“In The Next Recession, The S&P Will Drop Below The 666 Lows”

Albert Edwards, erneut via Zero Hedge, da man an seine Schriften direkt nur schwer kommt. Er bleibt bei seiner Erwartung, dass die US-Börse in der nächsten Rezession unter den Tiefststand von 2009 fällt. Eigentlich ist das doch undenkbar, wird doch das Geld vom Himmel fallen und die Notenbanken alles tun, um uns Richtung Inflation „zu bomben“. So zumindest die allgemeine Erwartung, der ich mich nicht ganz verwehren kann.

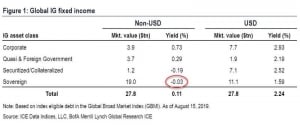

- „(…) after decades of waiting, (…) Albert Edwards vindication was finally here (…) as per BofA calculations, average non-USD sovereign yields on $19 trillion in global debt had, as of Monday, turned negative for the first time ever at -3bps.” – bto: Und man stelle sich vor, dass auch im Privatsektor die Ersten negative Zinsen bezahlen.

Quelle: Zero Hedge

- “Of course, it ain’t easy being a permabear – even when your global ‘Japanification’ thesis, 30 years in the making, has been validated – for the simple reason that there are haters always and everywhere, and for some odd reason Edwards decided that responding to them in his latest letter is a prudent use of his time.” – bto: Na ja, vielleicht gehen ihm ja sonst auch die Themen aus …

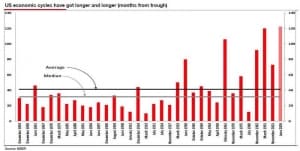

- “(…) my biggest Ice Age mistake was to assume that the US would be like Japan and that subsequent to the 2008 GFC, US policymakers would find it much harder to manipulate the economic and credit cycles. I thought we would return to „normal“ economic cycles with lengths nearer to 40 months.” – bto: Das passt aber generell auf das Thema. Die Amerikaner haben es geschafft, das Spiel so weit zu treiben, wie man es sich vor Jahren nicht vorstellen konnte.

Quelle: Zero Hedge, SocGen

- “(…) central banks decided that they need to unleash more central planning that the USSR, and effectively kill the business cycle, so rather than seeing shorter cycles of around 40 months, the US is still enjoying the longest economic cycle in its history of 122 months and counting! (…) For I had pencilled in the next US recession as the time when we see the next intensification of the Ice Age (as occurred in Japan), where equity prices and PEs would fall to new lower lows and where new and unprecedented monetary measures would need to be taken in the face of outright deflation. That is why I have been so wrong for so long and that also goes for my bearish view on bonds, articulated in 2011. I had by now expected the helicopters to have already dropped hundreds of trillions of confetti dollars onto the US economy and CPI inflation to have already begun to twitch into life like Frankenstein`s monster.” – bto: Das ist nichts anderes als die Aussage, dass es faktisch nur am Timing lag. Es wird aber genauso ablaufen, quasi al seine deflationäre Depression in Zeitlupe, dann gefolgt von einem Simbabwe-/Weimar-Ansatz ganz neuer Dimension.

- “Will equity yields continue to grind lower (PEs higher) in line with US bond yields falling into negative territory, and as the printing presses are started up again and running at such a frenzied pace you will be able to hear them from Mars? Or will, as I suspect, a slide into recession again be accompanied by the bursting of credit and asset bubbles and the ensuing recession be as surprisingly deep as the 2008 GFC?” – bto: Und Zero Hedge schreibt dann, dass die Antwort bei einem Perma-Bären (für Aktien, nicht für Bonds) nicht überrascht. Edwards bleibt bei seiner Sicht, dass es eben zu einer Schulden-Deflation kommt, die dann erst zu Helikoptern etc. führt.

- Edwards: “And, at the same time as the economy implodes, expect President Trump to explode with rage. Indeed, even before his election I felt it very unlikely that the Fed would be able to maintain its independence if it is the midwife for yet another credit-induced deep recession.” – bto: Die Unabhängigkeit der Zentralbanken ist doch schon seit Langem nicht mehr wirklich gegeben. Die Ernennung von Christine Lagarde ist der offensichtlichste Startschuss in die neue Welt der Staatsfinanzierung durch Notenbanken.

- “Oh sure, the Fed will try to fight it, and it will, culminating with the endgame for every central bank– the release of helicopter money in hopes of terminal currency debasement sparking debt hyperinflation. But to the SocGen strategist, that won’t be enough. Won`t [helicopter money] fill the swimming pool and cushion the equity market`s descent? Won`t an activist Fed, with President Trump screaming with rage in the background, be able to prevent any potential collapse in the equity market? I believe not. Why will the next recession be any different from the last one, which saw equities collapse despite massive monetary stimulus?” – bto: Das finde ich als Begründung unzureichend. Warum? Einfach, weil wir diesmal schon bereitstehen. Es herrscht Klarheit und Transparenz in den Notenbanken, was das Spiel ist. 2008 hat man gar nicht verstanden, was da passiert. Heute ist es allen Akteuren absolut klar. Deshalb werden sie schneller handeln. Was auch daran liegt, dass man heute weniger erklären muss als damals. Es wird schneller eine öffentliche Unterstützung geben.

