MMT ist schon lange Praxis

Wer kauft die ganzen neuen Schulden der Staaten? Nun, wie MMT es immer wieder betont, schafft der Staat durch die Verschuldung das Geld selbst, da letztlich alles über das Konto des Staates bei der Notenbank läuft. Kaufen die Banken oder andere Investoren dann Anleihen, so ist das nur ein Aktivtausch für das Finanzsystem. Statt Zentralbankgeld werden dann Anleihen gehalten. Soweit so gut.

Dennoch spielt es eine Rolle, um welche Dimensionen es sich handelt. Und diesmal sind sie gigantisch und das wirft die Frage auf, was folgt?

- “There has been a rising concern as of late about surging inflation as the Government injects more stimulus into the economy. While it seems logical, the reality will be quite different as weak economic growth rates force the Fed to monetize the entirety of future debt issuances.” – bto: Und das gilt erst recht in Europa.

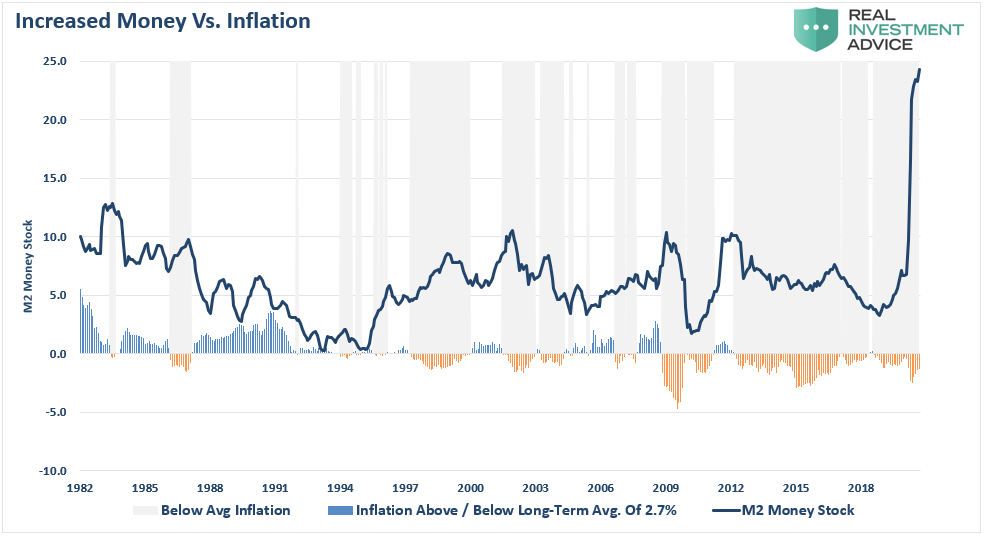

- “To fully explain why the Fed is now trapped, we must start with the inflation premise. The consensus expectation is the massive increases in monetary stimulus will spark inflationary pressures. Using the money supply as a proxy, we can compare the money supply changes to inflation.” – bto: Nun weiß auch ich – und die Leser von bto wissen erst recht –, dass es so simpel eben nicht ist.

Quelle: Real Investment Advice

- “What we find is since 1980, increases in the money supply tend to precede periods of below-average inflation. (…) As discussed previously: (…) High money velocity is usually associated with a healthy, expanding economy. Low money velocity is usually associated with recessions and contractions.” – bto: Und das hatten wir und bekommen es noch mehr.

