Monetarismus erklärt den Inflationsschub und spricht für einen Rückgang

In meinem Podcast am 22. Mai 2022 geht es um die Aussichten für die Inflation. Ich spreche erneut mit Tim Congdon, Gründer und Leiter des Instituts für internationale Währungsforschung an der Universität von Buckingham (GB). Condong ist ein führender Vertreter der monetaristischen Lehre und sagte frühzeitig die Rückkehr der Inflation vorher. So auch in Folge 83 (und #84 im Originalgespräch) von „beyond the obvious – der Ökonomie-Podcast mit Dr. Daniel Stelter“.

Zur Einstimmung einige Beiträge:

Heute ein Auszug aus einem der jüngsten Newsletter von Longview Economics. Chris Wattling, Gründer und Geschäftsführer war übrigens in Folge 79 zu Gast.

- „(…) in recent decades, monetarism became seen as a failed experiment, and was replaced by Keynesian ‘demand management’ with central banks charged with hitting a consumer price inflation target. With that, and starting with Greenspan in the late 1990s, central banks have quietly, and at several points along the way, dropped key money supply measures/analysis.“ – bto: Dies lag daran, dass es den Zusammenhang nicht mehr so gab – siehe Beitrag gestern.

- „The evidence of the past 2 years, though, with the introduction of helicopter money and aggressive policy responses in many parts of the globe, has seen a resurgence of the importance of monetary analysis.“ – bto: Nun war es offensichtlich, dass die Geldmenge eine Bedeutung hat.

- „(…) while various factors are important in the current inflation story (including lockdowns, substitutions effects between goods and services, commodity price shocks in part due to wars, absenteeism due to Long COVID, and so on), the dominant factor driving inflation is the massive surge in money growth brought about by the ‘helicopter money’ policies employed by the West.“ – bto: so unangenehm es den Kritikern der Monetarismus auch ist.

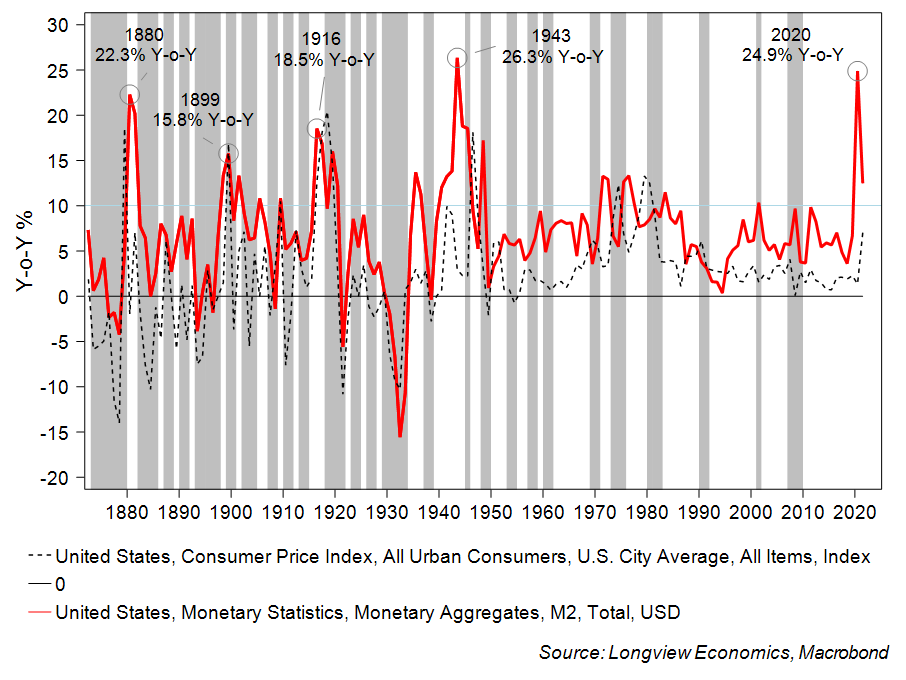

- „This is clearly evident in FIG 6 below which shows annual M2 money supply growth and consumer price inflation back to 1872.“ – bto: diese Abbildung zeigt aber genau wie wir gestern gesehen haben eine Abnahme der Korrelation in den letzten 40 Jahren.

- „As the chart shows, almost all prior spikes over 10% annual M2 growth in the past 140 years have been coincident with, or generally shortly followed by, a rapid acceleration in consumer price inflation. As the money supply growth then slows, CPI also slows (often, although not always, with a lag).“ – bto: Nachdem die Geldmengen deutlich weniger wachsen, ist ein Rückgang der Inflation absehbar.

- „Risks to that, as with all forecasts, are high. One major concern is the tightness of the US labour market (and the associated high service sector inflation). Less money to go around (as money supply growth slows), though, is more likely to lead to margin compression at companies rather than inflation (as a result of higher wages). In other words, when money tightens up, it becomes harder for companies to protect margins when faced with higher wage inflation (unless productivity growth is high). A second concern is that the money stock is still too high relative to nominal GDP (or put it another way there is still considerable excess savings in household bank accounts/i.e. future spending power). If that’s put to work, demand will remain too high for the available supply of goods and services – and inflation will remain at high levels.“ – bto: Aber auch das wäre ein vorübergehender Effekt.

- „In the 1970s, as the US and the west came off the Bretton Woods monetary standard, the prevailing economic ideology of the time was that fiscal policy should be used to fine tune the economy and ensure that unemployment was at low levels (i.e. 4% or lower). Monetary factors were, in many ways, largely ignored (until Volcker in 1979). (…) Today’s central bank targeting of the headline CPI growth rate, while not pure monetarism, does achieve its goals by (indirectly) controlling money supply growth. As such, it’s a stronger institutional framework for controlling inflation than that of the 1970s, with the implication that a repeat of the wage price spiral of the 70s is much less likely.” – bto: Das leuchtet mir ein. Dann haben wir einen Rückgang der Inflation, der zusätzlich durch die Straffungspolitik der Notenbanken verschärft wird. Also doch das Risiko einer Rezession?