“Italy on brink of banking crisis as debt costs spiral following battle with EU”

Leser von bto wundern sich nicht über die erneute Krise um Italien. Hat man doch die Probleme nicht gelöst, sondern verschleppt. Geht halt immer nur eine gewisse Zeit gut.

Hier eine (erneute) Zusammenfassung, weshalb wir uns eben auf einen Uscitalia einstellen müssen. Mit allen finanziellen Folgen!

- “Yields on Italy’s 10-year debt spiked to 3.62pc after the Lega strongman and vice-premier, Matteo Salvini, vowed to sweep away the existing European order. He called Jean-Claude Juncker and his Commission aides ‚enemies of Europe barricaded inside their Brussels bunker.” The furious outburst followed the leak of a stern letter from the Commission rejecting the deficit spending plans of the insurgent Lega-Five Star government, and more or less ordering Rome to go back to the drawing board.” – bto: Die Italiener wollen ein Ende der Dauerstagnation. Wer kann es ihnen verdenken?

- “The ‚risk spread‘ over German Bunds is entering treacherous territory after jumping 45 basis points over the last week to 310. ‚At this point it risks going hyperbolic,‘ said Carlo Bastasin from the Brookings Institution.” – bto: solange die EZB da ist, nicht.

- “Italian banks (…) hold €387bn of state debt and face automatic mark-to-market losses as their portofolios lose value, eroding their capital buffers. It forces them to raise fresh equity in a hostile climate, or to cut lending to the real economy and set off a contractionary spiral. The most vulnerable banks are quickly selling down their sovereign bonds to reduce ‚concentration risk‘, still 60pc in the case of UBI.” – bto: Auch das kann nicht überraschen und zeigt, dass es eben immer zu Problemen kommt, wenn man verkaufen muss. So entstehen Krisen. Übrigens kürzen die Banken nur Kredite für gesunde Schuldner, die Zombies bleiben am Leben!

- “This the ‚doom-loop‘ of interlinked sovereigns and banks can become a vicious circle in the eurozone’s unreformed system. (…) spreads of 400 are ‚not sustainable‘. A rise of 200 basis points cuts the common equity tier 1 capital of the Italian banks by 67 points, leaving them under water.” – bto: Wir wissen aber, dass die italienischen Banken ohnehin unter Wasser sind. Es ist nur eine Täuschung, dass es bisher nicht so offen war.

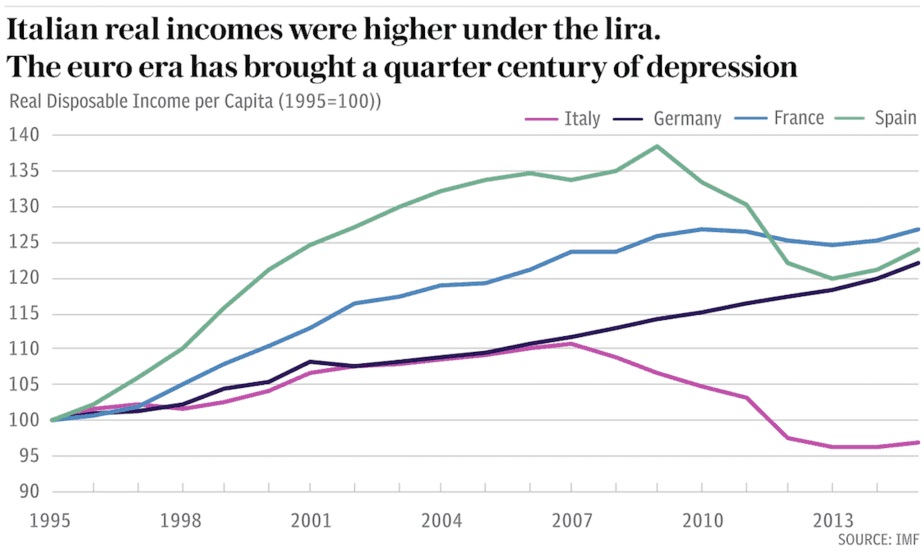

- Wie schlimm es um Italien steht, zeigt diese Abbildung:

- “The banks are being squeezed on multiple fronts. Issuance of subordinated debt has become costly and has ground to a halt, drying up liquidity. Rising spreads eats into tangible book equity, degrading share value.(but) the picture is not yet as bad as 2011.” – bto: Und ich denke immer noch, dass die Europäer alles zulassen werden!

- “Italian banks have cut their reliance on the wholesale capital markets from 27pc to 21pc of their funding. Yet there could still be a credit crunch and I am afraid that we are already in a crisis. This government is aiming to win the European elections (in May) and it is just crossing its fingers and hoping disaster does not strike, (…) Capital erosion is the killer for the banks. Citigroup estimates that each 50 point jump in spreads lowers core capital ratios for stronger banks by 19 basis points, or 28 points for UBI and 33 for BPM.” – bto: Freunde, pleite ist pleite. So einfach ist das. Alles, was hier gespielt wird ist Konkursbetrug. Aber nicht nur in Italien.

