John Authers erklärt, warum Milton Friedman verloren hat

- “Even the biggest capitalists in the U.S. seem now to accept that they must take the interests of more than just their shareholders into account. (…) But if there is growing acceptance that companies can take more than profits into account, there is still resistance to the idea that investors can do the same.” – bto: weil es zu einer schlechteren Rendite führen kann.

- “Earlier this year, Eugene Scalia, the secretary of labor (…) released a proposed rule that would effectively thwart most company pension funds in the U.S. from investing using ESG principles. He found that they conflicted with the rules laid down by the Employee Retirement Income Security Act, or Erisa. Here is the key passage: (…) investment decisions must be based solely on whether they enhance retirement savings, regardless of the fiduciary’s personal preferences. The department’s proposed rule reminds plan providers that it is unlawful to sacrifice returns, or accept additional risk, through investments intended to promote a social or political end. (…) That trade-off may appeal to some investors, but it is not appropriate for an Erisa fiduciary managing other people’s retirement funds.” – bto: Denn es geht nicht um die “Reichen”, sondern es geht um die nicht so Reichen, die weniger Ertrag bekommen.

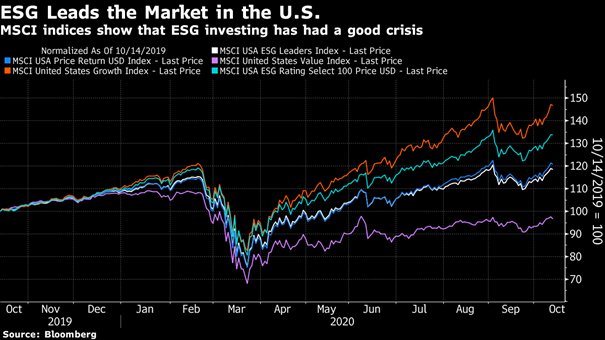

“In the U.S., it is hard to see how any pensioners would have been upset. The MSCI index of U.S. companies with strong ESG factors has done as advertised and matched the market as represented by its MSCI USA gauge almost perfectly. MSCI’s ESG ‘select’ index of the top 100 stocks on these principles has obviously captured many growth companies. It easily beats the the main index, and looks in practice like a watered-down growth index. The value index, in which Erisa funds are free to invest, has had a horrible time.” – bto: Und woran liegt das? Nun, vor allem daran, dass die FANGs alle als ESG-konform gelten. Zurecht?

