“Ist es bald soweit? The Ingredients Of An ‚Event‘”

Wir haben in den letzten Wochen bei vielen Beiträgen gesehen, dass wir es mit erheblichen Problemen zu tun haben und die Pause der Krise sich dem Ende nähert. Bleibt die Frage, wann es so weit ist.

Real Investment Advice wagt die Prognose mit der Aussage, dass alles, was es für ein “Event” brauchte, bereits vorliegt:

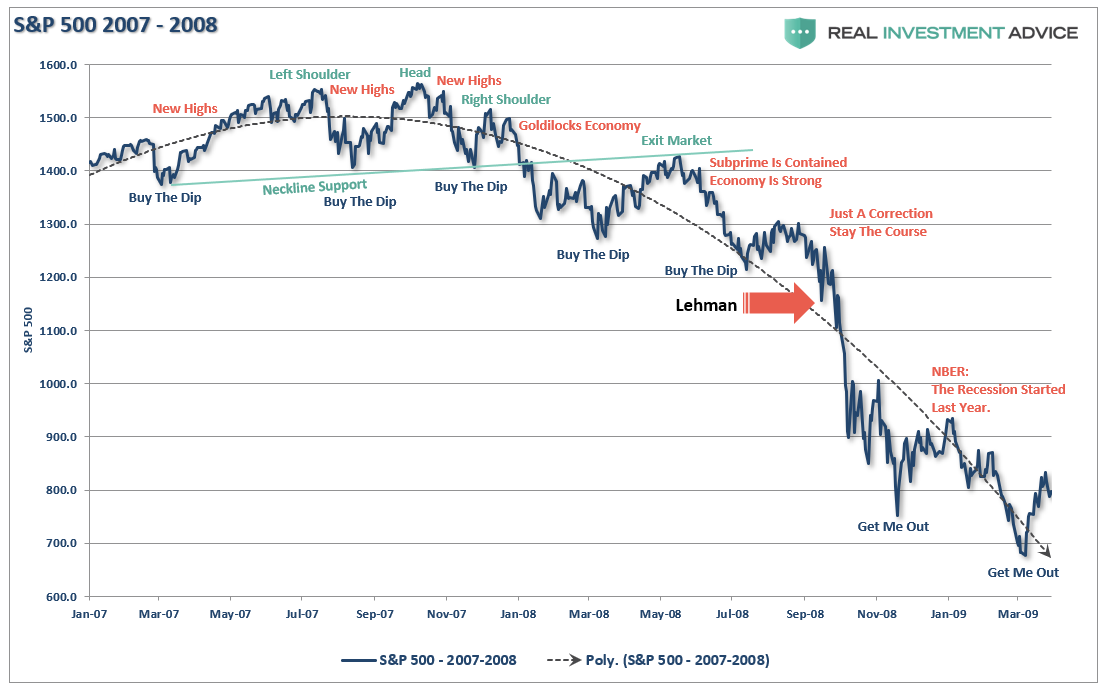

- ” In the case of the ‚financial crisis,‘ Lehman was the ‚event‘ which accelerated a market correction that was already well underway.” – bto: So ist es. Es war nur ein Symptom, keineswegs die Ursache, wie auch hierzulande gerne erzählt wird:

Quelle: Real Investment Advice

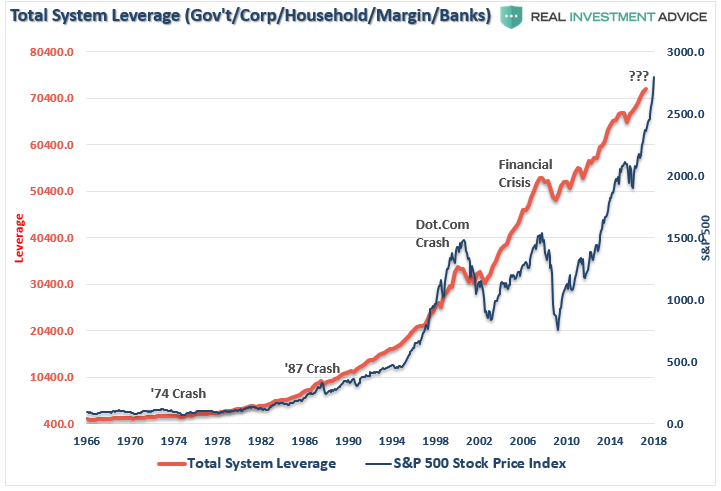

- “Throughout history, there have been numerous ‚financial events‘ which have devastated investors. The major ones are marked indelibly in our financial history: ‚The Crash Of 1929,‘ ‚The Crash Of 1974,‘ ‚Black Monday (1987),‘ ‚The Dot.Com Crash,‘ and the ‚The Financial Crisis.‘” – bto: Und alle hatten ihre Ursache in zu viel Leverage, wobei es wohl noch nie so schlimm war, wie heute.

