Lasst uns tanzen?

Beiträge von Jeremy Grantham und seinen Kollegen von GMO werden häufig bei bto besprochen. Immer wieder faszinieren die gründlichen Analysen, die nicht nur negativ sind. So verweisen sie schon seit Jahren auf das erhebliche Potenzial in den Emerging Markets.

Immer wieder lesenswert:

→ Was steckt hinter den hohen Margen der US-Unternehmen?

Und vor allem:

→ Die kommende Blase bleibt ein Thema

Darin hat Grantham erklärt, dass wir wohl erst einen richtigen “Melt-up-Boom” erleben müssen, bevor die Blase an den Börsen platzt. Nun könnte es soweit sein, meint er zumindest in seinem neuesten Kommentar. Die Highlights:

- „The long, long bull market since 2009 has finally matured into a fully-fledged epic bubble. Featuring extreme overvaluation, explosive price increases, frenzied issuance, and hysterically speculative investor behavior, I believe this event will be recorded as one of the great bubbles of financial history, right along with the South Sea bubble, 1929, and 2000.“ – bto: Es gibt aber nicht wenige ernst zu nehmende Stimmen wie Robert Shiller, die mit Blick auf die tiefen Zinsen und hohen Anleihenkurse die Meinung vertreten, dass Aktien auf jeden Fall besser performen als Bonds. Na ja, das könnte auch bedeuten, sie verlieren weniger.

- „(…) this bubble will burst in due time, no matter how hard the Fed tries to support it, with consequent damaging effects on the economy and on portfolios. Make no mistake – for the majority of investors today, this could very well be the most important event of your investing lives.“ – bto: Ich denke, unabhängig von Blasenängsten haben wir eine viel problematischere Situation: Es ist nicht nur eine Blase an den Märkten für Vermögenswerte, sondern eine Überschuldungssituation der Gesamtwirtschaft. Damit droht der Systemkollaps – offenbleibt dabei aber, ob und wie sich dieser organisieren bzw. abmildern lässt.

- „The real trouble with asset allocation (…) is (…) when asset prices move far away from fair value. This is not so bad in bear markets because important bear markets tend to be short and brutal. The initial response of clients is usually to be shocked into inaction during which phase the manager has time to reposition both portfolio and arguments to retain the business. The real problem is in major bull markets that last for years. Long, slow-burning bull markets can spend many years above fair value and even two, three, or four years far above. These events can easily outlast the patience of most clients. And when price rises are very rapid, typically toward the end of a bull market, impatience is followed by anxiety and envy. As I like to say, there is nothing more supremely irritating than watching your neighbors get rich.“ – bto: So ist es in der Tat. Gilt auch für Einkommen – vor allem in Deutschland. Deshalb auch immer der Ruf nach (noch) höheren Steuern.

- „A simpler way of saying this may be that if Keynes really had said, ‘The market can stay irrational longer than the investor can stay solvent,’ he would have been right.“ – bto: Gemeint ist, dass man nicht genug Geld hat, um vergeblich auf fallende Kurse zu setzen. Ich denke an jene, die seit Jahren gegen Tesla wetten und brutale Verluste erlitten, während jene, die sich nicht daran störten, dass Tesla mehr wert war als die gesamte deutsche Automobilindustrie im letzten Jahr, ihren Einsatz vervielfachten.

- „(…) it is highly probable that we are in a major bubble event in the U.S. market, of the type we typically have every several decades and last had in the late 1990s. It will very probably end badly, although nothing is certain. I will also tell you my definition of success for a bear market call. It is simply that sooner or later there will come a time when an investor is pleased to have been out of the market. That is to say, he will have saved money by being out, and also have reduced risk or volatility on the round trip. This definition of success absolutely does not include precise timing. (Predicting when a bubble breaks is not about valuation. All prior bubble markets have been extremely overvalued, as is this one. Overvaluation is a necessary but not sufficient condition for their bursting.) Calling the week, month, or quarter of the top is all but impossible.“ – bto: was es auch so schwierig und so unangenehm macht. Letztlich für jeden, der nicht mit der Herde läuft.