- “I would expect renewed rounds of QE, and/or helicopter money, as MMT is embraced as a desperate solution to the next slump. But this liquidity is not guaranteed to flow into equities or indeed any risk asset while the economic downturn is in full force. (…) Ample liquidity cannot be guaranteed to flow into any particular risk asset if its fundamentals turn negative. Liquidity will initially flow into whatever momentum trade is still standing at the time, backed by fundamentals, and that will most likely be government bonds.” – bto: Auch hier wäre ich nicht sicher. Denn letztlich würde jeder wissen, dass das viele Geld nur inflationär wirken kann. Doch dann ist es keine gute Idee, in Anleihen zu gehen. Es ist also ein Grundszenario, das durchaus unterschiedlich ablaufen kann.

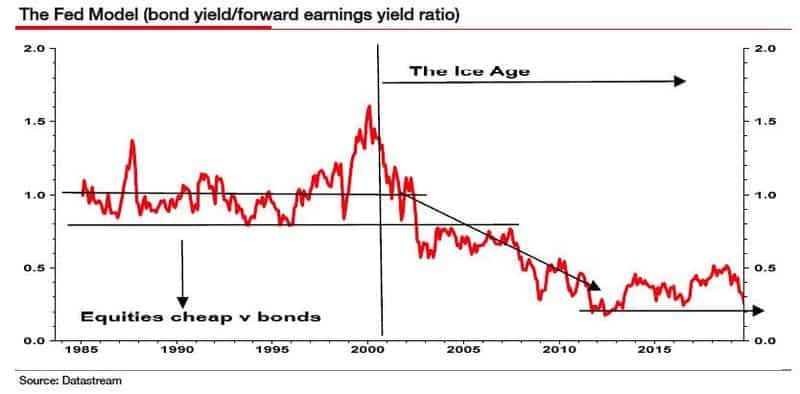

- Doch würden Aktien nicht – wie heute – auch davon profitieren und steigen? Edwards bemüht dazu das sogenannte Fed-Modell, um zu zeigen, dass es eben nicht stimmt: “The so-called Fed Model (below) was an essential asset allocation reference tool in the 1980s and 1990s. It was thought that this ratio of 10y US bond yield and forward earnings yield (inverse of PE) enjoyed some sort of ‘equilibrium’ level at 1.0, as for most of that period the ratio oscillated above and below 1.0 (until the Nasdaq/TMT bubble).” – bto: Ein Blick auf die Abbildung zeigt, dass es schlicht nicht stimmt.

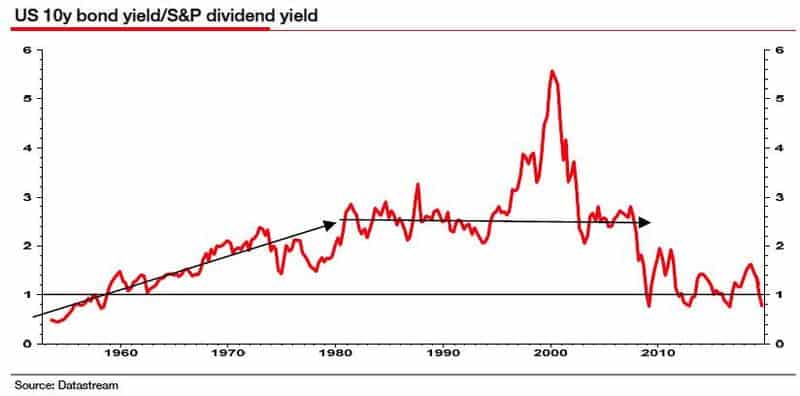

- “The 1982-2000 period was an anomaly in the longer-term context. A fundamentally important Ice Age forecast was that we were going to return to a world where the equity dividend yield would rise above the bond yield and stay above it. It was the 1965-2000 period that I thought was the anomaly. So, while market commentators have recently noted that the US 30y bond yield has fallen below the dividend yield I believe that is the natural order.” – bto: was dann nachvollziehbar ist, wenn man davon ausgeht, dass Aktien riskanter sind und ein höherer Anteil des Ertrages aus den Ausschüttungen und nicht den Kursgewinnen kommt.

- “My key Ice Age contention was that (…) a more volatile and uncontrollable post-bubble economic cycle would drive the equity (cyclical) risk premium higher (driving PEs lower) and deflationary conditions would drive long-term eps expectations to be more in line with anemic nominal GDP growth (also driving PEs lower). In the Ice Age the PE compressing force from falling long-term eps expectations and rising cyclical risk premiums would outweigh the PE expanding influence from falling bond yields. (…) But experience has shown us that in a post-bubble world a cyclical recovery could lead to a pause or even reversal of the two PE depressing drivers. And the longer the economic recovery continues the more the markets will believe there is a return to Great Moderation ‘normality’ and the more it can ignore the Ice Age. That is exactly what has happened, aided by QE.”