- “‚Mean reverting events,‘ bear markets, and financial crisis, are all the result of a combined set of ingredients to which a catalyst was applied. Looking back through history we find similar ingredients each and every time.” – bto: Und die schauen wir uns jetzt an:

Leverage

- “Throughout the entire monetary ecosystem, there is a consensus that ‚debt doesn’t matter‘ as long as interest rates remain low. Of course, the ultra-low interest rate policy administered by the Federal Reserve is responsible for the ‚yield chase‘and has fostered a massive surge in debt in the U.S. since the ‚financial crisis.‘” – bto: klar, solange Geld billig bleibt. Wobei selbst da aufgrund des abnehmenden Grenznutzens die Risiken zunehmen, sodass es auch ohne Verteuerung des Geldes problematisch wird.

Quelle: Real Investment Advice

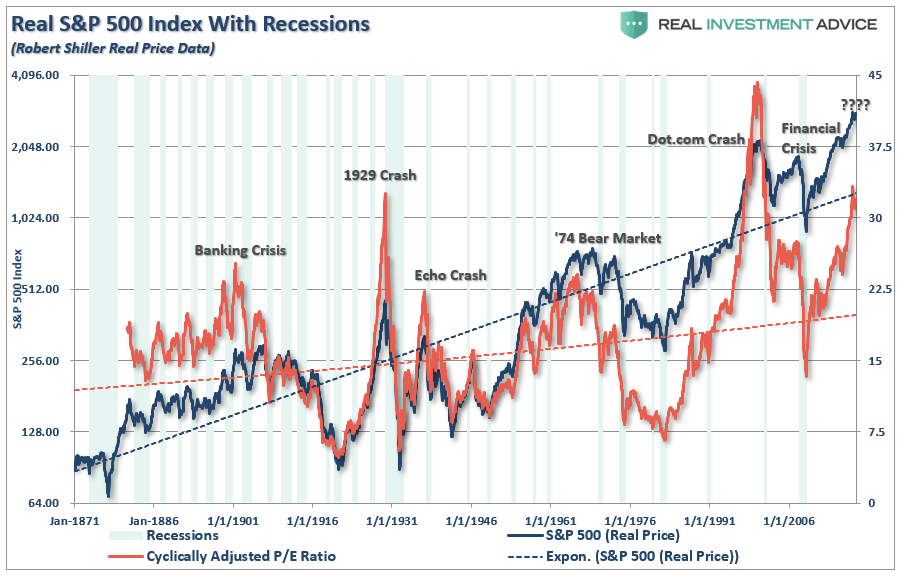

Bewertung

- “(…) high valuations are also ‚inert‘ as long as everything asset prices are rising. In fact, rising valuations supports the ‚bullish‘ thesis as higher valuations represent a rising optimism about future growth. In other words, investors are willing to ‚pay up‘ today for expected further growth.” – bto: Aktien waren nur 1999 richtig viel teurer.

Quelle: Real Investment Advice

- “While valuations are a horrible ‚timing indicator‘ for managing a portfolio in the short-term, valuations are the ‚great predictor‘ of future investment returns over the long-term.” – bto: So ist es!

Psychologie

- “(…) one of the critical drivers of the financial markets in the ‚short-term‘ is investor psychology. As asset prices rise, investors become increasingly confident and are willing to commit increasing levels of capital to risk assets. The chart below shows the level of assets dedicated to cash, bear market funds, and bull market funds. Currently, the level of ‚bullish optimism‘ as represented by investor allocations is at the highest level on record.” – bto: was bei mir als prinzipiell konträr denkendem Menschen natürlich eher zur Vorsicht führt.