- „(…) I was three years too early in the Japan bubble. We at GMO got entirely out of Japan in 1987, when it was over 40% of the EAFE benchmark and selling at over 40x earnings, against a previous all-time high of 25x. It seemed prudent to exit at the time, but for three years we underperformed painfully as the Japanese market went to 65x earnings on its way to becoming over 60% of the benchmark! (…) Similarly, in late 1997, as the S&P 500 passed its previous 1929 peak of 21x earnings, we rapidly sold down our discretionary U.S. equity positions then watched in horror as the market went to 35x on rising earnings.“ – bto: Er betont allerdings auch, dass er das Hoch 2008 richtig erkannte und auch den Kaufzeitpunkt Anfang März 2009. Es ist sehr schwer, was man besonders an speziellen Situationen wie Tesla und auch Bitcoin sieht.

- „The single most dependable feature of the late stages of the great bubbles of history has been really crazy investor behavior, especially on the part of individuals. For the first 10 years of this bull market, which is the longest in history, we lacked such wild speculation. But now we have it. In record amounts. My colleagues Ben Inker and John Pease have written about some of these examples of mania in the most recent GMO Quarterly Letter, including Hertz, Kodak, Nikola, and, especially, Tesla. As a Model 3 owner, my personal favorite Tesla tidbit is that its market cap, now over $600 billion, amounts to over $1.25 million per car sold each year versus $9,000 per car for GM.“ – bto: Man muss sehr aggressive Annahmen definieren, um da einmal zu einer Situation zu kommen, in der die fundamentale Performance des Unternehmens die Bewertung rechtfertigt.

- Sodann geht es um die Blasen-Indikatoren. Und da gibt es einige: „The ‘Buffett indicator,’ total stock market capitalization to GDP, broke through its all-time-high 2000 record. In 2020, there were 480 IPOs (including an incredible 248 SPACs (Unternehmen, die als Hülle an die Börse gehen, um zum Beispiel den Börsengang anderer Unternehmen in der Zukunft zu erleichtern) – more new listings than the 406 IPOs in 2000. There are 150 non-micro-cap companies (that is, with market capitalization of over $250 million) that have more than tripled in the year, which is over 3 times as many as any year in the previous decade. The volume of small retail purchases, of less than 10 contracts, of call options on U.S. equities has increased 8-fold compared to 2019, and 2019 was already well above long-run average. Perhaps most troubling of all: Nobel laureate and long-time bear Robert Shiller – who correctly and bravely called the 2000 and 2007 bubbles and who is one of the very few economists I respect – is hedging his bets this time, recently making the point that his legendary CAPE asset-pricing indicator (which suggests stocks are nearly as overpriced as at the 2000 bubble peak) shows less impressive overvaluation when compared to bonds. Bonds, however, are even more spectacularly expensive by historical comparison than stocks. Oh my!“ – bto: Das ist natürlich ein witziger Punkt. Wenn selbst Shiller sich nicht mehr traut, zu sagen, dass es eine Überbewertung ist, kann man natürlich nur zu dem Schluss kommen, dass wirklich eine ist …

- „(…) as prices move further away from trend, at accelerating speed and with growing speculative fervor, of course my confidence as a market historian increases that this is indeed the late stage of a bubble. A bubble that is beginning to look like a real humdinger.“ – bto: was allerdings nicht sagt, dass sein Platzen unmittelbar bevorsteht.

- „Previous bubbles have combined accommodative monetary conditions with economic conditions that are perceived at the time, rightly or wrongly, as near perfect, (…) But today’s wounded economy is totally different: only partly recovered, possibly facing a double-dip, probably facing a slowdown, and certainly facing a very high degree of uncertainty. Yet the market is much higher today than it was last fall when the economy looked fine and unemployment was at a historic low. Today the P/E ratio of the market is in the top few percent of the historical range and the economy is in the worst few percent.“ – bto: weil es allein auf der massiven monetären Stimulierung basiert.

- „All bubbles end with near universal acceptance that the current one will not end yet … because. (…) All three of Powell’s predecessors claimed that the asset prices they helped inflate in turn aided the economy through the wealth effect.Which effect we all admit is real. But all three avoided claiming credit for the ensuing market breaks that inevitably followed: the equity bust of 2000 and the housing bust of 2008, each replete with the accompanying anti-wealth effect that came when we least needed it, exaggerating the already guaranteed weakness in the economy.“ – bto: eine Politik, die auch William White im Gespräch mit mir gut erklärt hat.

