Kreditbooms und Krise: Die BIZ sieht es kritisch

Heute Morgen haben wir die Entwarnung gehört: Kreditbooms wären gar nicht so schlecht und es käme nur in jedem vierten Fall zu einer Krise. Ich bin da allerdings mit Blick auf heute skeptisch. Denn wir erleben nicht irgendeinen Kreditboom, sondern wohl den Kreditboom: wachsende Verschuldung zu unproduktiven Zwecken, ausgehend von einem schon hohen Verschuldungsniveau.

Skeptisch ist bekanntlich auch die BIZ. Hier Auszüge aus einer Rede des BIZ-Chefvolkswirts vor zwei Wochen:

- “(…) the resource misallocations induced by large financial expansions and contractions (financial cycles) can cause material and long-lasting damage to productivity growth.” – bto: Und damit unterminieren die Schulden die Tragfähigkeit der Schuldner!

- “The self-reinforcing interaction between credit, risk-taking and asset prices, especially property prices, can lead to self-sustained expansions and contractions that, when sufficiently large, can produce deep recessions, shallow recoveries and persistently lower growth, leaving long-lasting scars on the economic tissue. This is so especially when banking crises occur.” – bto: wie wir sie hatten und wieder bekommen werden im nächsten Abschwung!

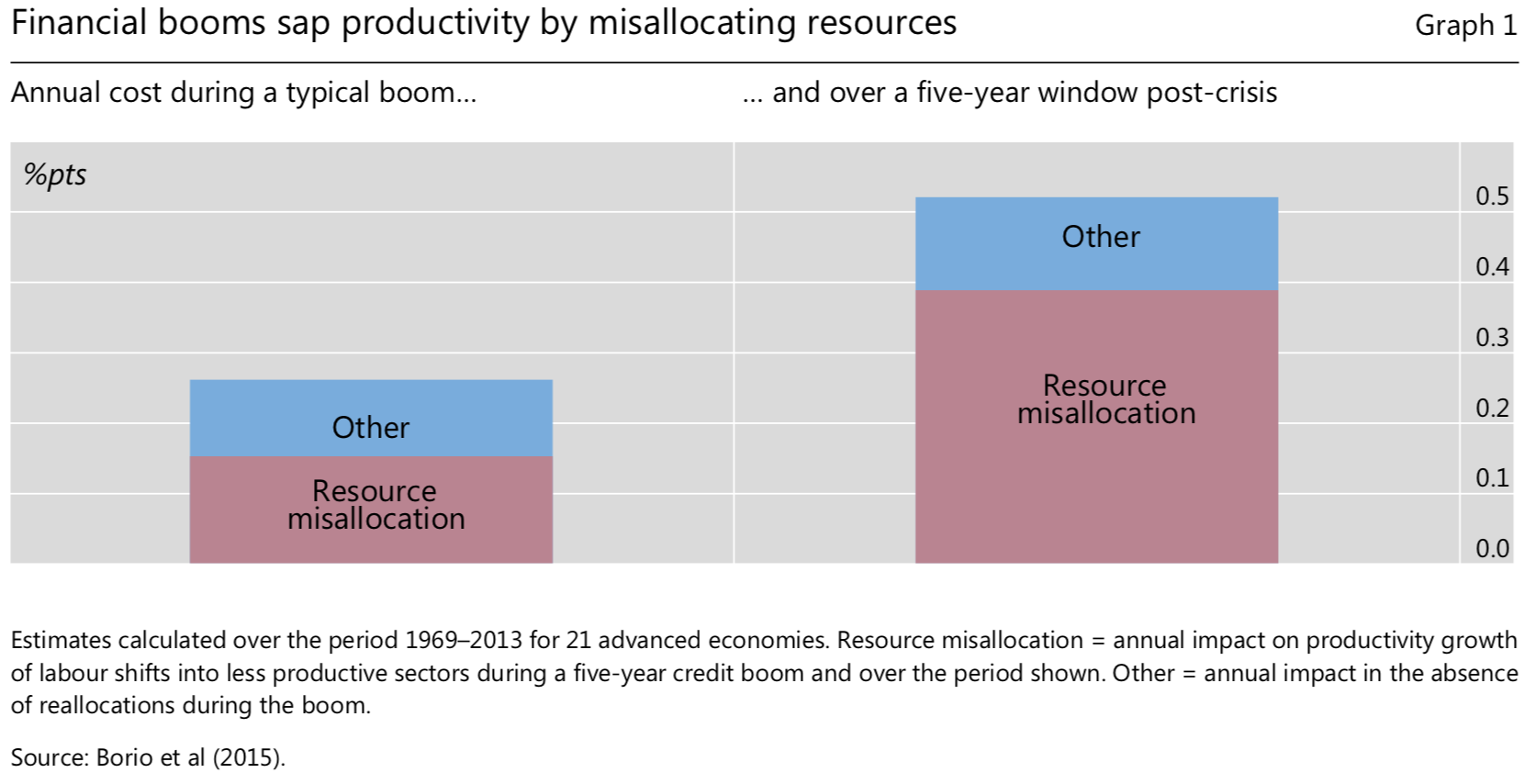

- “(…) credit booms tend to undermine productivity growth as they occur. For a typical credit boom, a loss of just over a quarter of a percentage point per year is a kind of lower bound (Graph 1, left- hand column). The key mechanism is the credit boom’s impact on labour shifts towards lower productivity growth sectors, notably a temporarily bloated construction sector. That is, there is an economically and statistically significant relationship between credit expansion and the allocation component of productivity growth (compare the left-hand panel with the right-hand panel of Graph 2). (…) not only do credit booms undermine productivity growth, (…) but they do so mainly by inducing shifts of resources into lower productivity growth sectors.” – bto: was man in Spanien sehr gut beobachten konnte.

