de-regulation of labour markets. Concern is expressed over inequality, but little has actually been done. Policymakers have mostly failed to notice the dangerous dependence of demand on ever-rising debt. Monopoly and “zero-sum” activities are pervasive. Few question the value of the vast quantities of financial sector activity we continue to have, or recognise the risks of further big financial crises.” – bto: dabei sollten Banken eine Versorgungsfunktion haben und nicht eine dominierende.

- “It is little wonder populists are so popular, given this inertia, not to mention the miserable experience of so many citizens since the crisis and, in important cases, before that. Politics abhors a vacuum. Ideas as dangerous and divisive as those of US president Donald Trump or Matteo Salvini, Italy’s deputy prime minister, are bound to fill it. One cannot beat something with nothing.” – bto: ich denke aber auch, dass die Migration ein Thema ist.

- “What makes this even more shocking is that there is so little confidence that we could (or would) deal effectively with another big recession, let alone yet another big crisis.” – bto: ja, die Munitionslager sind leer. Dennoch denke wird es nochmal so richtig versucht werden, aus vollen Rohren.

- “Some have argued for a shift from debt to equity finance of house purchases. Others have called for the elimination of the tax deductibility of debt interest. Some note the perverse impact of executive incentives. Some argue convincingly for higher equity requirements on banks, rejecting the argument that this would halt growth. Others ask why only banks have accounts at central banks. Why should every citizen not be able to do so? Some wonder why we cannot use central banks to escape dependence on debt-fuelled growth.” – bto: alles wichtige Fragen, die auch bei bto immer wieder eine Rolle spielen.

Quelle: FT

- “A more likely cause of inertia is the power of vested interests. Today’s rent-extracting economy, masquerading as a free market, is, after all, hugely rewarding to politically influential insiders.” – bto: das ist die FT nicht die TAZ!!!!

Da hat er Recht: Yet the centre’s complacency invites extremist rage. If those who believe in the market economy and liberal democracy do not come up with superior policies, demagogues will sweep them away. (siehe die Überlegungen von Thomas Fricke letzte Woche an dieser Stelle).