Konkurse werden abgeschafft

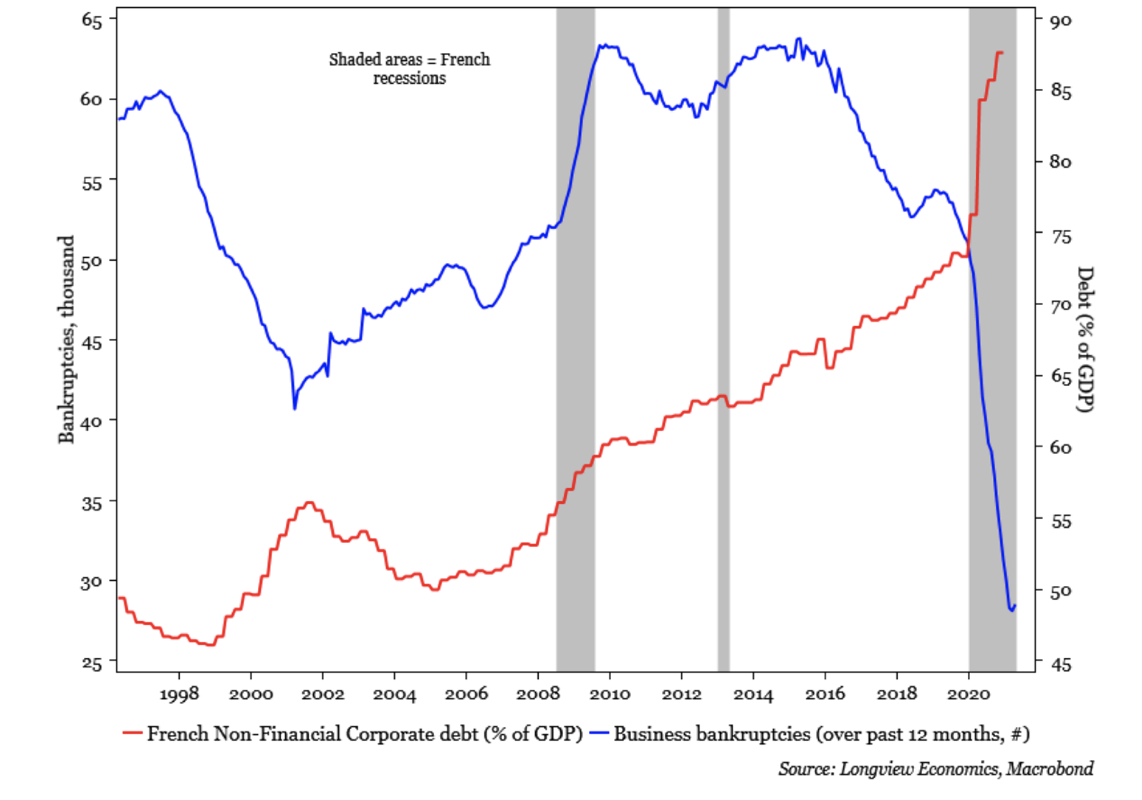

Der immer sehr lesenswerte John Authers hat bei Bloomberg das Thema “Zombies” erneut aufgegriffen. Ausgangspunkt ist dabei eine Vielzahl an Charts, die alle das Gleiche zeigen. Nämlich, dass die Anzahl der Konkurse in der wohl größten Wirtschaftskrise seit Jahrzehnten gefallen ist:

Quelle: Bloomberg, Longview Economics

Das kommentiert er dann so:

- “Recessions are supposed to lead to more bankruptcies, and make it harder for companies to borrow. Rises in debt outstanding, all else equal, should increase the risk of bankruptcies down the line. So what has happened in the last 12 months virtually surpasses understanding. French bankruptcies had steadily declined since the brief recession caused by the sovereign debt crisis, while companies took advantage of the dirt-cheap credit that had been engineered to save the euro to refinance and take on more leverage. When the crisis hit, they were then able to borrow far more, while bankruptcies tumbled.” – bto: Und wir haben das bereits vor einigen Wochen mit den Daten der BIS diskutiert, dass die Zahl der Zombies deutlich gestiegen ist und dass es vor allem bereits vorher hoch verschuldete Unternehmen waren, die sich in den letzten zwölf Monaten besonders stark zusätzlich verschuldet haben.

- “Logic might dictate that an increase in bankruptcies lies ahead. This should mean that debt investors demand a higher yield to compensate them for the greater risk of defaults. In the U.S., this is exactly what has not happened. The spread between the yield on ‘high-yield’ bonds (which might need to be renamed) over five-year Treasury bonds hasn’t been this low since the summer of 2007. And we know what happened after that.” – bto: Vor allem wissen wir, woran das liegt. Es ist die Folge der einmaligen Politik der Risikoabschaffung durch die Notenbanken.