Quelle: BIZ

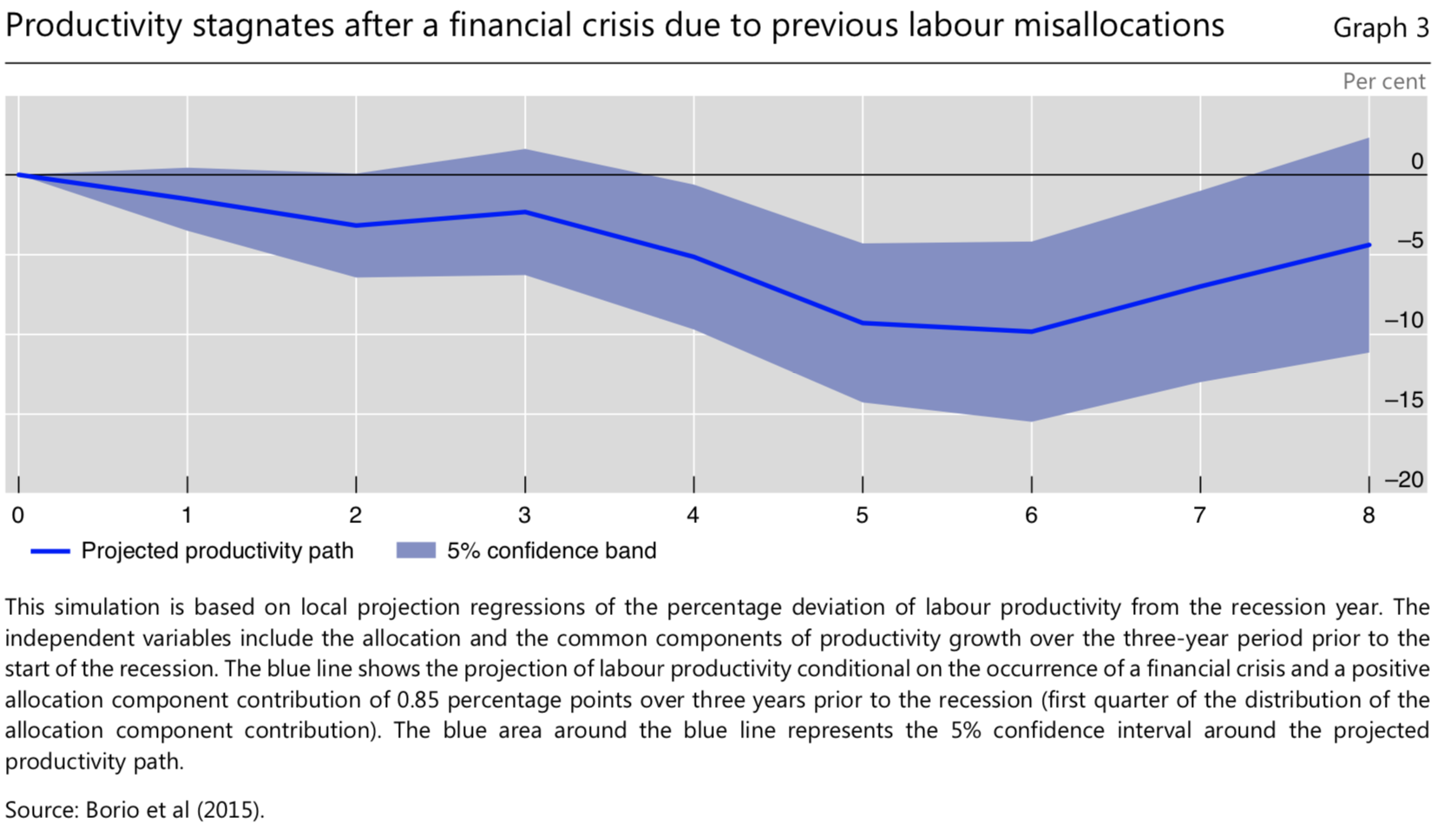

- “Indeed, as shown in the simulation presented in Graph 3, the impact of productivity growth in that case is very long-lasting. The reallocations cast a long shadow.” – bto: genau das, was wir gerade durchleben und dabei aber die wirkliche Bereinigung verhindern.

Quelle: BIZ

- “The overall effects can be sizeable. Taking, say, a (synthetic) five-year credit boom and five post- crisis years together, the cumulative shortfall in productivity growth would amount to some 6 percentage points. Put differently, for the period 2008–13, we are talking about a loss of some 0.6 percentage points per year for the advanced economies that saw booms and crises. This is roughly equal to their actual average productivity growth during the same window.” – bto: was wirklich dramatisch ist.

- “(…) the larger costs in the wake of a banking crisis may reflect, at least in part, how overindebtedness and a broken banking system hinder the required adjustment. For instance, if households are underwater, with mortgage debt exceeding the value of their house, they will find it harder to relocate to take advantage of job opportunities. More to the point, banks with impaired balance sheets and high non-performing loans have strong incentives not to recognise losses and to misallocate credit: they will tend to keep the spigots open for weaker borrowers (“evergreening”) while curtailing or increasing the cost of credit to healthier ones, which can afford to pay. Evidence confirms this.” – bto: Und das billige Geld verschleppt die Anpassung nur.

- Das sieht auch die BIZ so: “(…) low rates following a financial bust are welcome and necessary to stabilise the economy and prevent a downward spiral between the financial system and output. This is what the crisis management phase is all about. The question concerns the possible collateral damage of persistently and unusually low rates thereafter, when the priority is to repair balance sheets in the crisis resolution phase. Granted, low rates lighten borrowers’ heavy debt burden, especially when that debt is at variable rates or can be refinanced at no cost. But they may also slow down the necessary balance sheet repair.” – bto: Auch genau dieses können wir heute beobachten.