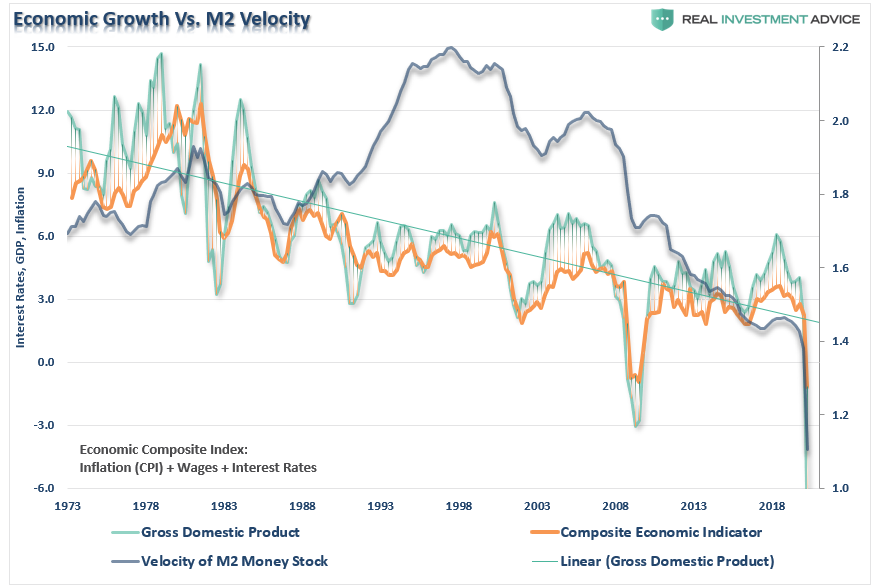

Quelle: Real Investment Advice

- “The question we must address is, ‘what happened in 1998’ caused monetary velocity to collapse? (…) In 1980, the Federal Reserve became active in monetary policy, believing they could control economic growth and inflationary pressures. Decades of their monetary experiment have succeeded only in reducing economic growth and inflation and increasing economic inequality.” – bto: Und das stimmt vor allem auch in Europa.

- “However, in 1998, the Federal Reserve “crossed the ‘Rubicon,’ whereby lowering interest rates failed to stimulate economic growth or inflation as the ‘debt burden’ detracted from it. When compared to the total debt of the economy, monetary velocity shows the problem facing the Fed.”

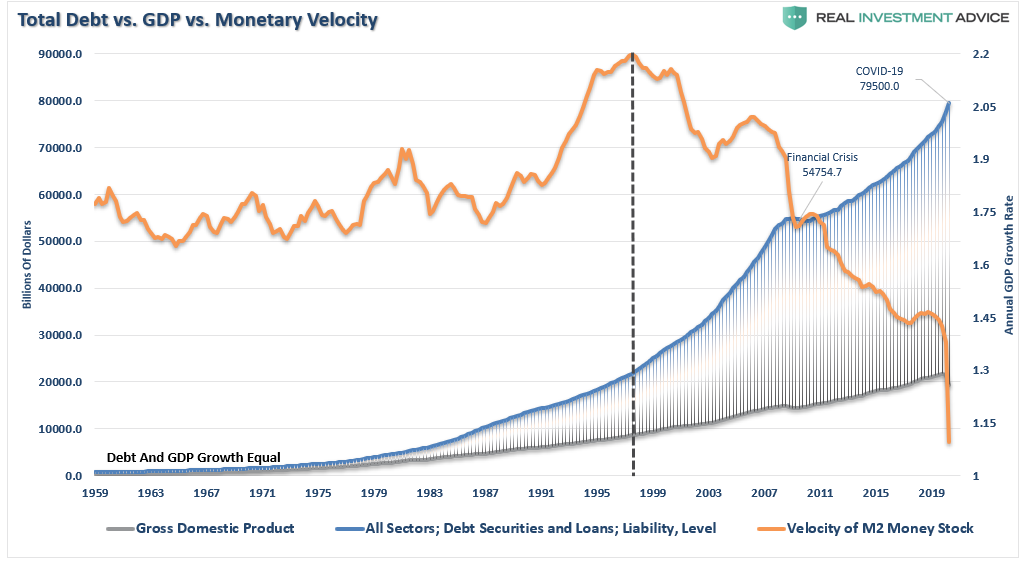

Quelle: Real Investment Advice

- “Look closely at the chart above. From 1950-1980 the economy grew at an annualized rate of 7.70%. The total credit market debt to GDP ratio was less than 150% to accomplish this growth rate. (…) Lower levels of debt allowed for personal savings to remain robust, fueling productive investment in the economy. Secondly, the economy focused primarily on production and manufacturing, which has a high multiplier effect on the economy. This growth feat also occurred in the face of steadily rising interest rates peaking with the economic expansion in 1980.” – bto: Es lag einfach daran, dass neue Kredite überwiegend produktiv eingesetzt wurden.