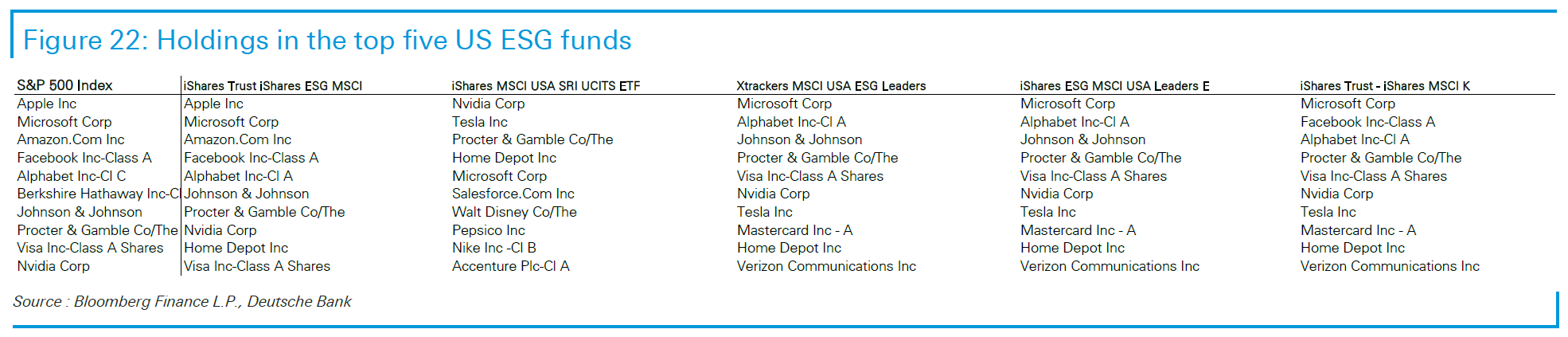

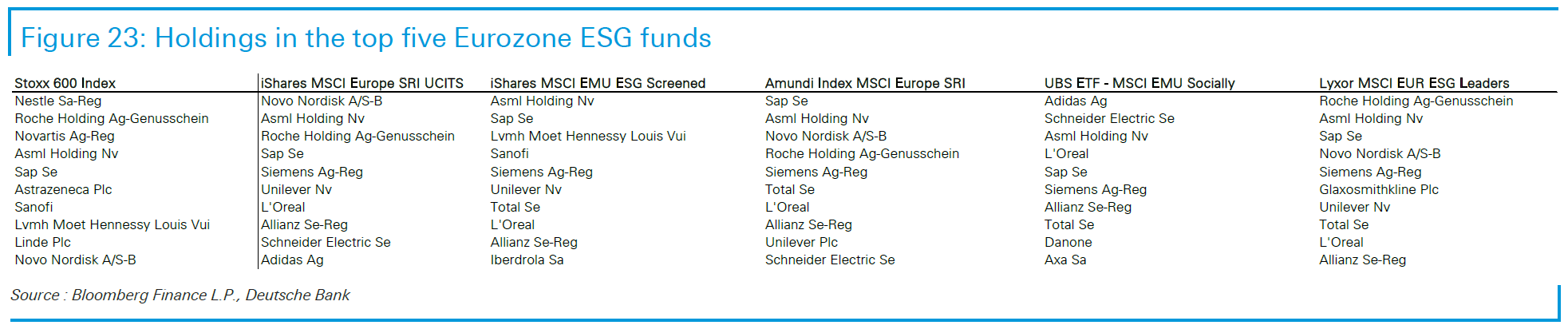

- “When we look under the hood, we do find something concerning, which is that ESG funds seem to be overloaded with currently fashionable stocks, particularly the FANGs. This survey of the biggest U.S. ESG funds repeatedly shows names like Facebook Inc. (which many would exclude on social grounds), and Tesla Inc. (whose governance record is surely questionable) among the top holdings. Are they really ESG stocks?” – bto: Das sind doch gute Fragen!

- “Meanwhile in Europe, which lacks a few huge and largely non-polluting tech companies, there is a wider range. Intriguingly Total SE, a French oil company, is a popular ESG stock.” – bto: Es hilft halt, die Definition zu beeinflussen.

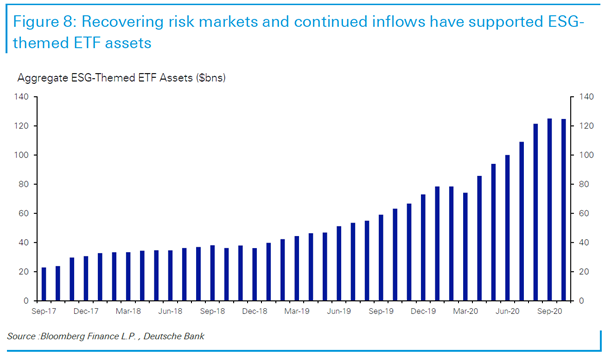

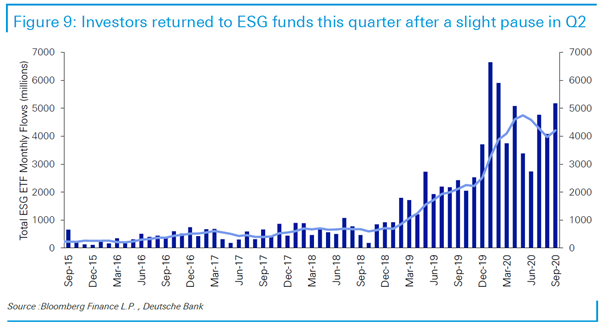

- “Commercially, those marketing ESG funds seem to have won the argument (possibly helped by the fact that their screens lead them into the hottest FANG stocks). The growth in assets held globally by ESG exchange-traded funds has been phenomenal. They have multiplied fivefold in three years, as this chart from Deutsche Bank AG shows.” – bto: Das bedeutet nicht, dass die Manager daran glauben. Aber man kann damit Geld verdienen.

- “This is mostly down to new inflows of capital, rather than market appreciation. Over the last four years, ESG ETFs have never suffered a monthly outflow.” – bto: Bingo! Es ist ein super Argument und man kann damit Geld anlocken, was man sonst nicht bekommen hätte.