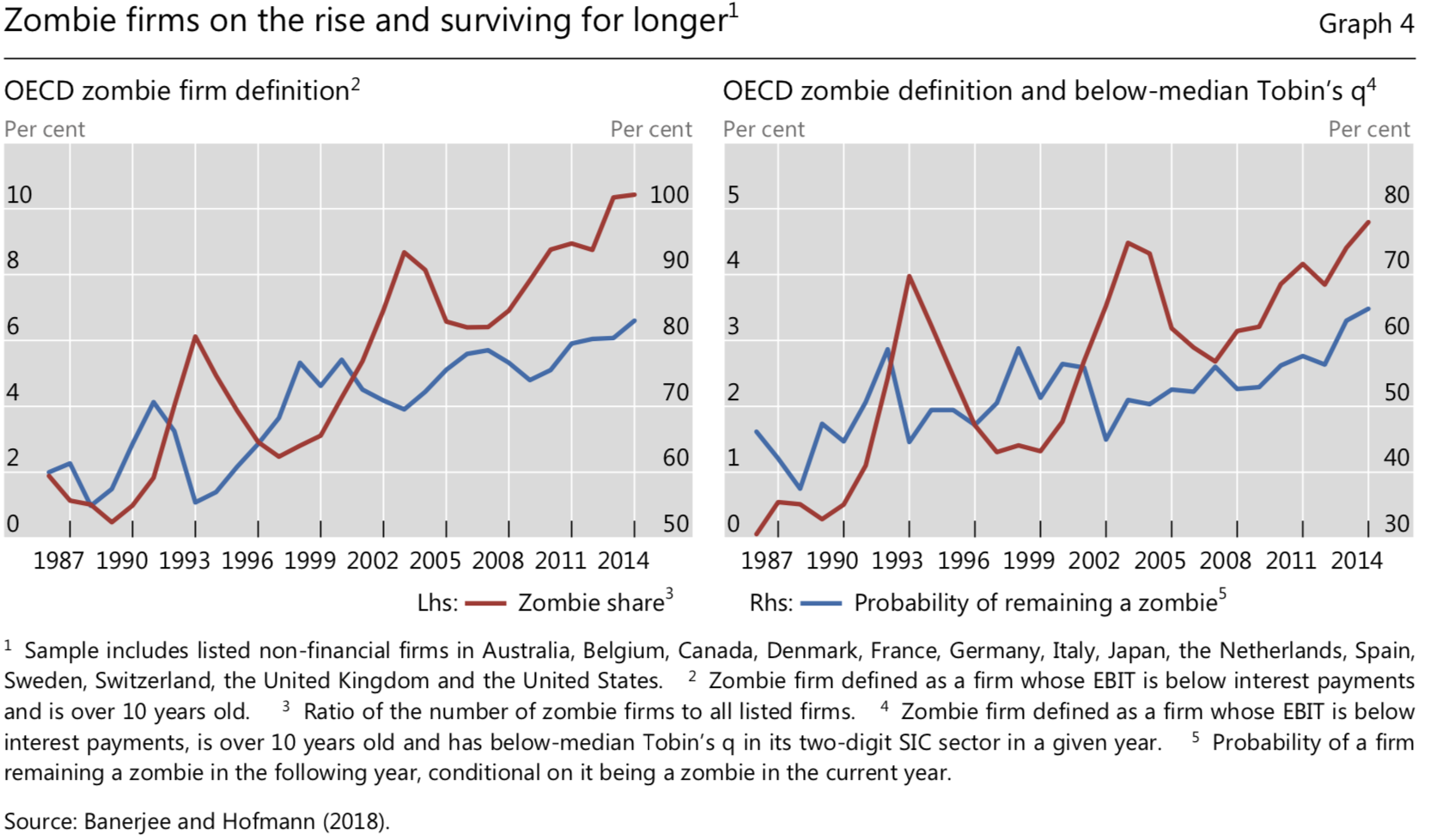

- Und deshalb geht er vertieft auf das Phänomen der Zombies ein: “The first point to note is that zombies have been on the rise and survive – if I can use that term – for longer. Cyclical variations aside, the mean share of publicly quoted zombie firms across these economies has steadily trended up, from close to zero to above 10% under the OECD definition (Graph 4, left-hand panel), and up to 5% under the more restrictive one (right-hand panel). Furthermore, zombies remain in that state for longer (both panels). For instance, based on the narrower definition, in 1987 the probability of a zombie firm remaining a zombie in the following year was approximately 40%; by 2016 it had risen to 65%. That probability is even higher based on the OECD definition.” – bto: Zombies investieren nicht, bilden nicht aus und innovieren nicht. Folge ist klar.