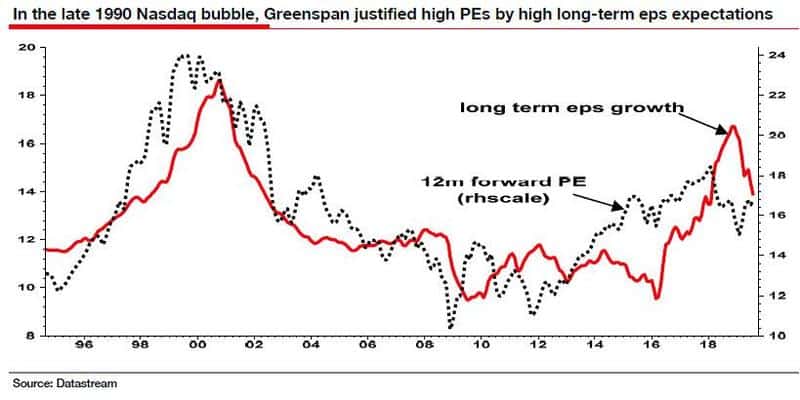

- “Indeed, the chart below shows that US long-term earnings expectations have done exactly what they did during the late 1990s Nasdaq bubble. The echoes of that time are unerringly similar. Belief in this equity market has been centered around the new large technology, growth stocks typified by the large-cap FAANGs (Facebook, Apple, Amazon, Netflix and Alphabet’s Google), rather than TMT generally.”

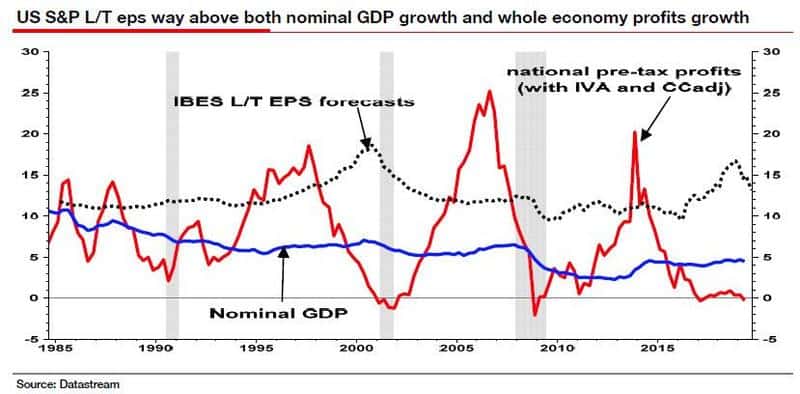

- “Despite the recent downtick, S&P Composite long-term eps expectations are still way out of line with both nominal GDP and particularly whole economy profits growth (see chart below, both 5y trailing to match the 5y projection for long-term eps expectations). In a recession, expect the dotted line in the chart below to lurch down sharply as it did in both the last two recessions (shaded areas). That is when you will see equity prices melt away.” – bto: Das passt natürlich zu der Tatsache, dass die ausgewiesenen Gewinne an der Wall Street schon länger nichts mehr mit den echten Gewinnen zu tun haben.

Quelle: Zero Hedge, SocGen

- “How can we possibly believe that the S&P could fall back below its 666 March 2009 low. Simple: I believe the 12-month forward PE will decline to a new lower low compared to the profit’s nadirs of 2002 (15.5x) and 2009 (10.5x). At the height of a bear market, during the eye of the storm, the equity market does not trade like an auto stock or a copper stock. It does not go to peak PEs of infinity at the bottom of the earnings cycle. Quite the reverse – the market in its panic goes to trough PEs on close to trough earnings.” – bto: immer vorbehaltlich des Szenarios bei dem die Flucht in die Sachwerte sofort einsetzt.

- “In the next recession, as the secular forces of the Ice Age thesis combine with the cyclical chaos of another deep GFC-like event, I would expect the S&P 12m forward PE to collapse from a QE inflated 16½x currently to around a 7x trough eps – while forward earnings fall something like 40% to $100/sh, just as they did in the last recession. Add in the impact of a loss of confidence in the Fed(just as there was a loss of confidence in the BoJ and MoF in Japan), and there is a realistic prospect of a decline below the March 2009 666 low.” – bto: Es sind einige Annahmen dabei. Ich könnte mir – o. k., ich wiederhole mich jetzt – vorstellen, dass wir im Zuge des Vertrauensverlusts direkt eine Flucht in Sachwerte, wozu dann auch Aktien gehören, erleben.

Zero Hedge hat heute zu Recht das letzte Wort: “It took about 20 years but Albert Edwards was eventually proven correct in his bond forecast. For the sake of civilization, one can only hope that his equity forecast is wrong.” – bto: So ist es.