Ist dies das Ende des Zinserhöhungszyklus?

Die Pleite der Silicon Valley Bank hat für einiges Aufsehen gesorgt. Es ist keine Finanzkrise 2.0, aber dennoch könnte es zu einer Änderung der Geldpolitik führen. Die Kapitalmärkte wetten darauf, dass die US-Notenbank Fed nun ihren Kurs der Zinserhöhungen verlassen muss.

Aus den vielen Artikeln zum Thema sind mir zwei aufgefallen. Zunächst der Kommentar von John Authers bei Bloomberg. Die Highlights:

- „(…) the Federal Reserve, US Treasury and Federal Deposit Insurance Corporation announced in a joint statement that all depositors will have access to their money as of Monday, and that no taxpayers’ money will be used. The statement suggests that any ultimate costs will be borne by other banks through the levy on them for deposit insurance: There will be no protection for holders of bonds or equities in the banks, and the senior management has been fired.“ – bto: Wobei die Fed die Anleihen zum Nennwert kauft, nicht zum Marktwert, der aufgrund der Zinserhöhungen darunter liegt. Das ist schon ein Unterschied.

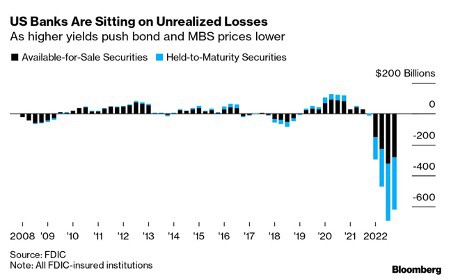

- „Meanwhile, the Fed will introduce a new acronym, the BTFP, which stands for Bank Term Funding Program, for which $25 billion is available. This will allow banks to borrow from the Fed using Treasury bonds as collateral and valuing them par. If the problem is solely one of liquidity rather than solvency, this should make a difference; banks are sitting on a lot of bonds whose value has tanked over the last year.“ – bto: Rund 600 Milliarden Buchverluste sind nicht schlecht…

- „This doesn’t matter so much if they can hold them to maturity, but becomes a very big problem if they have to sell them for a loss — in such a situation the possibility of a death spiral such as UK gilts suffered last autumn would arise. If the existence of the BTFP serves to calm the banks’ clients down, it doesn’t have to commit the money; if the pressure intensifies, it might have to come up with much more than $25 billion. (…) If all goes to plan, however, the outcome will be to make bank depositors (not just SVB’s) bear the bulk of the cost. That will ultimately be bad for banks’ profits, and therefore their shareholders.“ – bto: … was nun auch nicht so ungerecht wäre.

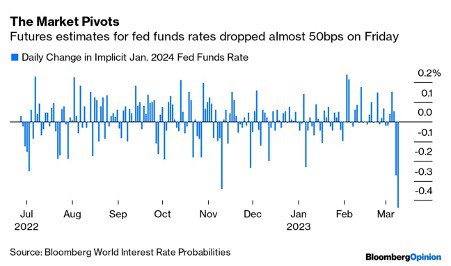

Die Frage ist aber: Wird die Fed nun aufhören, die Zinsen zu erhöhen? Die Märkte setzen auf jeden Fall darauf, sinken doch die Zinsen für alle Laufzeiten. Doch stimmt die Annahme?

- „Investors have spent months betting that a shift in the economy will cause the Fed to pivot — make a sudden move to cutting rates rather than raising them. This has always been unrealistic. (…) it’s plain that the Fed is more worried about making a dovish mistake (cutting too soon and letting inflation take hold), than a hawkish one (cutting too late and having to deal with a worse recession than was necessary).“ – bto: Das ist wiederum abhängig davon, was mit der Finanzstabilität passiert.

- „A true pivot requires a danger to financial stability. The cliché is that the Fed must tighten until something breaks. Now that something’s broken, it’s far more plausible that the Fed will change course. (…) This is how changes in the estimate for fed funds after the Fed’s meeting in January have moved since the futures contract to cover that meeting was launched last summer. This is a huge reassessment.“ – bto: Das wäre, wenn es so kommt, ein Boost für die Kapitalmärkte, denn es verspricht viel Liquidität.

- „Leveraged institutions getting themselves in trouble with duration bets have traditionally been one channel through which Fed tightening has slowed aggregate demand. If the regulators were to focus on law over discretion (not bailing out banks or depositors), then that might be a substitute for further increases of the fed funds rate.“ – bto: Bingo – wenn man nicht immer rettet, dann passieren auch die Unfälle nicht mehr.

- „So, banks will need to offer high rates to attract depositors, and that will dent their profits. With their funds more costly to acquire, they will also likely be more picky in the terms they put on loans. That tightens financial conditions, and reduces inflationary pressure. Which was the object of the exercise.“ – bto: So die Theorie.

- „The risk, as Ed Yardeni of Yardeni Research says, is that deposits above the $250,000 that the government will insure will move into Treasuries, or into the too-big-to-fail banks where a bailout would be more or less guaranteed. (…) As happened a few times in the past, tighter monetary policies caused funds to flow out of bank deposits and into money market instruments. Such disintermediation forced financial intermediaries to reduce their lending activities, causing a credit crunch and a recession. The big risk is that the SVB debacle triggers significant outflows from bank deposits exceeding $250,000 that are not insured by the FDIC into Treasury securities.“ – bto: Es würde also die Maßnahmen der Fed über Nacht wirksamer machen.

Die Frage ist dann, ob das hier zutrifft oder es nicht einfach ein Unfall wegen besonders schlechten Managements war.

- „The fall in its stock price over the last year compared to the financial sector as a whole shows that the market perceived the bank to be in some kind of trouble. SVB was also a well-known and popular short in the hedge-fund community, and this is born out by the data. (…) There were significant attempts to bet against it.“ – bto: Weil man von außen sehen konnte, dass das nicht funktioniert.

- „While the loss of confidence in SVB has been ongoing for a year, investors have only in the last few days caught up with it in any serious way. [andererseits:] (…) it was only on Monday last week that SVB made the Forbes list of America’s Best Banks for the fifth consecutive year.“ – bto: Das muss man erstmal hinbekommen.

Es gibt aber eben ein grundlegendes Problem. Die Finanzkrise hatte keine Konsequenzen:

- „The 2008 implosion left another issue. Virtually nobody was punished. Indeed, prosecutors under the Obama administration barely even tried to hold bank executives to account. This was a moral outrage that makes it far harder to persuade the public at large to support bailouts. Stopping a big bank from going under is meant to bail out depositors who might lose their money, not their executives. But if executives never pay a price, it looks much more as though public money has gone to bailing them out personally. And moral hazard is much increased — the sight of a few ‚perp walks‘ by senior financial figures going to jail might well have drastically changed the way investors and bankers went about their business. That never happened. With no significant criminal penalty, the argument is that moral hazard has been stoked further. It has also made people angrier (as it should), and much less willing to accept further moves to rescue other banks.“ – bto: Damit wächst die Gefahr eines wirklichen Unfalls, wobei ich sehr gegen den Moral Hazard bin.

Bleibt die Frage: War dies das Ereignis, welches wirklich das Ende des Zinserhöhungszyklus bedeutet? Ich bin unsicher.