Jetzt gibt es laut EZB doch Zombies

Eigentlich gibt es Zombies laut EZB nicht und auf jeden Fall ist die EZB an ihrer Existenz unschuldig:

→ Zombies: Die EZB will sie nicht sehen

→ SPIEGEL: Von wegen “Schauermärchen” über Zombies

Dabei gibt es viele mahnende Stimmen:

→ BIZ: Zombies sind ein massives Problem und Corona macht alles schlimmer

→ Studie: Die EZB-Politik führt zur Vermehrung von Zombies

Nun kommt auch die EZB mit den “Risiken der Zombifizierung nach Corona” – als ob es dieses Risiko nicht schon lange gab.

Die Kernaussagen:

- “Since the sovereign debt crisis, there have been concerns about the potential existence of a cohort of failing firms that continue operating on the back of cheap credit and debt forbearance. It is argued that such firms weigh on economic productivity by trapping resources and crowding out the emergence of new, more productive companies. Furthermore, the incentives for some banks to repeatedly extend or alter loan terms so as to avoid writing off their loans (forbearance) can also weigh on bank balance sheets over time, dampening banks’ profitability and capacity for new lending. Monetary, fiscal and prudential policy measures since the pandemic began have prevented a wave of insolvencies of otherwise viable and productive firms. (…) But could these conditions have the unintended side effect of propping up unproductive and unviable firms?” – bto: In der Tat gibt es diese Sorgen von seriöser Seite wie beispielsweise der Bank für Internationalen Zahlungsausgleich. Die übrigens auch – wie hier berichtet – erneut im Zusammenhang mit Corona vor einer weiteren Zombifizierung warnt.