Quelle: Real Investment Advice

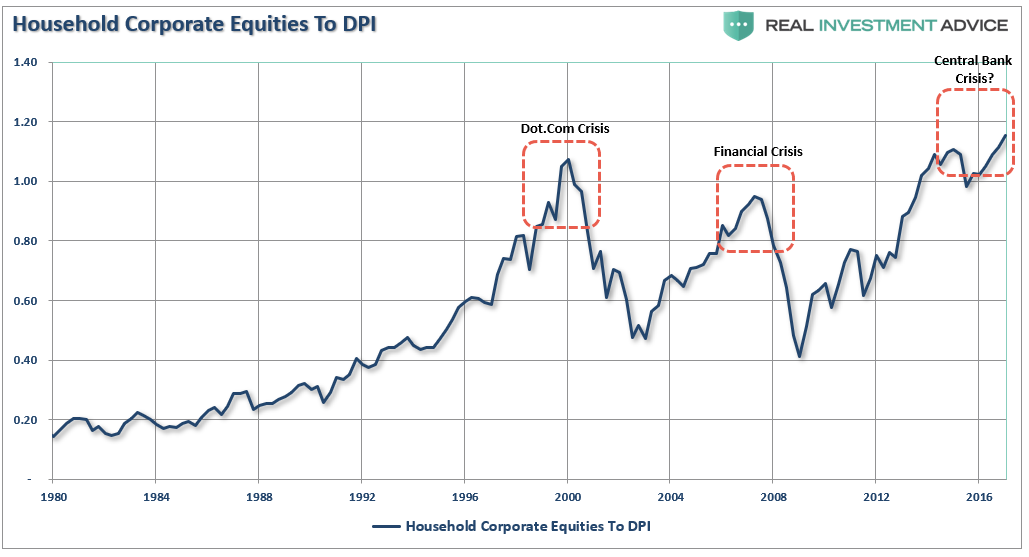

Investoren

- “Of course, the key ingredient is ownership. High valuations, bullish sentiment, and leverage are completely meaningless if there is no ownership of the underlying equities.” – bto: Relativ zum verfügbaren Einkommen halten Privathaushalte viel Vermögen in Aktien.