- “Ashoka Mody, former deputy-chief of the International Monetary Fund for Europe, said the EU’s budget target is theological nonsense, and the weight attached to a few decimal points here or there is false science. ‚These numbers are completely meaningless. The fiscal rule is economically illiterate and dysfunctional, yet a narrative has grown that it is somehow sacrosanct,‘ he told a forum at the American Enterprise Institute (AEI).” – bto: Und damit hat er auch recht! Kein Zweifel. Doch darum geht es natürlich nicht. Wir haben es mit einer Verteilung zwischen Ländern zu tun und das macht es innerhalb der Eurozone so schwierig und ungerecht.

- “Matteo Salvini is not yet showing any willingness to back down, repeatedly dismissing the rising spreads with a line from nationalist poet Gabriele d’Annunzio – ‚me ne frego‘ (I couldn’t give a damn). It is lost on nobody in Italy that this was also the rallying cry of Mussolini’s blackshirt squadrons in the 1930s. He accused Jean-Claude Juncker and the Brussels machine of ravaging the European economy for a decade with destructive policies, and blamed the spreads on orchestrated speculation. ‚Behind this surge there is old-style manipulation by speculators, like George Soros 25 years ago, to buy Italian assets at bargain prices. But whoever is speculating is wasting their time. This government is not turning back,‘ he said.” – bto: Im Zweifel kommt das gut an bei den Wählern.

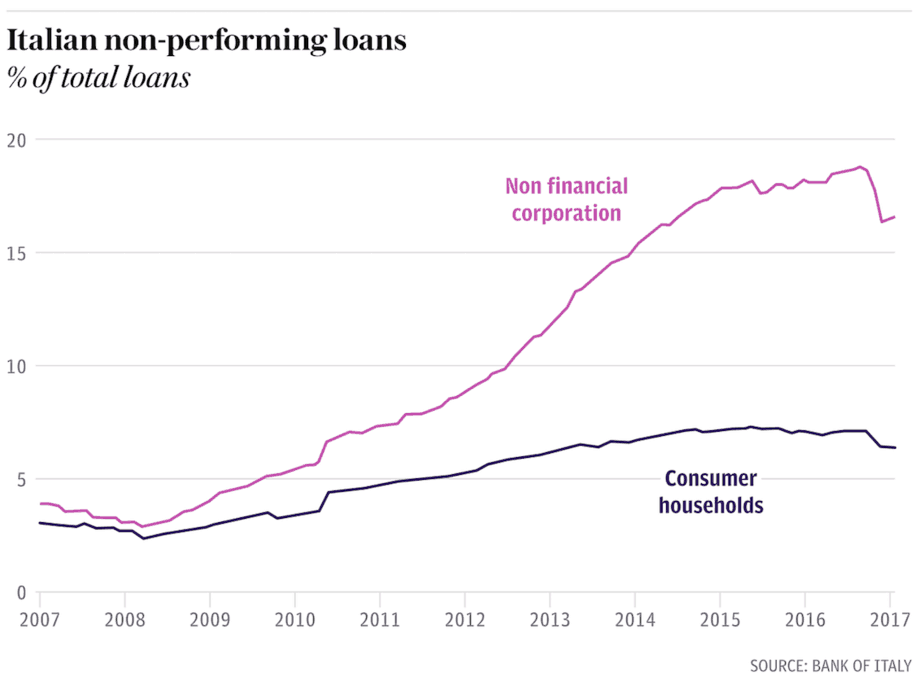

- Denn der Realwirtschaft geht es schon lange schlecht, was man auch an den non-performing Loans gut sehen kann:

- “Professor Luigi Zingales, an expert on the Italian banks at Chicago University, said the eurozone has done to Italy what foreign creditor powers did to Germany in 1930, cutting off capital flows in a ‘sudden stop’ and then enforcing drastic austerity. Brussels should not now be surprise at the political consequence of this myopia.” – bto: eine klare Aussage. Und leider eine, der man nur zustimmen kann.

- “At some point Europe must grasp the nettle. ‚What do we do about the fact that Italy does not belong to the euro? Either we change Italy dramatically and make it fit for for the euro; or we change the euro rules; or we exit the euro. Nothing else is possible,‘ he said.” – bto: Erst bezahlen wir, dann bricht der Euro auseinander.

- “Desmond Lachman, the IMF’s former deputy-director and now at the AEI, said markets are wrong to assume that the Italian drama is under control. ‚I don’t buy the idea that you can muddle through indefinitely. We are at a very different stage of the global cycle, and at a different level of tolerance,‘ he said. ‚When the spreads blow out, it creates a ›new fundamental‹. What worked at spreads of 100 does not work at 300. I think Italy may be entering a vicious circle. It is hugely systemic, and could be Lehman in reverse,‘ he said.” – bto: Und genau deshalb wird die Regierung in Italien erfolgreich den Bluff der EU und der EZB enttarnen. Natürlich werden sie Geld bekommen. Nicht, dass damit die Krise gelöst wäre, sie wäre nur erneut unterdrückt und verschleppt.