- „Now once again the high prices this time will hold because … interest rates will be kept around nil forever, in the ultimate statement of moral hazard – the asymmetrical market risk we have come to know and depend on. The mantra of late 2020 was that engineered low rates can prevent a decline in asset prices. Forever! But of course, it was a fallacy in 2000 and it is a fallacy now. (…) And here we are again, waiting for the last dance and, eventually, for the music to stop.“ – bto: Die Frage ist aber, was der Auslöser für eine Korrektur sein könnte.

- „(…) it feels like we could be anywhere between July 1999 and February 2000. Which is to say it is entitled to break any day, having checked all the boxes, but could keep roaring upwards for a few months longer. My best guess as to the longest this bubble might survive is the late spring or early summer, coinciding with the broad rollout of the COVID vaccine. (…) realize that the economy is still in poor shape, stimulus will shortly be cut back with the end of the COVID crisis, and valuations are absurd.“ – bto: Da bin ich nicht sicher, weil der Stimulus erst richtig losgeht, siehe das Programm von Biden mit immerhin 1,9 Billionen US-Dollar. Und dann kommt ja noch der European Green Deal.

- „(…) the market is now checking off all the touchy-feely characteristics of a major bubble. The most impressive features are the intensity and enthusiasm of bulls, the breadth of coverage of stocks and the market, and, above all, the rising hostility toward bears. (…) in the last few months the hostile tone has been rapidly ratcheting up. The irony for bears though is that it’s exactly what we want to hear. It’s a classic precursor of the ultimate break; together with stocks rising, not for their fundamentals, but simply because they are rising.“ – bto: Das habe ich so noch nicht erlebt, aber ich bin ja auch nicht im Geld-Anlage-Geschäft.

- „Another more measurable feature of a late-stage bull, from the South Sea bubble to the Tech bubble of 1999, has been an acceleration of the final leg, which in recent cases has been over 60% in the last 21 months to the peak, a rate well over twice the normal rate of bull market ascents. This time, the U.S. indices have advanced from +69% for the S&P 500 to +100% for the Russell 2000 in just 9 months.“ – bto: Das stimmt, ist aber von dem März-Tief gerechnet, was schon die Frage aufwirft, ob man das als Vergleich heranziehen kann.

- „(…) don’t wait for the Goldmans and Morgan Stanleys to become bearish: it can never happen. For them it is a horribly non-commercial bet. Perhaps it is for anyone. Profitable and risk-reducing for the clients, yes, but commercially impractical for advisors. Their best policy is clear and simple: always be extremely bullish. It is good for business and intellectually undemanding.“ – bto: Es ist auch die menschliche Natur, die Optimisten bevorzugt.

- „As often happens at bubbly peaks like 1929, 2000, and the Nifty Fifty of 1972 (a second-tier bubble in the company of champions), today’s market features extreme disparities in value by asset class, sector, and company. Those at the very cheap end include traditional value stocks all over the world, relative to growth stocks. Value stocks have had their worst-ever relative decade ending December 2019, followed by the worst-ever year in 2020, with spreads between Growth and Value performance averaging between 20 and 30 percentage points for the single year! Similarly, Emerging Market equities are at 1 of their 3, more or less co-equal, relative lows against the U.S. of the last 50 years. Not surprisingly, we believe it is in the overlap of these two ideas, Value and Emerging, that your relative bets should go, along with the greatest avoidance of U.S. Growth stocks (…).” – bto: Das wiederum leuchtet mir ein. Und dabei geht es nicht mal um einen Crash, einfach nur relative Performance …

Soweit Jeremy Grantham. Nachdem der brillante John Authers zunächst die Argumente von Grantham in seinem Newsletter bei Bloomberg diskutiert hat, ergänzte er die Analyse ein paar Tage später. Auszüge:

- “(…) the arguments that we are in a dangerous bubble boil down to two. The first is that valuations are dangerously dependent on the persistence of historically low bond yields. The second is that market behavior has reached the “crazy” stage in which there is no interest in fundamental valuations, and investors are instead merely calculating that they can sell for a higher price to a greater fool.” – bto: Nun mag man das aus seinem persönlichen Umfeld nicht so wahrnehmen, die Indikatoren, die oben aufgezählt sind, sprechen allerdings für diese Richtung.

