Indikatoren für den Crash

Nichts ist so spannend wie die Frage, ob man einen Einbruch an den Börsen vorhersagen kann. Scheinbar ja, wie die FT (dankenswerterweise) berichtet:

- “The quant team at SocGen spent last month coming up with a great new measure that could help time drawdowns of the S&P 500. It worked beautifully and would have forecast what just happened. But to the chagrin of Andrew Lapthorne at SocGen, they did not get around to publishing it until this week. Such is life.” – bto: Ja, so ist es. Die Untersuchung von Lapthorne zur Qualität der Unternehmensbilanzen habe ich hier schon diskutiert: → Das steht hinter dem Crash: gefährliche Bilanzschwäche der US-Unternehmen

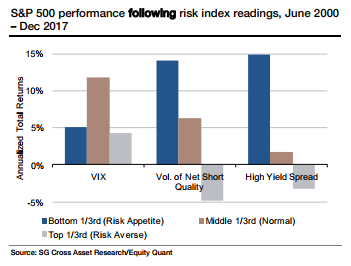

- “The nub of their argument is that the volatility of low-quality (as in poor balance sheet) stocks, and the volatility of high-yield bond spreads were a better indicator of a coming drawdown than a rise in the Vix. When investors get particularly nervous about the junkiest companies in their universe, in other words, it is a sign of trouble. And indeed, when the volatility of the worst quality companies in both equities and bonds is highest, equity drawdowns tend to follow. The Vix offers no such signal:” – bto: Es leuchtet ja auch ein. In einer Welt mit hohen Schulden, hoher Verschuldung der Unternehmen und hoher Verschuldung der Spekulanten ist klar, dass, sobald sich Turbulenzen anbahnen, die riskantesten Wetten als Erstes unter Druck kommen. Das Chart zeigt es auch sehr klar:

Quelle: SocGen, FT

- “When interest rates rise it seems obvious that the weakest business with the greatest amount of debt should fall before the strongest. So while the initial reaction to a rise in bond yields may be to sell lower beta defensive/higher dividend yielding business, eventually as the potential pain from higher rates becomes more acute, then selling balance sheet risk and then ultimately the equity market altogether will become the greater priority.” – bto: Das ist sehr einleuchtend. Man weiß nicht, wann es passiert, aber es genügt, um noch an den Börsen zu reagieren.

- “So it also seems intuitive to focus on the performance and volatility of the weakest segment of the equity market for signs of stress and not the aggregate market which is often biased toward the biggest, most profitable and usually better financed organizations. (…) The argument being that if the share prices of weak companies start falling, not only does it exasperate the problem by increasing implied leverage, but also it could be an early indication of investors becoming balance sheet risk averse.” – bto: eben, weil sie sich das Risiko nicht leisten können. Es ist immer wieder ein Minsky-Thema. Die Übertreibung treibt die Übertreibung, bis es irgendwann bricht.

Die Lehre: “we should treat junky over-levered companies as ‚canaries in the coalmine‘ at a time when the greatest concern is rising rates.” – bto: Und soweit ich das sehe, geben diese Indiaktoren keine Entwarnung.