Neuer Firmenname plus 2400 Prozent Kursgewinn

Wer noch daran zweifelt, dass es sich bei Bitcoins um eine Blase handelt, der sei auf folgende Geschichte verwiesen:

Der Telegraph berichtet:

- “Natural Resource Holdings, a small Israeli outfit that has invested in a group of precious metals mines, has seen its share price jump from 105 shekels (£22.40) to 2,615 shekels – a 2,400pc rise – since it announced it was moving into cryptocurrencies.” – bto: nur durch die Ankündigung hoch bewertete Assets zu kaufen! WOW.

- “In October, the company announced it was switching to working on blockchain – the database technology behind Bitcoin – and on Sunday it confirmed it is planning to buy a 75pc stake in Bitfarms, a Canadian company that ‚mines‘ cryptocurrency.” – bto: Der Kauf von Bitcoins eines Produzenten bedeutet also einen enormen Wertzuwachs an der Börse. Ich würde jetzt meine Anteile verkaufen, wenn ich investiert wäre.

- “Mining operations have become big business amid the stratospheric rise in cryptocurrency values. (…) The growth of the network means that mining now requires supercomputers and enormous energy bills, turning what was once an amateur hobby into a professional endeavour, carried out at companies like Bitfarms. The company is North America’s largest cryptocurrency mining operation (…).” – bto: und verbraucht bald allen Strom dort? Na, ich denke, es ist noch nicht das Ende der Party.

- “Before the announcement, Natural Resource Holdings was largely invested in a handful of gold, metal and silver mines across the US. It is far from the first listed company to cash in on investor excitement about cryptocurrency. Shares in London-based On-Line jumped over 300pc when it announced it was changing its name to ‚On-Line Blockchain‘, while shares in a small biotech firm, Bioptix rocketed more than 200pc after changing its name to ‚Riot Blockchain‘. – bto: Lasst uns feiern!

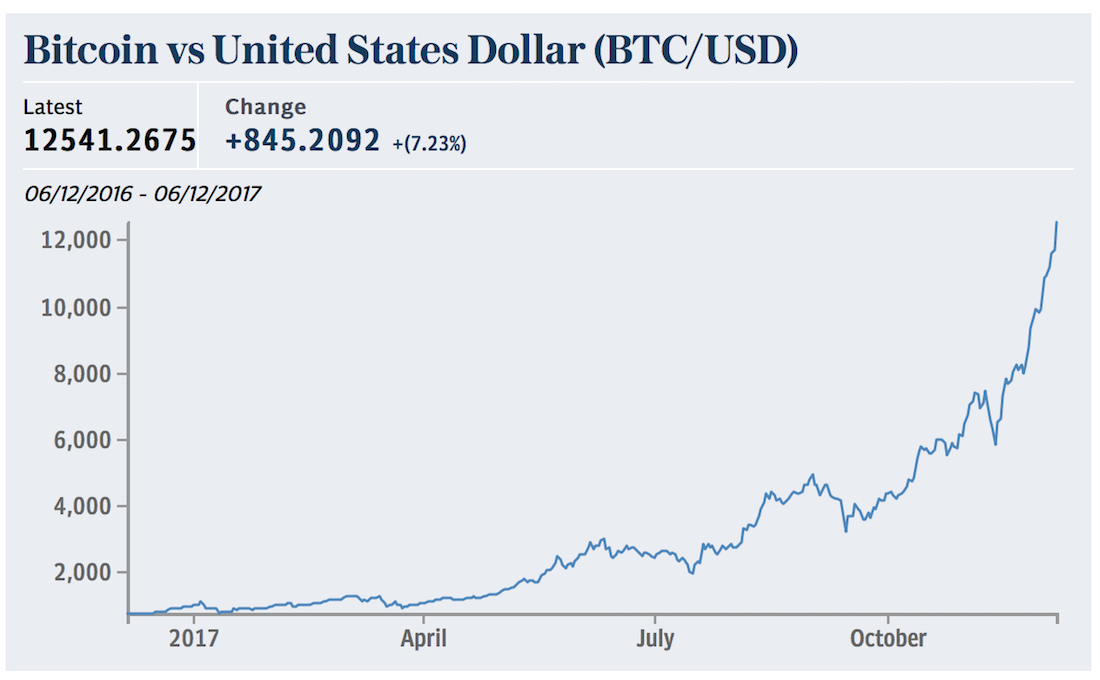

Hier nochmals das passende Chart:

Quelle: Telegraph