Quelle: BIZ

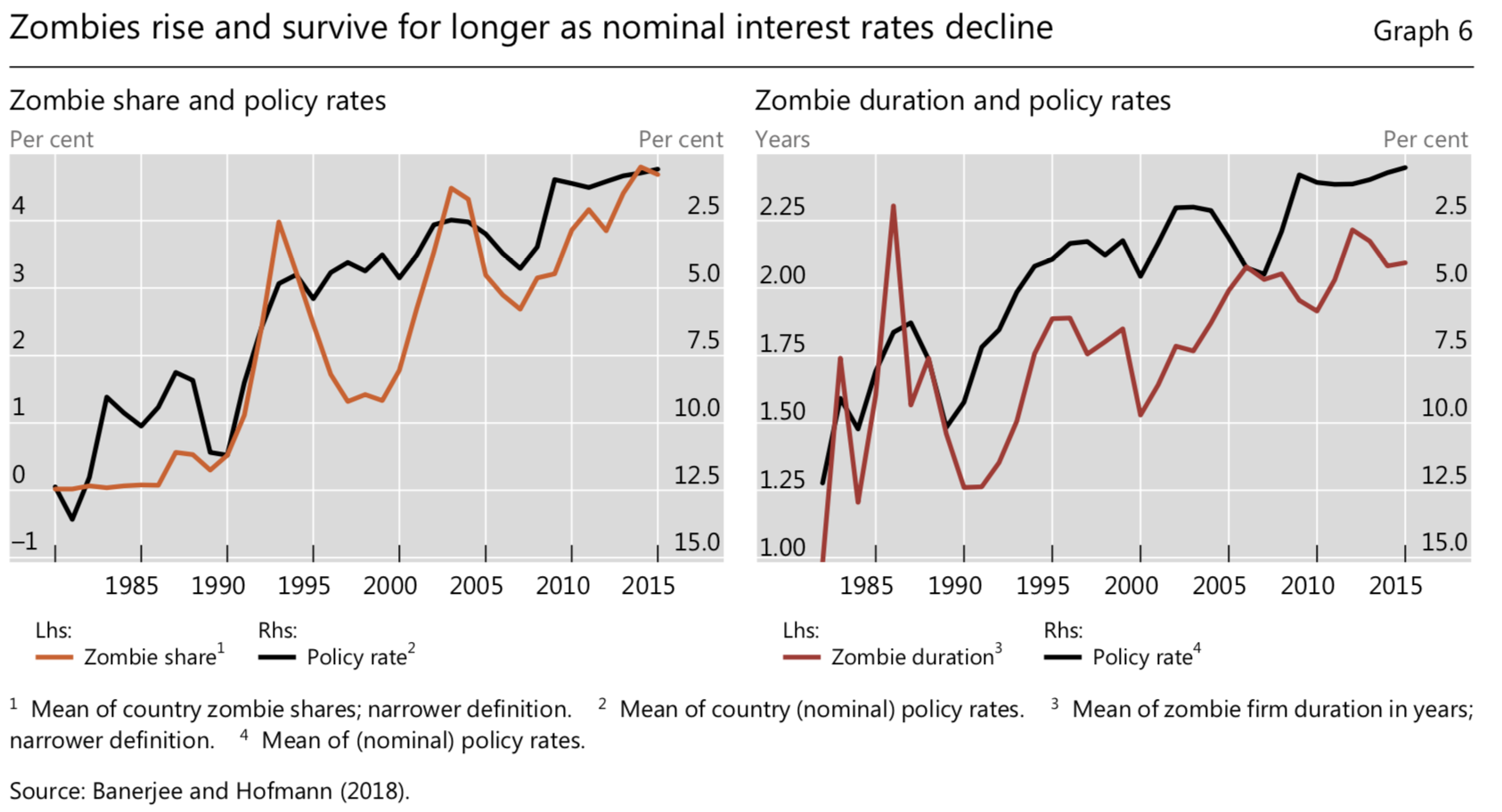

- “What’s more, regardless of the reasons, the higher incidence of zombie firms makes the economy more vulnerable to increases in interest rates to more normal levels – an aspect of what I have elsewhere described as a debt trap. All this raises difficult policy issues, ranging from appropriate targeted measures to broader structural and macroeconomic policies. Non-trivial trade-offs exist, especially in the short run.” – bto: Wir dürfen die Zinsen deshalb nicht mehr erhöhen! Das Chart zeigt sehr schön, wie das immer billigere Geld die Zombies erhält:

Quelle: BIZ

Schlussfolgerung: ” (There) is the need to tackle balance sheet repair head-on following a banking crisis so as to lay the basis for a strong and sustainable recovery. Such a strategy is also important to relieve pressure on monetary policy. Doing so, however, has proved quite difficult in some jurisdictions following the GFC. Other aspects need to be better incorporated into policy considerations. The impact of persistently low rates is one of them. How well all of this is done may well hold one of the keys to the resolution of the current policy challenges.”

Hier der Link zum Beitrag:

-> sp180110_emb