Italien: Rezession, Vertiefung der Bankenkrise und Endspiel um den Euro

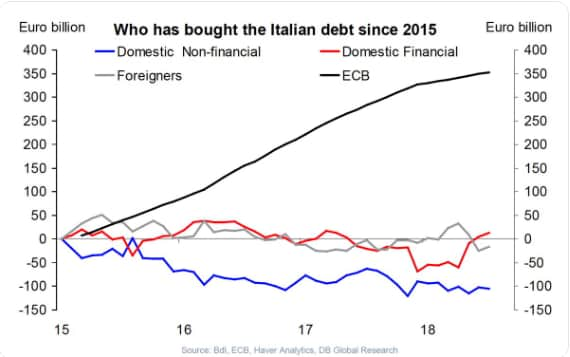

Zunächst die wichtigeste Abbildung des Artikels:

Zur Zeit läuft also das Spiel: die Nicht-Finanz-Investoren in Italien bauen Staatsanleihen ab, die Ausländer etwas, die italienischen Banken (mussten?) wieder rein. Großer Käufer ist die EZB. Also gibt es eine Verlagerung der Schulden auf andere Leute. Was zur Strategie gehören muss, will Italien den Schaden vor allem ausserhalb des Landes entstehen lassen.

Damit ist aber auch die Verbindung zwischen Banken und Staat wieder enger und verhängnisvoller geworden. Mit den zu erwartenden Konsequenzen:

- “Lorenzo Bini-Smaghi, chairman of Societe Generale and a former member of the ECB board, said events were repeating the onset of the eurozone debt crisis in 2011 when surging bond yields caused a contraction in credit. “Italy is going straight into a wall,” (…) “The economy risks tipping into recession in the fourth quarter. The banks have already cut loans over the summer, as soon as the spreads began to rise. The Italian government has not understood this. You can’t see the wall yet, but the crash is going to be violent,” he said.” – bto: weil die Banken die Kreditvergabe kürzen, kommt es zu Problemen.

- “Italian banks hold €380bn of the country’s sovereign bonds. Insurer Generali alone holds another €60bn. Rising spreads will cause mark-to-market losses and erode the capital buffers of the banks, forcing them to rein in credit. The whole banking system, whether big institutions or small, risks running out of funds for the real economy…” – bto: und das ist dann eine Abwärtsspirale, die sich selbst verstärkt. “Ultimately it threatens a systemic pan-EMU crisis and the survival of the euro itself.” – bto: so ist es.

- “The truth is that Europe cannot survive without the cushion of QE. The ECB is going to have relaunch QE next year and and as soon as that becomes clear, you’ll see the spreads come back down to 50 overnight. These spreads have nothing to do with our mildly expansionary budget. They are a function of whether or not there is a central bank guarantee,…”- bto: die EZB ist verdammt zum Kaufen.

- “Mr Borghi dismissed a German plan over the weekend for the mass seizure of Italian private savings as ivory tower madness, warning that any such move would detonate a systemic banking crisis and the rapid disintegration of the euro.” – bto: natürlich. Es ist auch besser, wenn andere bezahlen.

- “Karsten Wendorff, the Bundesbank’s veteran finance chief, proposed “national solidarity bonds” to cover half of Italy’s €2.3 trillion debt. This would be funded by a mandatory wealth tax of 20pc on the net private assets of the Italian people.” – bto: die bekanntlich deutlich reicher sind, als die Deutschen.

- “…Italian private wealth is not held in liquid assets. Attempts to collect such vast sums would set off a cascading fire-sale of bonds, equities, and property, causing a rapid collapse (…) It would crush the banking system.” – bto: was natürlich auch richtig ist. Denn wenn Assets finanziert sind und als Sicherheit dienen, dann ist es genau diese Folge. Es ist der immer wieder angesprochene Margin Call, der auch jene trifft, die nur mit Eigenkapitals arbeiten.

- “Long before it reached that point, the Lega-Five Star government would have to take emergency measures to defend Italy through temporary control of the banks and activation of their ‘minibot’ plan for a parallel liquidity. This would set in motion a de facto break-down of monetary union.” – bto: und das ist der eigentliche Erpressungshebel der Italiener.

- “…a drumbeat from the Bundesbank and the German Council of Economic Experts for debt-restructuring before there can be any rescue of Italy or other eurozone states. They have brushed aside warnings from ECB’s former president, Jean-Claude Juncker, that such plans would risk a “catastrophe”.” – bto: ist es natürlich nur, wenn man es EU typisch chaotisch durchführt.

- “….the eurozone’s northern bloc would demand “debt re-profiling” on Italian bonds as a condition for any ESM bail-out – (…) This would probably be a 20pc write-down, chiefly by stretching the maturities on the debt rather than as a haircut. It would still trigger bankruptcy insurance on Italian credit default swaps. He said international investors do not seem fully aware that this may be coming, or how risky this precedent could be for other Club Med debtors.” – bto: nur was schliessen wir daraus? Es kann doch nur bedeuten, dass es sich lohnt viel Schulden zu machen, weil andere dafür einstehen werden.

- “Europe faces a quandary. Survey data shows that Italians fell out of love with the euro long ago, but fear the trauma and losses of leaving monetary union would be unbearable. The more that the EU authorities talk of debt-restructuring or forced wealth taxes as the exorbitant price for staying in the euro, the greater the appeal of the lira for large blocs of the Italian nation.” – bto: spannend wird es in der nächsten Rezession in Europa. Dann werden wir noch extremere Maßnahmen sehen und zugleich wächst die Attraktivität für politische Experimente.