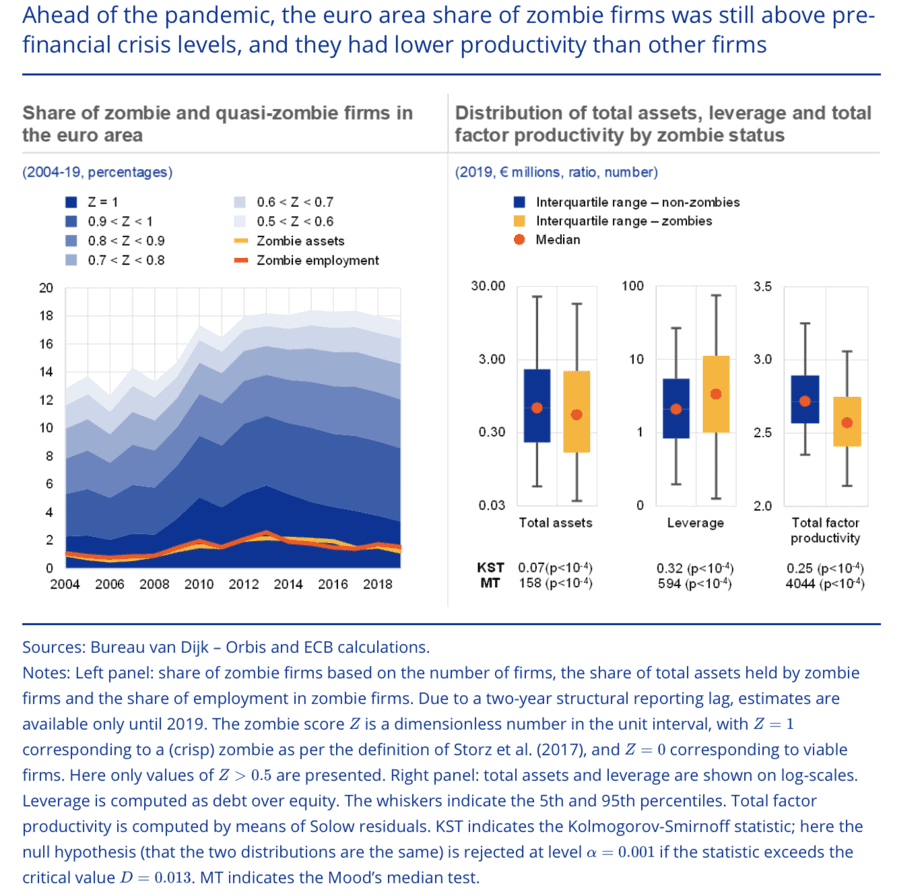

- “(…) previous studies have defined zombie firms in various ways, but they generally agree on seeking out firms that are being artificially sustained by credit. In this special feature (…) zombie firms are defined as those firms that meet all of the following three criteria over two consecutive years: (i) negative returns on assets (net income over total assets), identifying unprofitable firms; (ii) low debt servicing capacity (earnings before interest, taxes, depreciation and amortisation (EBITDA) over financial debt of below 5%), capturing indebted firms; and (iii) negative net investment (annual change in total fixed assets), to avoid capturing young firms. Using Orbis euro area firm-level data spanning fifteen years up until 2019 suggests an average euro area share of zombie firms of around 3.4% before the pandemic. This is above the 2% share in the early 2000s, but below the peaks of almost 6% following the euro area sovereign debt crisis.” – bto: Diese Werte liegen deutlich unter den Werten anderer Studien.

Quelle: EZB

Quelle: EZB

- “Zombie firms are found to be less productive, as well as typically smaller than other firms. Supporting concerns that zombie firms may weaken overall economic productivity, euro area zombie firms have on average lower firm-level total factor productivity than other firms, producing less per unit of labour and capital employed. The median zombie firm is also 20% smaller in terms of total assets, with micro-enterprises five times more likely to be zombies than large firms. They also contribute less than average to employment and, as well as being (by definition) less profitable, the median zombie firm is 60% more leveraged than its non-zombie counterpart.” – bto: Das ist alles bekannt und durchweg nicht überraschend.

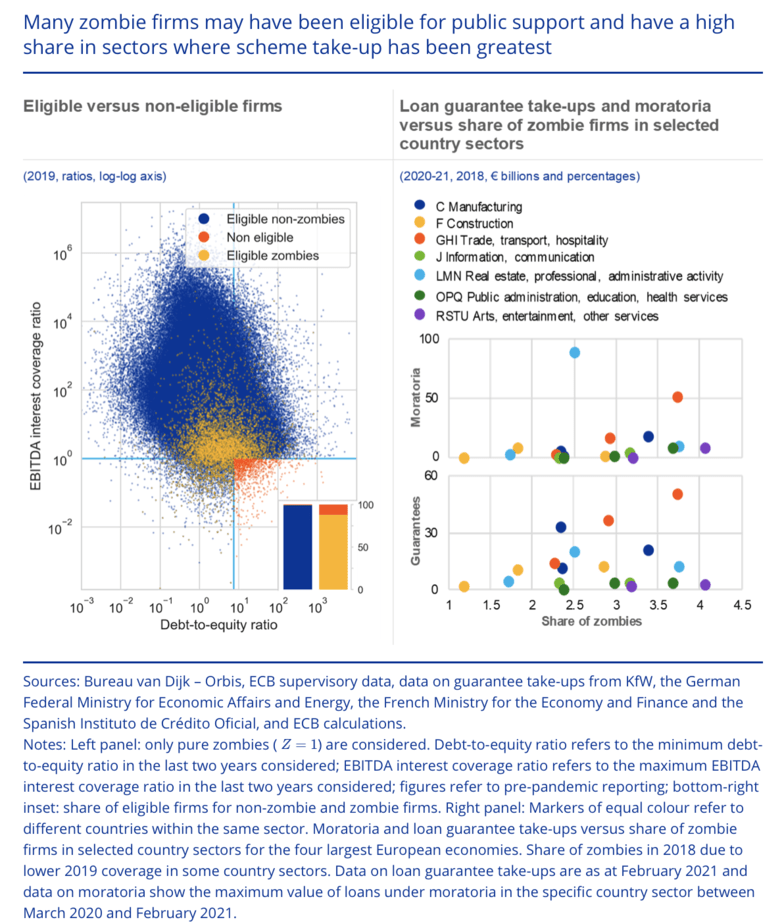

- “Zombie firms are likely to have accessed euro area government-guaranteed loan schemes and moratoria, given their broad eligibility criteria. Early in the pandemic, the European Commission set guidelines for access to loan guarantee schemes requiring that firms should have reported EBITDA interest coverage ratios greater than unity and debt-to-equity ratios below 7.5 for both of the last two most recent reporting years. (…) Firm-level data suggest that (…) they have also been unable to prevent as many as 90% of firms identified as zombies from becoming eligible for public support. – bto: Die Firmen wären auch selten dämlich, dieses Geld nicht zu nehmen!

