Negativzinsen führen zu geringeren Inflationserwartungen – nicht höheren, wie erhofft

Wo wir uns auf dem wohl unausweichlichen Weg in den Bereich der deutlich negativen Zinsen befinden – und damit verbunden zu Bargeldverbot, Kapitalverkehrskontrollen etc. – lohnt es sich, doch einen Blick auf das große „Vorbild“ zu werfen: Japan. Hat denn die Politik der negativen Zinsen dort gewirkt und die Inflationserwartungen nach oben getrieben? Die Studie, die ich gleich bespreche, wirft nicht unerhebliche Zweifel auf:

- “In many of the world’s advanced economies, central banks have set policy rates close to or below zero. Indeed, negative rates have been relatively common for some time in many countries. (…) we review recent research by Christensen and Spiegel (2019) analyzing the financial market’s reaction to negative policy rates and a number of other policies the Bank of Japan (BOJ) introduced to raise inflation and inflation expectations.” – bto: Das ist doch eine nahe liegende Frage. Hat es denn woanders gewirkt, ist auch ein wichtiges Zulassungskriterium bei Medikamenten, vor allem bei solchen mit erheblichen Nebenwirkungen.

- “Our market-based estimates indicate that, when the BOJ announced its plan to move to negative policy rates, inflation expectations actually declined and then continued to trend downward afterward. Therefore, Japan’s case is an extreme but potentially informative example illustrating the challenges associated with raising well-anchored inflation expectations through negative monetary policy rates.” – bto: Wenn die Notenbank laut von Deflationsängsten spricht und damit eigenes Handeln begründet, werden die Investoren skeptischer und erwarten weniger Inflation? Das ist ja mal eine Erkenntnis.

- “Japan has struggled with very low inflation since the mid-1990s. Its policy rate and related short-term interest rates have been close to zero for much of that time. Japan has also had an extensive experience with unconventional monetary policy, with limited apparent success.” – bto: Ja, danach sieht es wirklich aus. Kein großer Erfolg würde man da als Nicht-Notenbanker sagen.

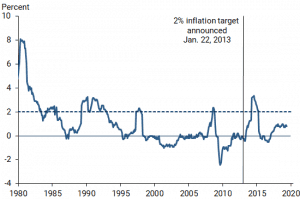

Japanese CPI inflation excluding fresh food:

Quelle: FED of San Francisco

- “(…) returns to investors (…) have continued to fall in Japan since the end of the global financial crisis in 2010. The extended period of weak conditions in Japanese financial markets provides an example of an environment where expectations of inflation are likely to be anchored at low levels, which is confirmed by survey data from Japan over this period.” – bto: Und das Beste ist, die Erwartungen waren auch noch korrekt. Damit hat man sich bestätigt gesehen und konnte noch mehr erwarten. Es gibt ja fundamentale Gründe für Deflation: Überkapazitäten, Zombies, hohe Schulden, Demografie und mehr.

- “Under (…) Abenomics, the Bank of Japan introduced a number of expansionary policies to raise inflation and inflation expectations. (…) Monetary policy easing included an increase in the inflation target to 2%, an expansion of the large-scale asset purchase program, and stronger forward guidance. However, after failing to achieve a sustained increase in inflation expectations with policy rates already at zero, the BOJ moved to negative rates in January 2016.” – bto: Nach dem Motto, wir müssen es nur noch stärker versuchen – wie für denjenigen mit dem Hammer, jedes Problem ein Nagel ist.