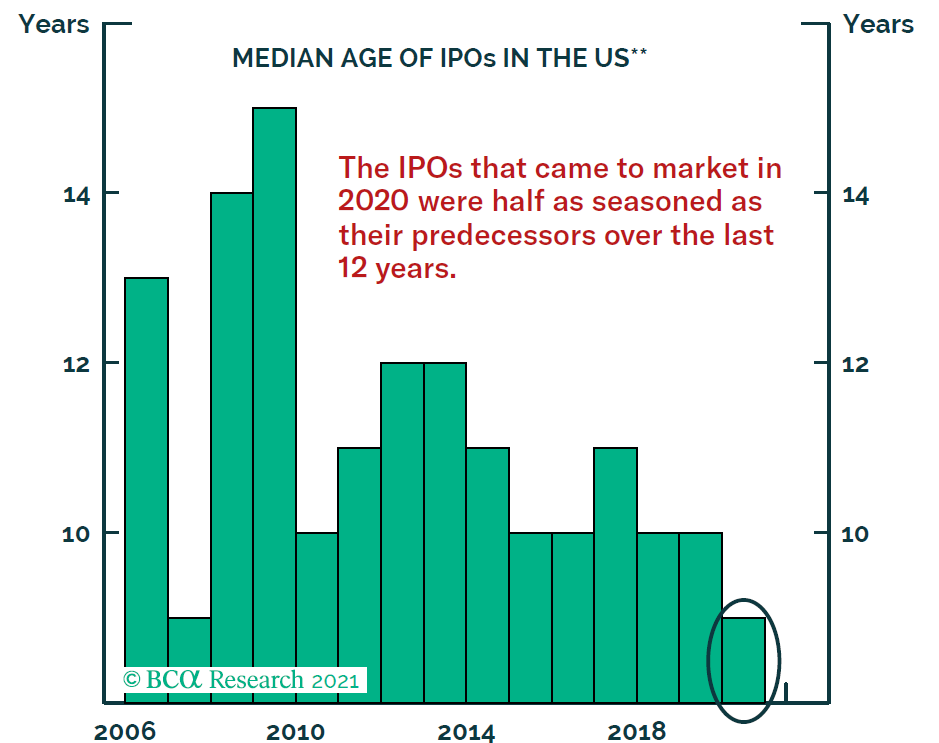

- Neben der Entwicklung von Bitcoin gibt es auch die Welle an IPOs von Unternehmen, die sehr jung sind:

Quelle: BCA, Bloomberg

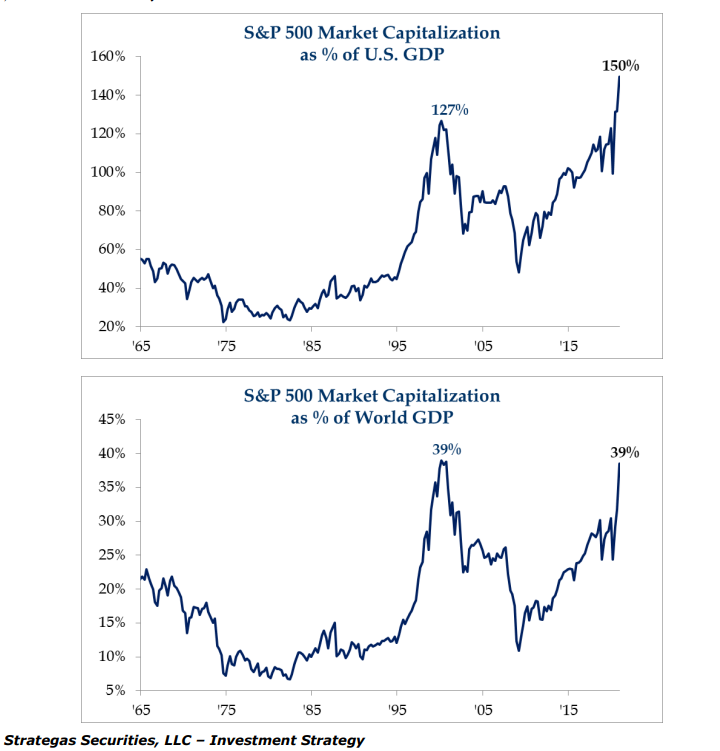

- “While excessive valuation isn’t an indicator that a bubble is about to burst, it is a necessary condition. (…) The ratio of the S&P 500’s total market cap to U.S. GDP, a rule of thumb made popular by Warren Buffett, is a well-known indicator, and it suggests that the stock market is more expensive than it was even at the top in 2000. But about 40% of S&P 500 companies’ earnings come from outside the U.S., so Trennert ran the same numbers comparing S&P market cap to global GDP. The world’s GDP has grown far more than that of the U.S. over the last 20 years — but remarkably, this indicator now shows the U.S. stock market as expensive as it was in 2000.” – bto: Natürlich kann man nun sagen, dass dies keine Rolle spielt, weil das Geld so billig ist. Doch, ob das genügt?

Quelle: Bloomberg

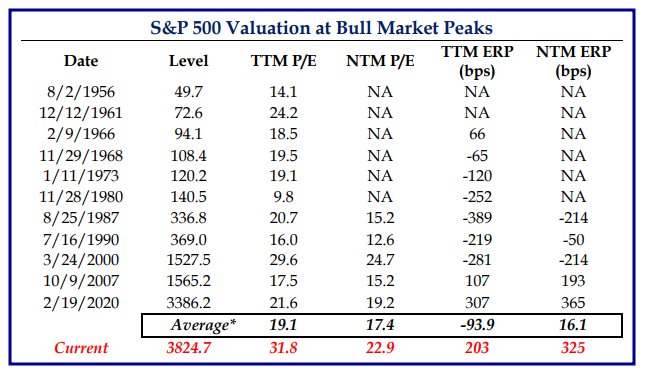

- “(…) provides this handy comparison with valuations at previous bull market peaks. On a trailing price-earnings basis, the market is more expensive than at any previous peak — although the prospective P/E was slightly higher at the top in 2000. When we look at the equity risk premium, the gap between expected returns on stocks and bonds, however, the market appears spectacularly cheap. This can be fixed either by a rise in share prices, or a fall in bond prices (and rise in their yields)” – bto: Das unterstreicht, wie sehr das Ganze an den Zinsen hängt.

Quelle: Bloomberg

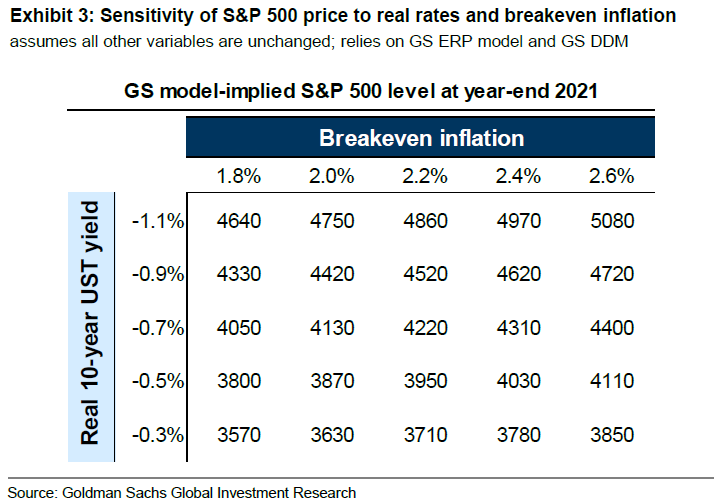

- “Are investors over-complacent about continuing low bond yields? There is some anecdotal evidence of this. Surveys reveal startling unanimity that rates will stay low for years to come, even from investors who have confidence that the global economy will reflate. But the most intriguing evidence to catch my eye that the chance of higher rates isn’t being taken seriously is in the following chart.” – bto: Wir brauchen also sehr negative Realzinsen und dabei möglichst hohe Inflation, um die Märkte weiter nach oben zu treiben.

Quelle: Goldman Sachs, Bloomberg

- “I think real yields are unlikely to exceed minus 0.3% this year. But the fact that a large investment bank seems not to have considered such a possibility when conducting a sensitivity analysis does rather suggest that there may be some complacency at work.” – bto: Aber wir wissen ja, dass es sich immer mehr lohnt, optimistischer zu sein als Bank.