Quelle: Real Investment Advice

Momentum

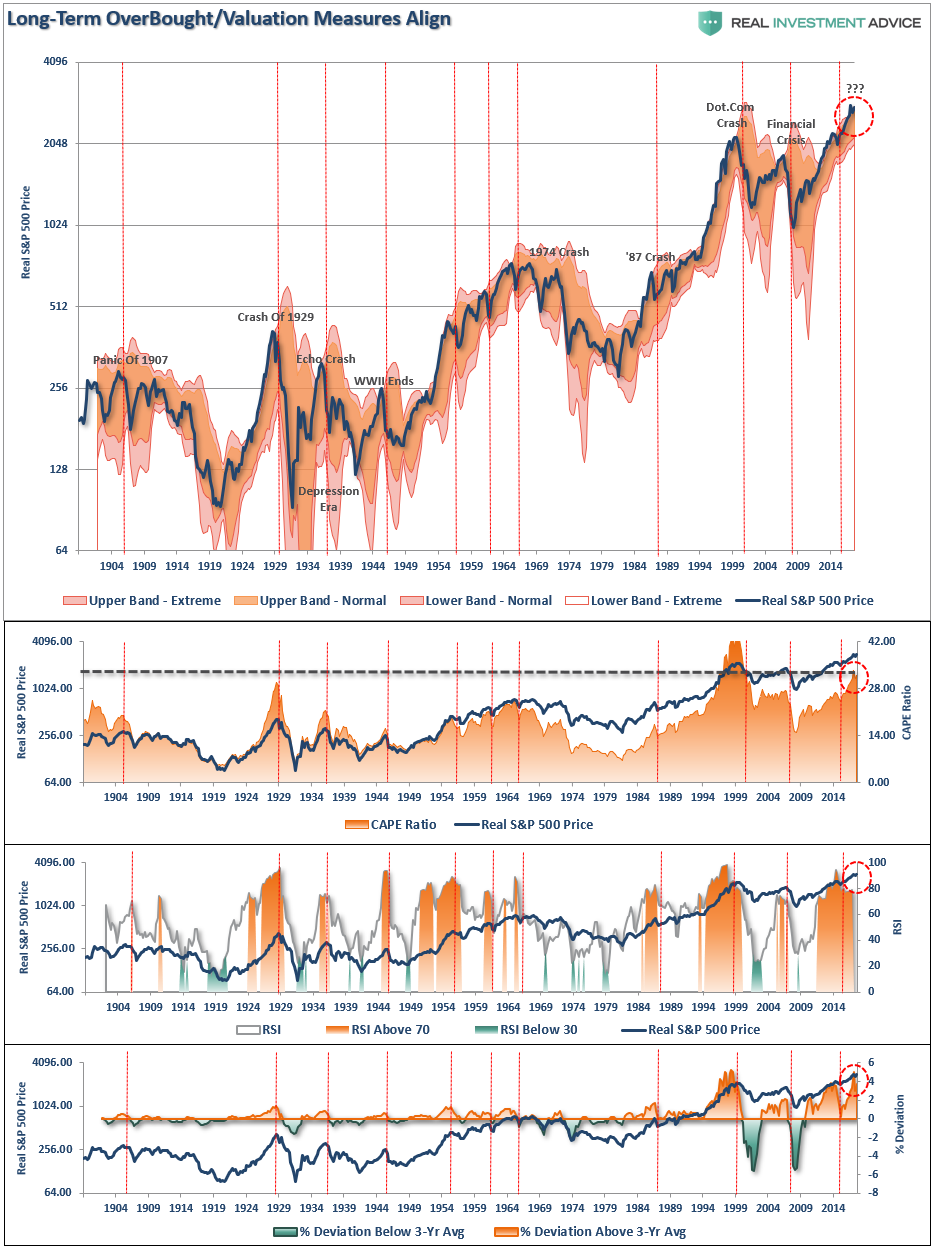

- “As prices rice, demand for rising assets also rises which creates a further demand on a limited supply of assets increasing prices of those assets at a faster pace. Rising momentum is supportive of higher asset prices in the short-term. The chart below shows the real price of the S&P 500 index versus its long-term bollinger-bands, valuations, relative-strength, and its deviation above the 3-year moving average. The red vertical lines show where the peaks in these measures were historically located.” – bto: Wir sind also am oberen Ende.

Quelle: Real Investment Advice

Fazit

Leverage + Valuations + Psychology + Ownership + Momentum = “Mean Reverting Event”

Der Auslöser

Es braucht aber einen Auslöser. In der Vergangenheit war es die Notenbank, die die Party beendet hat: “(…) the Federal Reserve has been the catalyst behind every preceding financial event since they became ‚active,‘ monetarily policy-wise. As shown in the chart below, when the Fed has embarked upon a rate hiking campaign, bad ‚stuff‘ has historically followed.

- “(…) the correction will begin as it has in the past, slowly, quietly, and many investors will presume it is simply another ‚buy the dip‘ opportunity. Then suddenly, without reason, the increase in interest rates will trigger a credit-related event. The sell-off will gain traction, sentiment will reverse, and as prices decline the selling will accelerate. Then a secondary explosion occurs as margin-calls are triggered. Once this occurs, a forced liquidation cycle begins. As assets are sold, prices decline as buyers simply disappear. As prices drop further, more margin calls are triggered requiring further liquidation. The liquidation cycle continues until margin is exhausted.” – bto: der klassische Margin Call.

- “But the risk to investors is NOT just a market decline of 40-50%. (…) The real crisis comes when there is a ‚run on pensions.‘ With a large number of pensioners already eligible for their pension, the next decline in the markets will likely spur the ‚fear‘ that benefits will be lost entirely. The combined run on the system, which is grossly underfunded, at a time when asset prices are dropping will cause a debacle of mass proportions. It will require a massive government bailout to resolve it.” – bto: Die Helikopter kommen!

- “Consumers are once again heavily leveraged with sub-prime auto loans, mortgages, and student debt. When the recession hits, the reduction in employment will further damage what remains of personal savings and consumption ability. The downturn will increase the strain on an already burdened government welfare system as an insufficient number of individuals paying into the scheme is being absorbed by a swelling pool of aging baby-boomers now forced to draw on it. Yes, more Government funding will be required to solve that problem as well.” – bto: und noch mehr Helikopter.

- “As debts and deficits swell in coming years, the negative impact to economic growth will continue. At some point, there will be a realization of the real crisis. It isn’t a crash in the financial markets that is the real problem, but the ongoing structural shift in the economy that is depressing the living standards of the average American family. There has indeed been a redistribution of wealth in America since the turn of the century. Unfortunately, it has been in the wrong direction as the U.S. has created its own class of royalty and serfdom.” – bto: deshalb die sozialen Spannungen.

“There are many who currently believe ‚bear markets‘ and ‚crashes‘ are a relic of the past. Central banks globally now have the financial markets under their control and they will never allow another crash to occur. Maybe that is indeed the case. However, it is worth remembering that such beliefs were always present when, to quote Irving Fisher, ‚stocks are at a permanently high plateau.‘“– bto: Und diesmal ist die Fallhöhe besonders hoch.

→ realinvestmentadvice.com: “The Ingredients Of An ‚Event‘“, 17. September 2018