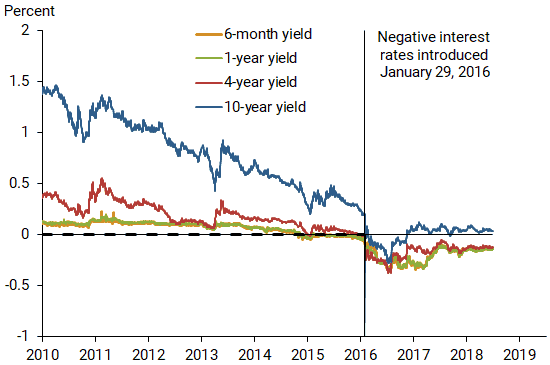

- “We assess the impact of monetary policy changes using the information contained in nominal and inflation-adjusted, or real, Japanese government bond yields. (…) we examine yields for the 23 inflation-indexed bonds issued by the Japanese government (…) Our sample contains bond yields for six maturities, four of which are shown in Figure 2, where the zero-bound constraint on short- and medium-term yields is clearly visible.” – bto: Man kann zumindest festhalten, dass nach einem deutlichen Rückgang der Zinsen eine leichte Erhöhung stattfand. Die Nominalzinsen für die zehnjährige Anleihe gingen sogar wieder über null.

Japanese nominal government bond yields:

Quelle: FED of San Francisco

- “(…) the inflation-indexed bonds issued since the 2% inflation target was announced in 2013 also provide ‘deflation protection,’ in that they pay off their nominal principal at maturity even if there is price deflation. Due to Japan’s very low inflation and occasional deflation over the past 20 years, this protection has turned out to be valuable—well over half a percentage point (50 basis points) for extended periods (…).” – bto: wie auch normale Anleihen einen solchen Schutz vor Deflation bieten.

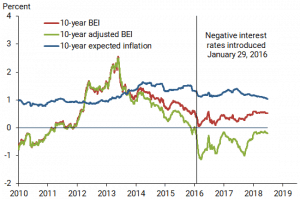

- “The difference between nominal and real yields of the same maturity, commonly known as the breakeven inflation (BEI) rate, is widely used to assess inflation expectations. (…) Figure 3 shows our estimates of 10-year BEI rates and expected inflation, with the BEI estimates since 2013 adjusted for deflation protection. The discrepancy between the adjusted BEI rate and estimated expected inflation can be interpreted as our estimate of the inflation risk premium.” – bto: In dem Beitrag erklären die Autoren, welche Anpassungen vorgenommen wurden, um der Deflationsversicherung und dem Inflationsrisiko Rechnung zu tragen. Die Daten sollen also akkurat die Veränderung der Erwartungen wiedergeben.

Estimates of 10-year breakeven inflation:

Quelle: FED of San Francisco

- “(…) inflation expectations immediately declined after the BOJ policy rate became negative, and dropped even lower at the end of our sample. (…) This announcement was largely unanticipated by financial market participants; the 10-year nominal yield dropped more than 9 basis points (0.09 percentage point) that day. The market’s reaction to the announcement therefore is likely to be informative about the policy’s effect on market participants’ inflation expectations.” – bto: Im Klartext kommen sie zu der Schlussfolgerung, dass die Inflationserwartungen der Marktteilnehmer gesunken sind und nicht gestiegen.

- “Figure 3 shows that the BEI rate was falling around the time of the negative rate announcement and dropped even more rapidly after adjusting for deflation protection. This suggests that the value of the deflation protection option in the market was increasing. (…) After adjustment, the change in the 10-year BEI rate following the BOJ policy change declined an estimated 8 basis points, split almost equally between a 3 basis point decline in 10-year expected inflation and a 5 basis point drop in the 10-year inflation risk premium.” – bto: was die Aussage nochmals verstärkt. Statt nun eine höhere Inflation zu erwarten und einzupreisen, wird eine tiefere Inflation als vor der Maßnahme erwartet.

- “Essentially, the market appeared to treat negative rates as bad news, perhaps because investors were concerned that the BOJ’s unprecedented move meant that economic conditions were worse than they thought. Indeed, both the 10-year expected inflation rate implied by our model in Figure 3 and corresponding surveys of expected inflation have trended lower since early 2016.” – bto: Das mag sein. Oder aber die Märkte durchschauen, dass die Medizin die Krankheit verschärft.