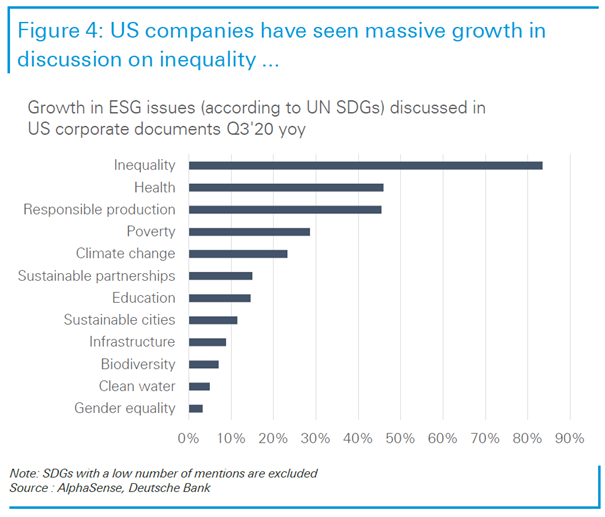

- “How exactly has ESG changed corporate priorities? Deutsche this week published a report by Luke Templeman (a former colleague) and Karthik Nagalingam which included an exhaustive study of the language used in corporate documents about the issues laid out in the United Nations Sustainable Development Goals, carried out for them by AlphaSense. The results are fascinating. Over the last 12 months, U.S. companies have become very preoccupied by inequality.” – bto: Wie Milton Friedman erwartet hat, ist es eine Anbiederung an Themen, um zu gefallen, nicht unbedingt weil es sinnvoll ist. (Nein! Ich bin auch gegen Diskriminierung und zu große Ungleichheit, es ist aber Staatsaufgabe, nicht die der Unternehmen.)

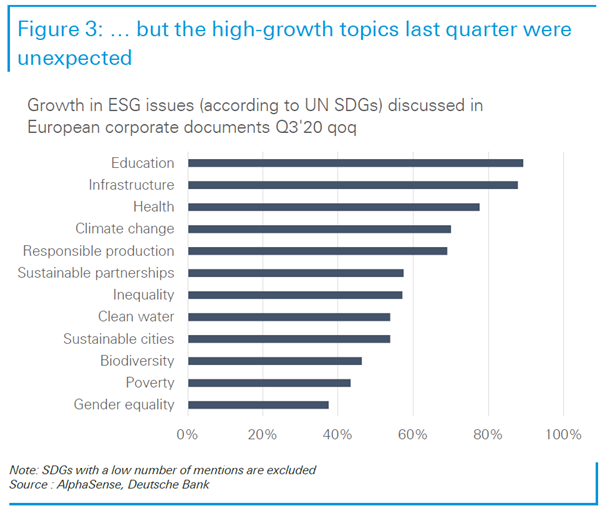

- “In Europe, health hogged attention; although inequality is also a great concern there.” – bto: Klima ist auch hier nicht unter den Top 3.

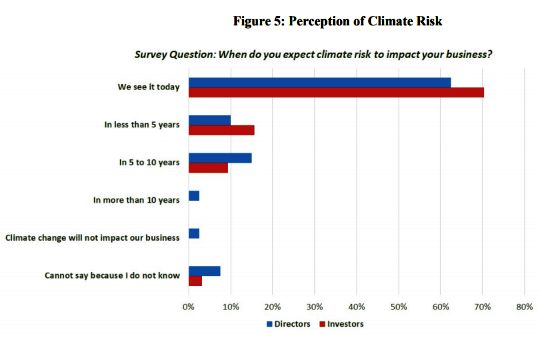

- “For another approach, Columbia Law School’s Ira M. Millstein Center for Global Markets and Corporate Ownership surveyed 130 senior directors and investors in the U.S. and Europe on how significant they considered climate change to be to their business. This is important to ESG debate; if climate change is a material risk, then even the Scalia/Friedman school of thought can support companies and investors giving it priority. It looks as though they do indeed find the issue very material.” – bto: Und dies zu Recht, drohen doch durch die politischen Eingriffe entsprechende Probleme!

Aber damit ist es kein ESG-Thema, sondern ein simples Business-Thema, das sich aus der Internalisierung externer Kosten ergibt.