Quelle: EZB

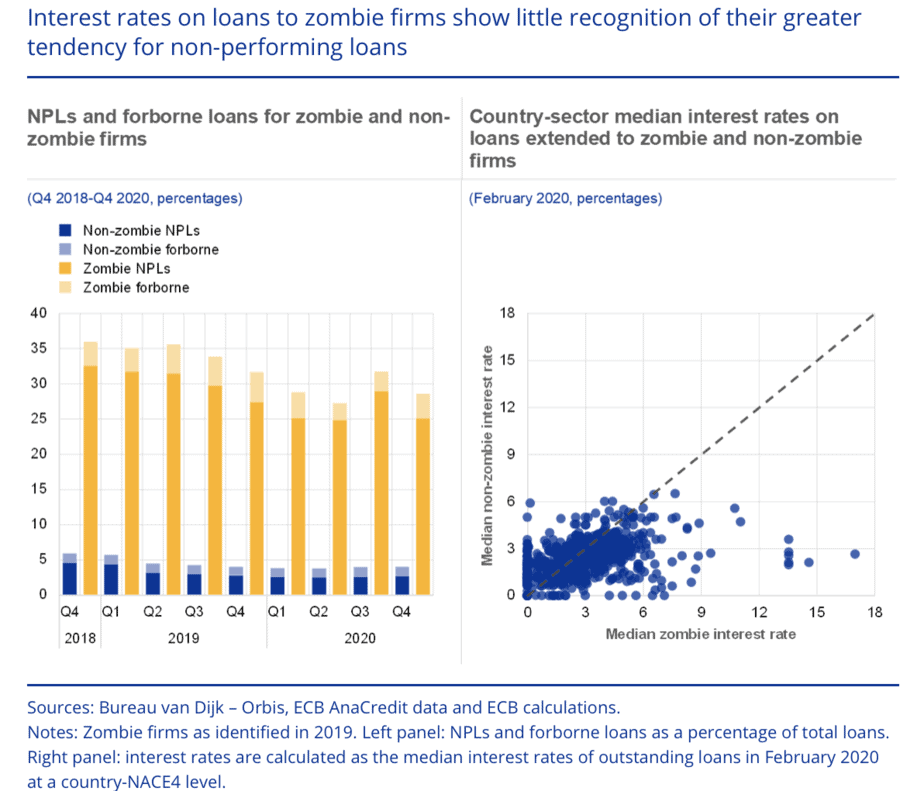

- “In an environment of highly accommodative credit conditions, zombie firms are also likely to benefit from accommodative bank lending rates. (…) Even though zombie firms are substantially more likely to have non-performing loans (NPLs), which is in line with their higher credit risk, the interest rates on zombie firms’ bank loans are not systematically higher than those on loans to other firms.” – bto: natürlich nicht! Das muss so sein. Sie werden eher noch tiefere Zinsen zahlen und in der Tat zeigt sich genau das in der Darstellung:

Quelle: EZB

- Und weiter: “(…) spreads between firms with different credit ratings are also low compared with historical ranges. This relatively small differentiation between firms with different credit characteristics suggests that there may be some degree of complacency among market participants. Firms at the lower end of the credit spectrum potentially benefit from cheap funding conditions, which increase their chances of survival; but this also means that investors exposed to such debt securities may face substantial losses if such firms become unviable in the medium term.” – bto: falls sie es nicht mehr bezahlen können. Doch wird das Spiel fortgesetzt, wird das ganz anders aussehen. Dann gibt es diese Verluste eben nicht, weil die Zombifizierung weitergeht.

- Konklusion: “Zombification may lead to an inefficient capital allocation, but also poses medium-term risks to the financial system if risks are not properly priced. The analysis of interest rates on bank loans as well as credit spreads in corporate debt markets suggests that firms’ cost of funding is relatively undifferentiated with respect to individual firms’ fundamental credit characteristics. (…) the existence of a sizeable cohort of firms with zombie characteristics may lead to sell-offs, large-scale downgrade or ‘catch-up defaults’. If unaddressed, these risks, in conjunction with an increase in the share of zombie firms, might result in a concrete source of losses, increasing pressure on financial institutions’ balance sheets and thus potentially jeopardising the stability of the euro area financial system. Additionally, the existence of a wider tail of overindebted corporates could be a drag on growth, as debt overhang can affect firms’ investment and employment. Such macro risks could in turn feed back into the banking sector and the financial system.” – bto: Nehmen wir dazu noch die (vermutlich realistischeren) Schätzungen deutlich höherer Zombie-Zahlen, haben wir es zusammen, das negative Szenario.

Ob jetzt gleich wieder der Artikel kommt, der das Gegenteil behauptet?

→ ECB: „Corporate zombification: post-pandemic risks in the euro area“, Mai 2021