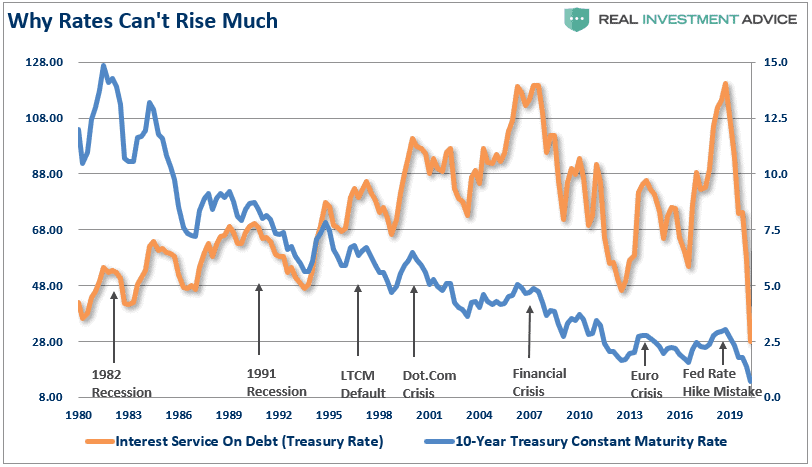

- “One of the biggest problems over the last decade is why interest rates don’t rise. (…) In an economy laden with $75 Trillion in total debt, higher interest rates have an immediate impact on consumption, which is 70% of economic growth. (…) each time rates have risen substantially from previous lows, there has been a crisis, recession, or a bear market. Currently, with rates at historic lows, consumers are rushing out to buy houses and cars. However, if rates rise to between 1.5 and 2%, economic growth will quickly stall.” – bto: Es ist eine asymmetrische Reaktion der Notenbanken, die jede Bereinigung von faulen Schulden und Zombies bereinigt.

Quelle: Real Investment Advice

- “In an economy that requires $5 of debt to create $1 of economic growth, changes to interest rates have an immediate impact on consumption and growth.” – bto: Natürlich, man hängt am Tropf des billigen Geldes.

- “An increase in rates curtails growth as rising borrowing costs slow consumption.”

- “As of October 1, the Fed now has $7.02 trillion in liabilities and $39.2 billion in capital. A sharp rise in rates will dramatically impair their balance sheet.” – bto: wobei ich das nicht sehe, dann ändern die einfach die Bewertungsregeln.

- “Rising interest rates will immediately slow the housing market. People buy payments, not houses, and rising rates mean higher payments.

- An increase in rates means higher borrowing costs and lower profit margins for corporations.

- Stock valuations have been elevated due to low rates. Higher rates exacerbate the valuation problem for equities.

- The negative impact on the massive derivatives market could lead to another credit crisis as rate-spread derivatives go bust.

- As rates increase, so do the variable rate interest payments on credit cards. With the consumer already impacted by stagnant wages, under-employment, and high living costs, a rise in debt payments would further curtail disposable incomes.

- Rising defaults on debt service will negatively impact banks that are still not adequately capitalized and still burdened by massive bad debt levels.

- The deficit/GDP ratio will surge as borrowing costs rise sharply.” – bto: am Ende des Weges in die Schulden-Sackgasse.

Die Fed steckt in der “liquidity trap”:

- “When injections of cash into the private banking system by a central bank fail to lower interest rates or stimulate economic growth. A liquidity trap occurs when people hoard cash because they expect an adverse event such as deflation, insufficient aggregate demand, or war. Signature characteristics of a liquidity trap are short-term interest rates remain near zero. Furthermore, fluctuations in the monetary base fail to translate into fluctuations in general price levels.” – bto: Das klingt nachvollziehbar.

- “(…) every ‘check box’ of a liquidity-trap has gotten filled:

- Lower interest rates fail to stimulate economic growth.

- Short-term interest rates near zero.

- Fluctuations in monetary base fail to translate into general price levels.

- People hoard cash because they expect an adverse event (economic crisis).

- Fed Monetize Debt Issuance.” – bto: Und genau das wird nun passieren.

- “In an economy supported by debt, rates must remain low. Therefore, the Federal Reserve has no choice but to monetize as much debt issuance as is needed to keep rates from substantially rising. Unfortunately, higher levels of debt continue to retard economic growth keeping the Fed trapped in a debt cycle as hopes of ‘growth’ remain elusive. The current 5-year average inflation-adjusted growth rate is just 1.64%, a far cry from the 4.79% real growth rate in the ’80s.” – bto: Wir bekommen also immer weniger Wachstum. Auch das leuchtet ein: Zombies und Spekulation und das “Zeigen” von Zinsen.

- “The debt problem exposes the Fed’s risk and why they have no choice but to monetize the Government’s debt issuance to keep interest rates suppressed. More importantly, the decline in monetary velocity clearly shows that deflation is a persistent threat, and one the Fed is most afraid of.” – bto: Es wirkt entsprechend deflationsverstärkend, was da gemacht wird.

- “The Federal Reserve has no real options unless they are willing to allow the system to reset painfully. (…) Ultimately, the Federal Reserve, and the Administration, will have to face hard choices to extricate the economy from the current ‘liquidity trap.’ However, history shows that political leadership never makes hard choices until those choices get forced upon them. While we continue to ‘hope’ we can ‘grow’ our way out of our debt problem, ‘hope’ has never been a functional strategy for fixing problems.” – bto: Stimmt, nur was die Lösung ist, bleibt auch hier offen.

→ realinvestmentadvice.com: „The FED will monetize all of the debt issuance“, 30. Oktober 2020