Minus 63 Prozent an der US-Börse?

Mehrfach habe ich mich an dieser Stelle mit der Bewertung an den Märkten auseinandergesetzt und dabei auch die Arbeiten von John Hussman erwähnt.

Heute tue ich dies erneut. Immer wieder ist zu lesen, dass es auch noch weiterhin bergauf gehen kann an der US-Börse. Die Zinsen bleiben tief, das ist Wachstum langsam und die politischen Risiken sind ohnehin nicht so relevant für die Börse. Da die US-Börse, ob wir es nun mögen oder nicht, weiterhin bestimmend bleibt für die Weltmärkte, lohnt es sich aber, auch auf die kritischen Stimmen zu hören:

- “Nothing in history leads me to expect that current extremes will end in something other than profound disappointment for investors. In my view, the S&P 500 will likely complete the current cycle at an index level that has only 3-digits. Indeed, a market decline of -63 % would presently be required to take the most historically reliable valuation measures we identify to the same norms that they have revisited or breached during the completion of nearly every market cycle in history.” – bto: Naja, ein Rückgang um 63 Prozent sagt nun auch nicht jeder voraus. Sonst nur Albert Edwards.

- “(…) any investor familiar with discounted cash flow valuation should recognize that if interest rates are lower because expected growth is also lower, the prospective return on the investment falls without any need for a valuation premium.” – bto: Das ist ein ganz wichtiger Punkt. Tiefere Zinsen rechtfertigen deshalb keine höheren Aktienkurse, da die Zinsen auch das künftige Ertragswachstum widerspiegeln. Da könnte man natürlich sagen, wenn wir erfolgreiche finanzielle Repression haben, könnten die Zinsen unter der Wachstumsrate liegen und doch höhere Kurse rechtfertigen. Dann aber nur für wenige Jahre.

- “With regard to future economic growth prospects, the fact is that demographic factors constrain likely U.S. labor force growth to just 0.3 % annually in the coming years, while U.S. productivity growth has declined from 2% annually in the post-war period, to 1 % annually over the past decade, and just 0.6 % annually over the past 5 years. Add 0.3 % and 0.6 %, and the baseline expectation for U.S. economic growth in the coming years is just 0.9 % annually, assuming that the unemployment rate does not rise at all from the current level of 4.3 %.” – bto: was zur säkularen Stagnation/Eiszeit hervorragend passt.

- “At present, however, we observe not only the most obscene level of valuation in history aside from the single week of the March 24, 2000 market peak; not only the most extreme median valuations across individual S&P 500 component stocks in history; not only the most extreme overvalued, overbought, overbullish syndromes we define; but also interest rates that are off the zero-bound, and a key feature that has historically been the hinge between overvalued markets that continue higher and overvalued markets that collapse: widening divergences in internal market action across a broad range of stocks and security types, signaling growing risk-aversion among investors, at valuation levels that provide no cushion against severe losses.” – bto: Man könnte auch sagen: Blase.

- “(…) internal dispersion is becoming apparent in measures that are increasingly obvious. For example, a growing proportion of individual stocks falling below their respective 200-day moving averages; widening divergences in leadership (as measured by the proportion of individual issues setting both new highs and new lows); widening dispersion across industry groups and sectors, for example, transportation versus industrial stocks, small-cap stocks versus large-cap stocks; and fresh divergences in the behavior of credit-sensitive junk debt versus debt securities of higher quality. All of this dispersion suggests that risk-aversion is rising, no longer subtly. Across history, this sort of shift in investor preferences, coupled with extreme overvalued, overbought, overbullish conditions, has been the hallmark of major peaks and subsequent market collapses.” – bto: Und es gibt auch gute Gründe für diese Vorsicht.

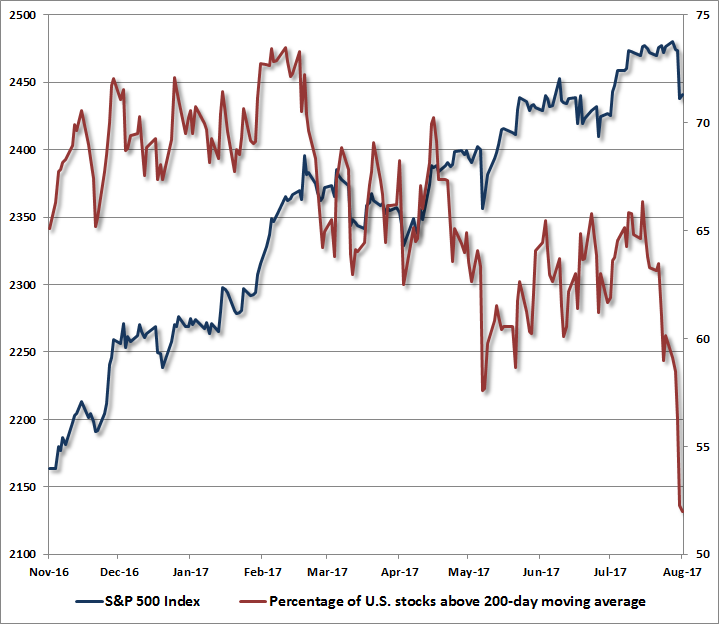

- “A few graphs will update the present situation. The chart below shows the percentage of U.S. stocks above their respective 200-day moving averages, along with the S&P 500 Index.”

Quelle: John Hussman

- “Last week, both new highs and new lows on the NYSE exceeded 7 % of total issues traded. Over the past three decades, I’ve periodically described this kind of internal dispersion as a negative consideration for the market (h/t Norm Fosback), particularly when it is joined by lopsided bullish sentiment and negative market internals across our own measures. While we don’t view this divergent leadership as necessary or sufficient for either a market peak or severe subsequent losses, it’s notable that the same set of features also emerged near the 1973, 1987, 2000 and 2007 peaks.” – bto: Ich denke auch, dass es mit dem Timing schwer ist. Sicher ist jedoch, dass man auf heutigem Preisniveau nur geringe künftige Renditen einfährt.

- “In my view, rich valuations are not at all ‚justified‘ by low interest rates. Rather, to the extent that low interest rates persist, it is likely to be because of failing U.S. economic growth. If one understands how assets are priced, that is a combination that justifies no valuation premium at all. Yet even if economic growth was to accelerate to historically-normal levels, and interest rates were held 3 % below their own historical norms for a full decade, only a premium of 30 % (10 years x 3 %) could be justified. Instead, the most reliable valuation measures we identify are about 170 % above (2.70 times) their historical norms.” – bto: Das ist der Punkt von oben. Man könnte eine Prämie ableiten, aber eben nicht in dem Maße, wie sie an der Börse sichtbar ist.

- “A market loss of [1/2.70-1 =] -63 % over the completion of this cycle would be a rather run-of-the-mill outcome from these valuations. All of our key measures of expected market return/risk prospects are unfavorable here. Market conditions will change, and as they do, the prospective market return/risk profile will change as well. Examine all of your investment exposures, and ensure that they are consistent with your actual investment horizon and tolerance for risk.” – bto: klare Ansage. In Deutschland sind wir deutlich günstiger, aber auch oberhalb der langjährigen Mittelwerte.

→ Hussman: „Broadening Internal Dispersion“, 14. August 2017