- “This makes no sense (…) unless we give up on the notion that defaults, and the compensation that investors ought to demand for bearing these risks, should be linked to the strength of the economy. Rather than betting on a remarkably potent and enduring recovery, investors in relatively risky bonds are making a bet on a potent and enduring dose of financial repression, in which central banks keep propping up markets, and effectively force everyone to lend to the government, and to companies, at otherwise uneconomic rates. Such a policy was adopted and sustained in the years after the war, and it’s not such a bad bet that more financial repression lies in our future after the pandemic.” – bto: gilt es doch, die Schuldenquoten nach unten zu bringen.

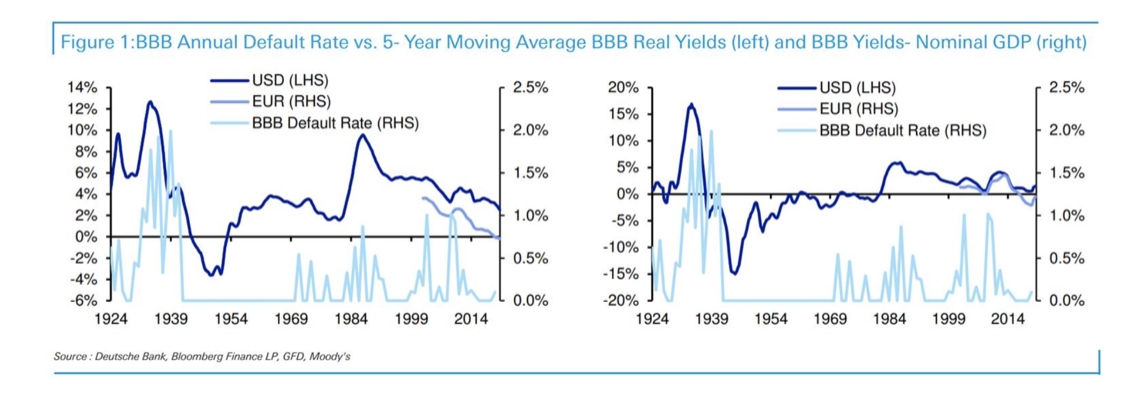

- “Deutsche Bank AG, Jim Reid (…) appears now to be resigned to financial repression: (…) over the last 15-20 years I’ve had to change these views and over the last decade or so the default study has incrementally tried to explain why default rates are low relative to history and while they’ll continue to stay suppressed even though economic growth has structurally trended ever lower over the last couple of decades. The biggest explanation is that, over the last 20 years, the authorities have implicitly and explicitly intervened to lower defaults. Implicitly via huge monetary stimulus lowering rates, and explicitly via larger and larger bailouts. This has driven down funding costs relative to economic activity and made it much easier for companies to survive even at lower levels of economic growth. In short, we’ve moved away from creative destruction and towards an economy with a higher percentage of zombie companies.” – bto: Und damit ist das natürlich selbstverstärkend. Wir bekommen weniger Wachstum und deshalb noch mehr billiges Geld – und so erneut weniger Wachstum.

- “Weak and unprofitable companies, free of the risk of going to the wall, tie up capital that could be used more productively. Such zombie companies are incapable of growing, but thanks to artificially low interest rates they are able to stay alive, spreading their deadening influence across the economy. (…) as a result there are fewer jobs (…) With poorer productivity, there is also a risk that such companies need to jack up prices, leading to higher inflation.” – bto: Da bin ich anderer Meinung. Ich denke, sie wirken deflationär, weil sie keine Gewinne, sondern Liquidität brauchen.

“Reid illustrates how the relationship between default rates and economic growth used to be firm, using data going back to 1924:”

Quelle: Bloomberg, Deutsche Bank

Interessant, dass es ab 1939 für fast 30 Jahre nur wenige Konkurse gab. Das dürfte aber andere Ursachen gehabt haben als nur das relativ günstige Geld.

Authers Schlussfolgerung: “If you think the Fed is serious about allowing inflation to rise, and I believe it is, then you should expect conditions like this to persist for a few years yet. The reduction in insolvencies might well help toward the goal of increasing inflation, but there is every chance that it will vitiate the desire for stronger growth. As for investors, when financially repressed, there’s a lack of good choices.”

Und es bedeutet, wir bekommen chronisch höhere Inflation und das wäre auf jeden Fall ein Thema. Gehen wir in dieser Woche weiter nach.

Kein Link aber der (erneute) Hinweis, dass man den Newsletter von John Authers bei Bloomberg unentgeltlich abonnieren kann.